Welcome to Quo Vadis, your periodic source for fresh programmatic news and off-the-beaten-path perspective. Click here to join the conversation.

Today is World Plumbing Day. It’s also Worship of Tools Day. A real double whammy for Home Depot and all you DYI folks…and for programmatic advertising too. Could the people of programmatic land use better plumbing and less worship of tools that clearly aren’t working for advertisers? We think so. If both were true, then maybe Gannett’s USA Today would not be caught up in an ad fraud snafu.

Reading Time: 7 wonderful minutes.

Q4-21 Scoreboard: 7 Programmatic Winners, 11 Losers

What’s changed since our last quarterly earnings update in November?

We’ve added three SPAC-to-IPO newcomers to our portfolio: Innovid (supply chain middleware), BuzzFeed (sell-side), and AdTheorent (buy-side).

Innovid and Buzzfeed are off to a poor start and well off their IPO prices, down –16%, and –56%, respectively. AdTheorent is off –0.4%, coming back from being -50% down at the end of January.

Compared to our last quarterly update in November 2021, Zeta Global has moved into the Top 5 in terms of overall returns, along with The Trade Desk, Magnite, S4 Capital, and Roku. LiveRamp is in the 6th spot running neck and neck with Zeta. After a lackluster first few months since Zeta’s June 2021 IPO debut, investors have become more hopeful about its potential for value creation.

Investor confidence that the bottom three — Viant, Acuity, and Buzzfeed — will eventually generate value has not changed since the Q3 earnings seasons.

Besides Criteo at +14% with management steadily marching toward its retail media strategy, all the other players in our portfolio are a drag on returns.

Reversion Continues

Overall, our programmatic portfolio of now 18 adtechies is up 419% since January 2018. In other words, had you bet $100 spread equally across a basket of 5 original stocks in January 2018 and rebalanced your equal-dollar portfolio as new players hit the IPO scene, your investment would now be worth $519. After you subtract your original $100 investment, you’re up 419%.

Just when you thought programmatic IPOs and consolidation would wind down from a super hot 2020/2021 lovefest, the IPOs and consolidation keep coming. It seems like the more players that enter the game make for the next weakest link and the worse our portfolio performs.

From an investor’s POV, it’s starting to become more clear that any desire to get exposure to adtech returns — outside of Google, Facebook, and Amazon — could be accomplished by holding just The Trade Desk. With $6.2B in ad flows under its control, there doesn’t seem to be a pressing need to own other downstream players like Magnite and Pubmatic because that kind of extra exposure is already embedded in TTD to some extent.

Since our Q3 earnings update last November, the NASDAQ is off –15%, but our 18 adtechies are off –40%. Interestingly, only Zeta was in positive territory, since with AdTheorent almost squeaked into positive performance. The grand majority are either trading at a 52-week low or darn close, with 11 out of 18 within 20% of that low-water mark. What explains this massive selloff?

One simple explanation is that the adtech party is over for now. Investors are probably having an increasingly difficult time justifying how future earnings will materialize for these companies who are all vying for the same advertiser dollars. There is only so much pie to go around and the mouth that usually gets fed the most is the least-worst alternative.

Another reason is increasing interest rate expectations. When interest rates go higher, so does the cost of capital. That means whatever future cash flows the company is expected to generate are now worth less than before.

Example Time

Let’s say investors today think an adtech company will eventually generate $100 million in cash and do that forever. If the cost of capital is 5%, the company is worth $2 billion ($100M/5%). If the company has 100M shares outstanding, each share is worth $20.

Now let’s say interest rates move higher, so now the cost of capital is 10%. That means any future cash is now worth less than before. In this case, $100M in future cash generation is worth $1B in today’s terms ($100M/10%), or $10 per share.

Think of it this way: You win $100 million in a lottery. The lottery offers you two choices, Choice A is to take the entire $100M today, and Choice B is to get $10M every year for the next 10 years. To see how much you really won with Choice B, you need to ask: How much money would you need to put in the bank today to be able to collect $10M a year? If you expect to get 5% in interest, then Choice B is worth just $78M today. Why? Because $10M in the tenth future year is only worth $6.1M today. In other words, getting $10M ten years from now is worth the same as getting $6.1M today at a 5% interest rate.

Programmatic Poetry #1

If you can't attract ad budget, then you can't charge fees. If you can't charge fees, no revenue growth you shall see. You can try to get your self-serve tech in a busy agency's door. But they don't have much time nor the people to deal with another chore. Sometimes agencies are short-staffed and must get budgets spent. So maybe an agency or two will gift you an insertion order present. Now you need to hire a managed service staff. But that means more fixed costs to run your craft. Investors don't like that very much. But what else can you do, when you're in a clutch? Maybe you want to be like Criteo or The Trade Desk. But you’re still much too small player-esque. They’re built to handle all the insertion orders they get. But scaling labor productivity can mean more working capital debt. And you still have costs of sales and compute cycles to worry about. Leaving you up at night full of doubt. How will you ever price your tech above marginal cost? Until then, your investor story will get lost.

Margin, Margin, Margin.

That’s the name of the programmatic game in three easy steps.

Step 1: Attract as much ad budget as possible into your adtech pipes.

Step 2: Extract as many fees as you can up to the point of your customer’s tolerance.

Step 3: Make whatever sales claims you like — no one will check or verify most of the time.

The sales part is super easy. All you have to do is survey big brand clients with a simple question like, “What’s the most important thing we can give you?” In all likelihood, the common client theme will be something like, “We praise reach and frequency above all else” and “we’re targeting low CPM inventory to reach cost (not value) goals.

That’s your money slide!

Just make sure to Always Be Closing (ABC) by talking about features very people understand and selling benefits — Reach, Frequency, Low CPMs, Best Inventory Ever!

“Our best feature is unprecedented reach across 119% of all consumers in the universe. Our data-driven, highly-scaled, purpose-built and brand-safe technology turns accurate frequency capping and control across our deterministic ID space from a dream to reality. It’s the only ad marketplace in the world where you pay the lowest prices and get the best quality.

Happy selling!

Contribution to Portfolio Gains

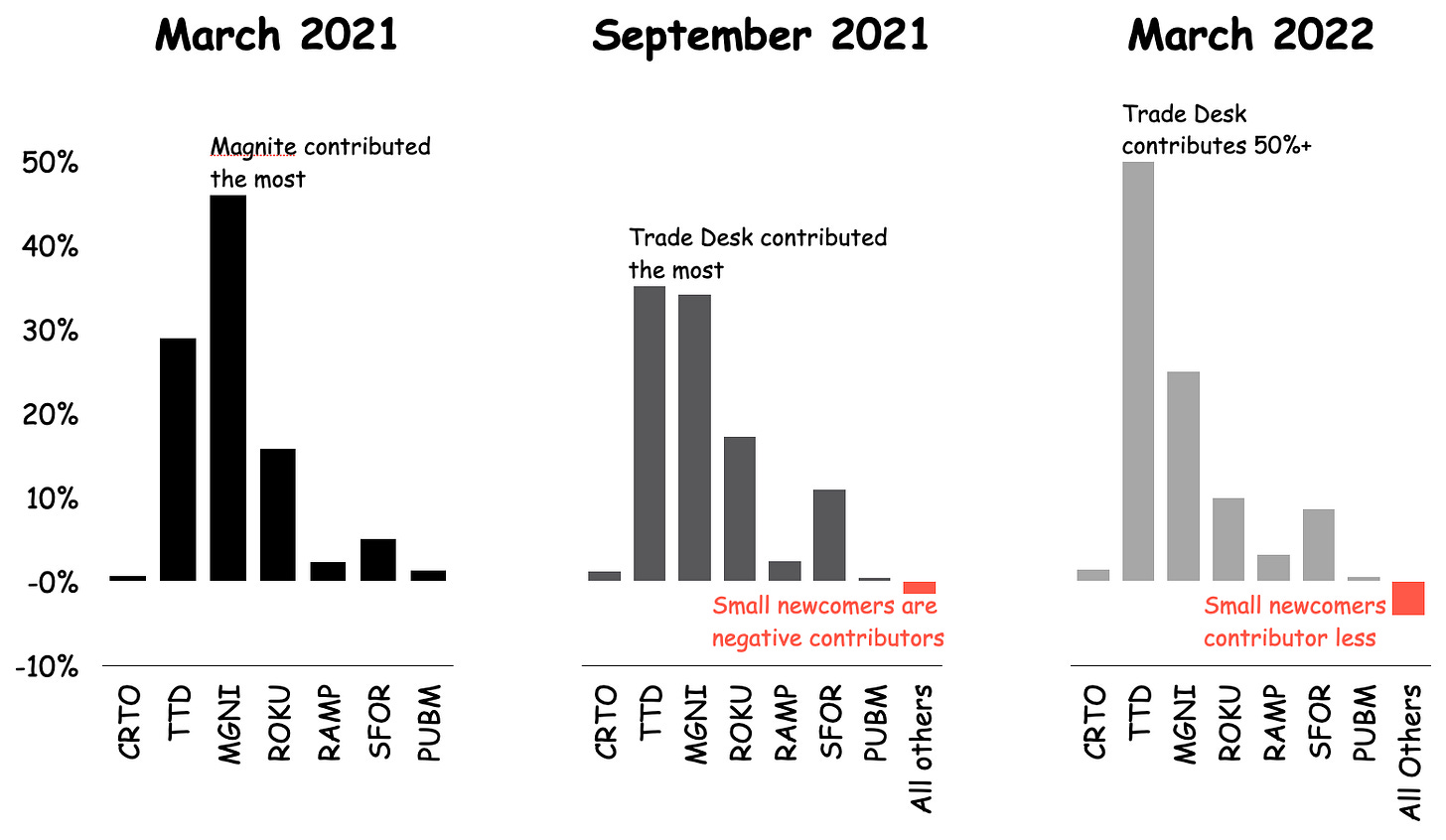

When we launched Quo Vadis back in March, investors loved Magnite’s story pushing its stock to $42. With new information, investors have less enthusiasm, driving MGNI’s valuation down to $12 today. It’s still up from our January 2018 starting point at just $1.90, but the odds say the road will get windy for Magnite and all other SSPs.

The Trade Desk is well off its 52-week high of $114 but now accounts for 50%+ of portfolio contributions. All the newcomers together generate negative contributions, with Zeta as the one exception eking out a 0.5% contribution.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.