#34: Agency Review

ChatGPT poem on media agencies; agency run-down; breaking down organic revenue growth

Reading Time: 9 minutes

As usual, this is not investment advice.

ChatGPT Poem on Media Agencies: In appreciation of our Quo Vadis community, we asked ChatGPT to write a poem about media agencies. Does the last line floor you like it did for us?

“…A media agency, always in demand” …never has a greater truth been spoken!

Agency Update

As our community knows, Quo Vadis focuses on 18 adtech companies because that’s where the action is the most interesting. But every once in a while, we also like to take a peep at how agencies are doing.

With our QV AdTech18 Portfolio, we track 18 adtech players in an equal-dollar portfolio.

When it comes to studying the agency world, we track five holding companies using the same approach. We call that equal-dollar portfolio QV Big5.

When we add two newer agencies — S4 Capital and Next Fifteen Communications — we get our QV Agency7 portfolio.

As of yesterday, we have four winners (barely) and three losers.

Overall, our QV7 portfolio is up only ↑14%. It has underperformed both the NASDAQ and S&P 500 by a wide margin since our January 2018 starting point.

It’s a bit worse for the holding company sector. If we pulled out S4 and Next 15 — as if we never let them into the legacy holdco party — our QV Big5 is down ↓–5%. Ouch! 😣 😩

IPG is clearly leading the way among the big holding companies, up ↑50%.

WPP can’t seem to get it cranked up, down ↓45% in overall returns.

The big winner of our “new agencies” is Next Fifteen Communications, a London-based modern agency up ↑141%. Similar to S4’s “holy trinity,” Next 15 focuses on three segments: brand marketing, data and analytics, and creative technology.

Translation: We are in business to innovate on the advertising job-to-done. We are not stuck in a business model where billing out FTEs trumps what would be value-creating innovation for our clients. While big holding companies don’t have the time or enough talent or the right client incentives to innovate, we do.

S4 Capital is the other new agency model that we track. Returns were up ↑507% during the height of the pandemic’s intense 50 Shades of Grey love affair with Programmatic Land (September 2021). S4 is still up ↑23% overall on rising.

sSince hitting a low this past July, S4 has busted through all five resistance levels on an upward trend which is encouraging news for their shareholders.

Where the action is

It’s easy to see where the action is when you compare the QV AdTech18 to the QV Agency7. Our adtech portfolio has outperformed the agency world by leaps and bounds.

Some might even say adtech has left agencies in the dust in very profound ways.

We’re not totally sure, but a big part of holdco growth problems seems to be a continuous loss of control in the digital age.

Why? As more media money flows through adtech land, the fewer payables agencies have to fewer downstream suppliers. Classic disintermediation.

For example, when GroupM (WPP’s media agency arm) spends media dollars via The Trade Desk or Google’s DSP (DV360) — or any other DSP — it only has one account payable to the DSP. On the other side of the trade, the DSP has payables to various SSPs, and the SSPs have a payable to publishers.

In the old days before programmatic, agencies controlled payables to publishers and ad networks directly. In that world, agencies could aggregate media buying power to get publishers to do just about anything. If add in the now long-term trend of in-housing digital media buying and creative, the accounting shift is even more profound.

These fundamental changes to accounting flows are perhaps the biggest and most underappreciated dynamic in Programmatic Land.

In the new world, much of this mighty power has shifted to DSPs (mainly The Trade Desk and DV360). And it looks like the power will continue to slip away even more as The Trade Desk attempts to go publisher-direct with its OpenPath strategy bypassing SSPs as the current owner of payables to the publisher.

“Get direct, transparent access to inventory from leading premium publishers, right from our platform.” — TradeDesk.

Obsessing Over “Organic Growth”… Why?

We have a little bone to pick. Let’s call it a “radical transparency” bone asking “what is true about organic growth?”

Every holding company starts off earnings calls with organic growth performance. Yawn! 🥱🥱🥱

What we find interesting to reconcile from an investor’s hypothetical perspective is this infatuation with organic growth by management and investors alike.

Yes, we know organic growth is something to keep an eye on, but it’s really only important and value-creating when overall revenue growth beats reported organic growth.

Let’s walk through our thinking…

The way organic growth is presented seems to have more to do with measuring how well an agency is staying alive in what has become a highly commoditized service offering, rather than demonstrating increasing probabilities of value creation.

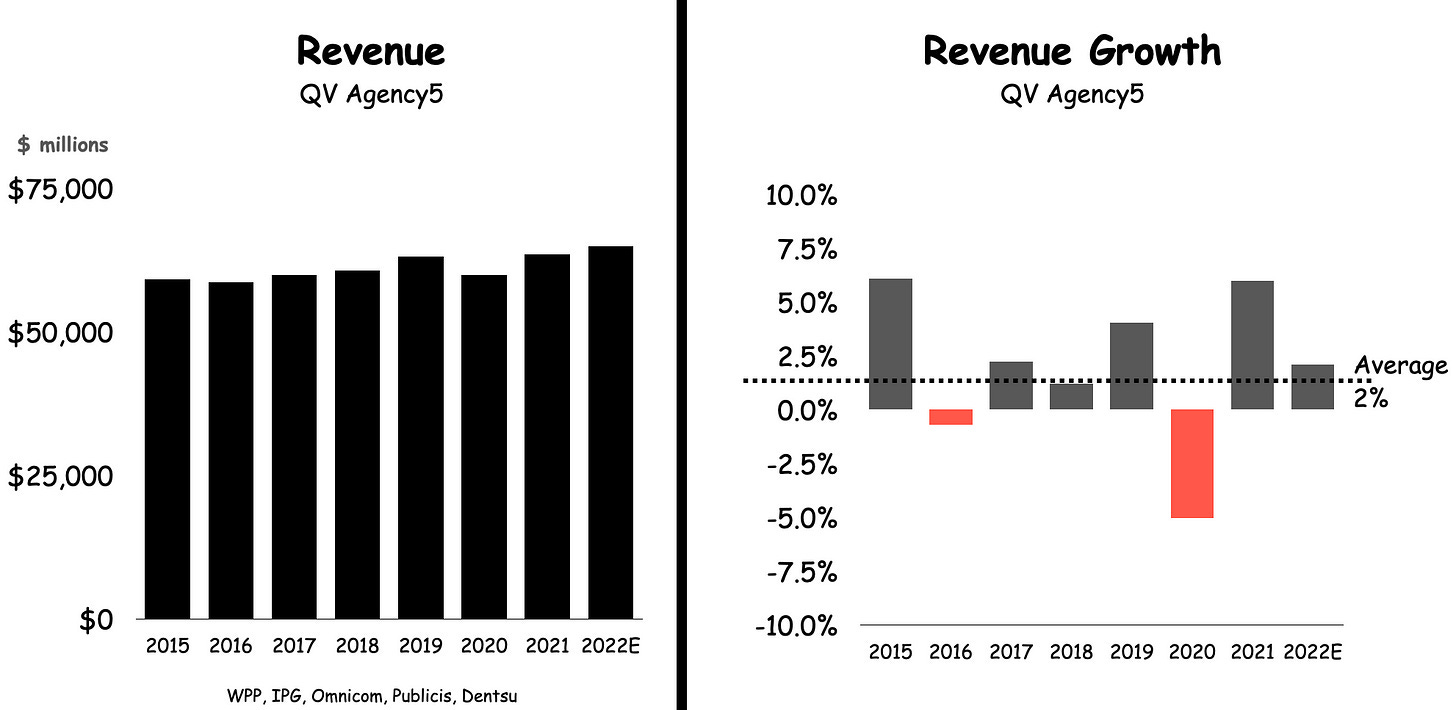

For instance, take a look at our Big5 holdco revenues since 2015. The average YoY growth rate is 2%. That’s kind of boring for investors to see year-over-year knowing quite well that client-side procurement teams have a never-ending need to screw down the fees they are willing to pay for agency services.

Let’s tighten the lens by looking at Q3-2022 organic growth compared to Q3 revenue growth.

It’s the same story. Overall revenue growth is slightly up but mostly down, while organic growth is up across the board (except for Dentsu). How can both exist for businesses looking to create value? They can’t.

Grading Organic vs. Overall Net Revenue Growth

Let’s take a look at the past three years and compare overall net revenue growth to organic growth at IPG, Omnicom, and Publicis.

Publicis gets a B for producing overall revenue growth with a bit of average organic growth. When you dig into segment growth, Publicis’ bet on Epsilon for data market exposure and Citrus Ads for retail media looks pretty smart.

Omnicom gets a solid D for delivering negative average growth rates with a tiny bit of average organic growth. It’s like getting Cs and Ds in math and science but bringing home an A in art. Everyone gets an A in art because all art is beautiful

FYI: If you’re in NYC, we recommend checking out the Cubism and the Trompe l’Oeil Tradition at the MET. It runs through January 22, 2023.

IPG gets an A for crushing it on all counts… relatively speaking.

A Thought Experiment

Let’s look at organic growth through two different lenses.

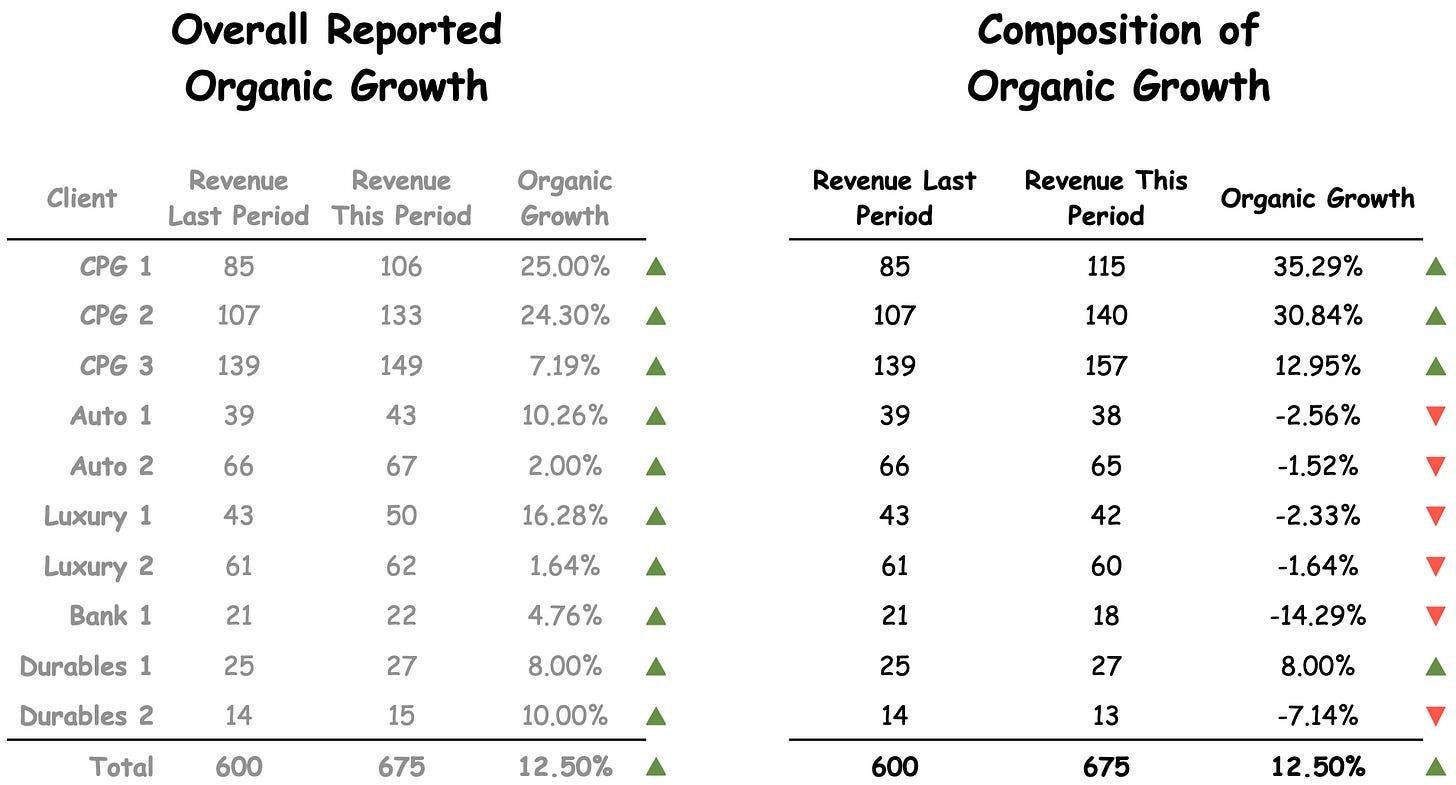

Lens 1: Let’s say an agency has ten total clients ranging from CPGs to auto to banks to durable goods.

When the agency reports “organic growth,” we only get to see an overall picture but not its composition.

In the overall reported view, all ten clients spent 12.5% more money on various agency services from the last period to the current reporting period. That’s a solid book of business!

Maybe it’s because the agency is awesome, or maybe it’s because economic times are really good so clients demand tons of additional services.

But what if the composition was totally different? Did every client from last period’s cohort spend more in the current reporting period? Did it really happen across every sector? That would be stunning!

Sure, maybe in a wicked-hot economy, but that’s not where we are today.

What you’d love to see is a client-by-client view into the composition of organic growth.

What if you found out that six out of ten clients spent less on agency services for all kinds of reasons (but mainly belt-tightening), while just a few in one sector like CPG demanded more agency services?

In that case, overall organic growth is still 12.5% like before, but the book of business shows a ton of weakness that otherwise goes unrevealed.

Lens 2: Now let’s turn revenue composition into a simplified waterfall exercise.

Start with beginning revenue indexed to $100.

Let’s say the agency sheds $5 in old or unwanted assets like an underperforming agency, so it loses the revenue produced by that business.

Agencies are almost always involved in new client pitches. Let’s say it won a few pitches from new clients or sold new projects from existing clients generating $2 in new revenue.

Along the way, the agency also acquired a new business line with $1 in new revenue.

At the same time, the agency lost $5 in revenue from existing clients (aka churn). That means our original $100 is reduced to $95.

In many cases, one agency’s demise is another agency’s gain in what has all the makings of a zero-sum game across a musical chair game of competing agencies. Another alternative explanation is when current clients churn away by taking their media and/or creative work in-house.

The good news reported by the agency is $10 in new revenue from existing clients.

Results: 10.5% in reported organic growth ($10 ➗ $95) but only 3% overall growth. Voilà.

Agency Revenue Productivity

A really nice way to see what’s going on between Programmatic Land and the agency world is to look at revenue productivity by headcount.

The Trade Desk shines above all holding companies both old and new when it comes to revenue per employee. Why? Because agencies use its platform by hiring FTEs to manage client campaigns and they bill out hours to clients in various forms.

Both TTD and CRTO lead the way compared to agency productivity levels. Criteo is most similar to the agency model by employing hands-on-keyboard managed services staff. Criteo’s productivity is higher mainly because of seasoned line management, aligned incentives, and continuous innovation on the tools these staffers use to get the job done.

Within our core agency group, Next 15 is the clear winner when it comes to revenue per head — and it’s improving every year.

What is Productivity?

Here’s what we said in our April 2021 post:

Economics Geek-Out Time

The Cobb-Douglas Production Function sounds fancy, but it’s really quite simple. All it says is that a firm makes stuff using a combination of just three ingredients: capital, labor, and productivity. Independent of how many employees an agency might have, whether it’s 110K at WPP or only 5.7K at S4 Capital, they both make the same thing — ads. Whomever makes more quality outputs that delight clients for the least input makes shareholders — and all other stakeholders — better off.

Independent of size, both firms have similar access to cheap capital.

Both companies have access to the labor market across a range of skills.

From a management perspective, you can deploy as much capital and hire as much labor as you want, but that will only get you so far in a digital world.

What you really want is to maximize productivity across labor and capital, create surplus value, and find a way to keep your fair share knowing that marketing procurement is watching and might try to take it back. That’s the rub.

Example: Let’s say you hire two people to paint a small room in your house. They’d both like to get it done faster, so they each enlist a friend to help. Now there are four painters in a small room. Soon, four more friends stop by with beers and pizza offering to help. Now there are eight people in the room, bumping into each other and making a mess of things. Productivity falls and the work quality suffers. Everyone gets frustrated and wants to quit.

So, instead of focusing only on labor and capital, what if you simply rented a Wagner Power Painter to paint the room in less time, with no additional labor, and did a smashing job?

That’s how we compare two companies of very different sizes. The more agencies focus on capturing productivity factors, the sooner clients and investors will reward them. Moral of the story: If all you have are FTEs, then every problem looks like hiring (and then firing) people instead using automation tools (build, buy or partner).

Then again…”A media agency, always in demand.”

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.