#43: Magnite + Pubmatic, unknown take rates

Using days receivables to back into undisclosed gross ad spend and daisy chain to take rate estimate

Reading Time: 6 minutes of curiosity.

If there is one thing our Quo Vadis community is always curious about it’s undisclosed take rates. In the disclosed world, The Trade Desk ( TTD 0.00%↑ ) takes ~20% of gross ad spend on a mostly self-serve platform used by media agencies. What we don’t know is how much gross ad spend is managed by some portion of TTD’s three thousand employees nor do we know what kinds of margins are made. In any case, TTD gives us take rakes on an annual basis.

Criteo ( CRTO 0.00%↑ ) takes ~40% (e.g. ex-TAC gross margin) which is run mostly by a managed service delivery model. They disclose quarterly. Viant and Adthorent are most similar to Criteo.

But what about SSPs on the other side of the trade? What are their takes rates?

Quo Vadis tracks two SSPs in our equal-dollar portfolio — Magnite ( MGNI 0.00%↑ ) and Pubmatic ( PUBM 0.00%↑ ).

Magnite explicitly disclosed take rates before 2020 (see FY19 10K page 11) at 14.5% and footnoted it the last two years.

2022 10K: "For the full year 2022, we reported revenue ex-TAC of $515 million and total ad spend approached $4.5 billion."

2021 10K: "We posted $416 million in revenue ex-TAC for the year on total ad spend of roughly $3.5 billion"

Pubmatic has never disclosed take rates as far as we know (more on that in a second). Looking back prior to 2019 we see MGNI take rates came down over time. Why?

The main change in 2017 was removing buy-side fees (a DSP connectivity charge) leaving only a supply-side fees.

A related explanation is about transparency pressures and competition. Prior to 2016, programmatic was the wild west compared to a somewhat more tamed wilderness today, but still opaque compared to financial markets, for example.

Another view could be that when Rubicon acquired Telaria in 2019, management did not want to show the world high take rates with that business.

Or perhaps around 2017, Magnite concluded that programmatic had tremendous growth ahead and took the view that transparent SSP players would likely get more loyalty with publishers and attract more gross ad spend from media agencies and advertisers.

In any case, always remember that more volume drives down marginal cost (a good thing), so as long as the margin between take rates (price charged) and marginal cost is positive (and hopefully expanding), that’s really good. It’s the most important business objective.

Anyhow, after 2019, Magnite investors were no longer allowed to know if this key financial indicator is high or low, growing or declining. If you can’t know anything about take rates, then you can’t know anything about gross ad spend… and gross ad spend is critical because it tells you about market share.

Pubmatic ( PUBM 0.00%↑ ) is a different story. They have never disclosed take rates (as far as we know). That leads us to consider a few reasons why PUBM’s management thinks this is the best strategy:

If real take rates are relatively high, management does not want its publisher customers or advertisers to see it fearing mutiny.

If PUBM take rates are high, that might call into question the quality of inventory PUBM is trading on the assumption that lower-quality “lemon” inventory expressed as “peachy” likely generates higher margins. Everything is groovy as long as the distinction between bitter and sweet cannot be taste tested.

If take rates are high, then PUBM’s FY22 net revenue of $256M might put gross ad spend below $1 billion. That’s not a great look because unicorn status is a rare club to be in Programmatic Land.

Backing into SSP take rates

Just because we are not given SSP take rates does not mean we can’t try to use basic accounting and financial ratios to take a stab at it.

The math is simple. If we’re looking to estimate gross ad spend, then all we need is a reasonable take rate estimate and divide it into MGNI and PUBM’s net revenue which is disclosed and audited.

Our first curiosity was to look at how many days it takes for DSPs to get paid receivables (days receivable) from their user base which are usually media agencies and/or direct advertiser relationships.

What’s interesting here is the difference between bigger DSP players (TTD and CRTO) vs Viant ( DSP 0.00%↑ ) which is a smaller DSP with just $197 million in FY22 gross ad spend compared to TTD's nearly $8 billion and CRTO's $2 billion. As logic would have it, it seems like the bigger the player the sooner payments arrive.

Between TTD and CRTO, the average days receivable is 120 days or 4 months. Customers take 4 months to pay bills. That’s the advertising world for you!

We also look at how long it takes DSPs to pay their bills to SSPs partners. It’s about 130 days.

This daisy chain of payables and receivables is based on contractual agreements called sequential liability.

Sequential Liability: When a company does not have an obligation to pay what they owe until they receive money that is owed to them.

Here’s how it goes:

Advertisers take as long as possible to pay media agencies (e.g. the longer the money sits as a pre-paid asset (current account) instead of an expense event the better).

Media agencies take the same working capital posture when paying DSPs.

Eventually, DSPs pay SSPs when they get paid from agencies

And finally, SSPs pay their publisher customers (raw material suppliers)

To put this long chain of payables into perspective, if an advertiser runs a programmatic campaign in January, publishers will get paid in July (if they are lucky).

Food for Thought: Marketers often get on stage at industry events claiming to be the biggest supporters of publishers, particular the 100 or so that capture the grand majority of consumer attention. But then again, if they are so genuinely empathetic to the social importance of open web publishers, then why do they take so long to pay them?

Regarding SSPs, the question becomes, how long does it take SSPs like Magite and Pubmatic to collect from DSPs?

Well, until we know something about gross ad spending we can’t know much.

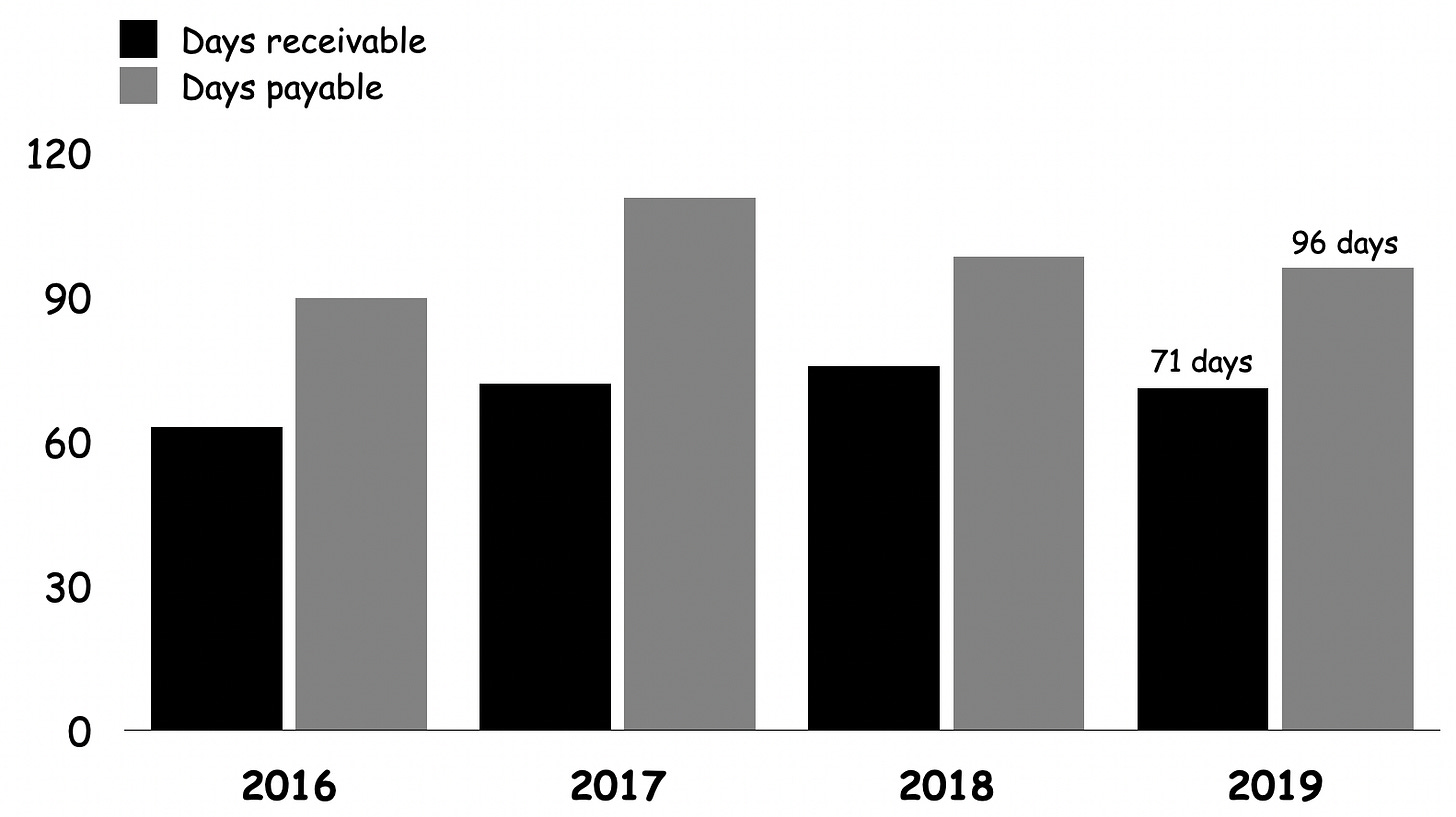

The first place we can look to get a clue is Magnite’s days receivable and payable prior to 2020 when they used to disclose gross ad spend.

Without knowing much more, we can see sequential liability in play. In 2019 it took Magnite 71 days to collect from DSPs and 96 days (nearly a month longer) to pay publishers.

Figuring out current takes for MGNI and PUBM

Since a DSP’s days receivable is 110 days, and assuming sequential liability is in play down the chain, that means an SSP’s days receivable is likely the same if not slightly longer.

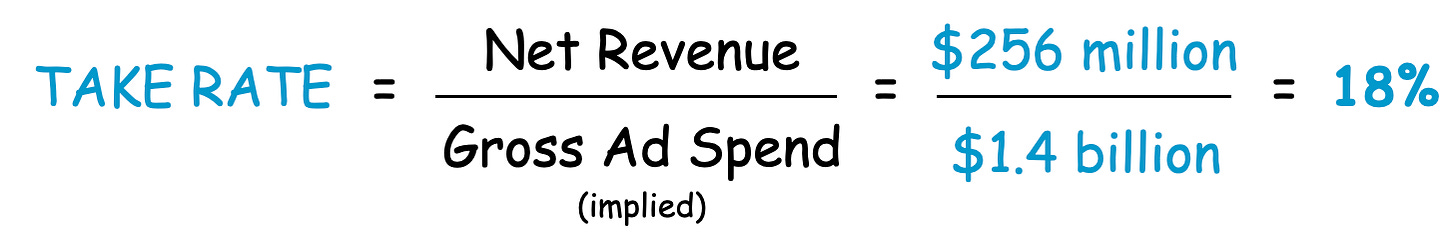

Looking at Pubmatic’s balance sheet we can see receivables are $314 million as Q4FY22 reporting. If we can plug in our 110 days receivable as a fair assumption to impute gross ad spend we get FY22 gross ad spend at $1.4 billion.

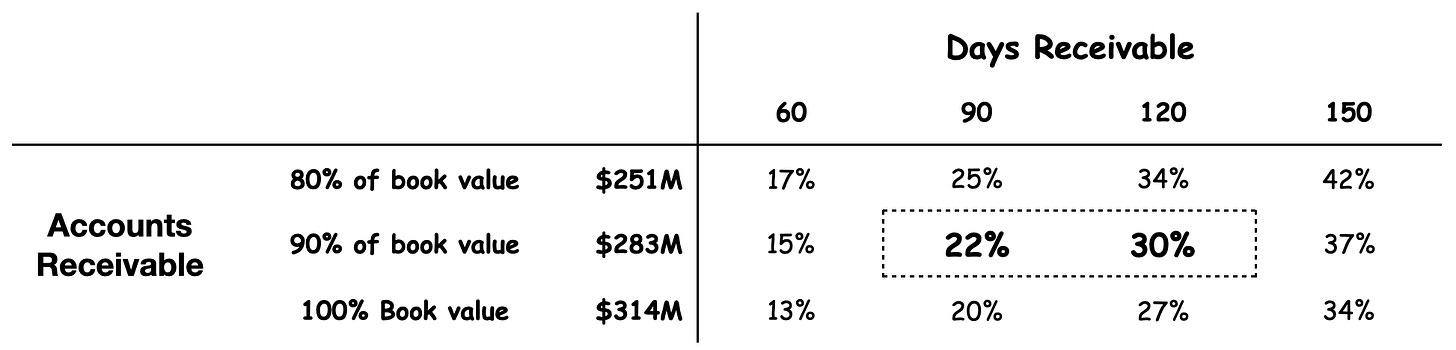

Now that we’ve backed into gross ad spend, we can get what feels like a pretty good estimate on Pubmatic’s likely take rate (give or take a few basis points):

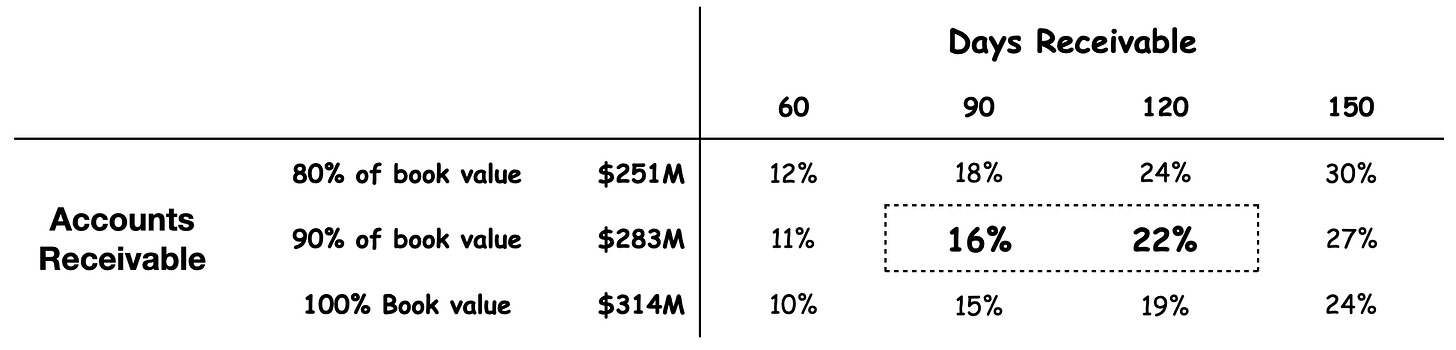

We can also look at these implied take rates as a matrix to narrow in on what we think is the most probable range between 22% and 30%.

When we run the same exercise for Magnite, you see that implied FY22 take rates are consistent with what MGNI used to disclose in the past.

Our analysis also shows a giant difference in gross ad spend share between Magnite and Pubmatic.

Pubmatic has grown more organically to attract gross spend while Magnite has acquired its way to nearly 4x more gross ad spend.

Golden Rule of AdTech: As Quo Vadis has pointed out many times, the ability to first attract gross ad spend and then extract the most take-rate that customers will tolerate is fundamental to profitability.

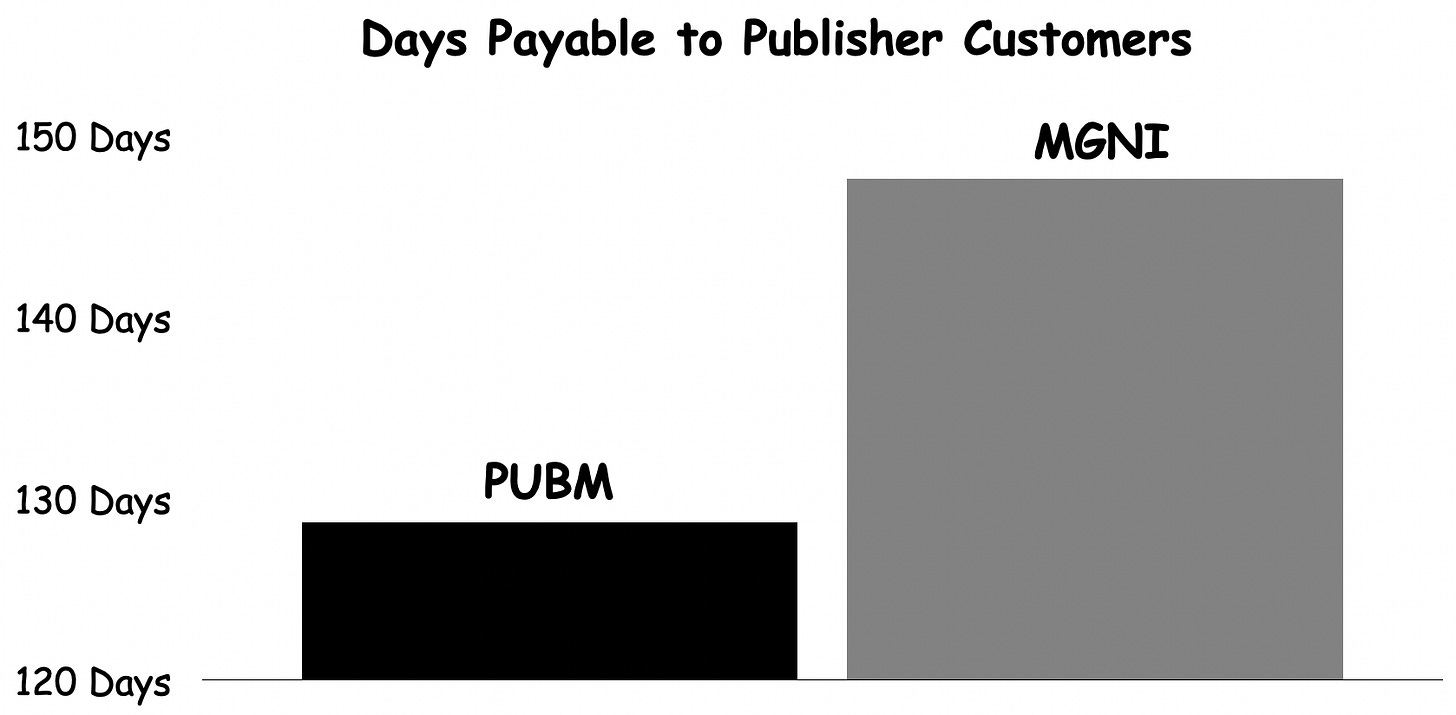

For what it’s worth, now that we have a reasonable clue about implied gross ad spend, we can also solve for how many days it takes MGNI and PUBM to pay their publisher customers.

Just like the power of bigger DSPs to make SSPs wait longer for payment, the same rule appears to hold when SSPs pay publishers. The more demand you bring to publishers, the longer the more payment patience they have.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.