#1: Quo Vadis 3/2021

Programmatic pure-play stocks are crushing it; Sir Martin is like Cassius Clay; and much more...

Welcome to Quo Vadis, your periodic source for fresh programmatic news and off-the-beaten-path perspective. If someone was kind enough to share this with you then you are in luck! Just click here to join the conversation.

Our Quo Vadis Portfolio Is Crushing It

Programmatic Pure-Play Stocks Beat Nasdaq by 11x Over Last 2 Years

We get our kicks in geeky ways. That’s why we’re sharing our favorite new toy with you, our subscribers. Behold, our Quo Vadis Programmatic Portfolio. We track a handful of pure-play programmatic stocks on an equal-dollar basis and tell you what we think the data says.

What’s an equal-dollar portfolio?

Good question. Let’s say an investor split $100 evenly across five programmatic-dependent stocks starting in January 2018 — TradeDesk, Criteo, Liveramp, Magnite, and Roku. As time goes by, we add two more stocks to our model — S4 Capital, which came into play in late 2018, and Pubmatic, which went public last December.

Our lucky (or very clever) investor would be crushing it today, beating the Nasdaq by 11x and with an extra $995 in her pocket. Not too shabby for a sector that investors used to run away from like a house on fire. 🔥

Shaking Off A Bad Week

Just a few short days ago, our little portfolio was up even more than today. With Google’s announcement around changes to how data on Chrome browsers can be used for advertising purposes, along with Ray Dalio’s wisdom asking, “Are We In a Stock Market Bubble?”, the programmatic tech sector has taken a beating since the end of February.

On February 26, programmatic stocks were valued at over $100 billion. By March 4, they lost $13 billion falling 13%. But even with this setback, you’d still be way ahead.

Standing Up to The Heat

Pubmatic, the newbie on the programmatic public scene, has taken the worst percentage beating losing over half a billion in value. But the biggest casualty is The TradeDesk, shedding over $7 billion in market cap.

S4 Capital, the company reinventing the holding co model, only fell off by less 1% which shows a lot of resilience because it usually trades more like an adtech company than an agency (more on that subject later).

What a Difference a Few Adtech Years Can Make

If you ask any adtech insider what it was like to raise a venture capital round before 2020, they’d tell you the chances were -155%. Academic mathematicians from around the globe are still scratching their heads and channeling their inner Einstein to comprehend the possibility of a negative probability. Of course, if any sector can defy normal math, adtech can.

Before 2018, VC and public market investors took an arm’s-length stance on pretty much everything adtech. Business Insider captured this sentiment best in July 2017:

“That's what happened on Tuesday when the ad tech company Rocket Fuel was acquired by rival Sizmek. The deal appears to mark the end of an era for the ad tech industry, which has been characterized by a massive flood of funding, a proliferation of startups, several rocky IPOs, along with lots of layoffs, pivots, and consolidations over the past half dozen years or so.”

From Disgust to Devotion

My oh my… how market sentiment has changed. Our little programmatic portfolio is like Tillie in The Little Engine That Could, chugging away to new frontiers. Choo choo!

Ari Paparo, adtech guru and CEO of Beeswax, summarized adtech love in a recent tweet:

Yes, it is quite something. And with so many adtech SPACs on the horizon, our Little Portfolio That Could is about to add a few more carriages to an already heavy load. But can the market handle the extra weight? 🚂 🚃🚃🚃…🚃

It’s Not Just TradeDesk Giving Investors Love

Sure, TradeDesk (TTD) is trading at a gazillion times earnings while management is sprinting away on the earnings treadmill. But if you thought TTD drives all the gains in our programmatic stock portfolio, you’d be wrong. By a lot.

It turns out that Magnite (MGNI) — formerly Rubicon Project smashed together with Telaria like an Oklahoma Onion Burger — has generated the largest share of growth in our Quo Vadis portfolio. Magnite punches well above its weight class, driving 44% of the gains compared to TradeDesk’s 29%.

Time Out for Oklahoma Onion Burgers!

If you love burgers like us and don’t know about Oklahoma Onion Burgers, you’re missing out!

The story behind this delicious burger is a lot like programmatic ad inventory. Just like how programmatic was born out of the Great Recession in 2008, the Oklahoma Onion Burger was born out of the Great Depression. When meat is expensive, just add in an equal amount of cheap oniony ad impressions — voila, magic happens.

Speaking of Magnite

Magnite had its fair share of news bites to kick off 2021. Two stick out — one could be good, but the other is definitely not so good.

Good News

Magnite has agreed to acquire SpotX from Amsterdam-based RTL Group in February for $1.2B, mashing more SSP inventory into its offering. (Onion or meat?)

RTL acquired SpotX in 2017 for a reported $400M, so whatever they changed in the three years they owned it, it worked! Getting a 3x return in under five years would make any VC envious. With P/E ratios trending near all-time highs, the Dutch media group picked a great time to sell and made a sweet profit.

Bad News

Spruce Point Management, an investment house focusing on short-selling and special situation investment opportunities, published a report in January claiming a laundry list of “dubious” issues at Magnite.

Dubious management

Dubious financial reporting

Dubious accounting and leadership

Dubious stock promotion

Excessive valuation: poor risk/reward

The report also claims, “Multiple customer interviews all tell us that Magnite does not have much quality CTV inventory to currently sell, the financial reporting has mathematical impossibilities and serious accounting issues.” ‘Nuff said.

As The Agency World Turns

Sir Martin Gonna Knock You Out!

When LL Cool J wrote his hit song “Mama Gonna Knock You Out,” he was obviously thinking about Sir Martin Sorrell and S4 Capital…

“Don't you call this a regular jam. I'm gonna rock this land. I'm gonna take this itty-bitty world by storm, and I'm just getting warm!”

What Would Ben Horowitz Say?

When legendary venture capital investor Ben Horowitz evaluates CEOs by asking three simple questions, he might be channeling Sir Sorrell as his muse.

1. Does the CEO know what to do?

2. Can the CEO get the company to do what he/she knows?

3. Did the CEO achieve the desired results against an appropriate set of objectives?

Horowitz also says:

“The story and the strategy are the same things. The proper output of all the strategic work is the story. The CEO is the keeper of the story.”

Sir Martin Sorrell obviously passes the Horowtiz Test with flying colors. Looking at S4 Capital’s rapid growth from “peanut to coconut,” Sir Martin clearly knows what to do and is incredibly skilled at getting his fast-growing team to do what he knows.

The Keeper of the Story

No matter where Sir Martin goes, he sticks to his home base message with laser-like focus. For him, it’s always about the so-called Holy Trinity.

“This is a continuous loop. You take the data, you develop the digital advertising content from the data, you pump it out programmatically, you look at the results, you get more data that improves the content. I liken it to an election campaign without an election date.”

The Results

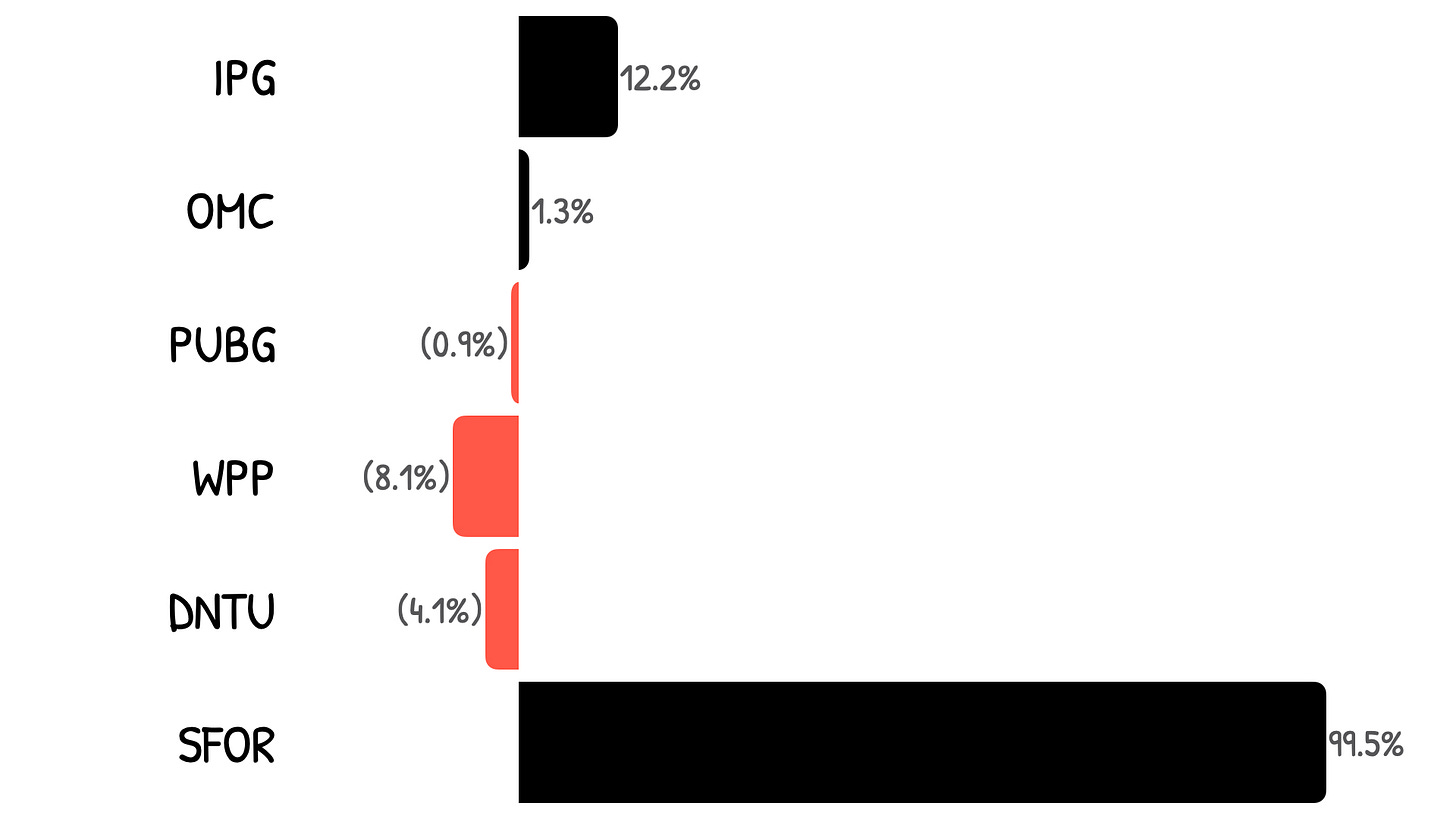

Our Quo Vadis Agency Portfolio has tracked five major holding companies on an equal-dollar basis since January 2018 — WPP, Publicis Omnicom, IPG, and Dentsu, with the addition of S4 Capital in late 2018.

S4 Capital’s results are off the charts and only getting better. That’s why Michael Levine at Pivotal kicked off the new year by saying, “We reiterate our BUY rating on SFOR capital with a target price of 700 pence" (that’s a 58% bet to the upside based on current price).

S4’s stock price is up 336%+ since planting the S4 Capital seed in 2018 with his reverse takeover of Derriston Capital (see our story on SPACs).

S4 contributes nearly all the gains across our Quo Vadis Agency Portfolio — four out of five of the legacy holding cos are negative contributors, with the exception of IPG contributing 12% of the gains.

S4 trades more like an adtech tracking stock, given its tight linkage as a Google reseller, while legacy holding cos trade a lot like old-school, non-digitized industrials.

“I didn't want to retire – I have a point to prove”

WPP is performing the worst across our portfolio, contributing -18% to overall gains.

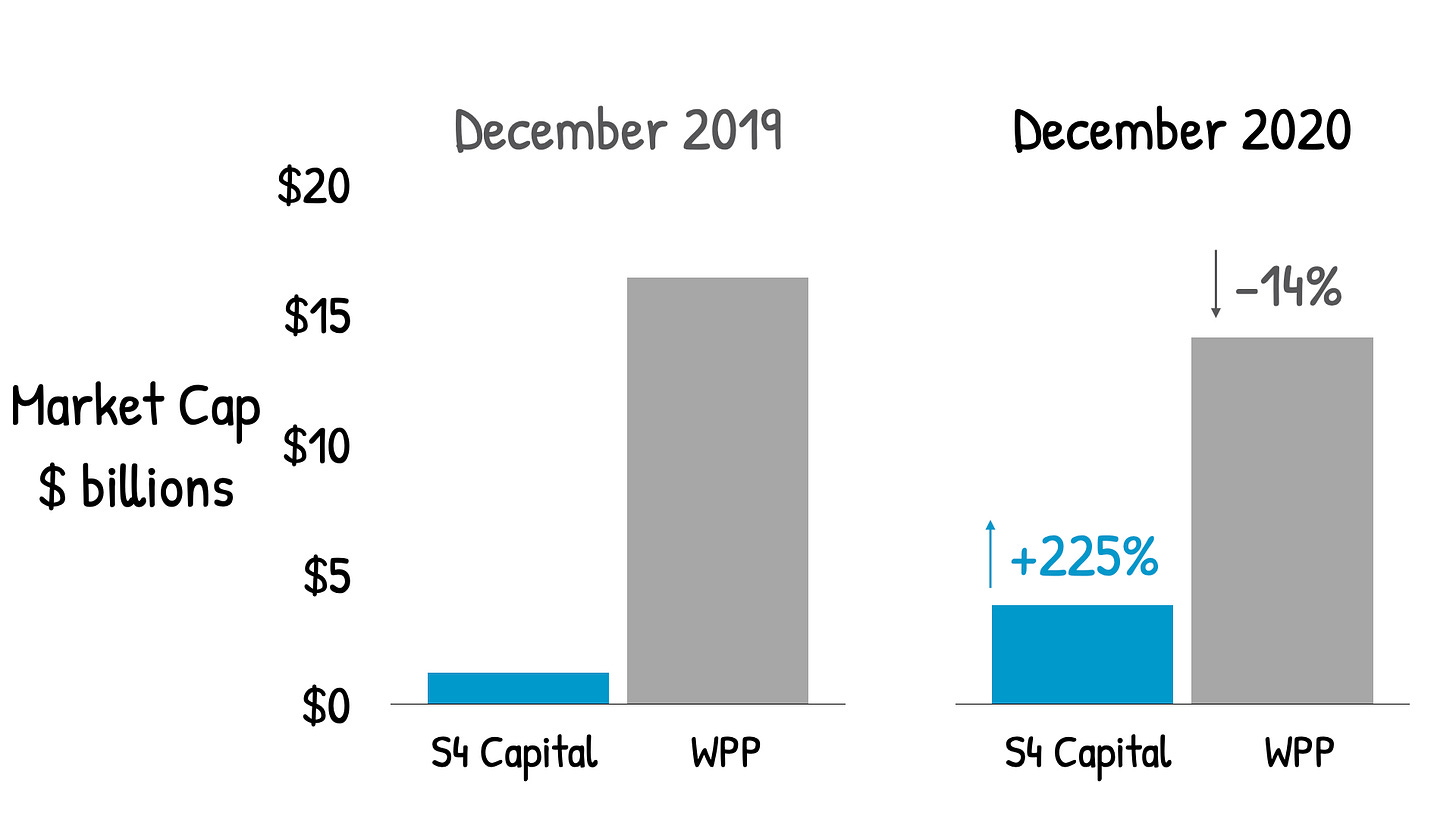

That will surely bring a wry smile to Sir Martin’s face, and we suspect his smile will get wider with each passing earnings call. Looking back to just over one year ago, S4’s market cap is up more than 3x, while WPP’s is down 14%.

The bout is starting to look something like this…

Fun Fact: Sports Illustrated magazine named their first meeting, the Liston–Clay fight (Ali had not yet changed his name from Cassius Clay), as the fourth greatest sports moment of the twentieth century.

The Problem With Being “Legacy”

Game Theory Concepts

Legacy holding companies are in trouble. No news there. The question is “why?”

S4 Capital gives us a real clue to the answer. If you have no story, it’s because you don’t have a compelling strategy to go talk about. It’s really that simple in any business, particularly the agency business.

Let’s think about in terms of game theory where there are dominant strategies and there are weak strategies. S4 Capital is a case study in dominant strategies, which is why their story is working with clients, acquisition targets, investors, and analysts.

Legacy agency businesses are the opposite. They practice weak strategies. They used to have an incredibly dominant strategy, but those days slipped away like ships in the night.

The big question remains: As big holding cos continue to restructure, will they sail into a blue ocean with a new cutting edge built for digital demands or will they struggle with demands from procurement trying to fight their way out of a wet paper bag?

Other Alternative Holding Co News

In January, You & Mr. Jones, “The World’s First BrandTech” holding company, closed a sizable $200 million Series B-2 valuing the company at $1.36 billion.

The upbeat press release revealed that YTD Q3 2020 organic net revenue growth was 27%. With 3000 employees in 40 offices in 40 countries, You & Mr. Jones is probably the closest comparable peer to S4 Capital, which has 3750 employees in 31 countries.

Squaring the Numbers

Just one year earlier in December 2019, the house Mr. Jones built had raised a $200MM Series B-1 valuing the holding co at a $1.3 billion post-money valuation.

Adding it all up, the pre-money difference between the two financing rounds was just $60M upside growth. We find it notable that during the same exact time period, S4 Capital’s valuation increased more than 3x from $1.2 billion to $3.8 billion. What gives?

Who knows… given all the SPAC hype plus $750M in private funding since 2015, what are the odds Mr. Jones joins the SPAC party in 2021?

Bring Out the Quants

Media Math Question of the Month

Wanna win a free paid subscription to Quo Vadis+ for one whole year?

Answer our programmatic math question correctly and you’re on your way! And don’t forget about the bragging rights!

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

This was incredible! I'd love to build a partnership, please email me at chris.hartley@britepool.com

Hi Omri — it comes down to 3 advantages:

1. " Do Criteo have some kind of publisher/SSP partnerships, that enable them a first look at auctions across certain publishers?". Yes, these direct deals used to represent 50% of clicks/revenue a few years ago, I'm not sure how significant it is today, but I'd guess it's still a big factor.

2. They charge advertisers a CPC and buy inventory on a CPM basis. That means the eCPM they bid = CPC x predicted CTR of users x 1000.

If the prediction is accurate, they have a tremendous advantage. And Criteo's error rate is likely sub 1%, so it's very accurate.

But keep in mind it's not that hard to get high ROAS by serving ads to users that have a high chance of converting anyway. Kind of silly when you think about it, but that's advertising.

3. Having many direct pub 1st look deals with SMB pubs is important because with retargeting you need 2 ingredients:

1) client appetite for vanity ROAS

2) an ability to win impressions "first and fast" because click probabilities decay rapidly over the first 24 hours since the user shops on a site.

Does that help you out?