Reading Time: 5 arbitraging minutes

For Paid Subscribers: See MFA Financial Model calculator at the end of this post. Enjoy!Last week we dug into Taboola’s numbers to estimate how much ad revenue they share with publishers (~67%) and we also backed into an estimate of ad revenue coming from MFA clicks (~8% of total revenue) vs. advertising revenue (92%). We postulated that MFA click-based revenue is used to fund variable costs until TBLA reaches enough scale to wind it down.

In this post we break down the arbitrage math of a typical MFA site to show how this amazing business model can be quite lucrative. Before we get into it, we remind readers of an important economic truism:

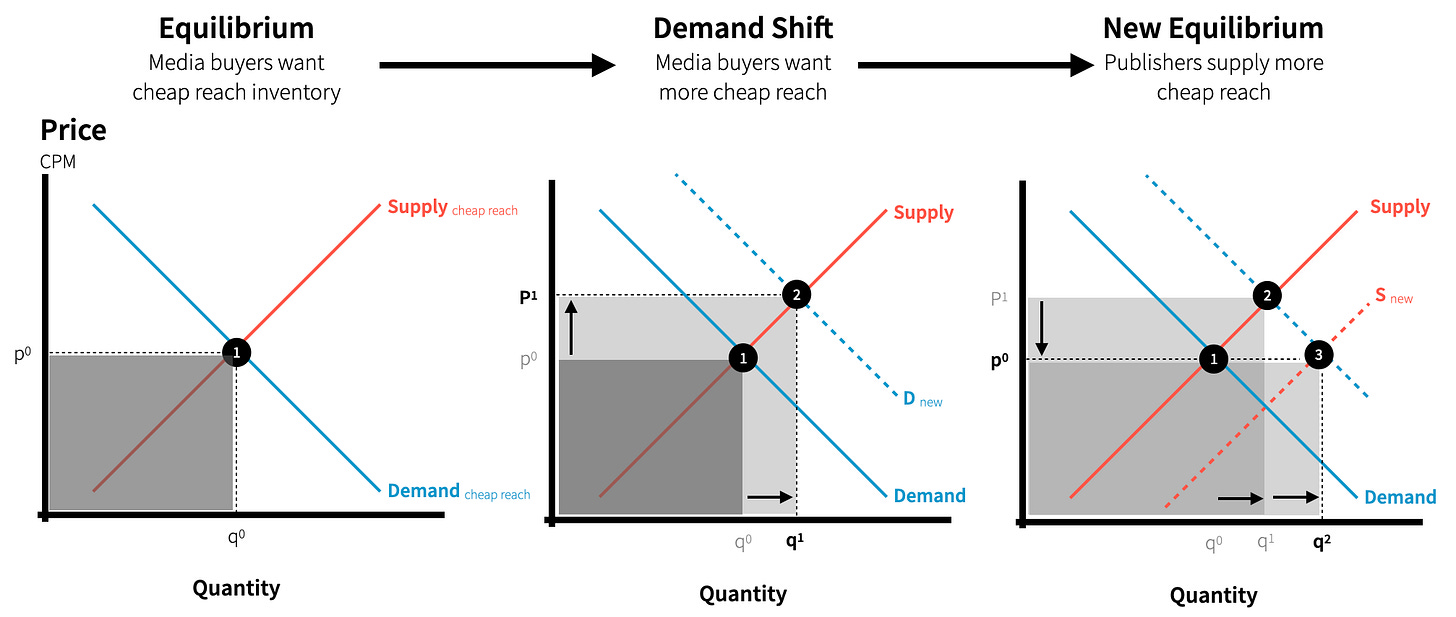

Economic Truism: Where there is demand for a good or service, there will always be someone on the other side willing to supply it. In the media buyer’s case, if they increasingly demand low-cost inventory without caring about ad quality, then publishers will find a way to supply this good to buyers.

Here’s how works.

In the initial equilibrium state, the market for cheap reach inventory starts by selling advertisers on the virtues of programmatic audience targeting. The basic pitch is: “The underlying inventory does not matter as long as you reach your target audience, so buy the cheapest stuff you can find.” The initial market size is represented by the grey box.

As long as campaign reporting says ROI is positive or better than alternatives, buyers will demand more. It does not matter if the ROI is accurate because perception is reality when the behavioral economics of success bias are in play. As time goes by, the demand curve shifts outward causing momentary upward price pressure and the quantity supplied grows.

Producing new cheap-reach ad inventory is nearly instantaneous. As more supply makes it to market from current suppliers producing more inventory along with new suppliers coming online (no barriers to entry), the supply curve shifts outward bringing prices back down toward the original price point (aka the marketer’s willingness to pay constraint). Now we have a new equilibrium and a bigger market for cheap reach inventory (grey box expands). The cycle continues and eventually reaches a steady state.

A Kitsch Market? Quo Vadis labels this kind of market as a Kitsch Market. In Milan Kundera’s “The “Unbearable Lightness of Being,” he describes kitsch as the absolute denial of shit, in both the literal and the figurative senses of the word. In essence, the kitsch of zero quality MFA inventory is denied and everyone [marketers] acts as though it did not exist. It’s not a great market by advertising standards, but it’s a market nonetheless.

Let’s make some MFA money

Congratulations! You’ve decided to become an MFA media mogul. You’re in it to win it so you set a goal to make a 30% operating profit margin which is quite healthy.

Content Creation

You buy a domain name and create a website. The content genre doesn’t matter much as long you have a steady and reliable flow of content (words and/or pictures). Low cost content production is obviously desirable. Look to AI as your content work horse.

Ad Inventory

Fill your page layout with all kinds of IAB standard ad units. More is better, there is no limit. When you’re done, your pages will have more ad real estate than content. Every time a user visits your site, they’ll get bombarded with tons of ads. Perfect. You smashed it.

Traffic

Nobody knows about your little rinky-dink site yet. And if anyone did, they would never visit it directly by typing the domain name into their browser. Your content is banal and the ad clutter will totally annoy most users.

Buying Traffic

Who needs organic traffic when you can just buy it. You quickly figure out the two best places to buy traffic for your site:

Social platforms like Facebook, Instagram, etc.

Native widgets on name brand publishers like CNN, The Independent, Der Spiegel, Le Monde, MSN, Sky News, etc. via companies like Taboola and Outbrain that own and operate ad-network-like inventory commonly referred to as “chum-boxes".” Both types are sold on a CPC basis.

Let’s say your CPC price on social is 10 cents and just 2 cents for chum-box clicks. You buy 75% of traffic from social and the other 25% from chum-box providers. You’re weighted average CPC cost is 8 cents.

Ad Serving Cost

Every time a user clicks on your social or chum-box ad you get fresh traffic coming to your site generating ad impressions that get monetized in programmatic auctions via an SSP. You play it conservative and figure you’ll pay a 5 cent CPM for ad serving.

Revenue

You’ve done your homework and found out you’ll probably be able to sell your ad inventory at auction for a $1.50 net CPM price. Assuming your SSP takes 30%, buyers pay $2.14 (gross). The SSP gets $0.64 and you get $1.50 for every thousand impressions sold.

The Money Shot

You’re paying an 8 cent CPC to get a single click. For every thousand clicks you’ll pay $80. Hold on second! Paying $80 to make a $1.50 is terrible idea. You’ll lose your shirt with that kind of business model.

The solution is easy. It sounds too good to be true but it will work like charm if the demand is truly there. All you need to do is send multiple ad impressions to auction for every user that clicks on your CPC ads and gets redirected to your site. Let’s do the math.

You put 10 ad units on the landing page (more is better and doable).

You figure out the average user will stay for about one minute so you make the page auto-refresh every 15 seconds sending 30 additional ad impressions to auction (go here for the full the experience) on top of the original 10.

You’re super clever. You know nobody is watching or checking, so you stuff four more hidden ads behind each of the 10 ad units to boost volume.

Now, every time a user shows up you you send 160 impressions (10x4x4) to auction earning a $1.50 CPM which is $0.24 per session. Now you’re in the money.

You could juice your site traffic by buying bots from a fake traffic provider, but after weighing the risk/reward trade-offs you decide to keep it legit for the time being. The last thing you want to do is raise red flags from ad verification vendors. Best to stay under the radar.

Your P&L

You sell 160 impressions at auction making $0.24 in revenue for every $0.08 click you buy. Ad serving 160 impressions costs you $0.01 leaving $0.15 in gross profits. That’s a 63% gross profit margin. Not too shabby.

After adding in your 30% operating profit target, you back into $0.08 in fixed costs for hosting, hardware/software, content, labor, rent, etc.

Scale

Let’s say you throttle your traffic buying to get one thousand visitors per day. At the end of the year, a single MFA site will make $26,000 in operating profits.

It was so easy make one MFA site, so you rinse and repeat making a hundred sites. Now you’re annual take home is $2.6 million. Not bad for creating zero value at all… accept for yourself, of course.

As economies of scale prevail, you’ll probably make even more as variable costs come down with volume discounts while you also leverage your fixed costs with more production throughput.

There you go. Creating MFA inventory is a friction-free way to add more supply to a kitsch market characterized by increased demand for cheap inventory.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.

MFA Business Model

For paid subscribers, we made a nifty MFA finance calculator so you can play with the numbers.