#5: SPACs Killed the IPO Star

What the heck is a SPAC? Who in programmatic land is thinking about it?

Welcome to Quo Vadis, your periodic source for fresh programmatic news and off-the-beaten-path perspective. If someone was kind enough to share this with you, then you’re in luck! Just click here to join the conversation.

Today is National Spinach Day. Not only does spinach provide iron, but it’s also an excellent source of vitamin K, vitamin A, and vitamin C. Reading Quo Vadis is like you getting programmatic ‘pinach full of vitamins RT and AD. “Radical Transparency” and “Ad Quality” help you avoid the nasty effects known as “winner’s curse.”1

SPACs Killed the IPO Star

Just like the hit song “Video Killed The Radio Star” launched MTV in the ’80s, SPAC-ing is killing the IPO star across the adtech landscape. These Special Purpose Acquisition Companies are becoming the preferred way for several adtech companies to go public.

Morning Brew summarized it best — “a SPAC is a shell company that goes public, raises money, then uses those funds to acquire a private company and, in doing so, take them public.”

If you want to learn more, check out how The Hustle explains SPACs. Vs. IPOs in a truly beautiful way. In the meanwhile, Quo Vadis explains SPAC 101 in 1-2-3 steps.

SPACs in 3-Steps

Step 1: Create and fund SPAC by filing various forms with the SEC.

SPAC managers (aka “sponsors”) get ~20% interest in the SPAC (commonly known as founder shares). The remaining ~80% interest is offered in an IPO of the SPAC’s shares.

Take Taboola, for example. Tabloola is a company the New York Times called, “Purveyor of Clickbait Ads,” they created a SPAC in late January.

Don’t worry about what clickbait means. Advertisers and publishers don’t seem to mind either, so why should you? On the other hand, if it sounds like the kind of advertising David Ogilvy and Mary Wells Lawrence would vomit over, then maybe you should worry just a little bit.

Taboola’s SPAC was funded with $259 million in sponsor funds, and it is publicly traded on the NYSE as ION Acquisition Corp. This is why SPACs are also known as "blank check” companies — investors in ION write a check to eventually merge with a target company like Taboola.

Step 2: Merge SPAC with the target company or a roll-up of several companies.

Following the IPO, proceeds ($259M in Taboola’s case) are placed into a trust account. The SPAC (e.g., ION Acquisition Corp) has 24 months to identify and consummate a merger of love with a target company (e.g., Taboola).

It will also include a host of financial information on the target company, such as historical financial statements, management’s discussion and analysis (MD&A), and pro forma financial statements showing the effect of the merger.

Step 3: Grow and report earnings just like any other public company.

We wish these SPAC-ers well. Keeping clean books and keeping up with an ever-faster earnings treadmill won’t be easy.

And folks like Edwin Dorsey’s Bear Cave are watching. His short-seller subscribers are watching too. As of March 14, “the dollar value of bearish bets against shares of SPACs has more than tripled to about $2.7 billion from $724 million at the start of the year.”

Who Else in Adtech Land is SPAC-ing?

Buzzfeed, Vice, Vox, MediaMath, InMobi = SPAC

Terry Kawaja, CEO of Luma Partners and creator of the SPAC Lumascape, equates the phenomenon to the nightclub scene. If he’s right, our Quo Vadis programmatic portfolio party is going to get much bigger with new SPACs (and a few IPOs) on the horizon. Will they pull our portfolio up or down? Time will tell and we’ll let you know!

Bustle Digital Group, Vice Media, Vox Media, Group Nine, and Buzzfeed

According to CNBC, a slew of digital publishers has been in “recent talks about going public via a SPAC or consolidating and then going public.” For publishers, Quo Vadis wonders how much Apple and Google’s identity lockdown handcuffs their ability to generate the kinds of future returns SPAC investors expect to get in return for whatever the risk level might be today.

With so much uncertainly around 1st party data and identity recognition in the DSP-SSP bid stream, publisher SPAC risk feels quite high.

SPACs in DSP World

MediaMath SPAC: Rumors are circulating about Media Math taking the SPAC route. If we look back at Media Math’s main peer group — The TradeDesk, Criteo, Appnexus, Amobee, DataXu — they’ve all either gone public or got acquired many moons ago. What once was a potential Cindarella story has not made it home before midnight. Not yet at least.

With a whopping $607 million in total funding going back to 2008 and roughly half in debt financing, a MediaMath SPAC will be a remarkable feat to pull off.

Quo Vadis thinks MediaMath’s SPAC success or failure will depend on its Unicorn status and a proven ability to attract ad budget share in a very crowded space.

As far as unicorn status goes, we estimate MediaMath is safely in the Unicorn Club with around $1.0 billion in ad budget under management. How do we get there?

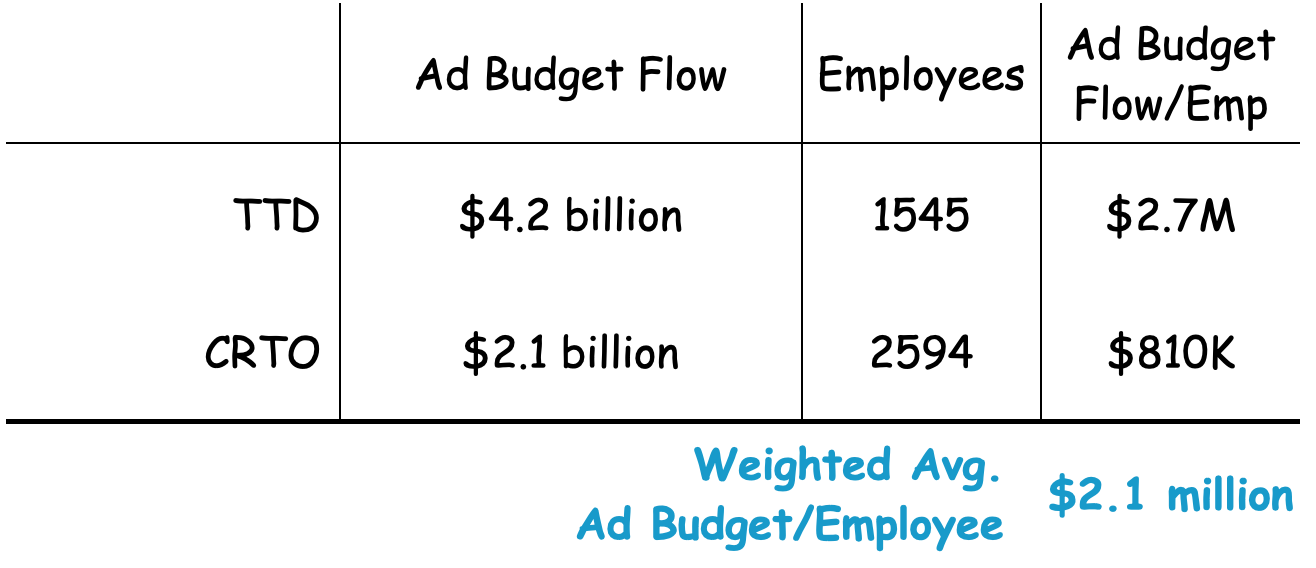

According to MediaMath, they count around 505 employees.

TradeDesk and Criteo are the closest peers with weighted average ad budget flow per employee at $2.1 million. Competitive market theory suggests MediaMath (or any other established DSP) won’t be far too off the mark.

505 employees x $2.1M = just over $1.0B in media flows.

Rule of thumb: Perfect Competition is a theoretical market structure where all firms sell an identical product (the product is a "commodity" or "homogeneous"). All firms are price takers (they cannot influence the market price of their product) and market share has no influence on prices.

Regarding the notion of breaking through, that’s a higher mountain to climb. If TradeDesk and DV360 currently dominate media agency incentives and attention, reaching the next base camp will not be easy.

Then again, agencies are also subject to competitive market theory. So, it would not be surprising to see DSP alliances shift toward the new best deal, which is what Brian Wieser (Global President of Business Intelligence at GroupM) might refer to as a BATNA — Best Alternative to a Negotiated Agreement.

What about valuation? Given our past estimates indicating the street gives ~$10 in valuation per $1 in ad budget, MediaMath post-SPAC IPO could be valued anywhere from $10 billion to $20 billion. We’re pretty sure any VC investor on its cap table would be ok with those returns. But Cinderella’s clock is ticking toward midnight… will MediaMath find that elusive glass slipper in time?

InMobi: Mobile DSP InMobi is planning an IPO for 2021. With two-thirds of their $320 million in venture funding well past a 10-year vintage mark, it would not be surprising to see management take the SPAC route as a path of least resistance. Less scrutiny and speed might be the key to getting some love while the getting is still good.

The Audience Targeting Job-to-be-Done

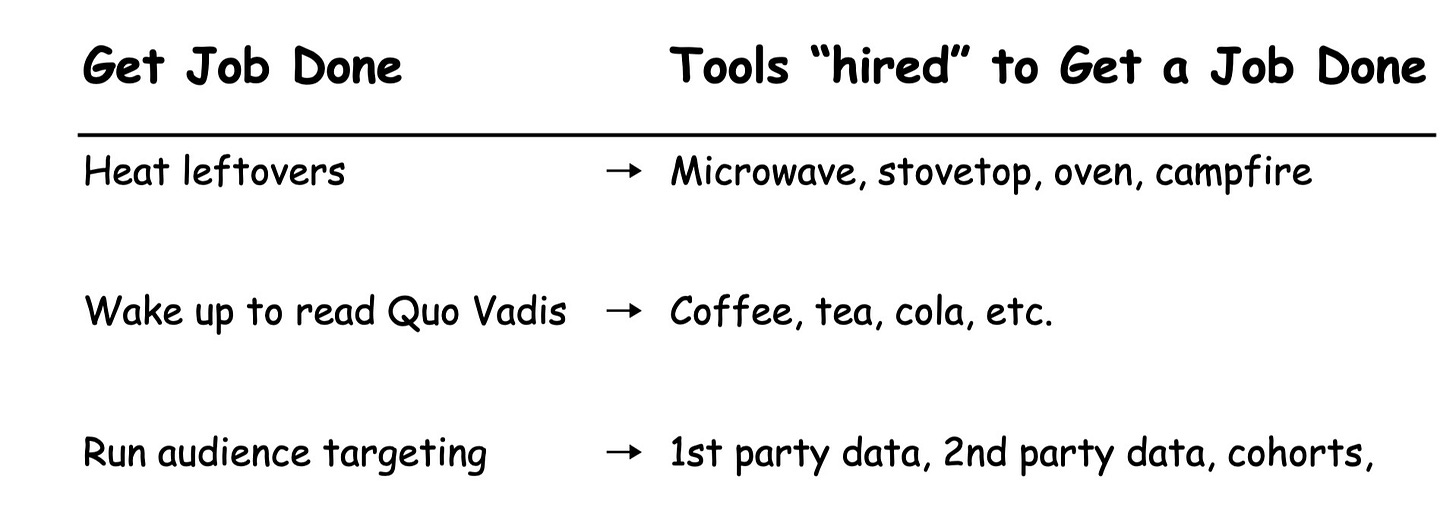

You don’t need a microwave to heat leftovers. You need to heat leftovers.

You don’t need a microwave to heat your food, you need to heat it. That’s the job you’re trying to get done. And just like programmatic is a tool to get your advertising job done, you want the best outcomes like safety, speed, quality, cost-efficiency, etc.

Take Quo Vadis as another example. You don’t need coffee to wake up before you read Quo Vadis. You need to read Quo Vadis to get that programmatic ‘pinach!

What about the hottest topic du jour — audience targeting. It turns out that marketers don’t need 3rd party cookies to run audience targeting, they just need to get the audience targeting job done safely, quickly, with quality, and cost-efficiently.

We could go on all day. In fact, every product you use in real life — and every adtech tool you use in your programmatic life — is built to get a specific job done (or not). That’s Jobs-to-be-Done (JTBD) innovation theory in a nutshell.

Get The Job Done

If you’re unfamiliar with JTBD, you can get the gist by checking out how a smart researcher discovered the real reason why people “hire” quick-serve milkshakes to get certain jobs done. Can you guess what it is?

At Quo Vadis, we first look at advertising use cases from the JTBD perspective and only then do we look for tools and ideas to help our audience to get the job done.

That’s precisely what our Use Case Education Sessions are all about. So join us on April 13 at 12pm ET to learn more about getting the audience targeting job done without 3rd party cookies.

What Happened to Audience Targeting?

Unless you just arrived on earth from a distant planet, you’ve probably been overwhelmed by all the adtech Chicken Littles talking about how the sky is falling because 3rd party identifiers on Safari, iOS 14, and Chrome are either long gone or going bye-bye very soon.

If that wasn’t enough, when Google announced in early March that e-mail-based identifiers on DV360 (and other properties) would not be allowed, many folks felt like the sky was falling even faster. Spoiler alert — it’s not.

Chicken Little — One who warns of or predicts calamity especially without justification. The moral of the traditional Chicken Little story is to have courage, even when it feels like the sky is falling.

What It Means

Quo Vadis loves a good 2 x 2 game matrix. When it comes to understanding the crux of user identification in the bidstream (e.g. the job you want to get done), a 2 x 2 can frame it in simple terms.

Why It Matters = Google

DSPs: Google’s DV360 is the biggest DSP player by a long shot. According to WSJ, DV360 has a 40% market share. The TradeDesk is the largest non-Walled Garden player with 10% (Quo Vadis estimate) with $4.2 billion in ad budget flowing through its pipes, so the total open web programmatic market size is ~$40 billion — give or take.

Amazon’s DSP falls somewhere in between with a 13% share (Quo Vadis estimates $6.5B in ad budget flows based on its 2020 10K), leaving 39% for every other DSP to fight over (e.g. competitive market theory).

SSPs: And as you can imagine, many programmatic rivers tend to meander into Google’s own SSP, known on the street as “AdX”.

Google’s 2020 10K says they did $23B in what they call “Google Network Members' properties” revenue, which is primarily DV360 and AdX. So, if DV360 runs $16 billion in ad budget, and if we assume around 75% goes to its own AdX ($12 billion), that means all the other DSPs including Amazon also tap AdX supply to the tune of $11B.

Frenemies: According to our model, all the DSPs competing with DV360 for market share end up directing ~45% of their hard-fought budgets to Google. If that’s not a case study in what Ken Auletta calls “Frenemies”, then we don’t know what is!

Quo Vadis Use Case Education Session

Get The Job Done with Deal IDs + LiveRamp + Index Exchange

If Google won’t allow e-mail-based identifiers on DV360, then how will audience targeting get done for a majority of the market? Join our Quo Vadis Education Session on April 13 at 12pm ET to find out.

Guests: Your truth-seeking host, Tom Triscari (CEO, Lemonade Projects) will interview Travis Clinger from LiveRamp and Lindsey Bridgham from Index Exchange on how to get the audience targeting job done in a cookieless world.

Topics:

We’ll start by framing the core use case and then walk you through how to run it successfully time and again.

We’ll dig into using 1st party identifiers in private marketplace Deal IDs

Touch on Deal ID automation techniques to turn all the manual work into more productivity — it’s a quick-win solution that works with any DSP. Yes, Deal ID curation is still very manual work today.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

The term “winner’s curse” was first coined in a 1971 paper called, "Competitive Bidding in High-Risk Situations.” See Journal of Petroleum Technology. “In competitive bidding, the winner tends to be the player who most overestimates the true value.”