#19 Portfolio Update 3Q21 Earnings

A sucker is born every day; Reversion to the mean; IPG stands out for investors

Welcome to Quo Vadis, your periodic source for fresh programmatic news and off-the-beaten-path perspective. Click here to join the conversation.

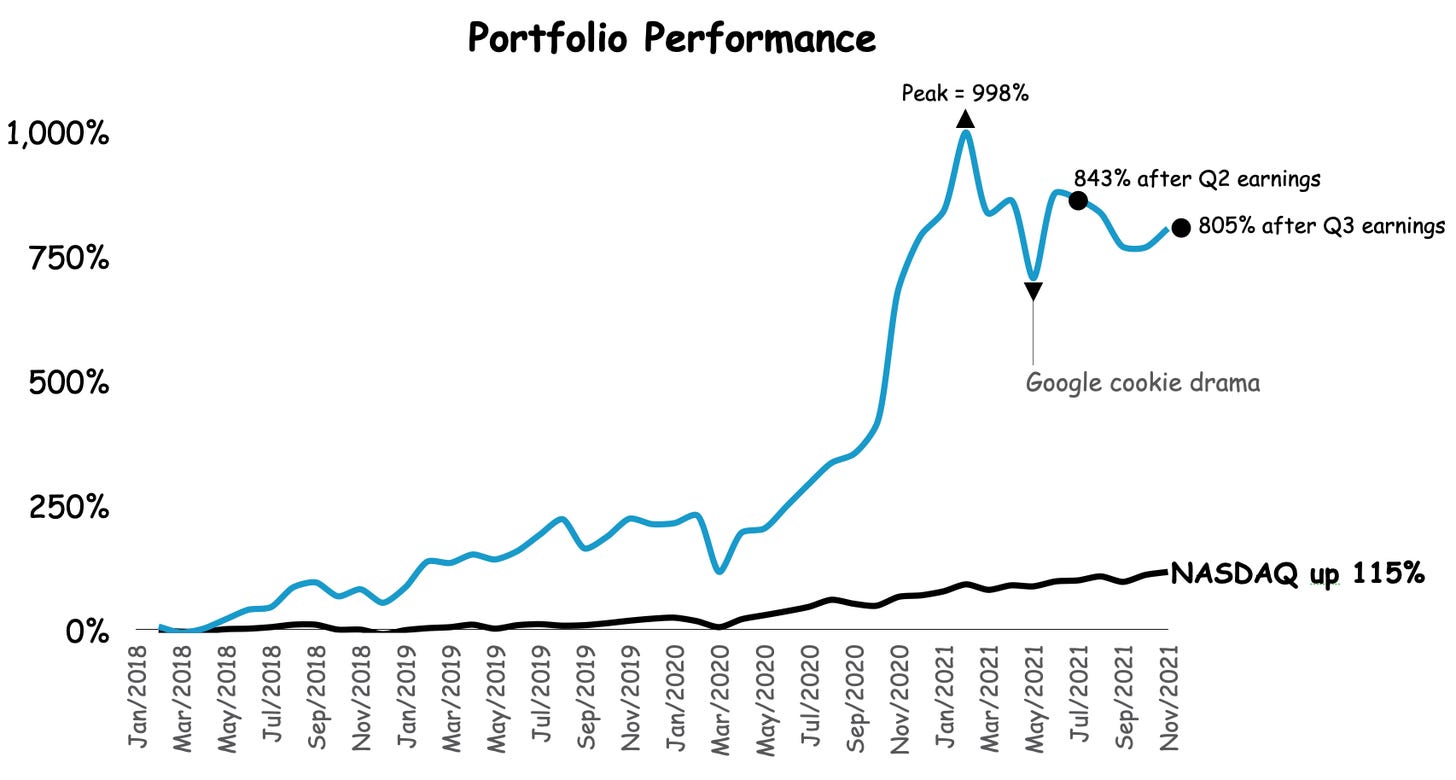

Today is World Philosophy Day. The year before Plato died in 347 BC, he had the foresight to remind future generations that “you can discover more about adtech in an hour of play than in a year of conversation.” If marketers spent less time listening to P.T. Barnum adtech pitches and more time looking under the hood, they’d spend less and get more. But then again... if that happened our Quo Vadis portfolio would not be up 805%!

Scoreboard: 9 Programmatic Winners, 6 Losers

In March 2021, our equal-dollar programmatic portfolio started with just 6 companies (TradeDesk, Criteo, Liveramp, Magnite, Roku, and S4 Capital).

Then, in our 2Q-21 update on August 30, we added 8 newly public adtech companies.

Flashing forward to this 3Q-21 update we added Outbrain — a lovely adtech gem already down -4% since its debut. Sure, they tout themselves as a content marketing & discovery company, but they actually compete with other chum bait players like Taboola putting “content” like this on publisher pages.

It looks like P.T. Barnum was right again about the programmatic market. If marketers are willing to believe this kind of ad inventory results in positive ROI, then so be it.

Don’t hate the players, hate the game. Clever players like Taboola and Outbrain are making a hedge bet that continues to pay off with Q3 revenues up ~30% for each player.

They’re betting that the struggle between a marketer’s (and agency buyers) ability to spend outsized ad budgets (by a specified time at a specified low CPM target) and their ability to maximize quality ad outcomes forces demand toward the need to find more low ad quality supply. When buyers demand for junk someone will supply it at a profitable price.

Right or wrong, that’s the way markets work. If an arbitrage opportunity exists, someone will come along and squeeze it until there is nothing left.

Portfolio Rundown: Reversion to the Mean?

Overall, our programmatic portfolio is up 805% since January 2018. In other words, had you bet $100 spread equally across a basket of 5 original stocks in January 2018, and added S4 Capital in September 2018 when it converted from SPAC to IPO — and then added 9 adtech newcomers in 2021, your investment would be worth $905.

Adtech’s hot streak started in early 2020 when investors could not get enough adtech love. Before then, adtech and investors were like oil and water.

With record-breaking M&A and consolidation — and accelerated online shopping making for easy revenue growth — more adtech companies saw an IPO window to take money off the table.

Our programmatic portfolio peaked in February 2021 when Google’s Sun Tzu cookie drama weakened support for adtech to grow future cash flows.

As time goes by, we’d expect the earnings treadmill to catch up to most (if not all) of these players, causing them to miss out on revenue growth and earnings expectations.

If or when that happens, we’d expect the portfolio to revert to the overall market average in line with NASDAQ/S&P 500 returns.

Litmus Test 1: Imagine you’re offered the “opportunity” to own this same portfolio of 15 adtech companies today. In hindsight, you could have bought it for $100 in January 2018, but you didn’t. So now you have to pay $905 to get in the game. Are you buying today? Or are you passing on the deal thinking there are better alternatives to maximize returns?

Litmus Test 2: Would you rather invest your $905 today to buy our programmatic portfolio, or plunk it down on a crypto currency like Shibu Inu, which is up 76 million percent since inception!!! 🔥🔥🔥

S4 Capital is an “agency” that trades like adtech

A few weeks ago, Quo Vadis’ parent company (Lemonade Projects) held a fun “fly-on-the-wall” chat with three of the sharpest minds in advertising — Sir Martin Sorrell, Michael Farmer, and Ian Whittaker. You can watch it here.

The Plug — If you’re into advertising and have not read Michael Farmer’s book Madison Avenue Manslaughter, you should. And in the meantime, you should sign up for Ian Whittaker’s newsletter “The Bigger Picture” to get his unique view of the world in your inbox.

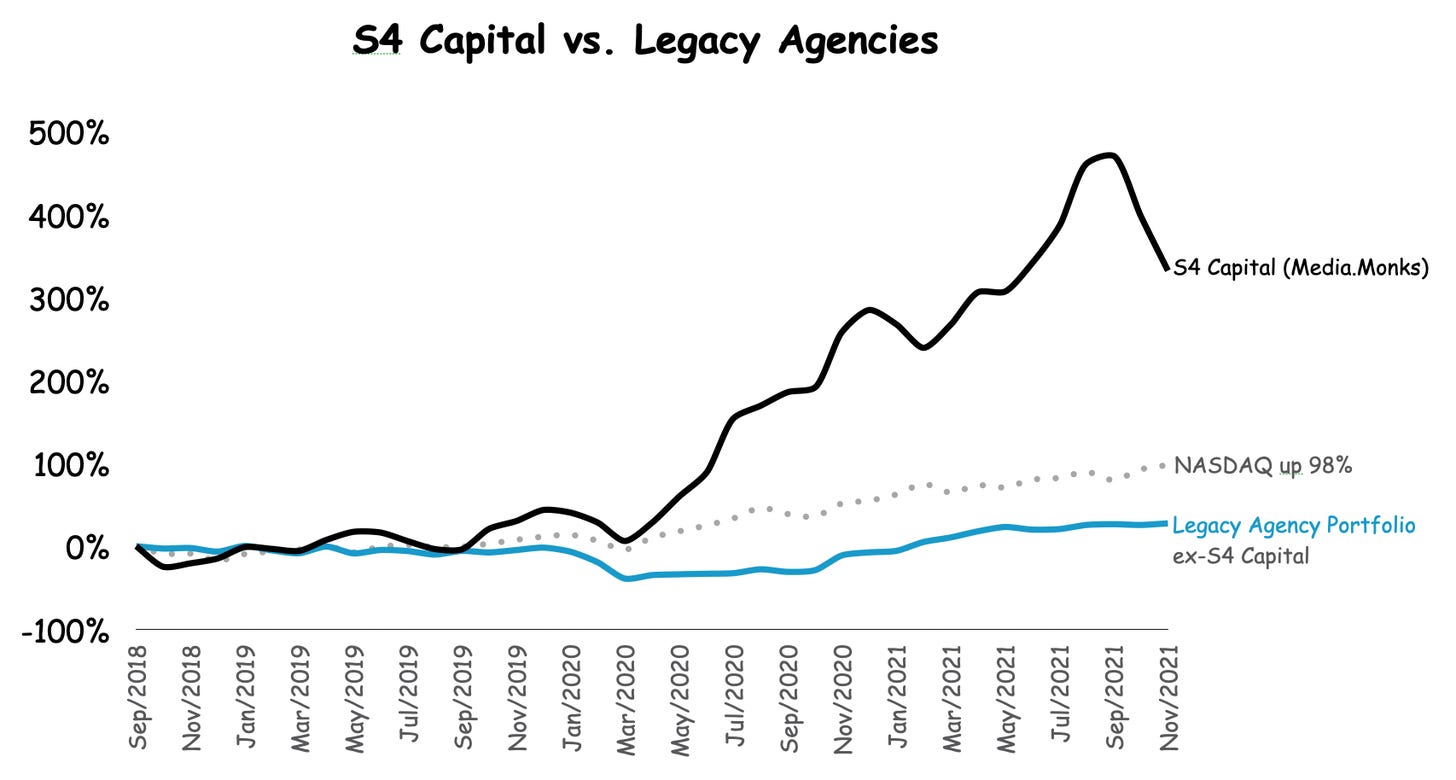

S4 Capital is the 4th-best performer in our portfolio, right behind Roku. So, when market industry observers look at S4 Capital as the new-age agency in town, they might think its performance is amazing compared to that of super-sized legacy agencies (more on that comparison below).

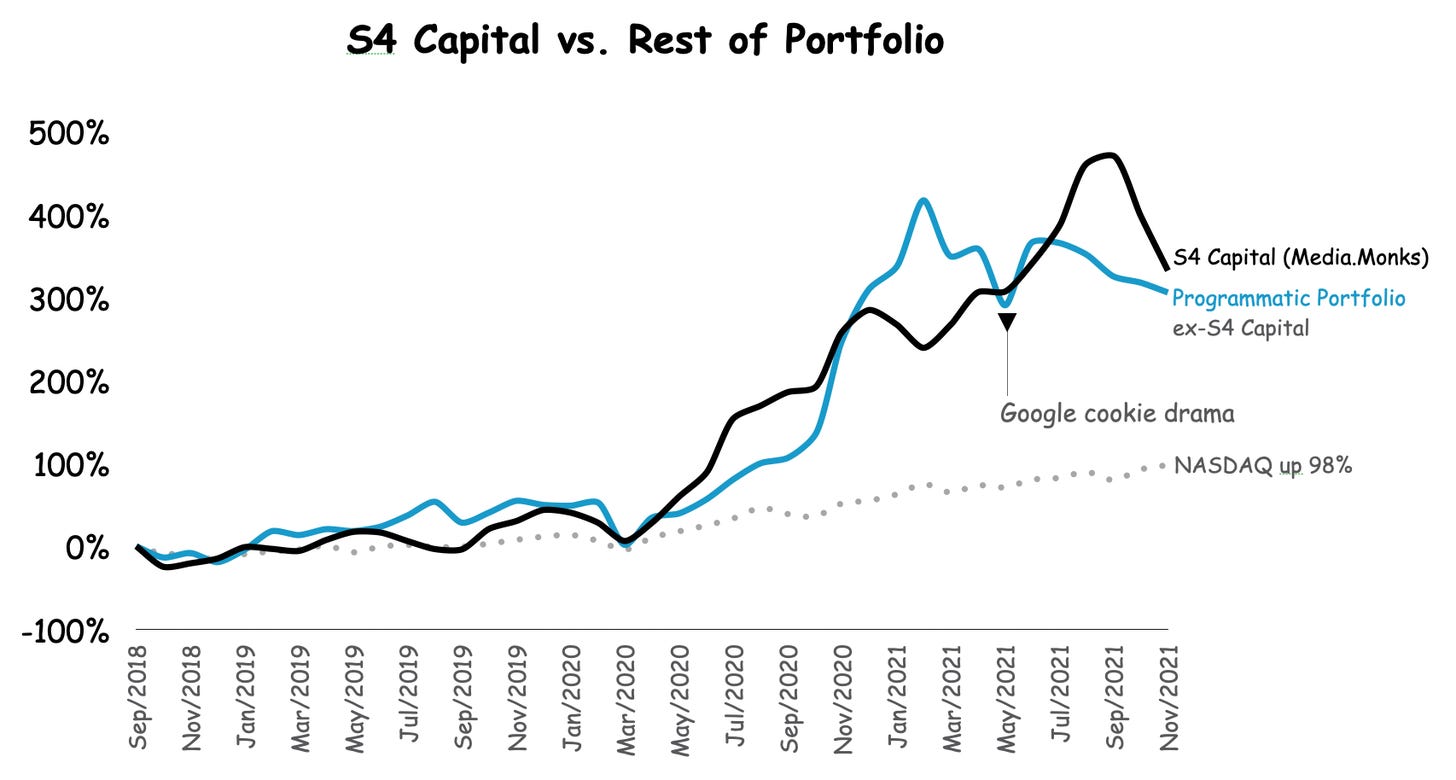

But correlation tells a different story. When we compare S4 Capital’s stock price to the rest of our programmatic portfolio without S4 Capital, it clearly trades more like an adtech stock than an agency.

In fact, if you check how tightly S4 Capital trades with the 14 other programmatic stocks using a simple Pearson’s correlation, you’ll get a 93% correlation.

On the other hand, if you run the same exercise comparing S4 Capital to legacy agency holding companies (IPG, WPP, OMC, PUBG, DNTU), you’ll see much less correlation (59%).

Google Cookie Drama

Perhaps one of the more interesting observations is the severe dip programmatic stocks (ex-S4 Capital) took around May 2021, which we call the “Google Cookie Drama.”

Since MightyHive is one of S4 Capital’s bigger assets (and also a big Google reseller), it appears that when non-Google adtech went low on the cookie news, S4 Capital went high. That also helps explain why S4 Capital and Google have a 95% correlation in stock returns since S4 Capital went public in September 2018.

That said, it appears that initial investor enthusiasm about this locked-in advantage is catching up to the idea that everyone will suffer from the cookie drama except Google (and Apple too as all those rich iPhone/Apple users get harder and harder to reach except for Apple).

Defense or Offense: Imitation is the best form of flattery

Think about it this way: S4 Capital’s business model is set up to play offense and defense at the same time compared to legacy agencies always seem to be on their backfoot playing defense as best they can with what they have.

These defensive gaps are usually filled with by seasoned storytellers, which is a huge asset on its own and potentially a massive asset but only when the actions meet the story (a rare outcome).

Legacy agencies have relatively poor digital assets and capabilities. So, when the pandemic hit, they took it on the chin while S4 Capital’s digital-only assets and capabilities paid off big time. That’s defense.

Now that ad budgets have returned on the backend of a fast V-shaped recovery, pushing legacy agency organic growth upward, S4 benefits again as the new agency in town that competes like hell and wins pitches. That’s offense.

In our view, it’s not a matter of if legacy agencies follow the same strategy. It’s a matter of when.

Read More on Innovation vs. Imitation: The great Harvard B-school scholar Theodore Levitt wrote an article in 1966 called “Innovative Imitation.” This is why it’s just a matter of when.

Contribution to Portfolio Gains

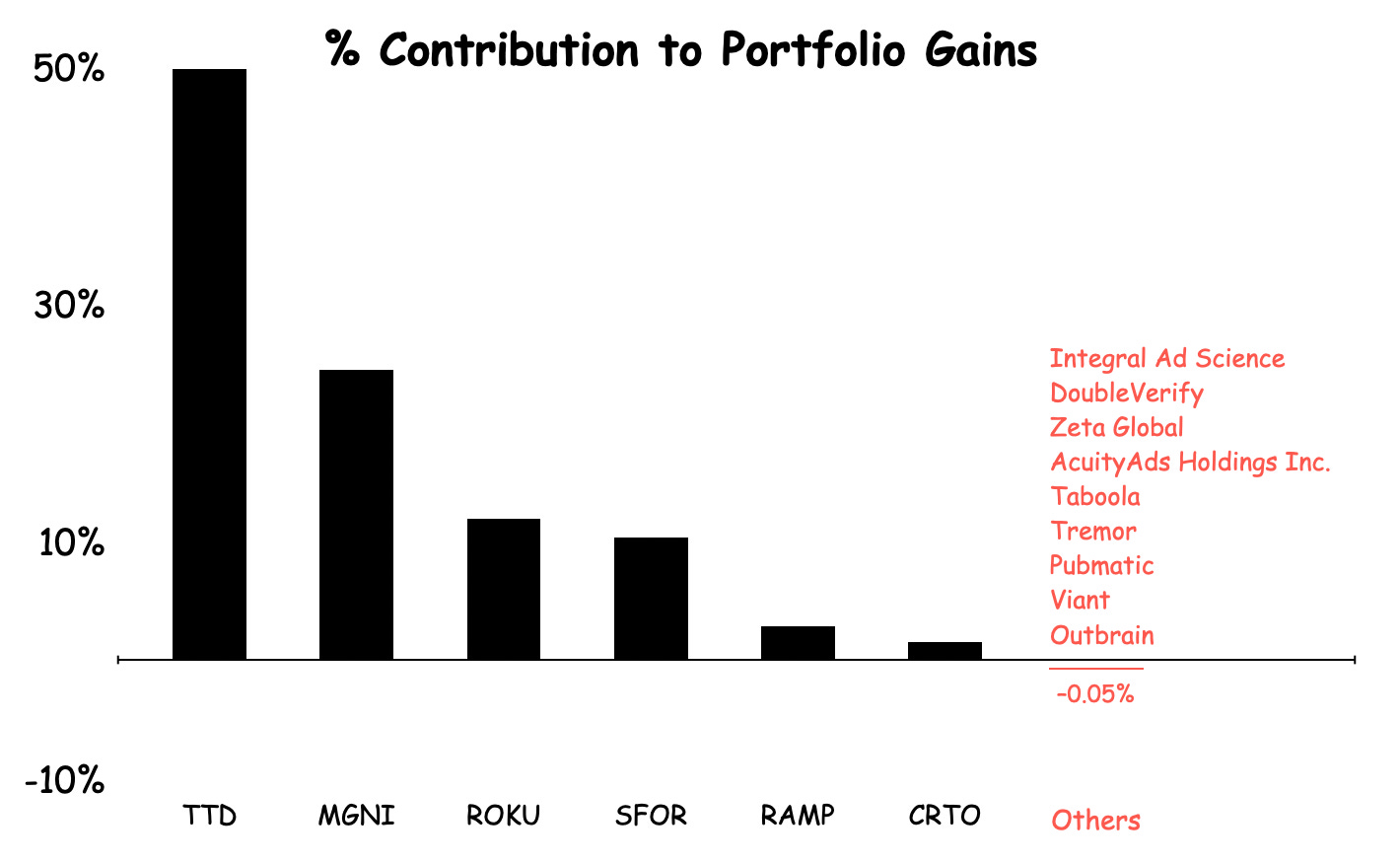

Across the 15 companies in our portfolio, only 6 contribute to gains. All the rest put together contribute precisely zero.

Sure, the 6 producers — Tradedesk, Magnite, Roku, S4 Capital, Liveramp, and Criteo — have the benefit of more time in the portfolio compared to our roster of newly minted public companies, but they also happen to produce 65% of the revenue across the portfolio.

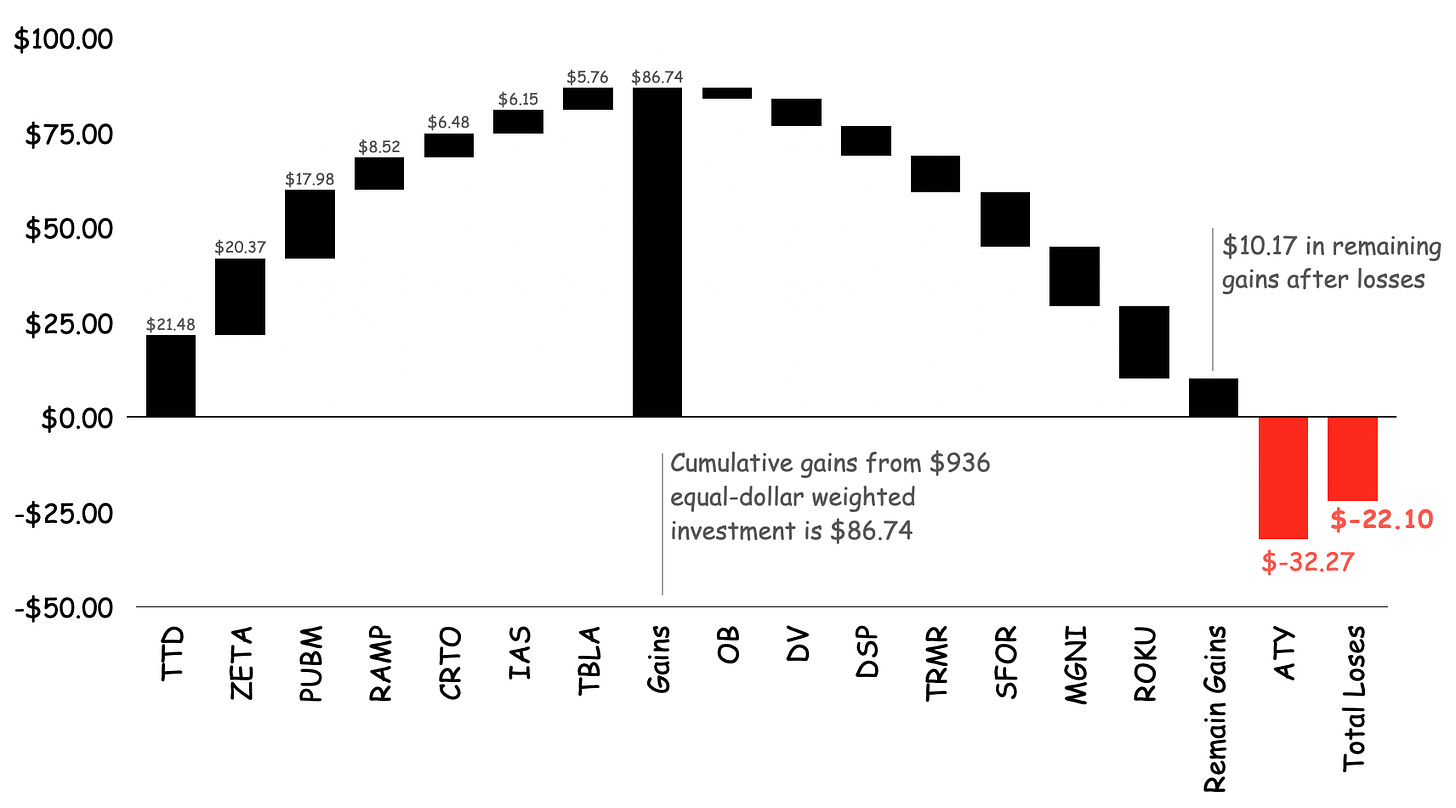

What if… we reset the entire portfolio of 15 companies to erase the headstart bias. For instance, what if we’d sold the entire portfolio this past August (Outbrain was the last IPO in late July) when it was worth $936, and reinvested it equally across all 15 companies? We’d be down by 2.3% and have lost $22.10.

In this updated scenario, the only older stalwarts still contributing to the gains would be Tradedesk, Liveramp, and Criteo while newer small players like Zeta Global and Pubmatic become meaningful contributors.

On the downside, three of our biggest past contributors since January 2018 — S4 Capital, Roku, and Magnite — would be taking from the gains with Acuity playing the portfolio killer role wiping out 37% of the gains.

Future Updates: Quo Vadis will be tracking this “reset” portfolio going forward. We expect a wild adtech ride!

Q3 Agency Performance

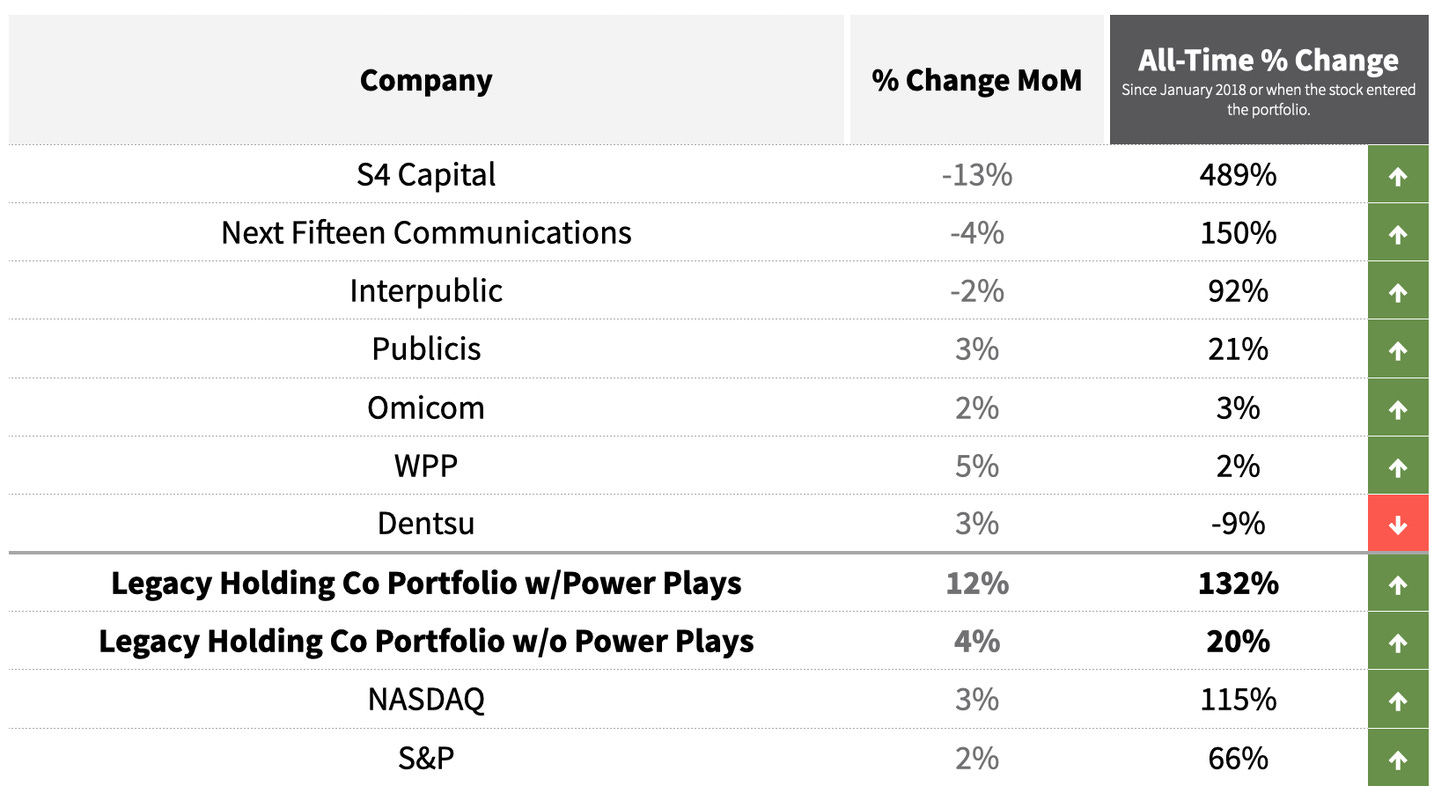

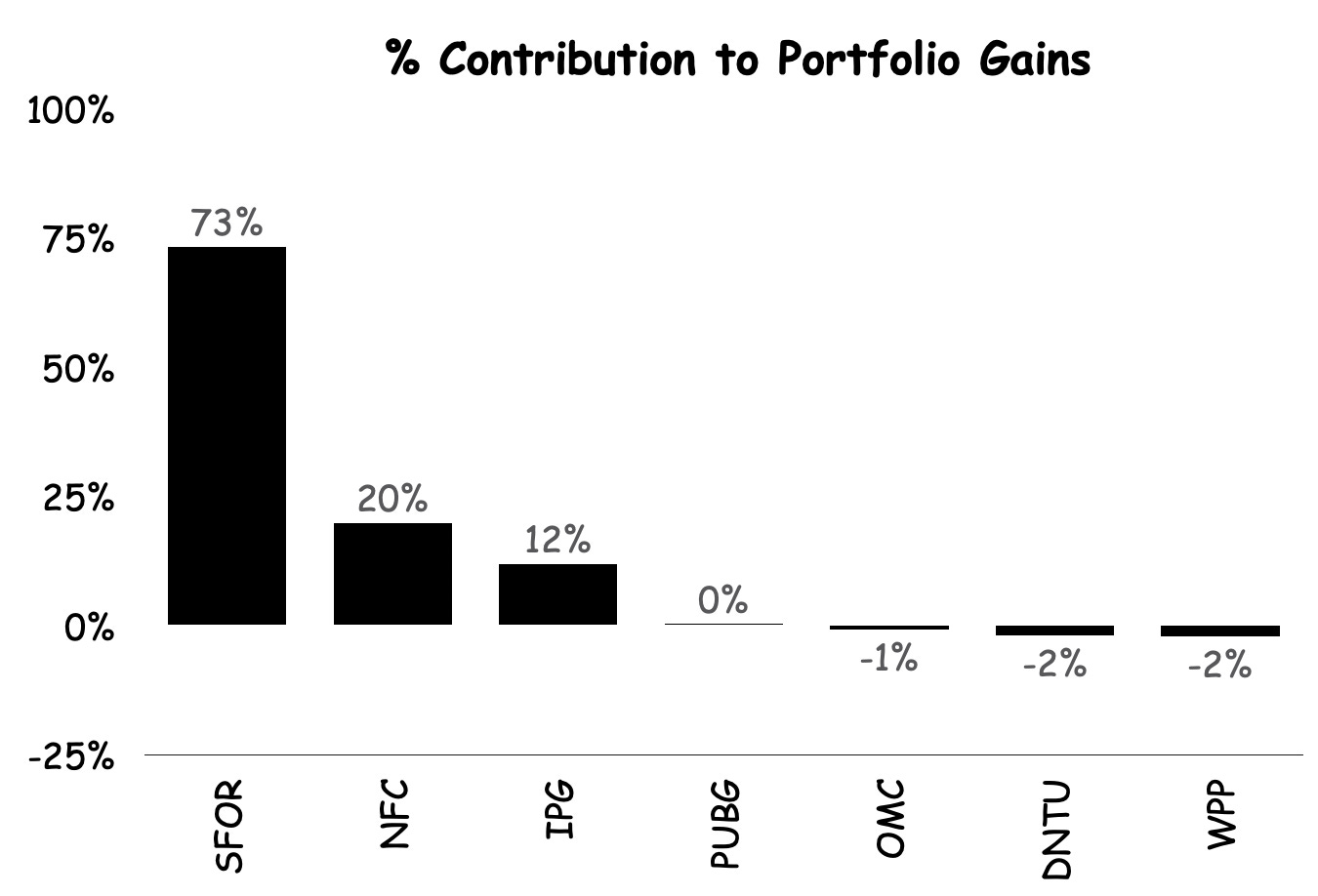

As far as agency portfolio returns go, our top overall performers (S4 Capital, Next Fifteen, and IPG) performed the worst from October to November, but overall these 3 players still drive nearly all the contribution to 132% gains.

As far as we can tell, IPG is the most interesting case to watch across the legacy players. Not only does IPG appear to be more insulated to macro changes across its book of business, but there may also be a perception amongst clients that IPG is moving the fastest and furthest with digitizing its business (imitation vs. innovation).

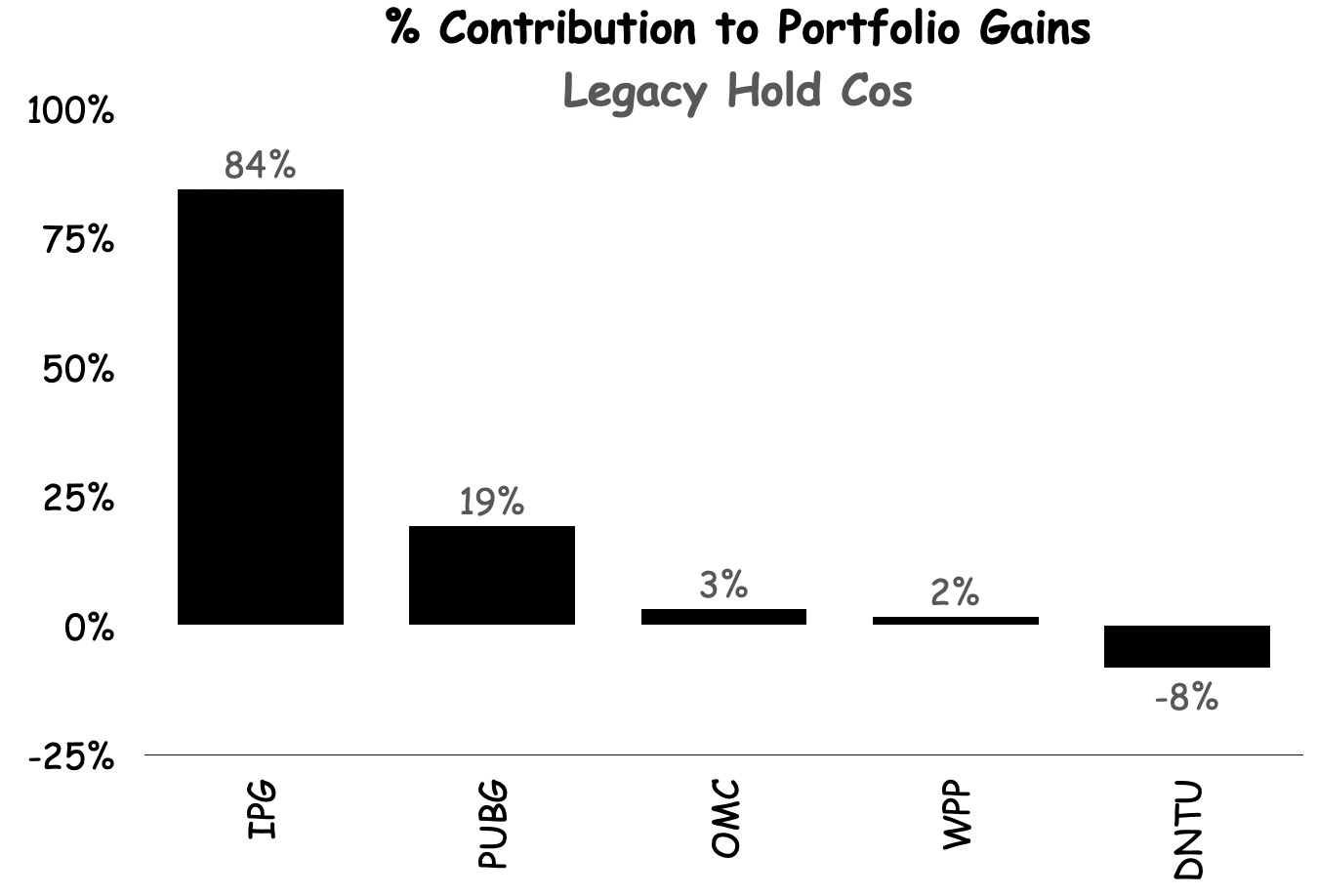

In fact, if we only look at the 5 legacy holding cos (IPG, WPP, Omnicom, Publicis, Dentsu) and remove the newer all-digital players (S4 Capital and Next Fifteen), IPG would generate a whopping 84% of the gains.

Organic revenue growth is all that matters

For industry observers watching agency performance, you’d think the myopic focus on organic revenue growth would be the most important outcome. But that’s only true if organic growth is a true reflection of management’s performance and leads to a little thing investors really love the most called free cash flow. It makes their world go around.

Who knows, maybe legacy agencies like reporting on organic growth because it’s hard to verify from a forensic accounting perspective. Or perhaps they want to distract investors from their inability to generate cash and value creation compared to other alternative investments. Either way, legacy holding company market caps remain more or less uninterestingly flat as they struggle to innovate (or imitate) at the speed clients and the market expect.

Organic Growth at 2 Speeds

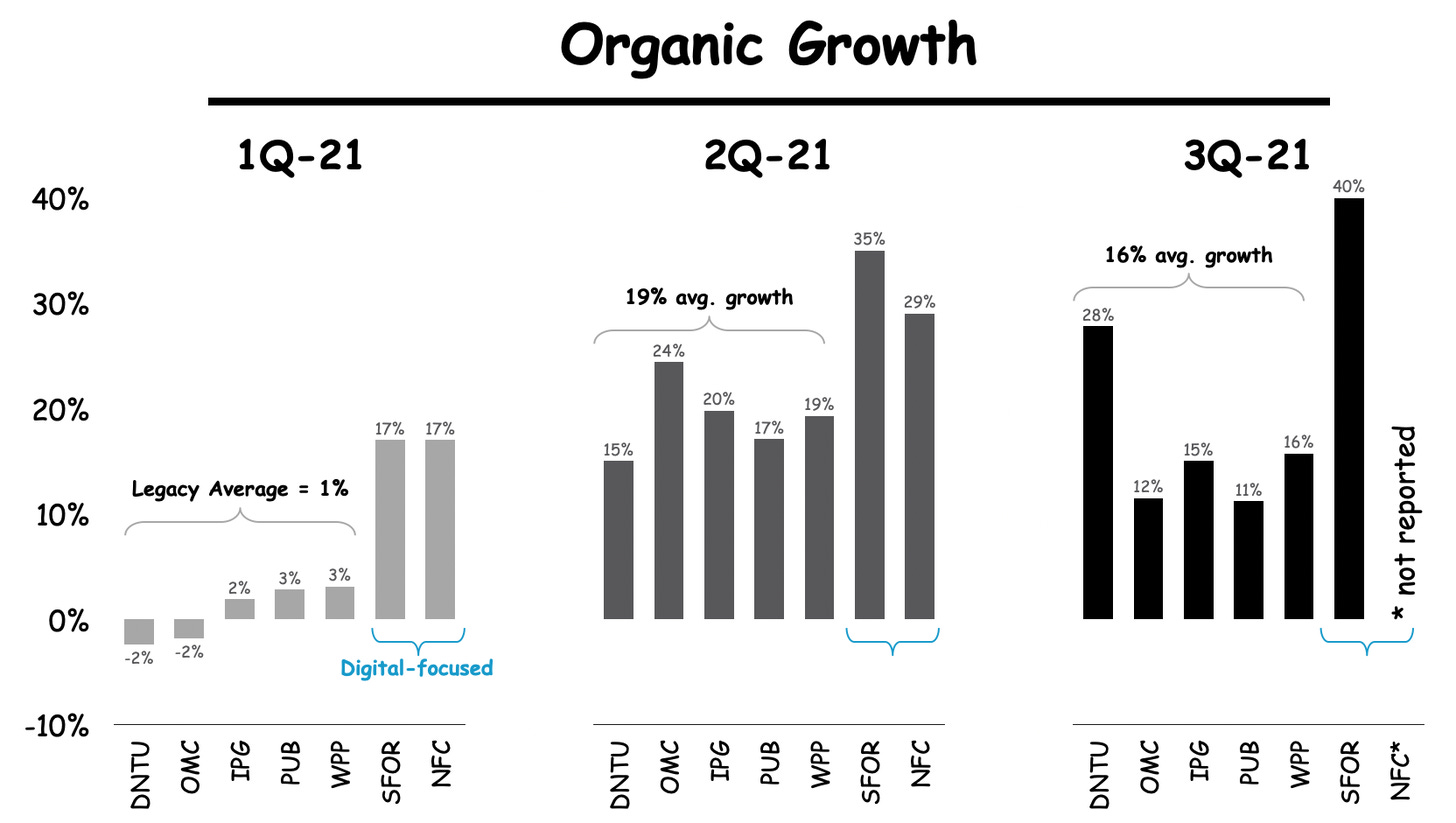

We’ll leave that dilemma for another day. For now, let’s pretend organic growth is all that matters and take a look-see at how it’s gone from Q1-21 through Q3-21.

1Q-21 organic growth was tough on legacy holding cos due to a lack of perceived digital assets and capabilities.

For the newer all-digital players like S4 Capital and Next Fifteen, organic growth has been easier to come by as order takers capitalize on inbound demand.

In 2Q-21, the legacy players got a boost from macro-econ recovery averaging 19% organic growth. But the same boost filled the sails of the new players pushing organic at S4 Capital to 35% and 29% at Next Fifteen.

The same pattern was repeated in 3Q-21, except for Dentsu. Organic revenue growth for Dentsu Japan was 49% on Olympic tailwinds and did well enough in other markets to pump out 28% overall growth.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

Been reading your posts and they are very informative. It would be interesting if you do deep dives on specific verticals - like retail media (I guess there's also CTV but that's gotten a lot of buzz and coverage these days). Your thoughts and expertise would be appreciated.