#46: MediaMath

Spitballing with deduction; Breaking down MediaMath's bankruptcy filing; Implied valuation approaches

Besides the crazy amount of made-for-advertising inventory and misrepresented YouTube inventory, the biggest story in AdTech Land is the Chapter 11 bankruptcy of MediaMath — one of the original demand-side platforms (DSP).

According to MediaMath’s bankruptcy filing, the company owes various media-related suppliers at least $69.5 million in unsecured claims across three broad categories:

Media Cost

Third-Party Data

Ad Verification

Unsecured Claim: A claim or debt for which credit was extended based solely upon the creditor's assessment of the debtor's future ability to pay.

The good news for the various SSPs, data providers, and ad verification companies with receivables due from MediaMath is the likelihood (hopefully) that they carry receivables insurance which is also referred to as Trade Credit Insurance. It covers against any losses caused by the inability to collect payment from a customer. It costs around $1.00 per $1,000 dollars of coverage.

Adjustments to get a pure look at media-related claims: We removed a rent claim from World Trade Center Co Silversteain Properties for $2,511,572. We also removed an IT software claim from Presidio Holdings for $1,144,175. There were two separate “media cost” claims from Google's SSP "AdX" (#13 and #25) that we grouped into a single claim for $2,575,007. With these adjustments the Top 30 claims are now the Top 27. Analysis and Things to Think About

The Top 27 media-related claims across the three buckets total $69.5 million. If we extrapolate out to the Top 100 claims using a smoothed best-fit model, the grand total is around $72 million. The Top 27 represent ~97% of unsecured claims, the rest are smaller claims in the long tail (not including employee liabilities).

The biggest line item for MediaMath is “Media Cost” at $61 million (87% of the Top 27 unsecured claims). This is the money owed to SSPs for supplying the DSP with ad inventory.

As we pointed out in #43 Magnite + Pubmatic, unknown take rates, DSPs take ~130 days on average to pay SSPs. If we go with this as a plug value for MediaMath, we can infer that these SSP payables turnover 2.8 times per year which further implies that MediaMath processes around $170 million per year in media dollars flowing to SSPs. We’ll come back to this subject in a minute.

It’s interesting that Google’s SSP known as “AdX” is owed just $2.6 million which represents only 4.25% of the total media cost owed to SSPs. In most cases, DSPs like MediaMath would likely spend ~50% (or more) of client money on AdX so we’d expect any debt owed to Google would be the single biggest line item and much larger than the $12.6 million owed to SSP Magnite (the largest unsecured claim in the Top 27). But it’s not. One explanation is that smaller DSPs like MediaMath depend on Google’s ad inventory (lifeblood) so Google can demand payment in say 60 days (more likely in 30 days) or else they will turn off the spigot.

Given our $170 million in media dollars flowing to non-Google SSPs, and assuming MediaMath sources 30% of its inventory (likely more) from AdX, total SSP media flows are around $243 million.

Since other SSPs need to capture as much demand as possible from DSPs, they probably let DSP payment terms slip to 100 days or more, hence our belief in 130 days payable highlighted above. In MediaMath’s case, it should not be surprising to find out that some of these debts are aged 180 days or longer.

Third-Party Data suppliers are owed $7.2 million, which is 10% of the total media-related debt. The rule of thumb in Programmatic Land is that audience data costs around 10% of the advertiser media budget so assuming these claims are aged similar to the other claims, that number jives.

MediaMath also owes $1.5 million to DoubleVerify for whatever ad verification is going on at the DSP level. Looking at DV’s $452 million in FY22 revenue and $167 million in receivables equates to 130 days receivable from customers like MediaMath. Interestingly, Integral Ad Science’s (IAS) days receivable was 97 days in FY22.

Assuming 2.8 payable turns per year (365 ➗ 130 days receivable), MediaMath spends $4.2 million per year with DoubleVerify.

Given $243 million in total annual SSP media flows with $4.2 million going to ad verification (1.7% of media flows) and assuming an average $2.00 CPM going to SSPs (before take rate), DoubleVerify charges equate to a 3.4 cent CPM for verification services. That number mostly jives too.

Note: One of the reasons ad verification companies have found consistent growth over the years is their ability to collect what is akin to “insurance premiums” from everyone in the supply chain (advertisers, agencies, DSPs, SSPs, and Publishers). From the advertiser’s perspective (the ultimate payer), it might seem like a redundant and compounded expense but for ad verification companies it’s like Janis Joplin said, “Get It While You Can.”

Valuing MediaMath off Form 204

Using these inferences and estimations, let’s see if we can come up with a valuation for MediaMath using info from Form 204 along with a few market comps and other reasonable assumptions.

Revenue Composition

The first assumption we’ll make is about revenue composition between self-serve revenue (hands-on-keyboard clients that pay MediaMath rent to use its DSP) and managed service insertion order revenue (when MediaMath’s own staff runs insertion orders on behalf of clients and agencies).

Let’s assume a 50/50 revenue split.

Self-service DSP rents are assumed to be a market rate of ~10% of media spend running through the platform.

Managed service rates are assumed to be at least 40%. For example, Criteo’s managed service margin is around 40%, and Viant’s is around 43%.

So MediaMath’s weighted average take rate would be around 25%.

Media Cost Payable Inventory Turns

The TradeDesk had $1.87 billion in payables at the end of FY22 (most of this is SSP inventory payables).

TTD processed $7.74 billion in gross ad spend in FY22 and kept 20% to extract net revenue.

We can infer that TTD turns over its payables around 3.3 times per year ($7.74B x 80% ➗ $1.87B) which equates to days payable of around 110 days.

Above we assumed MediaMath takes a bit longer to pay SSPs at 130 days or around 2.8 payable turns per year. With $61 million in media cost claims right now, and assuming 2.8 turns, we can infer that MediaMath processes around $170 million in non-Google SSP bid requests.

Google AdX

Let’s assume Google’s AdX supplied at least 30% of MediaMath’s inventory needs.

If so, total annual SSP spending by MediaMath was about $243 million ( $170 million on non-Google inventory + $73 million on AdX).

Put another way, assuming Google makes DSPs like MediaMath pay their bills in 30 days, and MediaMath owes Google $2.5 million today, that translates to $75 million over 12 monthly billing cycles — close enough.

Gross Media Spend on MediaMath

By applying our 25% weighted average take rate to the $243 million in SSP spend, Gross Ad Spend from advertiser clients would be about $324 million.

That’s substantially more than Viant’s $197 million in gross ad spend for FY22.

Third-Party Data and Ad Verification

MediaMath likely ran a “data marketplace” inside its DSP for customers to create and buy audiences.

If we use LiveRamp receivable turns of 3.8 times per year as of FY22, the $7.2 million MediaMath owes to various 3rd party data providers (e.g. LiverRamp, Oracle Blue Kai, Eyeota, etc.) equates to $20 million in 3rd party data spend.

Assuming MediaMath made a 30% revenue share by reselling data segments, the total 3rd party data spend by advertisers on MediaMath is topped up to $29 million.

Add $29 million to $324 million in gross ad spend BEFORE accounting for data revenue and the grand total gross ad spend processed on behalf of advertisers is around $353 million.

Note we don’t add back the $4.2 million for ad verification because MediaMath would likely embed that in their DSP rent. Market Comps

TTD’s market cap is $37 billion, with $7.74 billion in FY22 gross ad spend therefore TTD is valued at 4.8x gross ad spend.

Given our March 2023 fundamental DCF model and our more recent piece #45: Back-of-the-Envelope TTD Valuation, our models indicat TTD is probably worth about $20/share or $10 billion in total (if everything goes really well over the coming years) bringing its adjusted (realistic) gross ad spend multiple down to 1.3x.

Criteo is trading at 0.9x gross ad spend. That’s probably on the low side but we’ll go with it. (Stay tuned for our Back of the Envelope Valuation on Criteo coming before Q2 earnings results in August).

Viant is trading at 1.4x gross ad spend. That might be a bit high, but we’ll go with it for now.

That makes an average gross ad spend valuation multiple of 1.2x across the three comps.

MediaMath Implied Valuation

With $353 million in implied gross ad spend moving through MediaMath’s DSP and assuming a 1.2x valuation multiple on gross ad spend, MediaMath could be worth $419 million.

Alternative Valuation

An alternative method leans on employee headcount as a proxy to estimate net revenue (gross ad spend x take rate) and then we apply a valuation multiple.

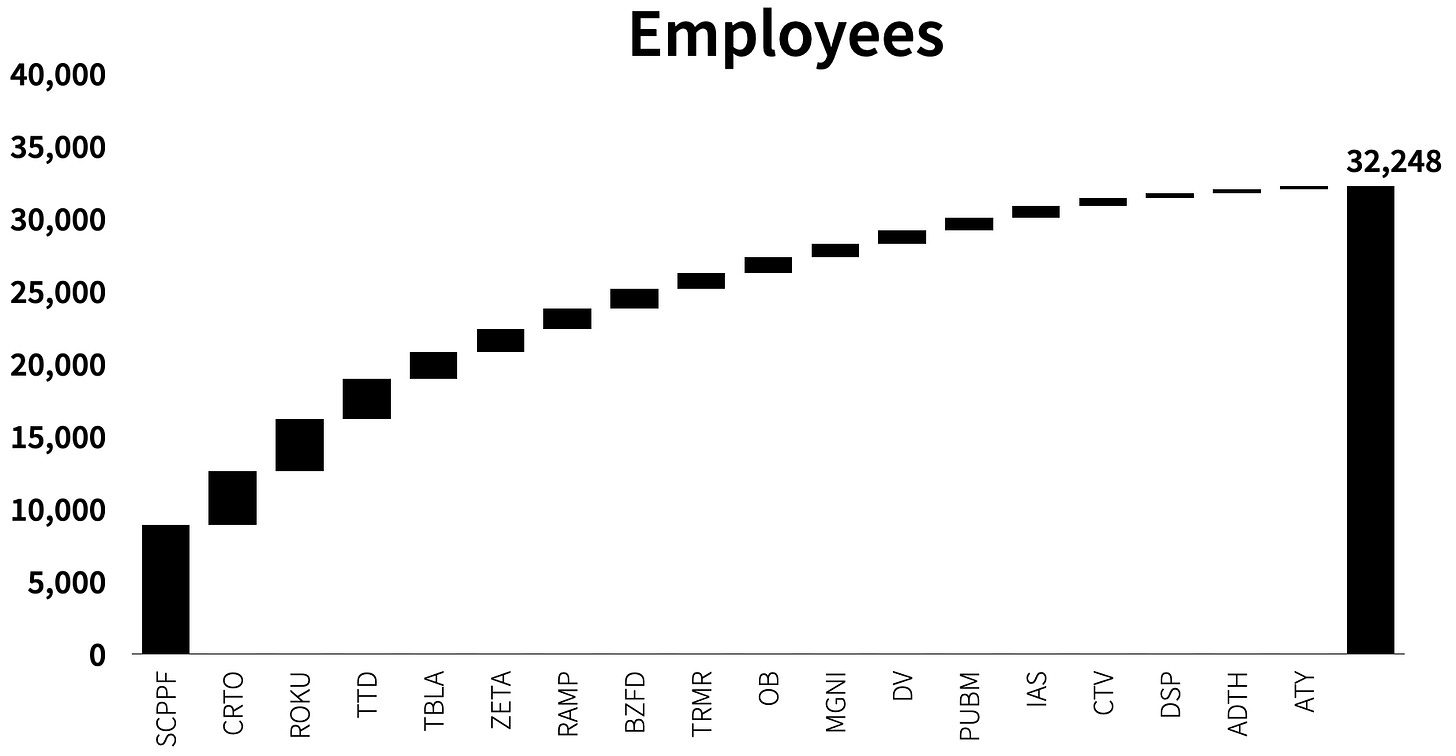

As of FY22, the Quo Vadis AdTech 18 companies employed 32,248 employees and generated $13 billion in net revenue which implies ~$400K in net revenue per employee across the sector.

However, The Trade Desk is at the high end of the range generating $569K in net revenue per employee. We think Criteo, Tremor, and Viant are better comparables for MediaMath which average $260K per employee.

LinkedIn tells us that MediaMath has 363 employees which implies $94 million in net revenue (363 x $260K). Assuming our 25% take rate highlighted above, gross ad spend on MediaMath’s platform would be $377 million.

Assuming our 1.2x multiple, MediaMath would be worth $453 million using this method.

Valuation Approach Using The 70%/70% Approach

We can also take the 363 employees and assume $150K average cost for each employee (fully loaded). If so, MediaMath’s employee bill is around $55 million per year.

From there, we take a rule of thumb short-cut that assumes 70% of total SG&A costs (fixed costs) are direct employee expenses giving us an implied total SG&A estimate of $78 million (rent, admin, corporate costs, other fixed costs, etc.)

Lastly, we assume that SG&A expenses are 70% of total expenses giving us $111 million in total operating costs (fixed plus variable costs). If we assume MediaMath was not profitable, then our net revenue estimate is also $111 million. Given a 3.1x net revenue valuation multiple across the Quo Vadis AdTech18, MediaMath would be worth $345 million using this method.

Conclusion: The average valuation across the three approaches is $400 million. However, as MediaMath customers head for the door and transfer ad campaigns to other DSPs, whatever the real valuation might be is diminishing by the day.

So what is MediaMath most probably worth right now?

Assuming our $324 million in total gross ad spend at 25% take rates + 30% revenue share as 3rd party data reseller, MediaMath’s net revenue would be around $90 million.

From there we can lean on a fundamental concept called capital efficiency to deduce MediaMath’s asset value.

Capital Efficiency is how how much net revenue an adtech company generates per $1.00 in invested capital.

Capital efficiency across our Quo Vadis AdTech 18the averages 2.0x with a range of 6.0x on the high end and 0.7x on the low end. If we had to guess, we’d say MediaMath’s capital efficiency is closer to the lower end at 1.0x so that’s what we’ll go with.

With $90 million in net revenue, MediaMath’s invested capital would be the same amount ($90M ➗ 1.0x = $90M).

Net Revenue ➗ Capital Efficiency = Invested Capital

To put that into perspective, Viant and AdTheorent’s invested capital is $72 million and $60 million, respectively, as of FY22.

Breaking down Invested Capital to solve for total asset value

Invested capital = Total Assets – Payables – Accrued Expenses (e.g. employee payables – Excess Cash.

Let’s assume excess cash is zero because all of MediaMath’s remaining cash would be needed for basic operating expenses. As per Lara O’Reilly’s excellent reporting at Insider, MediaMath ran out of cash in June.

Above we estimated total trade payables of $72 million across media-related and other smaller payables through the Top 100.

Let’s also add back the $2.5 million for rent and $1.1 million for software IT payables taking total payables up to $76 million.

For accrued payables, let’s assume 300 of the 363 employees are US based (e.g. at-will employees with two-week severance due and the rest have 90 days severance due, so total employee payables are close to $10 million using $150K per employee (we assume one final month is due + severance). That takes total payables and accrued liabilities to $86 million.

Now we can re-arrange the formula and solve for Total Assets which would be $176 million.

Total Assets = Current Assets + Fixed Assets

Assuming 110 days receivable like other DSPs (e.g. collections from customers) and $353 million in gross ad spend coming into MediaMath from customers, we estimate that the company’s outstanding receivables are around $106 million.

Now we can solve for Fixed Assets which would be ~$70 million.

$176 million in Total Assets – $106 million in Current Assets = $70 million in Fixed Assets

Lastly, we’ll break down Fixed Assets into Tangible Assets, Intangible Assets, and Goodwill.

Across the Quo Vadis AdTech18, Intangible Assets (e.g. intellectual property, brand recognition, reputation, relationships, etc.) represent 10% of Total Asset value so MediaMath’s intangible asset value could be around $17.5 million.

Over the course of MediaMath’s history, it made eight acquisitions according to Tracxn so we’d expect the company to have some goodwill sitting on its balance sheet. Goodwill in the sector is about 2x intangibles so we’ll estimate it at $35 million.

Conclusion: At auction MediaMath’s remaining assets could be had for somewhere between $35 million and $70 million depending on the value of goodwill — whatever it might be.

Since MediaMath’s customers are likely already gone to other DSPs, we’d assign zero value to MediaMath’s customer book of business which leaves fixed assets as the only thing left to value.

MediaMath’s demise could be someone else’s gain. Assuming our $400 million operating value is close to reality, a buyer could end up getting $400 million in potential value by buying $35 million in assets (net of goodwill).

Lastly, MediaMath has about $165 million in outstanding secured loans owed to private equity. After employees, these players collect next (they own the business now). On the fair assumption, they collect $106 million in receivables and sell the remaining assets for $70 million, less paying down any lease obligations, the PE players might get out with just a few scratches but no major damage.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.

MM owes AdX that number because when they switched to SOURCE (supply transparency) in 2019 they began weighting the supply flow to SOURCE partners (Magnite/Pubmatic) intentionally. However, that's also the exact moment campaigns started performing notably worse in the platform and in head-to-head's