#47: Portfolio Update, 23Q2 Earnings Pre-Read

Winners/Losers; Breaking through resistance; Introducing QV AdTechCore10

Reading Time: 9 minutes of thinking “Why doesn’t it add up?”

Where do they stand?

With AdTech Q2 earnings seasons upon us, we’re giving readers a head start pre-read. We’ll report back after Q2 dust has settled.

ROKU was the first to report a few weeks ago. Management delivered A Beat For The Ages, This Rally Is For Real. Roku beat on revenue and profits sending the entire sector up early in earnings season but has since sold off a bit.

Across our AdTech18, TTD still leads the way by a county mile. They report on Wednesday.

Had you bet $100 in January 2018 when our AdTech18 portfolio started, you’d be up $469 today after accounting for your $100 downstroke. The sector has scored gains of ↑60% since we ran our Q1 update in March so 1H23 has been really good for adtech.

Winners: We count six players above water. We don’t expect to see much change other than perhaps DV floating in and out of the winner’s circle. ZETA is still trading way above book value at 15x and also floats in and out of the winners club on a regular basis.

Losers: Out of the other twelve in the loser’s locker room — with the exception of PUBM which will get to a minute — they are unlikely to create enough value to impress investors anytime soon. According to our valuation model, PUBM has the highest return on invested capital (ROIC) so its fortunes might change.

We’re just guessing, but one thing the losers might have in common is having built businesses on suspect or low-quality ad inventory in a world where advertisers are increasingly on a flight to quality. Put another way, some (or all) adtech businesses might depend too much on a flood of low-quality or “synthetic” inventory to make their unit economics work. The more these issues come to light, the more difficult growth becomes.

Then again, that same dynamic might be true for everyone in adtech but perhaps some players are simply better than others at managing customer (and investor) perceptions.

QV AdTech18 trending up

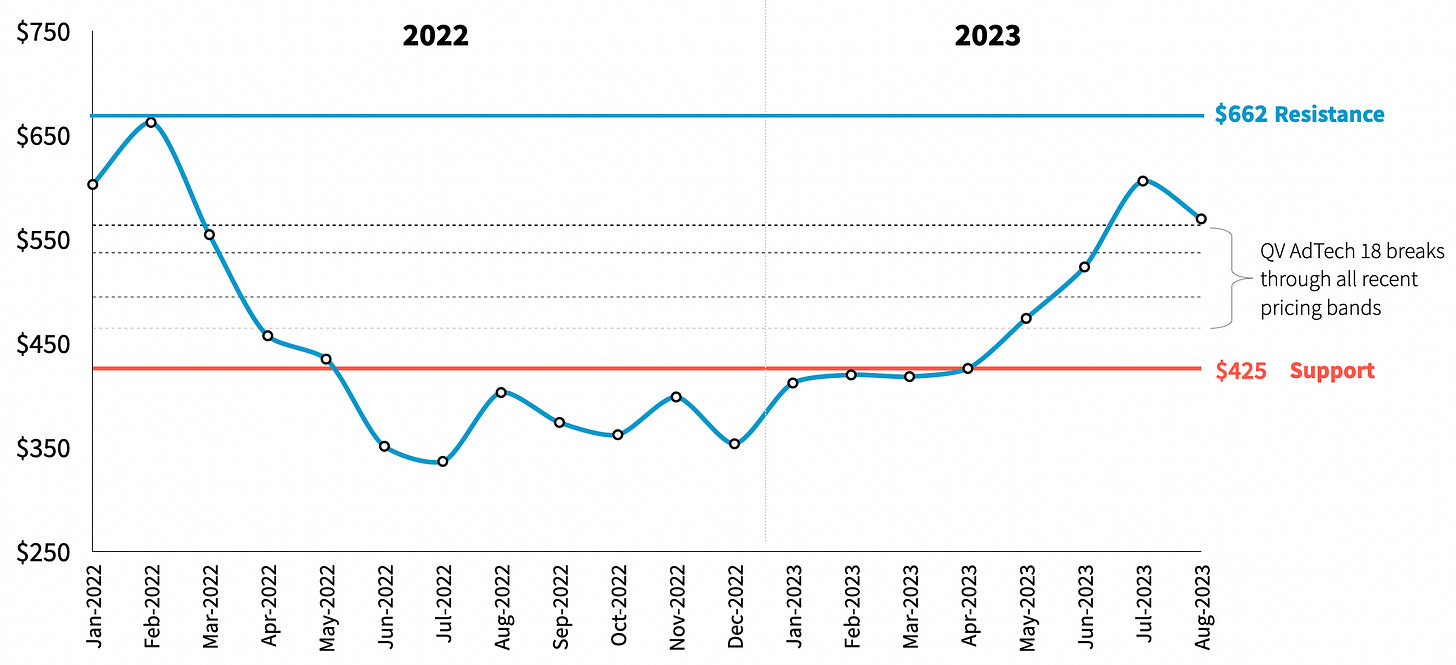

Looking back at 2022, adtech stocks stabilized in the back half of last year seesawing up and down but still ended the year down ↓55%. Rockiness last year has turned into significant gains in the first half of 2023 — the sector is up 61% so far this year.

Looking back at our last update on Fibonacci resistance analysis in March 2023, the high watermark was set at $662 with a lower boundary set at $336.

The portfolio bounced around for a while briefly breaking through our $406 resistance level before falling back. At the time we said:

“We’d give better odds on the QV AdTech18 busting through the $336 lower support line before it sniffs $406 again.”

We were wrong… at least for the time being.

Not only has the QV AdTEch18 busted through the $406 level, but it also smashed through all the intermediate retracement levels except for the old high of $662. Our new support level on the lower end is $425 with upside resistance staying put at $662.

It will be interesting to see how things shake out after Q2 earnings. TTD has generated 67% of our portfolios gains so far, so if management beats on revenue and profit in Q2 earnings this week — and maybe we’ll start to see some separation between TTD revenue and cost growth — then we could see the group to surpass our $662 resistance level over the coming weeks.

Introducing the QV AdTech Core10

Going forward, we’ll continue to track all 18 players as we’ve always done but with more focus on what we call the QV AdTech Core10.

3 DSPs: Trade Desk, Criteo, and one smaller player Viant.

2 SSPs: Magnite and PubMatic

2 Ad Verification: DoubleVerify and Integral Ad Science

2 Made-for-Advertising: Taboola and Outbrain

1 Data Provider: LiveRamp

We define these ten companies as “core” because they are completely dependent on open web programmatic inventory and all the audience targeting that comes along with it.

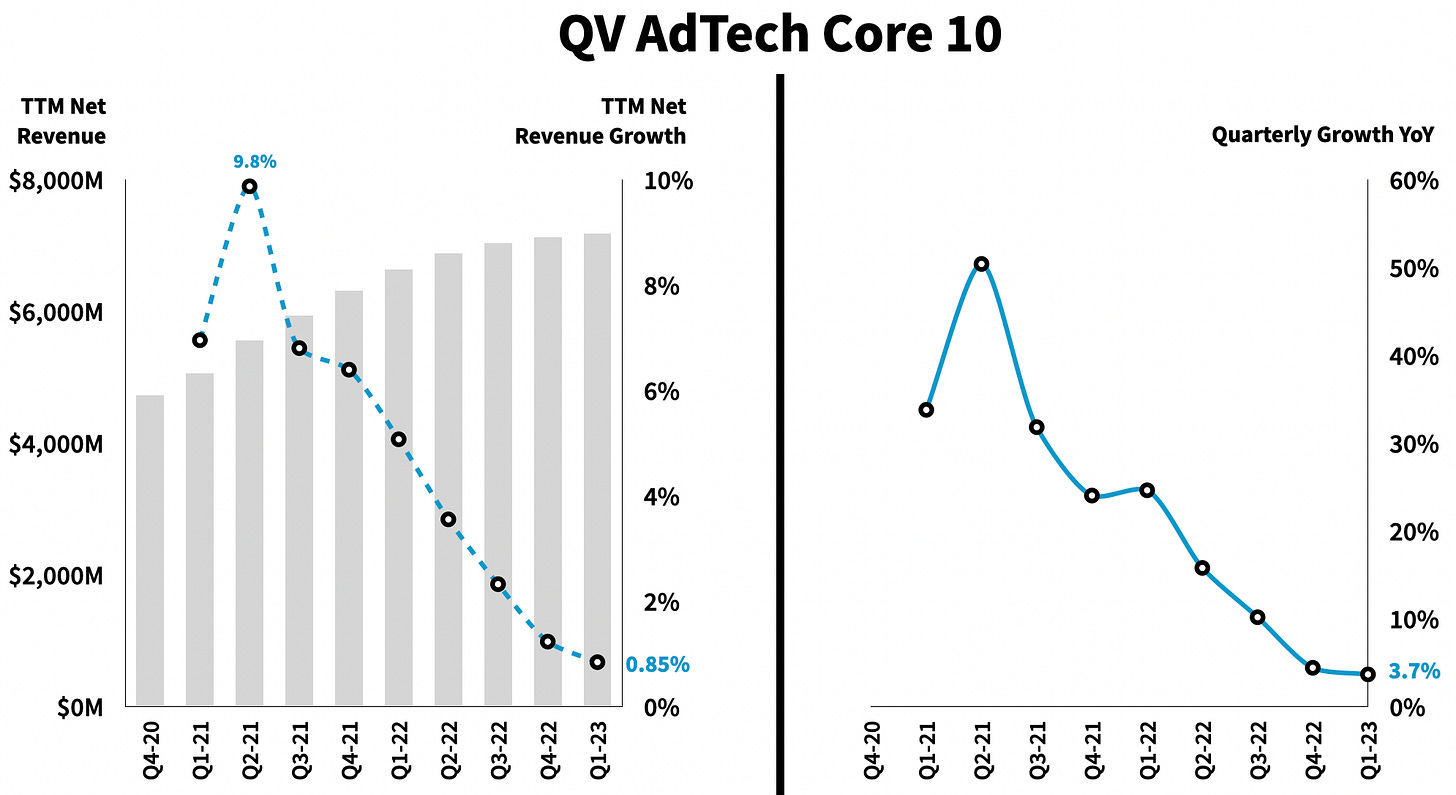

As you can see, the core group of 10 adtech players tracks the AdTech18 list albeit with breakout performance starting about a year ago. We expect this trend to continue and the gap to widen over time.

But here’s the concerning thing — and the M&A opportunity too. Revenue growth for all companies (and industries) always trends downward over time and eventually reaches a maturity point.

Adtech players are not immune from this reality. On a TTM basis, YoY net revenue growth rates for our AdTechCore10 have fallen from +9.8% during Covid-related boom times to less than 1% after Q1-23 earnings.

AdTech Fundamental: Recall that net revenue is what adtech companies get by extracting fees from the ad bugets or impressions they process.

Looking at YoY quarterly growth, the group grew at just 3.7% as of 1Q-23. And therein lies the opportunity for an uptick in M&A which has been mostly dormant in the sector over the last six months. The group holds $3.8 billion in cash and equivalents (including short-term investments) so we’d expect to see more investment into future growth bets with a big focus on A.I. to expand offerings and/or bring down costs.

Catching Our Eye in Q2

MediaMath: Top of mind is the upcoming bankruptcy auction for MediaMath’s assets. We dug into the numbers a few weeks ago. We were surprised by how many new subscribers came from that one post which was seemingly boring yet evidently important subject matter for our Quo Vadis community. One explanation for subscriber interest in MediaMath is about blood in the water with many sharks looking for a good (albeit misguided) DSP tech assets. In any case, we concluded that at auction MediaMath’s remaining assets could be had for somewhere between $35 million and $70 million.

The Trade Desk: TTD’s stock price has gone hyper since February trading above $90/share at times with a giant market cap close to $42B. To put investor expectations into perspective, our model estimates that TTD will need to grow gross ad spend from $7.7 billion in FY22 to a whopping $90 billion by FY28 based on our 5-year forecast model. That’s a 55% CAGR compared to 25% YoY growth between FY21 and FY22. And that’s not all that has to happen. Management will need to bring down costs from 93% of net revenue today to around 57% of net revenue. TTD reports Q2 earnings on August 8 so we’ll see how much more momentum investors will pump into expectations for TTD. We don’t see how all this happens, but time will tell and Ciaran O’Kane from FirstPartyCapital said it best:

“TTD has a once-in-a-generation CEO that cannot only build amazing products but also sweet talk Wall Street.”

Criteo: CRTO is in the midst of shifting from its old retargeting business to owning a big chunk of the retail media space. Looking at our 5-year forecast model, Criteo can justify its current market cap of $1.7 billion by getting EBIT margins from 5% in FY22 to a ~12% steady state by FY28 and by growing net revenue to $900 million which is just a 2.5% CAGR over 5 years. CRTO beat on revenue and also adjusted EBITDA in Q2 earnigns. We expect another beat in Q3.

Viant: DSP represents a small-ish demand-side platform in our AdTechCore 10. We honestly don’t see how Viant’s underdifferentiated “commodity” business model will generate meaningful free cash flow let alone FCF growth. We think DSP’s current market cap of just $290 million is justified when management gets costs from –160% of net revenue to 85% (=15% EBIT margin) and grows net revenue from $80 million to $120 million over the next five years. That’s an 8.3% CAGR and not an easy hurdle by any measure. Viant reports Q2 at the close today — we don’t expect to be impressed.

PubMatic: PUBM reports Q2 on August 8. We think the market is valuing PUBM pretty much correctly as long costs as a percentage of net revenue come down from 87% to 70% over the next five years. If A.I. delivers on the hype then achieving these productivity gains seems doable. PUBM also has to grow net revenue from $256 million to around $400 million which is a 9.3% CAGR. YoY net revenue growth was 13% in FY22 so as long as PUBM grows ahead of the overall ad market growth then we might even say the company is slightly undervalued today. Notably, PubMatic announced in July that it is “Advancing Responsible Media By Removing MFA Inventory From Auction Packages.” The question we have is, “What took so long?”

Magnite: MGNI reports on Thursday. With a market cap of $2 billion, we can only get there if management achieves amazing results. First of all, EBIT margins were –9% in FY21 and doubly worse in FY22 at –18%. Assuming management gets costs under control AND produces an 11% EBIT margin AND grows net revenue from $557 million in FY22 to $3 billion by 2028, then the current price is justified. Net revenue growth in FY22 was 23%. Getting it to $3 billion in 2028 is a 40% CAGR — that’s a big leap. Assuming 12% take rates, Magnite needs to attract $25 billion in gross ad spend by 2028. We can’t see that happening. Something has to give.

DoubleVerify: DV is in the same boat as TTD and MGNI. The things that must happen to justify the current $5.7 billion market cap are real head spinners. For starters, DV management needs to bring down costs and double operating margins from 13% in FY22 to 26% by 2028. That’s a stretch but doable. DV acquired Scibids (an A.I. custom algo company) last week for $125 million with $60 million coming from cash. With $296 in million in cash (and equivalents) on its balance sheet, management is making a big bet (20% of cash) with Scibids. That brings us back to net revenue growth requirements. The current share price placed by investors requires ~$5 billion in net revenue in 2028. Net revenue growth last year was 36% so we don’t see how management achieves a CAGR of 62% over the next five years. If marketers figure out that DV is raking in what might be determined to be redundant fees from every play in the supply chain then growth headwinds will likely follow.

Integral Ad Science: Compared to DV, IAS looks undervalued. But it’s not. If IAS achieves the same performance over the next years, then our model says it’s worth ~$35/share not the current $15/share price. Put another way, if IAS grows operating margins from 8% to 20% (easier than what DV has to achieve), and grows net revenue from $408 million to $1.8 billion by 2028 (35% CAGR vs. 62% for DV), then its current $2.4 billion market cap is justified. That kind of growth is not easy albeit somewhat easier than what DV has to make happen. That said, IAS also faces potential headwinds when or if light gets shun redundant fee structures.

Taboola: Ah… made-for-advertising (MFA). What a great business model. It goes to show you something about the permanent state of desperation and/or gullibleness that marketers find themselves mired in as adtech eats their world. TBLA had –2% and –3% operating margins in FY21 and FY22, respectively. Assuming management reduces costs as a percentage of net revenue by 20% and grows net revenue from $464 million to $1 billion by 2028 (17% CAGR), only then can investors justify TBLA’s $1.2 billion current market cap. The trouble is that YoY net revenue was just 5.3% in FY22 so achieving 17% growth every year over the next five years is unlikely in cards. Then again, never underestimate how marketers are forced to justify their existence and “success” in the magical world of advertising. At least that seems to be what investors are partially counting on when they invest in adtech.

Outbrain: OB is in the same place as Taboola but with roughly half the revenue and trading at a quarter of TBLA’s market cap. The big difference appears to be how both companies capitalized on Covid 2021 growth spurts but Taboola sustained it while Outbrain lost steam with -20% net revenue growth in FY22. Assuming 20% operating margins, OB needs to grow net revenue by 16% every year through 2028 to justify its current price. That’s a tall order. Notably, if TBLA and other competitors are finding ways to sell MFA site owners a cheaper CPC price and also pay publishers more to implement their native ad widgets, then OB is swimming against strong currents on many fronts.

Made-for-Advertising: If you don’t what MFA is, learn about it here.

LiveRamp: RAMP has always had trouble finding its way to profitability. Platform operations eat up 29% of net revenue. Stock-based compensation eats up another 21% with SGA/R&D costs taking up another 64%. If you’re keeping track, all these costs generated –14% operating margins in FY22. Net revenue growth was decent in FY22 at 13%, but not enough to squeeze out profits. RAMP’s current price gets justified when management somehow achieves 15% operating margins and grows net revenue by a 22% CAGR over the next five years to $1.6 billion. With 3rd party cookies in shambles, and no clear replacement outside of Google’s privacy sandbox, RAMP has much to figure out (or acquire and reinvent). The same goes for all those other venture-backed cookie replacement alternatives.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.