#10: Portfolio Update 4/2021

Programmatic Pure-Play Mojo Continues + PubMatic Short Interest + DoubleVerify IPO + S4 Capital expands gains over legacy holding cos

Welcome to Quo Vadis, your periodic source for fresh programmatic news and off-the-beaten-path perspective. If someone was kind enough to share this with you, then you’re in luck! Just click here to join the conversation.

Today is National Haiku Day. So, without further ado…

Programmatic lemons

Everywhere you turn today

Valuations high

Programmatic Pure-Play MoJo Continues

Since our inaugural portfolio update on March 4, our Quo Vadis basket of programmatic pure-play stocks has experienced modest overall gains, rising from 778% in the March posting to 882%.

Reminder: We’re running an equal-dollar portfolio that starts in January 2018 (we explain why here) and studies stocks that are either 100% dependent on programmatic advertising or heavily reliant on it.

In other words, had you bet $100 on these stocks in January 2018, you’d have $782 extra cash in your pocket today, and you would’ve beaten the NASDAQ by almost 10x.

Quo Vadis wonders about what all those VC firms think now after passing on ad tech rounds just a few years ago with lame excuses, “we don’t invest in ad tech, ad tech has no future.” This kind of poor thinking goes to show you that following the VC herd and not thinking about your LP’s well-being vs your own silly biases means you also miss out on big returns. In case you forgot, big returns are what in business to get.

Short-term Recovery

As of mid-April, programmatic stocks are still looking for steadier footing after Google Sun Tzu-ed the adtech community with its policy update on first-party identifiers, sending shockwaves through the audience targeting world. The dust is still settling.

Our portfolio was trading at an all-time high in February, but it dropped 16% on the identity news. It has recovered a bit over the past five weeks, but investors are still worried about how big the problem may or may not be. Here are three good reasons why they need not worry:

Adtech earnings season is right around the corner, so we expect to see strong results from most (but not all) players. Overall, we expect a post-earnings recovery to take our programmatic portfolio past $1000 again as we approach the halfway mark in 2021.

Right or wrong, good or bad, advertisers have an insatiable appetite for audience targeting. Yes, they all say consumer privacy and responsible advertising are important too, but when we follow actions instead of being blinded by words, we always find more audience targeting, not less. Headlines like “P&G Worked With China Trade Group on Tech to Sidestep Apple Privacy Rules” are good indicators of actions to come over words.

If Google wants audience targeting, the world will have audience targeting. What remains to be seen is which identity tools marketers will put at their fingertips to get the audience targeting job done. Lots of choices, lots to test and learn.

Frenemies At The Gate

Not only does our Quo Vadis programmatic portfolio beat the NASDAQ by 10x, but the NASDAQ beats agency holding co performance by 10x (more on holding cos below). That tells you how bad things really are in the legacy holding co world.

Over the last two years, our equal-dollar holding company portfolio has basically been anemic (IPG, Omnicom, WPP, Publicis, and Dentsu). Sure, they’re all trading at or near 52-week highs today, but the highs 52 weeks ago were extremely low.

Call Out: Notice how we keep S4 Capital in the programmatic pure-play portfolio but out of the legacy agency holding co portfolio? That’s because S4 is 100% digital — it has no legacy assets or labor issues to weigh it down.

If we did include S4 Capital with its estranged brethren, our holding company portfolio would be up 80% instead of just 9% and almost even with the NASDAQ. But as they say on the “This Morning” show in the UK, "If my grandmother had wheels, she'd be a bike."

Our Portfolio Had a Baby! Congratulations! It’s a DSP!

Viant went public in February under the apropos symbol “DSP,” so we added this pure-play programmatic company to our portfolio. Here are the highlights — or lowlights, depending on how you look at it:

Viant’s stock price is off –24% since going public in February.

With only $165 million in 2020 gross revenue (e.g., billings), the company is currently valued at $2.5 billion, which is certainly on the high side considing Vista Equity Partners only paid 2.8x on gross ad flows for TripleLift and the overall the market is trading around 6.6x on ad flows (Viant is trading at 15x).

Ex-TAC revenue was $111 million in 2020, meaning they paid SSPs $55 million for supply. So, whomever its advertisers are, they paid Viant $3 to buy $1 of inventory.

With 66% gross margins, Viant reminds Quo Vadis of Rocket Fuel, which made most of its money by charging blackbox-managed service fees. And we all know what happened to Rocket Fuel… it ran out of fuel.

We also noticed a big Quo Vadis pet peeve in Viant’s prospectus. Viant’s management cites expectations from eMarketer saying that the programmatic advertising market could balloon to $140 billion in 2022 (from $65 billion in 2018). These inflated — and highly conflated — market sizings never get old in programmatic land. What DSPs like Viant forget to tell you is that the $140 billion eMarketer estimate includes programmatic display ads on Facebook, Twitter, Snap, and other walled gardens.

Quo Vadis thinks the real market Viant competes in is the $40 billion slug of total ad budget moving through DSPs like the TradeDesk, which has a ~10% share (Quo Vadis estimate). $40 billion + growth is still really big, but not $140 billion big.

We’d hope Viant’s investors bother tofact-check as much as we just did. What management should do is say they are 100% focused on the $40 billion “Open Web” game and how they hope to compete like hell with a managed service offering. ‘Nuff said.

Short Interest in PubMatic Is Concerning

There’s only so much Open Web programmatic love to go around. Given all the short-selling interest in its shares, investors seem to be concerned that PubMatic will not get its due share.

Short interest is the number of shares that have been sold short but have not yet been covered or closed out.

Although short interest for Magnite is 3x more than the average short interest across other players in our portfolio, short interest in PubMatic is 15x higher. Why?

When investors compare PubMatic to other programmatic peers, they likely conclude the company is a 90-pound featherweight in the ring with multiple heavyweights. But who knows, maybe management can pull off a miracle victory like in Rocky 4.

Investors are worried that PubMatic is too small to thrive in the dog-eat-dog world of programmatic competition. Adding to their worries, they might be questioning if PubMatic has enough cash to buy into the right assets and/or are worried about the SSP space in general, which explains why short interest in Magnite is also significant.

PubMatic might also be viewed as having insignificant growth in dollar terms as well as a sub-scale marginal cost position, making it hard to compete as SSPs face transparency and take-rate pressure from publishers and advertisers.

DoubleVerify is Going Public

Ad verification company DoubleVerify filed its S1 to IPO on the New York Stock Exchange under the ticker “DV.”

DV was founded in 2008 to conquer issues like ad fraud, brand safety, and viewability. Despite these unresolved issues getting bigger and more complex every year, DV was acquired in 2017 by private equity firm Providence Equity Partners for $300 million. With a planned $4.2 billion IPO valuation, Providence certainly knows how to make money the old-fashioned way! Buy low, sell high!

Only In Programmatic Land

Think about it. If you’re an advertiser spending millions on ad inventory that also happens to need verification services with $4.2 billion, how good can the underlying inventory be, and why would you expect the ads to perform if they need that much “double” verification?

Key Points to Consider

Evidently, “verification” technologies like DoubleVerify appear to have zero incentive to solve chronic ad quality problems for advertisers. If they solved these issues, there would be no market for technologies like them.

Whatever nickel-and-dime fees verification vendors charge, their business proposition is more akin to an insurance model where agencies and advertisers pay to have someone to blame if/when an ad impression shows up in the wrong place, at the wrong time, to the wrong person. Since programmatic ads have a high chance of blowing up, leaving egg on a marketer’s face, they’ll happily pay for a “throat to choke.”

Looking into the risk factors cited in DV’s S1 filing, the first risk factor says, “If we fail to respond to technological developments or evolving industry standards, our solutions may become obsolete or less competitive.” So, the question becomes this: What does a new entrant or substitute look like? For example, if marketers start using all this wonderful data and processing power to make incrementality measurement standard on every campaign, they won’t really need verification services anymore. Only ads served to humans in brand-safe viewable environments can create incremental lift. Therefore, if marketers can somehow change their focus, they no longer need a throat to choke — getting advertising lift is all the verification they’ll need.

Advertising Tip:

Buy the biggest banner or video player ad units you can find. On known publishers. Measure for 100% viewable pixels for 3 seconds or more (don’t fake it, just do it). You’ll capture all the incrementality lift there is to capture. You’ll no longer need to pay unnecessarily for a throat to choke because you’ll be doing actual advertising with high standards instead of just trying to spend ad budget on low standards.

As the Agency World Turns

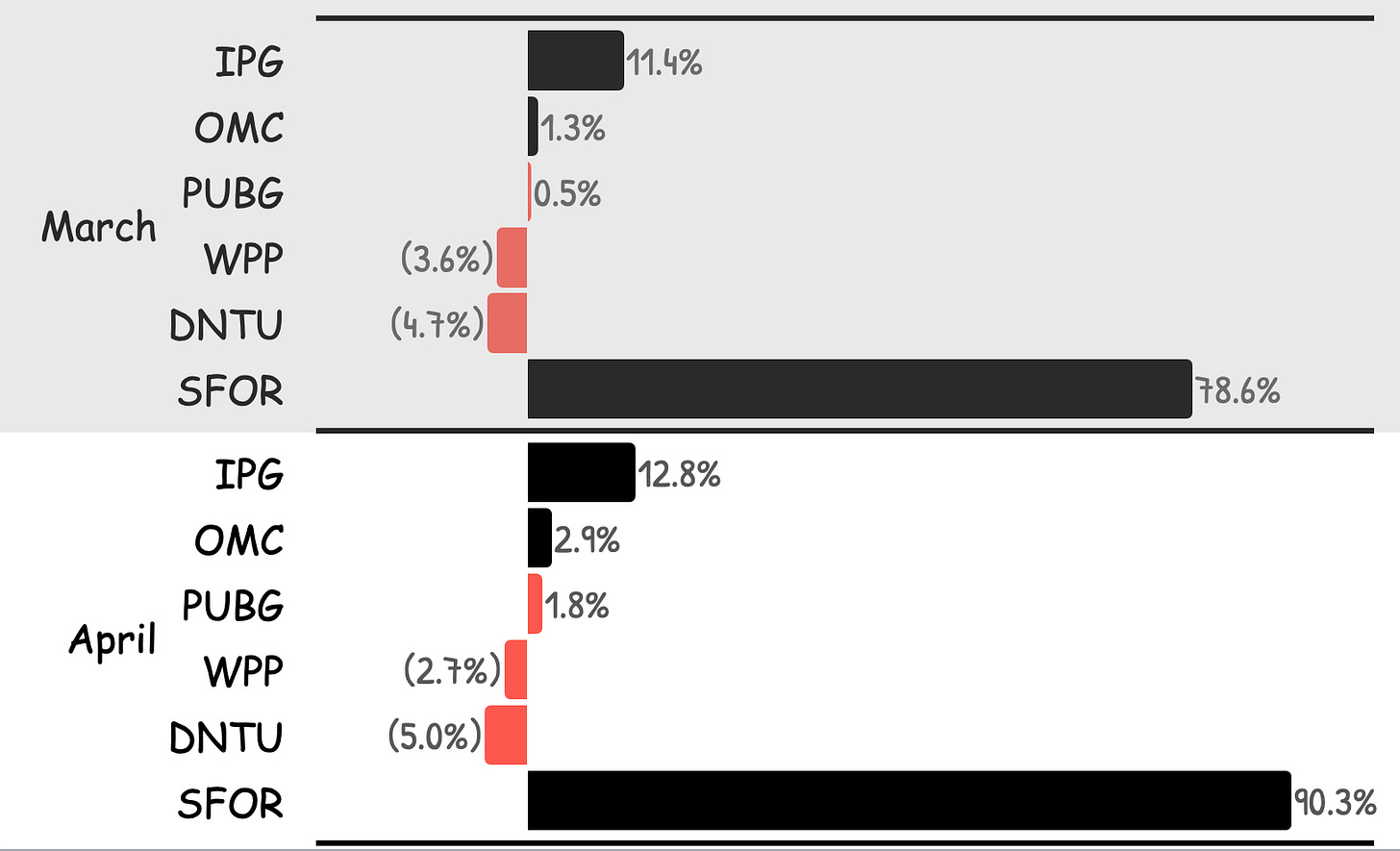

With the exception of S4 Capital, not much has changed in our Quo Vadis Holding Co Portfolio since early March.

S4 Capital continues to generate nearly all the gains across agency players in our equal-dollar portfolio.

S4 Capital expanded its share of gains since early March.

IPG is the only other meaningful value producer in the portfolio, but a distant second.

You Can’t Compare S4 Capital to WPP! Oh Yes We Can. We Just Did.

One of our avid Quo Vadis readers reached out last month saying we shouldn’t compare S4 Capital and WPP. Why? Because WWP has ~100K employees and S4 only has ~4.4K employees. All true, nothing to argue there… except for one little thing called the Cobb-Douglas Production Function.

Economics Geek-Out Time

The Cobb-Douglas Production Function sounds fancy, but it’s really quite simple. All it says is that a firm makes stuff using a combination of just three ingredients: capital, labor, and productivity. Independent of how many employees an agency might have, whether it’s 100K like WPP or only 4.4K like S4 Capital, they both make the same thing — ads. Whomever makes more quality outputs that delight clients for the least input makes shareholders — and all other stakeholders — better off.

Independent of size, both firms have similar access to cheap capital. Both companies have access to the labor market across a range of skills. From a management perspective, you can deploy as much capital and hire as much labor as you want, but that will only get you so far in a digital world.

What you really want is to maximize productivity across labor and capital, create surplus value, and find a way to keep your fair share knowing that marketing procurement is watching.

Example: Let’s say you hire Sir Martin (CEO of S4 Capital) and Mr. Read (CEO of WPP) to paint a small room. They’d both like to get it done faster, so they each enlist a friend to help. Now there are four painters in a small room. Soon, four more friends stop by with beers and pizza offering to help. Now there are eight people in the room, bumping into each other and making a mess of things. Productivity falls and the work quality suffers. Everyone gets frustrated and wants to quit.

Moral of the story: Throwing more warm bodies at a client’s digital needs will only get you so far because labor (and capital) is merely additive to production. In other words, labor doesn’t scale well (e.g. a 1% increase in labor generates less than 1% in additional output).

Productivity is different — it’s the essence of scale. Productivity comes in the form of software, know-how, and continuous process improvement. These factors are multiplicative to production (e.g. a 1% increase in productivity generates more than 1% in new output).

So, instead of focusing only on labor and capital, what if Sir Martin simply rented a Wagner Power Painter to paint the room in less time, with no additional labor, and did a smashing job?

That’s how Quo Vadis compares two companies of very different sizes. The more agencies can focus on capturing productivity factors as digital acceleration presses forward, the sooner clients and investors will reward them.

Use Case Education Session With ID5

Reimagining the Direct Response Job-to-Be-Done

You’ve been Zooming a lot lately, one video call after the next. You’re getting a bit tired of looking at yourself with those old reading glasses you’ve had forever — you need to update your look!

You head over to WarbyParker.com, and while you browse the latest and greatest frames, Warby drops a cookie on your browser. No biggie, you’ve been fine with cookie drops for years now. Life goes on.

The next thing you know, you’re checking out Fodors.com for exotic travel tips. Now that you’ve been vaccinated, you’re more than ready for that big backpacking adventure you’ve been dreaming about since 2019. Don’t worry, you’ll get there eventually!

Boom! That’s when it happens. You get a Warby Parker ad for the very frames you were just admiring not even one hour ago! Amazing! The product image in the ad gets your attention — the perfect frames for you! How did they know?

That was then, this is now

That’s how retargeting used to work. Not anymore. Not without cookies.

If you’re a DR marketer looking to run that kind of ad strategy, you’ll need a new approach and new tools. It all starts with the right identity solution, and like everything else in advertising, it ends with measurement that tells a true story.

Direct Response and Cookieless Identity

The first thing you need to know is that 100% of retargeting success happens when you stick to our Three Rules of Modern DR:

Rule 1: Clicks don’t matter at all.

Clicks are not incremental. Clicks only tell you what “they” want you to believe. Stop chasing clicks, and focus on view-throughs instead. Quo Vadis thinks of a view-through as a “mental click” because that’s what good advertising is all about (e.g., attention, salience, and measurement).

How do you measure mental clicks? Simple. Get really good at running incrementality statistics.

Incrementality statistics were really hard to do well with cookies, but they’ll get a lot easier with stable first-party data that has less risk of test/control group contamination.

Rule 2: Viewability drives 99% of incremental lift.

We’ll cut to the chase. Stop buying crappy, low-quality, non-viewable inventory and start buying large ad units that have a historical track record of being 100% viewable for three seconds or more. Do that and you’ll be amazed.

Rule 3: Be first and fast.

Direct response advertising is a long-tail game of being “first and fast.” As an advertiser, you have just a few hours to “find-back” that shopper ID and show her an ad for those cool new frames she’s been eyeing.

With every passing hour, the probability of achieving a mental click quickly decays. If you can’t find her within 24 hours, you’re better off giving up; the probability of advertising success has dropped to zero. That’s precisely why buying the best inventory possible in the publisher long-tail is absolutely key.

Retargeting is only useful up to a certain point — it is useless if the shopper is ready to convert. So, when you get really good at buying and measuring IDs on high-quality long-tail inventory, you’ll also find out where the retargeting cut-off line is so you can avoid being “creepy.”

Join Our Use Case Education Session with ID5

Register for our Quo Vadis Education Session on April 27 at 1pm ET with ID5 for a deep dive into the art and science of cookieless direct response advertising in non-authenticated environments.

Your truth-seeking host, Tom Triscari of Lemonade Projects, will interviewID5’s Scott Menzer, Co-founder & VP of Product, on how our three rules play out in the cookieless world.

Bring Out the Quants

Media Math Question of the Month

The Set Up: You buy 1000 impressions via your favorite DSP. You get a report from your viewability vendor saying 80% of the impressions were “viewable". That means 8 out of 10 impressions passed your low standard criteria of 50% pixels in view for at least 1 second.

You’re no David Ogilvy, that’s for sure! You’re a programmatic trader and really happy because your media auditor tells you the industry benchmark is 50%. You set the high jump at 1 foot and you crushed it — yes!!!

The Twist: Your viewability report also tells you that 50% of the impressions were “unmeasurable.” What the heck does that mean? Advertisers don’t care, so why should you? You’re just a programmatic trader pressured buy the big bosses to make sure that ad budget gets spent on time and in full.

It turns out that your viewability vendor gives “unmeasurable” impressions the same score as “measurable” impressions. That kind of thinking bothers you. How can that make sense?

So, you collect some data and find out that unmeasurable impressions have just a 5% chance of passing your viewability standard.

Question 1: What is your adjusted viewability score now?

Question 2: Are you advertising or something else?

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.