#45: Back-of-the-Envelope Valuation: TTD

Welcome to our new series called “Back of the Envelop Valuation.” We’re running compact valuation models across our QV AdTech18 portfolio one player at a time. When it comes to adtech companies, they don’t have complicated financial structures making them relatively easy to model. What matters most is model consistency from one company to the next and limiting forecast assumptions to just a handful of key drivers. That’s what this series is all about.

We’re starting with The Trade Desk. Let’s face it, as far as our QV AdTech 18 goes, TTD is pretty much the only one people care about. We’ll followup PubMatic next — that one might surprise you in a good way.

Enjoy.

The momentum of investor belief in The Trade Desk (TTD 0.00%↑) continues. TTD’s share price approached $80/share on June 2 and sites at ~$76/share (as of June 16) with a ballooning market cap hovering around $37B. TTD is worth almost two times more than the rest of our portfolio combined, at least that’s what investors think.

Investor appetite for TTD’s story has nearly doubled its market cap since this time last year. That’s a lot of investor confidence in management's ability to extract tons of value in the future.

Bottom Line: If everything goes totally right for TTD over the next five yuears AND they manage to bring operating costs down (way down) AND they manage to attract $50 billion in gross ad spend by 2027 AND keep take rates at 20%, that’s pretty much the only way investors can get to a $37 billion valuation today (more or less). Investor sentiment for TTD is reminiscent of Tesla’s valuation when it flew over $1 trillion in 2021

Even though Tesla’s financial reality and fair market value deviated greatly from all the hyped-up momentum in late 2021, the best explanation for the spread was posed as a compliment to Elon Musk and his management team. Investors were basically saying:

We have massive confidence in management’s ability to figure it out and grow into our lofty expectations. Compliments don’t get much better than that.

The same story seems to be in play with investor sentiment for TTD. But let’s go back to Tesla for a minute to make a point about competition.

Tesla is now trading ~30% down from the $1 trillion+ high note in 2021

Competition for electric cars is setting in. Pretty much every car marker that matters either has an all-electric car or is making one. Even V12-loving Ferrari — the gold standard of art, science, and perfection — is planning to build its first fully electric car for rollout in 2025.

But any time you see someone driving around in a Rivian, EQS Mercedes, F-150 Lightning, Volvo XC Recharge, or even Mustang Mach-E (god help you for having such poor taste) means a Tesla was substituted for another electric car. That’s competition.

For Tesla, which looks more like a long-term platform play than a pure-play auto company, competition is great news. When the pie grows, Tesla’s platform grows. A bigger pie built on new consumer norms is much better than a bigger share in a small non-growth market.

Growing the size of the pie is noted by McKinsey Corporate Finance Institute as the very best way to grow. They also note that advertising is the worst way to grow a business because competitor retaliation with tit-for-tat mouse and cat advertising tactics is easy to do. This point alone might explain a lot about adtech growth because adtech typically generates revenue on a percentage of media basis making escalation of competitive commitment (while ignoring diminishing returns issues) a big growth driver for the sector. If advertisers wake up one day and say, “enough is enough”, that would likely spell trouble for a sector that is already not in the greatest shape outside of TTD (don’t worry, the odds of that happening are not high).

One of the best examples of growing the pie is how P&G promotes hygiene and handwashing practices around the world in programs like "Safeguard Handwashing Program." The program is aimed at raising awareness about the importance of handwashing and providing education on proper handwashing techniques. One of the primary goals of the program is to reach children and teach them the habit of handwashing from an early age. More hand washing, more soap sales for all companies, everyone grows for years to come. The same goes for Tesla’s platform play.

That brings us back to The Trade Desk. It appears that management is looking at the same grow-the-pie platform playbook. That’s apparently why they introduced Kokai along with a strange periodic table.

At an event in New York City on Tuesday, The Trade Desk (TTD) announced an AI-powered upgrade to its platform – dubbed Kokai – that [CEO] Green pitched as an attempt to save the open internet from being dominated by Big Tech. (See AdExchanger for more).

The Programmatic Table

In terms of user experience, Kokai will incorporate a revolutionary new design based on the Periodic Table. The Programmatic Table will offer an intuitive cockpit that harnesses the full power of programmatic for all users – from power traders to CMOs. It allows the user to move intuitively through the media buying process, from human decisioning through AI support, with all campaign information and relevant data surfaced on the main campaign view. Already available for select users, The Programmatic Table will launch for all users later this summer.

Back-of-the-Envelope Valuation

Big questions remain: Will TTD’s efforts to become a platform play and a viable web alternative to Google be enough to support its $37 billion valuation? How much gross ad spend are investors expecting TTD to attract over the next few years and how much are they expecting operating costs to decline for the company to create the kind of implied cash flow to justify the current valuation?

Let’s find out.

Historicals and Ratios

TTD attracted $7.74 billion in gross ad spend in 2022 on ~20% take rates generating $1.57 billion in net revenue.

YoY gross ad spend growth in 2022 was 25% and YoY net revenue growth was 32% — impressive for sure.

Platform operations costs (variable cost to crunch data), fixed operating costs (ex-stock-based compensation), and stock-based compensation expenses were 18%, 43%, and 32% of net revenue, respectively.

In total, all-in operating costs eat up 93% of net revenue leaving $124 million and $113 million in operating profits in 2021 and 2022, respectively. TTD is just a 7% margin business as it stands today.

Since we are running a consistent model across all 18 companies in our QV AdTech portfolio, we assume the taxman will eventually show up for every player (once they get profitable) and take a 27% marginal tax rate. But to be ultra-favorable to adtech financial structures, we drop our tax assumption to 20% to account for R&D and other tax credits.

Given the tax assumption, net operating profits after taxes (NOPAT) in 2022 was $91 million, down 9% from $100 million in 2021.

Turning to invested capital, TTD had $863 million and $968 million in invested capital in 2021 and 2022, respectively. That means net investment ( (working capital and operating assets) cash outflows were $105 million in 2022.

With $91 million in NOPAT and $105 million in investments, free cash flow was –$14 million in 2022. Not great.

From a capital efficiency perspective, TTD generated $1.40 and $1.60 in net revenue for every dollar of invested capital in 2021 and 2022, respectively.

Forecast Assumptions

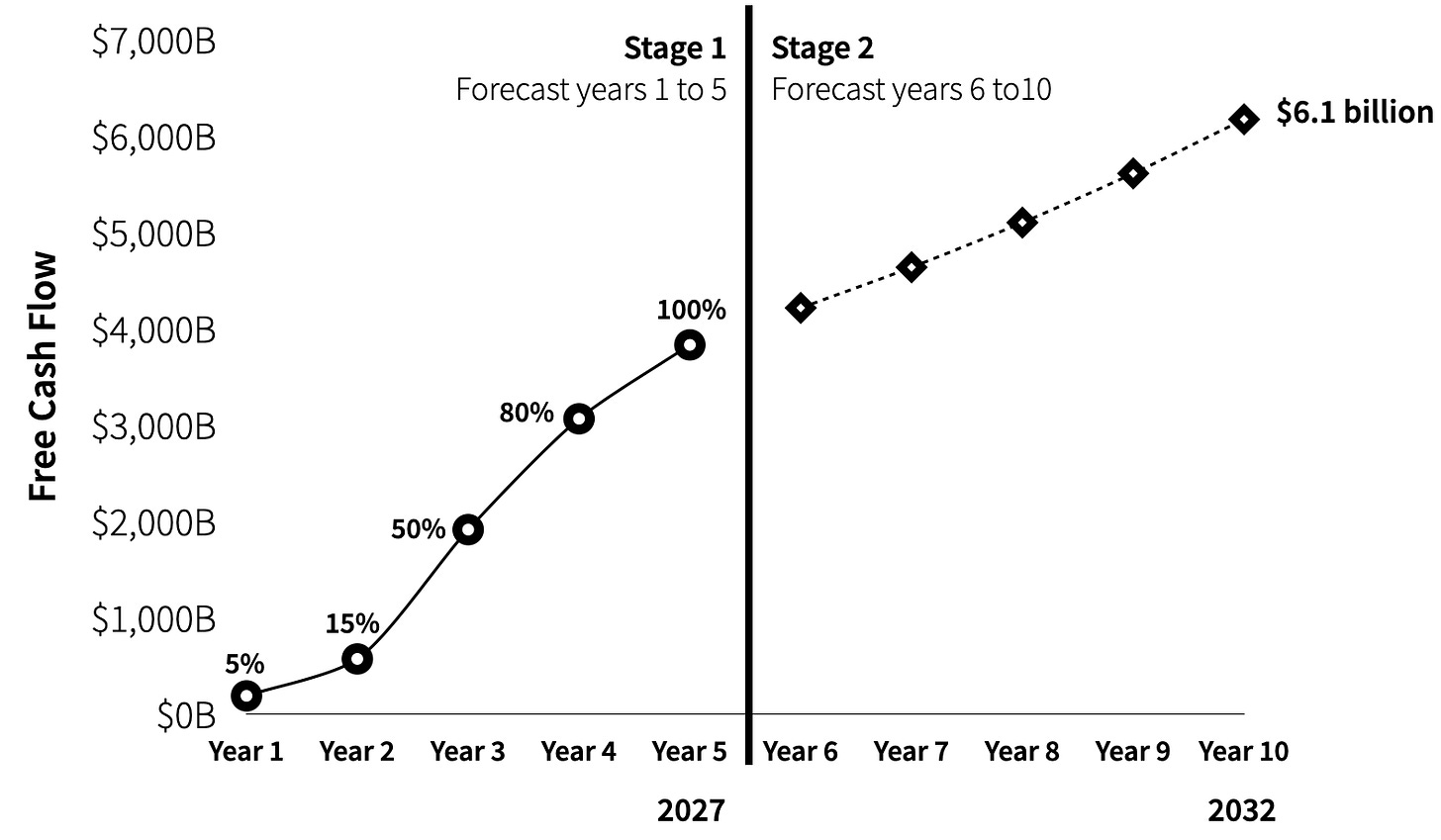

Our back-of-the-envelope model is a three-stage model. The first stage runs out five years to 2027. After the fifth year, we give a favorable benefit-of-doubt 10% growth rate running another five years in Stage 2 (forecast years 6 to 10) and end with a terminal growth rate of 4% in Stage 3.

Since our model favors current investor optimism, we assume takes rates remain at 20% forever. Is that possible? Maybe. Is it probable? It’s hard to get there when competitive theory comes into play —and it always does.

Looking at future costs, let’s say A.I. technology and supply path optimization kick in bringing platform operations down from 20% of net revenue to 10% in 2027.

Let’s further say that staff growth and other fixed expenses stop growing with revenue. For instance, let’s say A.I. tools along with other innovations replace human expenses by increasing productivity driving down operating costs as a percentage of net revenue by half to 22% in 2027. That’s not easy to do.

Stocked-based compensation was 28% and 32% of revenue in 2021 and 2022, respectively. Given comparables of older more mature technology companies, we’ll go out a limb and assume these costs go down to 10% of revenue in 2027. Keep in mind, it is difficult to rationalize big ad gross spend growth, big efficiency gains, and big cost reductions without big incentives also in play.

Last but not least, let’s assume TTD sales team efforts crush it over the next five years bringing in $50 billion in gross ad spend in 2027. That’s a 45% CAGR when last year’s YoY gross ad spend growth was 25%. If you like leaps of faith then you’ve certainly found one.

With our favorable 20% take rate assumption running in perpetuity, net revenue in 2027 would be $10.0 billion.

With marginal taxes set to 20% on operating profits, The Trade Desk’s NOPAT would be $4.6 billion in 2027. Not too shabby.

Assuming moderate growth in capital efficiency from $1.60 (net revenue generated for every dollar of invested capital) to $2.00 in 2027, that means invested capital would be $5.0 billion in 2027 (e.g. $10 billion net revenue / $2.00 = $5 billion in invested capital).

Over the five-year Stage 1 forecast, we simplify our model by averaging out invested capital in a straight-line fashion, so invested capital for FY27 would be $806 million per year ($5 billion in 2027 – $968 million in 2022 / 5 years = $806 million per year over Stage 1).

At the end of Stage 1 in 2027 TTD will have $3.8 billion in free cash flow.

Of course, these cash flows will not grow in a straight line linear fashion. Instead, they will grow in a curved fashion over time. Our simplified model assumes the following upward momentum on the way to $3.8 billion.

5% of the $3.8 billion in cash flows will happen in year 1

15% achievement happens in year 2

50% in year 3

80% in year 4

Reaching the full $3.8 billion in 2027

At that point, TTD enters our Stage 2 forecast. This is where we give a huge benefit of doubt by letting free cash flows grow 10% per year on a compounded basis from year six to ten all the way to 2032.

After Stage 2, our model assumes a 4% terminal rate on free cash flow forever.

Last but not least, we estimate The Trade Desk’s cost of capital to be 13.5% with a 1.8 beta, 5.5% risk premium, 3.7% risk-free rate, and 4.9% AA-corp debt rate.

Voilà! That’s how you can get to a $37 billion valuation for The Trade Desk (or close enough).

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.