#15: Portfolio Update (Agencies)

S4 Capital still leads the way; Racing for 2nd place; Value creation is king; You & Mr. Jones in the news

Welcome to Quo Vadis, your periodic source for fresh programmatic news and off-the-beaten-path perspective. Click here to join the conversation.

Today is National Corn on the Cob Day in the US. Who knew, but a guy by the name of Deangelo De Moulin in Casper Wyoming holds the record for eating entire corn on the cob in 11.61 seconds. Give it a shot this weekend — let us know how it goes!

S4 Capital Still Leads the Way

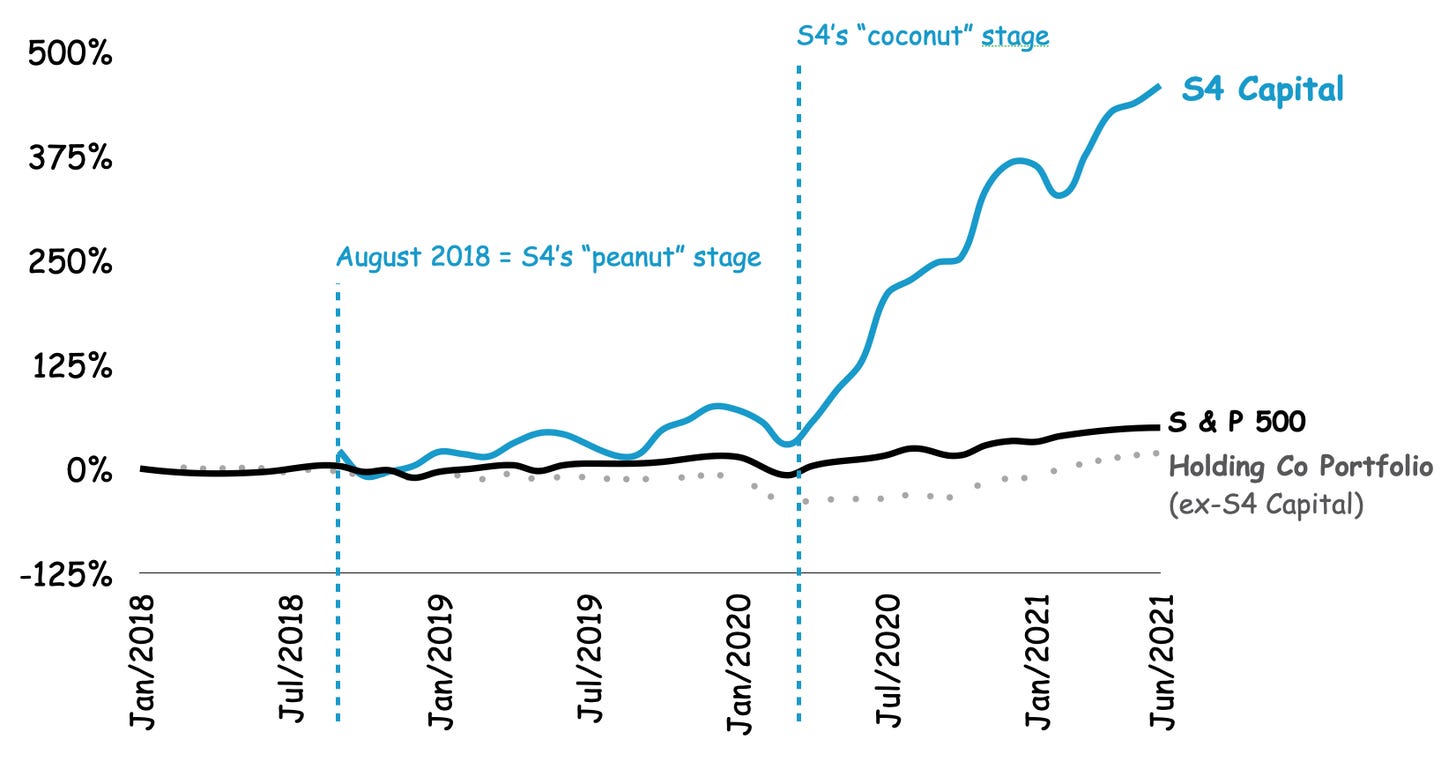

Since our inaugural portfolio launched on March 4, our Quo Vadis basket of agency stocks is moving in the right direction up from 67% in March to 92% as of June 7, 2021. However, if we exclude S4 Capital, which trades more like an adtech company than an agency, the portfolio is only up 19% overall.

Reminder: We’re running an equal-dollar portfolio that starts in January 2018 (we explain why here). We include stocks that are either 100% dependent on programmatic advertising or heavily reliant on it. S4 Capital is ~30% dependent on programmatic media (e.g. MightyHive) while the five legacy agency holding companies have a varying degree of programmatic dependence, particularly on profits.

In other words, had you bet $100 on the basket of stocks that includes S4 Capital in January 2018, you’d have $92 of extra cash in your pocket today, and you would’ve beaten the S&P by almost 2x.

S4 Capital is the Portfolio

As far as our equal-dollar portfolio across six agency holding companies goes (IPG, OMC, PUBG, WPP, DNTU, SFOR), S4 Capital is still the most interesting game in town.

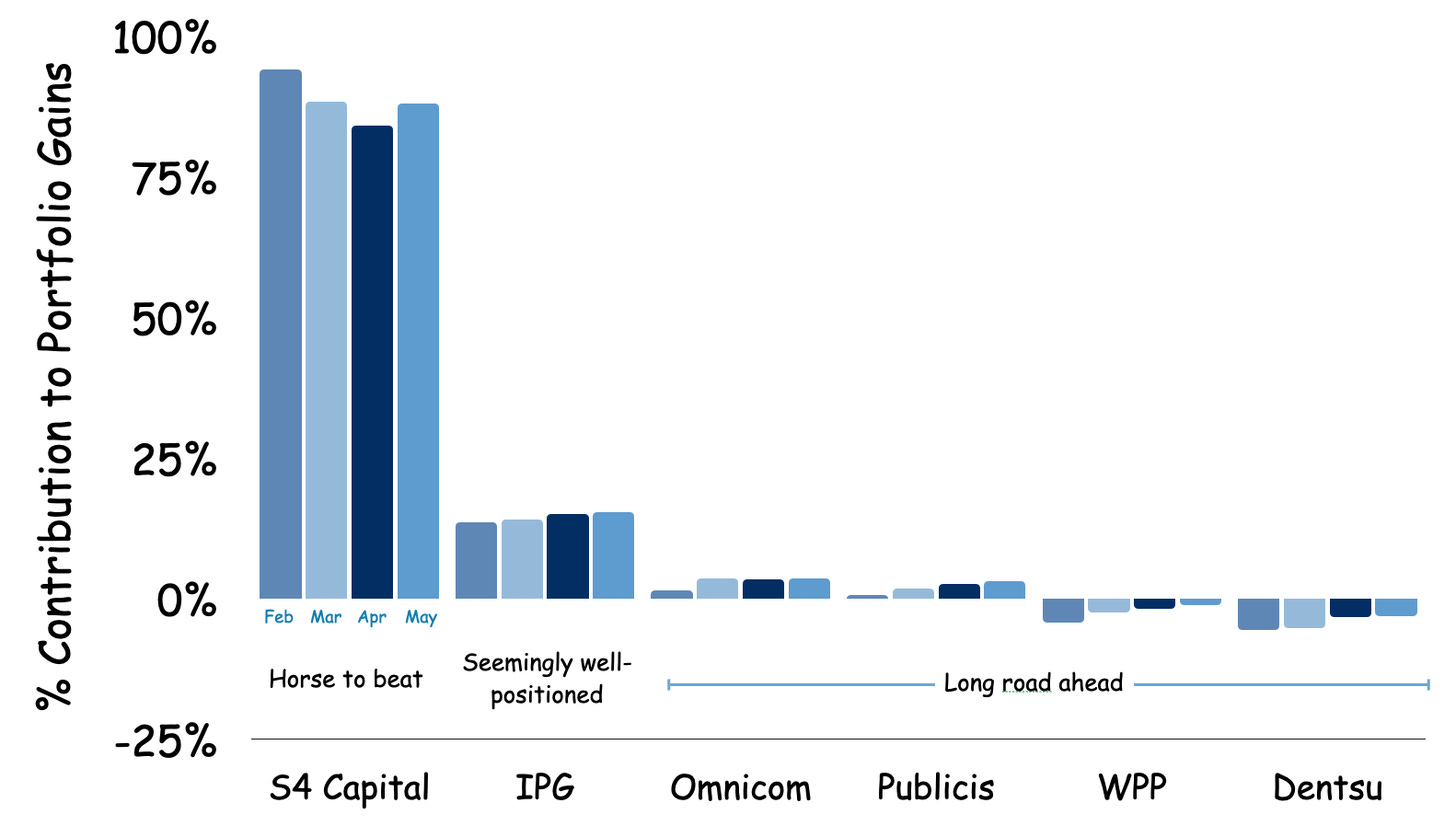

Put it this way: When we exclude S4 Capital from our agency portfolio, the non-SFOR group doesn’t beat S&P 500 returns. If we include S4 Capital, it delivers 88% of the gains while the other five deliver 12% of which IPG contributes the most.

The future is bright for “better, faster, cheaper” S4 Capital

$700 million in dry powder including cash-on-hand, debt facility, and 50/50 unitary deal structure.

More all-digital acquisitions to come.

As S4 hunts down more “whopper” clients ($20 million in annual net revenue or more), investors like what they see.

Racing for 2nd Place

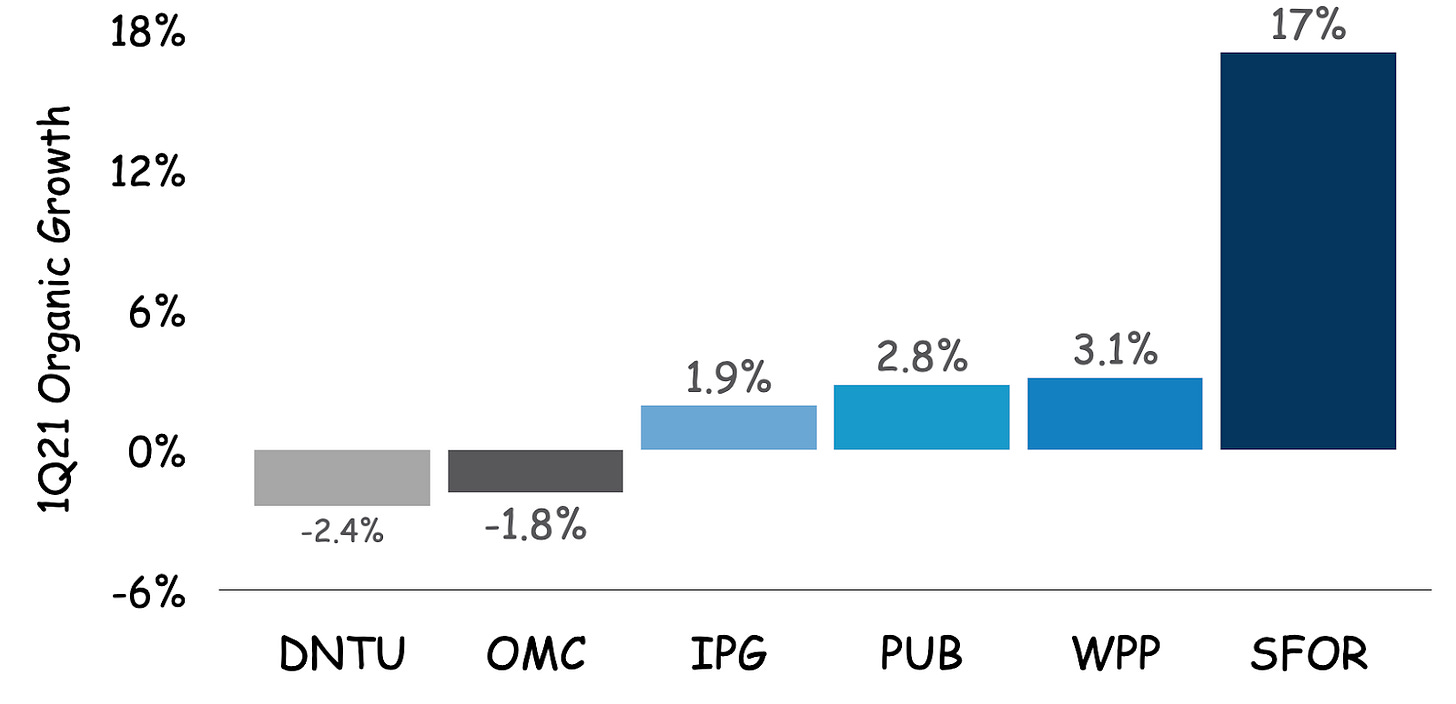

While S4 Capital contributes the most to portfolio gains, all the legacy holding cos reported a positive albeit similar 1Q21 story — organic revenue is up a few ticks with outlook slowly improving.

Good News: Over the past three months, all six holding co stocks are up and returning more than S&P 500. However, what’s unclear is an ability to hold up what’s left of pricing power when legacy agencies come under pressure from clients (marketing and procurement). Yes, showing organic growth is better than the alternative, but if the price per unit sold (e.g. scope of work or whatever the undefined unit economic might be) is falling in real terms, that’s like pouring water into a bucket with a hole in it.

More Good News:

A telling signal of positive change to come is how the recent blitz of media reviews is coming up against agency hesitation, and in some cases, resistance. Nick Manning covered the story in MediaTel:

It’s six years since the first ‘Mediapalooza’, when media agency reviews came fast and furiously. We are now seeing another big flurry but this time the causes are different and the nature of such reviews has changed dramatically.

One different and unexpected aspect is that media agencies are being highly selective about which pitches to take part in. It may have been assumed that they would chase every opportunity to restore revenues lost to the pandemic. This isn’t happening.

The pitch intermediaries universally report that they are having to persuade agencies to take part in tenders. The use of the word ‘unprecedented’ is, well, unprecedented but we have never before seen media agencies being so selective, and rightly so.

As agencies reimagine themselves into better, faster, and more valuable extensions of the client’s team (transparency, trust, etc.), we suspect digital holes will get filled as legacy players buy their way into digital reinvention, level up talent, and invest in productivity gains over billing out labor. And while nobody knows how long it will take, we do know two things for sure:

New all-digital models like S4 Capital and You & Mr. Jones have become shining examples. Both companies are not only past a hype cycle peak but have skipped right over the trough of disillusionment and straight into growth mode.

The less time legacy media agencies have to spend on pitches (with low expected values), particularly the kind that aim to ratchet down fees yet again, they’ll have more quality time to focus on reinvention that can more quickly meet the client’s rapidly changing needs.

Contribution to Portfolio Gains

In terms of contribution to our agency portfolio, the second-best performer is IPG, which also happens to be the smallest of the legacy holding cos. It seems reasonable to believe that IPG’s smaller size has allowed management to reinvent faster than the larger legacy players. What do you think?

Value Creation

Let’s take a quick tour into how well each of our portfolio companies in terms of value creation. Like all profit-seeking companies, our programmatic pure-play adtech stocks and agencies all create value by turning their assets into cash flow. In other words, each player has a certain amount of invested capital that funds operations to produce operating profits, aka Returns on Invested Capital (ROIC).

As each player goes about their business, they also have to contend with the Cost of Capital, which is the cost to fund operating assets. When ROIC is greater than the Cost of Capital, a company is generating value. If the reverse is happening, then value destruction is in play. The overall objective is to create as much “economic spread” as possible and then maximize growth rates creating a cash printing press effect.

Legacy Media Agencies and S4 Capital

No surprise, S4 Capital is creating the largest economic spread across its peer agency group.

Until WPP completes its turnaround (e.g. restructuring asset base), the agency group is going the wrong way as it turns out negative profits from its asset base.

While Dentsu has positive profits, the returns are still less than its cost of capital. There is no use focusing on growth until the spread is corrected as that means more value is destroyed faster.

Programmatic Stocks

As you can see, even though S4 Capital is an agency, its all-digital assets generate value making it trade more like an ad tech company.

Surprisingly, while Magnite contributes the most to our equal dollar portfolio gains, it’s not generating value. In fact, value is being destroyed in a big way. We think investors will eventually catch up to this notion — they always do.

The biggest positive surprise for Quo Vadis is the cognitive disconnect between what appears Pubmatic’s amazing ability to generate a relatively large economic spread, yet at the same time, short-seller interest in the company is also relativity large. If the short-sellers are right, it means they don’t believe the valuation numbers. If they are wrong, then it will play out in a rising stock price for PUBM.

You & Mr Jones Aims to Reinvent the “Holding Co”

With a similar-sized war chest compared to S4 Capital, and 1Q21 net revenue organic growth up 34.3%, Quo Vadis likes where “BrandTech” is heading with You & Mr. Jones. The firm raised $260MM in 2020 at a $1.36 billion valuation, so its currently less than half SFOR’s market cap is $3.4 billion.

Of note, You & Mr Jones is launching a Media unit to bring its market-leading disruption to the media industry. Former Mindshare Global CEO Nick Emery joined as Founding Partner. Armed with $300 million, the new group is looking to build a new media model for brands.

Quo Vadis sees the notion of “new” as the opposite of the current state. For example, if current digital media planning and buying are slow and generally non-transparent, along with a general reluctance to turn tech/data into way better measurement, then any new media model will be faster, radically transparent, and come with believable performance measurement (e.g. not every campaign can achieve a gazillion percent ROI when diminishing returns are always in play).

Along with Nick Emery, the recent addition of Will Luttrell as partner and CTO presents a more clear bridge to “new.” Luttrell was the founder and CTO of Integral Ad Science as well as founder and CEO of Amino, which recently sold to Integral Ad Science, so he knows a thing or two about building stuff. According to the PR, Will will focus on connecting the group from a tech perspective and accelerate its media “newness.”

Other Programmatic News

Zeta Global IPO

Zeta Global IPO-ed on June 10 at an opening price of $10. As of press time, the stock trading down 17% at $8.30. Once we get a glimpse of Zeta’s first quarterly earnings we’ll likely get a new addition to our portfolio.

Similar to Viant and other managed service DSPs, Zeta is heavily dependent on trading programmatic media with acquired assets such as IgnitionOne ($21.6 million post-solvency price tag); Sizmek’s DSP and DMP ($31.9 million, another distressed asset); and PlaceIQ's ($1.28 million).

Chris Greiner, Zeta Global CFO, and 3-time IPO star explained negative IPO pop by saying, “What will matter about our performance of our stock and our company is ten years from now.”

Amobee

After Verizon peeled off its media business (Yahoo and other less valuable assets) and is expected to write down $4.6 billion, SingTel announced its interest to do the same with Amobee. Does anyone care?

MediaMath

MediaMath is exploring a sale, and it could be for real this time. In our DSP market sizing post on May 7, we estimated that MediaMath handles around $600 million in gross revenue (e.g., ad budget flows).

Looking at the comp set (Trade Desk and Criteo), we don’t think there’s a buyer out there that will value MediaMath at TTD’s 6x multiple on ad budget flows. They simply are not in the same league.

While Criteo’s market value is moving up, it’s still only 1x ad budget flows. It’s hard to imagine a smaller DSP like MediaMath getting a better valuation multiple than Criteo with 20K advertisers, thousands of direct pub integrations, a hook into Retail Medial, and tons of shopper data.

Although MediaMath is holding $500M in debt financing, no one knows how much has been spent. Assuming it’s water under the bridge, and 1x multiple, the result is not going to be pretty for MediaMath’s VCs or anyone with vintage options.

In the spirit of Cannes Lions that will again be virtual in a few week’s time, c’est la vie! Bon et chance!

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

No new posts?