#62: Taboola Ad Revenues and MFA Subsidy

Reading Time: 6 gloriously enlightened minutes.

Today is Bodhi Day. It’s the day Buddha achieved enlightenment through meditation. Our Quo Vadis meditations must have gone right because a Taboola banner ad was served while researching for this post. And it happened on what appears to be an MFA-like site. You can’t make up this kind of stuff in Programmatic Land. It just happens.

It’s also Jim Morrison’s birthday today. So let’s “Break on Through (To The Other Side)” of Taboola’s business model.

Brilliant Business Model

Taboola (and Outbrain too) is a brilliant business model. Not because it’s algorithmically complex but because it’s so darn simple. Simple is always best when you’re selling to marketers (and publishers) with many choices.

Get publishers to put a native ad widget on their site in exchange for making extra cash through a revenue share agreement. Voilà… you have an ad hoc ad network (supply). At the end of the day, everything always resolves to an ad network in AdTech Land.

Get direct response advertisers looking for ROAS (perceived or real, it doesn’t really matter) to buy the ads. Ideally, you want big advertisers but you really want thousands of SMB advertisers just like Taboola has achieved (demand).

Mix so-called made-for-advertising (MFA) content into the ad inventory and now you have a “native” user experience.

Advertisers get tons of cheap reach inventory that they evidently demand because the market for $1.00 CPMs keeps growing year after year. Publishers get much needed short-term revenue (independent of considering opportunity cost trade-offs). And users get content recommendations which they apparently like to click on and consume. Everyone is happy.

MFA Bad Press

The MFA subject has been in the trade press a lot in 2023 and not in a good way. But any way you cut it, “advertising” (perceived or real, it doesn’t really matter) on MFA sites is another type of brilliant business model. As we’ve said time and again on Quo Vadis:

“There is nothing either good or bad, but thinking makes it so.” — William Shakespeare’s Hamlet, Act II, Scene 2

Here’s the MFA business model in a nutshell:

Create, generate or “borrow” content of all types (AI is clearly a boon for the MFA world).

Create eye-catching “chum-bait” headlines to get regular folks of all types to click.

Buy low-priced CPC traffic by placing the salacious and fun headlines on social newsfeeds (e.g. Meta) and also on the native widgets across Taboola’s name brand publisher network (e.g. NBCUniversal, CBSi, The Independent, El Mundo, etc.) to bring users to the MFA site.

Create lots of ad slots on a single page. Lots of ads. Ads upon ads.

Monetize the impressions in programmatic ad exchanges. You need to send enough ad units to auction to cover your traffic costs and other costs to make a profit. Classic arbitrage.

Yes, players like Taboola are tangentially in the MFA space. But it’s a small portion of top line revenue (e.g. gross ad spend) for TBLA. We’ll get into the numbers in a moment, but the important thing is to not confuse the two moving parts of Taboola’s business model. We need to separate ad revenue sources from MFA revenue sources. The distinction is critical when trying to value TBLA and OB.

Before going further, the main thing to realize is that where there is advertiser demand, someone will be on the other side of the trade to supply it. Along with the reality of economic trade-offs, alternatives and free choice, that’s what free market capitalism is all about.

That’s precisely why "there is nothing either good or bad in AdTech land, thinking makes it so.” If advertisers and their advisors demand cheap reach inventory because they think it’s good for their shareholders, then so be it.

Ad Revenue

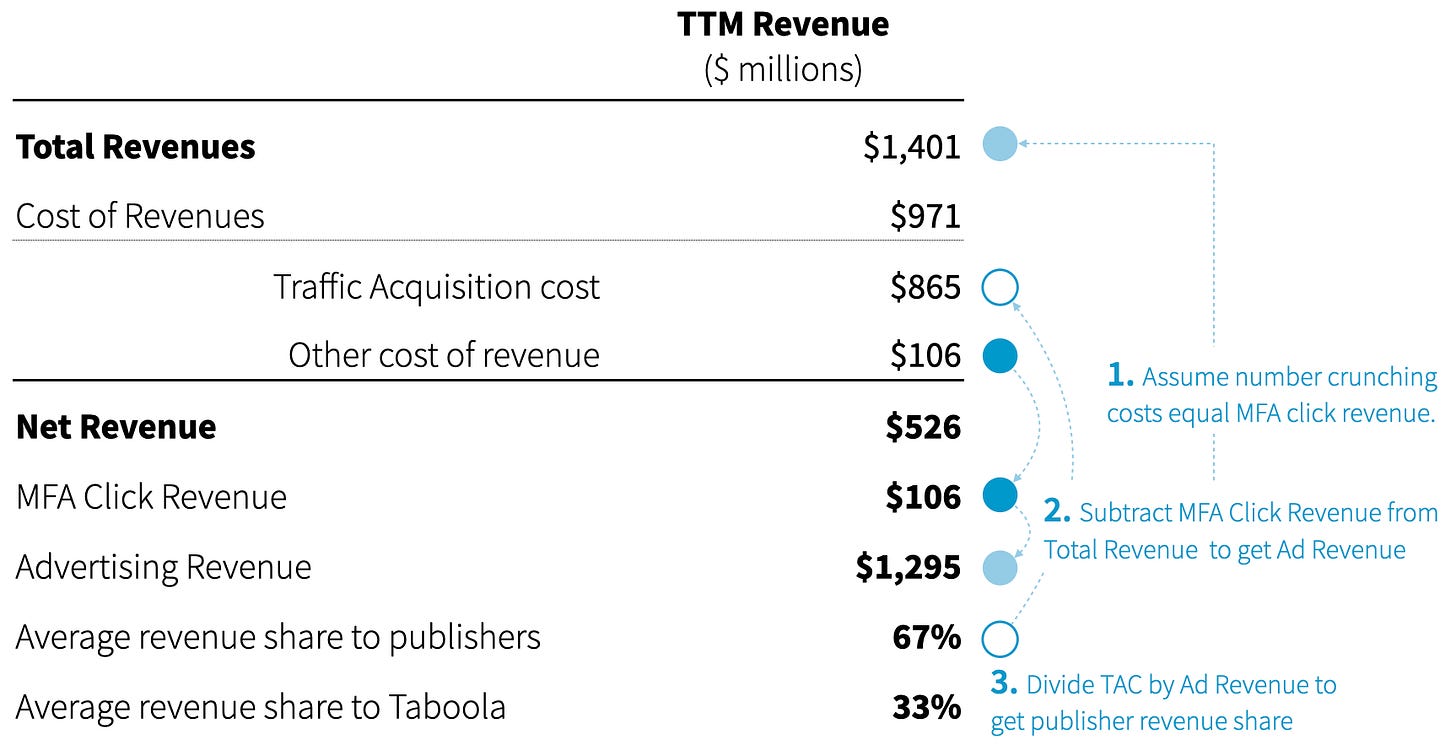

Taboola generated $1.4B in top line revenue on a TTM basis (3Q22 to 3Q23). They pay out 62% in revenue share to publishers which is recorded as traffic acquisition costs (TAC).

Another 8% goes to “other cost of revenue.” These are variable costs related to crunching high data volumes (data center related costs, depreciation expense related to hardware, facilities costs, etc.)

The question arrises on how to dissect ad revenue coming from advertisers and revenue coming from what is likely thousands of MFA sites paying a Taboola for clicks (a few pennies per click) on its native content widgets spread across the web to drive traffic.

There is an easy way to get there as imperfect as it might be. Simply assume “other cost of revenue” (number crunching variable cost) is roughly the same as revenue generated from sell clicks to MFA sites. In other words, the revenue from MFA clicks funds variable costs.

That leaves $1.3B in Ad Revenue. Therefore, TAC as a portion of Ad Revenue is 67% which seems like a decent estimate of the publisher’s revenue share of Ad Revenue. Taboola keeps the other 33%.

Notably, Google keeps ~32% of ad revenue from publishers monetizing on AdSense, at least they used to up until November. Before the change, one could imagine a 32% take rate as the perfect number to pitch publishers to join Taboola’s network

Sales Person to Publisher: “Google shares 68% with you. We offer the same reward so what’s stopping you from giving Taboola a go.”

Here’s where this assumption gets interesting. Taboola does not necessarily need to sell MFA clicks from a business model perspective, but it needs this inflow from a financial model perspective at least for the time being.

Trailing 12-month operating profits are going the wrong way at Taboola. With 8% of net revenue going to variable costs, they need to subsidize it by selling low-priced clicks to MFA publishers looking to buy traffic. In fact, without this revenue stream Taboola’s financial model would completely fall apart and would likely never generate free cash flows.

If we are right, it's really smart of management to subsidize COGS with MFA click revenue because it makes the whole model work. On the other hand, if MFA clicks go away, Taboola's business model breaks in a severe way. Jounce Media's November report indicates what appears to be the beginning of a "market crash" regarding MFA bid requests falling from 30% to 20%… and that's in Q4 when MFA bid requests usually rises to take advantage of big budget spending.

Looking at Taboola’s revenue trend line, one would guess management will need to hang onto selling MFA clicks until things start moving in the right direction.

If there’s one silver lining in Taboola’s future it would be striking a 30-year deal with Yahoo. At full throttle across Yahoo’s main properties, that could translate into nearly $140 million in ad new revenue for Taboola.

Here’s how we get there:

Taboola touts 500 million daily active users (DAU).

We can’t find any recent published numbers on Yahoo’s DAU, but they do claim 900 million monthly active users (MAU).

Assuming a DAU/MAU ratio of 20% for Yahoo, we get 180 million daily active users.

Taboola currently pays out $832 million/year in TAC on 500 million daily active users which works out to $1.63 per DAU.

With 180 million DAUs, Yahoo’s potential revenue share is $300 million.

Assuming the same 68% revenue share mentioned above, Taboola’s portion would be around $140 million which adds 26% to its current revenue base. That’s huge!

Note: In our November valuation webinar on Yahoo we overstated Taboola's opportunity for Yahoo. It's still substantial and does not materially alter our overall valuation around $16B to $20B. Next Week: Breaking down the financial genius of an MFA Site

Next week we’ll breakdown the arbitrage math of a typical MFA site in all its glory. It’s so simple. That’s what makes it so beautiful. Always remember, where there is advertiser demand, there will always be supply… especially for cheap reach inventory in AdTech Land.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.