#38 Quo Vadis Month In Review | January 2023

Who's up/down; Adtech & Agency Reporting Season; Fibonacci Finally Breaks Through Resistance

Reading Time: 6 marvelous minutes

For some of our readers, it’s just another day at the home office. But for everyone else today is Working Naked Day! Get your mind out of the gutter! It’s not what you think. It just means you get to work from home. While getting “naked” at the home office used to be an occasional thing, the U.S. Census Bureau now estimates that the number of people working from home tripled from 5.7% (roughly 9 million people) to 17.9% (28 million people). That’s a lot of “naked” people! With so many tech layoffs recently we expect clothing sales to dip in 2023 🤣

Who's up or down in January?

Overall, our QV AdTech 18 equal-dollar portfolio is up 312% since its inception in January 2018 and is still well ahead of the broader market.

The good news: six out of the eighteen adtech players we track are up.

TTD, MGNI, SFOR, ROKU, and CRTO are proving to be more resilient than others. We don’t expect much change at the top of the pack in 2023.

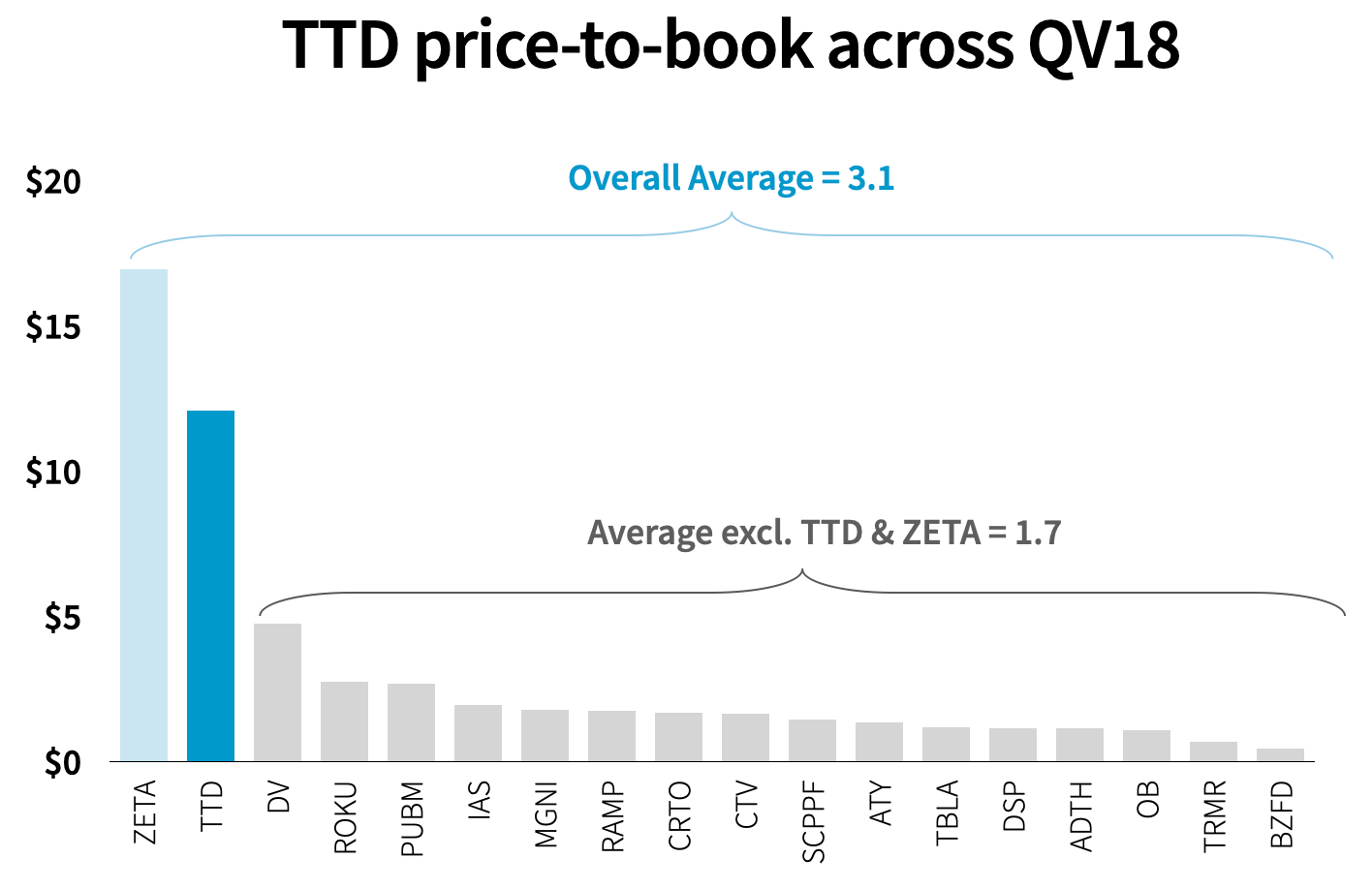

ZETA slips in and out from up ⬆️ to down ⬇️ on a regular basis. For reasons that totally elude us, ZETA is trading at around 17x book value. We have no idea how management is going to grow into those kinds of expectations. For what it’s worth, the QV18 trades at a 3.1 average price-to-book ratio. If you can explain what we can’t see, please hit the comment button and go for it!

RAMP has been hanging around positive territory but can’t seem to break through. They are the first to report on Feb 7. If they show a good Q4 with decent guidance and offer some believable clarity on where the ID space is heading, and how they fit into it, then they might make it back to green territory ✅.

The bad news: Not only are the other twelve down ⬇️, but every single one of them is trading below its IPO price.

And even though Criteo is up overall in our portfolio (starting in January 2018), it’s currently trading at –15% below its IPO $35 IPO price on October 13… for now at least. Criteo reports earnings next Wednesday.

With a mix of ~20K SMB advertisers and many large brand clients, and dollar currency exposure across the 30+ markets, it will be interesting to see if Criteo does better or worse than Google (revenue up↑ 2% on a constant currency).

Turning to agency land

So far, so good in January for most of the agencies we track. Our QV Big 5 and QV7 equal-dollar portfolios are up 5% and 26%, respectively, but still far behind the broader markets since January 2018.

The good news: Five out of seven are contributing to our portfolio gains with Dentsu and WPP dragging it down.

Publicis reported yesterday. Investors liked 👍🏼 the news sending the stock up ~34% (as of today). Shareholders also liked management’s 2023 guidance on organic growth expected at +3% to +5%.

January was good for IPG. It slipped into the #2 spot edging out S4 Capital. IPG and Omnicom report next week. We expected decent numbers and similar guidance on “organic growth” across the board.

Although Next Fifteen is the front-runner in our QV7 tracker, and by a large margin, they are the only agency that had a ↓down January. See January’s player-by-player update below.

The bad news: Tough sledding for WPP and Dentsu, but they’ll eventually turn it around. WPP is the biggest holding company across the board. We can’t help but imagine the potential upside when they figure out how to use A.I. to get more productivity out of the old-fashioned FTE billing model on both the media and creative sides of the shop. The same goes for all the players in our QV Agency Big 5 portfolio.

If productive output = productivity x (capital + labor), then every increase in productivity means a multiple of more outputs with fewer inputs. That means surplus value creation. As long as agencies figure out more ways to defend and keep what they create for clients, the happier their investors will be.

January quick review, adtech en fuego🔥🔥🔥

January stock price performance across our QV AdTech 18 felt like an LL Cool J moment.

Don't call it a comeback

We’ve been here for years

Rocking our old-school agency peers

And putting marketers in fear

Making ads rain down like a monsoon

Listen to my topline go boom! Broad Markets:

NASDAQ 11.5%⬆🔥

S&P500 6.6%⬆🔥

QV AdTech18: 16.5%⬆🔥🔥

QV Agency 7: 9.3%⬆🔥

QV Agency Big 5 8.7%⬆🔥

DSP:

TradeDesk 15.2%⬆🔥🔥

Criteo 16.9%⬆🔥🔥

Tremor 27.9%⬆🔥🔥🔥

Viant 18.2%⬆🔥🔥

AcuityAds Holdings11.3%⬆🔥

AdTheorent 6.7%⬆🔥

Zeta Global 8.9%⬆🔥

Agencies:

S4 Capital 29.8%⬆🔥🔥🔥

Next Fifteen -1.2%⬇😥

WPP 16.8%⬆🔥🔥

IPG 7.9%⬆🔥

Omnicom 4.2%⬆🔥

Publicis 10.9%⬆🔥

Dentsu 1.3%⬆🔥

Blended DSP/SSP:

Roku 41.8%⬆🔥🔥🔥🔥

Data Provider:

LiveRamp 13.2%⬆🔥🔥

Ad Serving:

Innovid 25%⬆🔥🔥🔥

SSP:

Magnite 21.7%⬆🔥🔥🔥

Pubmatic 16.4%⬆🔥🔥

Content Verification:

DoubleVerify 24.8%⬆🔥🔥🔥

Integral Ad Science 14.5%⬆🔥🔥

Made for Advertising:

Taboola 29.2%⬆🔥🔥🔥

Outbrain 27.1%⬆🔥🔥🔥

Publisher:

BuzzFeed ↑233.3%⬆🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥🔥

Case & Point: Human labor is additive to production, not multiplicative. One unit of labor fetches one unit of production. That’s why BZFD investors sent the stock flying last week when WSJ reported, BuzzFeed to Use ChatGPT Creator OpenAI to Help Create Quizzes and Other Content.

A.I. “staffing” makes total sense for BuzzFeed. And so does the unit economics thinking. For instance, if A.I. can generate 10 units of content better, faster, and cheaper than a human (but with some human oversight/tweaking), then Buzzfeed can dramatically reduce staffing costs as a path to maybe reaching profitability someday down a long road. With ChatGPT “Professional” is priced around $42/month, we can’t wait to see how adtech players bring generative A.I. tools into their cost reduction and profitability plans. When A.I. starts taking over hands-on-keyboard roles across adtech companies (and agencies) that rely on managed service, look out!

Adtech & Agency Reporting Season

Publicis was the first to report across the players we cover. Besides the big agency players, our attention will mostly be on the more established adtech players that we track, particularly Trade Desk, Criteo, Magnite, and Pubmatic.

S4 and Next Fifteen (UK-based) don’t report for a while but we think their numbers will be more important than ever. Why? Because these newer reinvented “agencies” will be able to move much faster on productivity strategies than legacy shops.

It’s easier, cheaper, and quicker to lay down productivity pipes while you’re young and growing vs. trickling layoff waves as bigger shops figure out a new way forward to get an old job done.

One of the big things we are waiting to see across Q4 earnings is employee counts. As of FY21, the QV AdTech18 + QV Agency 7 employed 417,447 folks around the globe, up 12% from 2021. With big tech (GOOG, AMZN, APPL, MSFT, META, etc.) laying off ~10% of staff between the end of last year and early this year, we are quite curious to see what happens with other players across the adtech sector.

Fibonacci finally breaks through resistance

Last November on Fibonacci Day we mapped our QV18 portfolio to Fibonacci Retracement lines. Long story short, our QV18 has been bouncing along between support at $336 and resistance at $406 for more than six months.

We followed up in December asking our awesome Quo Vadis community to take a poll. Not a single person thought it would break to the upside. But it did.

Now what? What’s in store as earnings season unfolds? Tell us what you think, take our new poll.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

Quo Vadis is for informational purposes only. You should not construe this information as investment, financial, or any other form of advice.

Thanks Tony — I've considered bringing it into the portfolio and still might. You said it, the MFA world is not sustainable, yet it still holds up. That says a lot about how marketers do/don't do their homework. PERI does not appear to be a value stock, but a speculative play based on how long management can keep the ball in the air.

Any reason why you guys not including $PERI in your reporting? The stock appears to be a favorite of many adtech analysts... and numbers do look good.. although I can't figure out why a made-for-ads content network is getting so much attention.