#11: Open-Web DSP Market Size

How big is it? Who get's what? What's leftover for the small players?

Welcome to Quo Vadis, your periodic source for fresh programmatic news and off-the-beaten-path perspective. If someone was kind enough to share this with you, then you’re in luck! Just click here to join the conversation.

Working from home was built for today! It’s National No Pants Day. With so many people doing the WFT thing, no pants day is a no-brainer!

How big is the DSP market? Who gets what?

Let’s cut to the chase. Media budgets either flow through a demand-side platform (DSP) or they don’t. Either way, the total between the two categories was around $557 billion in media spend in 2020, with $53 billion moving through DSP pipes.1

Depending on whose forecast you like the most, both are poised to see meaningful growth in 2021 and beyond as the world economy bounces out of lockdowns with digital transformation accelerated into high gear.

Everyone in DSP land — from bigger players like Google and TradeDesk to smaller players like MediaMath, Beeswax, and every big retail media player from Walmart to Instacart — is licking their chops like Wile E. Coyote!

TL; DR

How wrong could we be? How much might we change our answer?

The total DSP market size is $53 billion, give or take.

Google’s two DSPs take the most — no surprise there! (DV360 for enterprise clients + Google Ads for SMBs)

Amazon’s DSP take is hard to nail down, but we think it’s sneakily big and certainly getting bigger as trade advertising budgets morph with media budgets, giving a big boost to retail media.

A rising tide lifts all boats — Criteo’s 4% take across a massive base of 20K performance advertisers is well-positioned for the retail media boom, which will certainly benefit from the digitization of ~$520 billion in trade advertising budgets (we’ll have more on this hot topic in May).

After the big players get their share, $9.4 billion is left over for ~50+ smaller DSPs to fight over. We break them out into 10 “Unicorns” (who get $1 billion or close in ad flows) and 40 “Small of the Small.”

“Small of the Small” DSPs share around $400 million, averaging around $10 million each in annual ad budget flows. If you’ve been around this space long enough and have access to small DSP financials, you’ll know our estimates are pretty close to reality.

Our advice to small DSPs is to connect with their inner David because the Goliaths are hungry. And if you know your revisionist history, it turns out thatDavid always had the advantage — so there is hope for some!

Starting Point Anchor

Our model starts with an “anchor” value provided by the Wall Street Journal and Jounce Media that estimates the total size of the DSP pie at $53 billion.

“The TradeDesk Inc., which specializes in helping companies buy online ads across publishers’ websites, did what others failed at: eating into Google’s share of the market. While Google dominates that area of ad-buying with about 40% of the business, TradeDesk is up to nearly 8%, and its share is growing faster than Google’s, according to ad-tech consulting firm Jounce Media.”

So, if we believe TradeDesk’s 8% share is a reasonable estimate (which we do), and its 2020 10K claims $4.2 billion in gross billings, then the total DSP market size is $53 billion ($4.2 ➗ 8%).

The neat thing about our starting point is that we get three key values from which we make a few adjustments:

Total DSP market size is $53 billion.

TradeDesk touches $4.2 billion or 8%.

Google’s apparatus touches 40% of the DSP market.

On Google’s DSP(s) + Minor Adjustment

Google’s DSP comes in two forms: DV360 for large enterprise customers and Google Ads for SMB advertisers.

According to Google’s 10K, the ad giant books $23.1 billion as gross revenue (e.g., advertiser demand via Google’s display world) and reports it as “Google Network Members' properties, consisting of revenues generated on Google Network Members' properties participating in AdMob, AdSense, and Google Ad Manager (See 2020 10K, Page 34).”

While Google does not split out DSP revenues specifically, we feel safe in assuming the entire $23 billion comes from checks written by advertisers to buy and monitor display ads, either on Google’s owned and operated supply of ad network inventory or via other non-Google SSPs connected to DV360.

Minor Adjustment

As Google says, “Our customers generally purchase advertising inventory through Google Ads [self-serve SMB customers], Google Ad Manager and Google Marketing Platform [where DV360 sits], among others (See 2020 10K, Page 59).”

Since Google includes revenue from its impression tracking tool known as Campaign Manager 360, formerly known as DoubleClick Campaign Manager (DCM), within Google Network Members' properties, we need to remove this revenue stream (est. $1.1 billion in gross revenue) because it’s separate from Google’s DSP revenues but lumped into the total.

Advertisers use impression tracking (aka marketer ad server) to count and reconcile display ads that run not only across the DSP landscape but also on direct publisher buys usually called reserved or guaranteed or insertion order deals.

Flashback: In the old days before programmatic, when display ads were purchased directly from publisher and ad network sales teams, they had a tendency to overstate how many impressions were served when billing the advertiser. So, advertisers wanted a way to keep publishers honest — this is where third-party ad tracking comes in handy.

It will come as no surprise to our readers that Google owns around 95% of the marketer ad server market. If you want to fact-check it, pick 10 advertisers at random and they’ll probably all tell you they use Google for ad tracking.

Here’s how we get to $1.1 billion for Google’s ad tracking revenue.

Start with the total market size for all display ads in 2020 = $206 billion (Source: eMarketer).

Subtract total open-web DSP spend = $53B.

Subtract display ads on walled gardens, which are included in eMarketer’s forecast but aren’t trackable by third parties because walled gardens still get to grade their own homework = $129 billion.

The remaining $24 billion is the implied market size for direct/reserved publisher deals (aka insertion order buys). If you haven’t already automated this manual workload with tools like AdSlot, you should. Get ahead of the productivity game, the clock is ticking.

Add open-web DSP spend ($53B) + direct deals ($24B) = $77 billion in ads that need third-party tracking.

Assume Google sucks in a 95% share = $72 billion in tracked media spend.

Field experience tells us that ad tracking fees are about 1.5% of media spend, giving Google around $1.1 billion in ad tracking revenue.

For what it’s worth, we can reconcile our $1.1 billion estimate with more field experience:

Assume average CPMs across DSPs (e.g., remnant inventory) and direct-sold reservation deals (e.g., the good stuff) = ~$8.

Therefore, marketers pay Google a $0.12 CPM to track banner and video ads, which jives with prices we see on the ground in display ad land — more or less.

All in all, Google ends up with $22 billion or 42% of the open-web DSP pie.

If you want to check out our model and assumptions, then join Quo Vadis+ Premium. It’s only $9/month or $96/year, and it’s the best bargain in programmatic land for off-the-beaten-path models and analysis! We have some really great frameworks in the works to help you make better programmatic marketing and investment decisions!

Amazon’s DSP

Amazon offers 12 different ad solutions including its DSP, which we can safely assume is primarily a direct response retargeting tool via its publisher ad network.

In essence, Amazon operates a Criteo-like ad network model using its own audience data, conversion data, and publisher ad network across thousands of advertisers.

Amazon’s 2020 10K report breaks out revenue into five buckets:

Online Stores

Physical Stores (e.g., Whole Foods)

Third-Party Seller Services

Subscription Services

Other ($22 billion in 2020) — ”Other primarily includes sales of advertising services, as well as sales related to our other service offerings.” (See 2020 10K, Page 68)."

If we’re going to take an educated guess at how much ad budget flows through Amazon’s DSPs vs. all the other ad tools it offers marketers, we need to devise a reasonable method using other things we know.

Step 1: Assume Amazon’s universe or economy is like a separate version of the Internet.

Step 2: Start with $22 billion in total ad revenue and remove ~10% to account for “other” vs. “primary,” leaving us with $20 billion.

Step 3: Assume marketers fund Amazon’s ad revenue with either trade advertising budget (which is increasingly shifting from physical to online stores) or media budget.

Trade Advertising Budgets on Amazon are tactics like Sponsored Display (think Google AdSense competitor) and Sponsored Products (e.g., replacing endcap displays in a physical store with virtual ads similar to search links).

If the money comes from media budget, then the majority likely funds retargeting tactics via Amazon’s DSP.

According to Alix Partners, a management consulting firm, marketers spent $518 billion on trade advertising in 2019. Add that to the $557 billion in media spend, and markets worldwide spend over $1 trillion on “advertising.”

Step 4: When marketers spend dough on Amazon, we assume a 45/55 split between Trade and Media budgets, leaving us with $11 billion in the media bucket.

Step 5: If ads in the Amazon universe are like ads anywhere else in the digital universe, then we’d expect the media budget portion to split on a 42/58 basis between search ads and display ads, leaving us with an Amazon DSP size of $6.4 billion.

Rule of thumb: How wrong could we be? How much does it change our estimate?

Criteo

Like TradeDesk, Criteo makes sizing its portion of the DSP market rather easy. Criteo is a pure-play DSP like TradeDesk, with gross revenues of $2 billion in 2020 taking a 4% share of the market.

Criteo also does something unique in the publicly traded DSP world — they provide good information on unit economics. These units of production not only tell us what Criteo’s factory produces (e.g., Targeted Ads Delivered) but also allow us to disentangle a DSP’s financial structure and tell you about it.

For instance, if you’re an advertiser thinking you only pay 10% in DSP fees on media running, you might be surprised to learn that real fees on the underlying media cost (aka undisclosed auction clearing price) are more like 30–40% or more.

Big or small, every DSP is a profit-seeking company, and they all have similar financial structures — give or take.

And running a DSP means having to process billions of ad requests. It’s not only expensive from a variable cost perspective, but it also might incentivize buyers into low ad quality inventory because maximizing volume is life or death in the DSP game.

Rule of thumb: More volume means lower marginal cost. Lower marginal cost drives better price competitiveness. But any way you cut it, DSPs need to make around 40% fees on the real underlying media cost, or else making a profit for their investors is not in the cards.

Join Quo Vadis+ Premium to check out our DSP unit economics model.

Facebook Audience Network = DSP

Similar to Amazon and Google, Facebook sells two kinds of ads. Most of the ads they sell are the ones you see on your newsfeed, but they also chase you around the open-web serving retargeting ads on publisher sites that partner with Facebook’s Audience Network (aka a DSP).

While Facebook does not break out revenue for Audience Network or make a single mention of it in its 2020 10K, Digiday wrote about it last August, saying:

The company [Facebook] has not recently disclosed separate financial figures for its Audience Network, but its revenue appears to be in the multibillions of dollars. Facebook’s Audience Network paid more than $1.5 billion to publishers and developers in 2018, according to the Audience Network by Facebook website. In 2015’s fourth quarter, when it was just catering to mobile apps, Audience Network had a “$1B revenue run rate in ad spend,” Facebook said, but it hasn’t provided an updated figure since. Jounce Media estimated, pre-Covid, that Facebook Audience Network would generate about $3.4 billion in gross revenue in 2020.

Assuming Jounce Media’s estimate is close enough, Facebook Audience Network generates 56% gross margins, which is in line with Criteo’s and other DSP unit economics once you factor in the underlying media cost.

Rule of thumb: If you’ve been around enough DSPs, big and small, you’ll come to learn that they all deal with the same inventory, they all have very similar financial structures, and they all covet high-volume spend over ad quality. Everything in DSP land always comes down to the daily struggle to reach economies of scale and the marginal cost advantages that allow them to compete with big players like Google and Amazon.

Retail Media Is Hot!

Retail Media — or e-retail — is the hot new thing in the DSP world.

When you’re shopping online at Walmart, Target, CVS, or Instacart, these e-retailers also act as publishers serving you retargeted ads or sponsored listings. That’s Retail Media in a nutshell — formerly known as “trade advertising.”

Here’s how Forrester/AdExchanger summed it up last week:

“It’s working. Already advertisers are spending $5 billion annually on non-Amazon retail media platforms.”

Retail Media is a massive growth area for DSPs looking to tap into $520 billion in old-school trade advertising budgets.

Criteo is leveraging its smart 2016 acquisition of HookLogic, reporting “retail media revenue grew 69% year-over-year” in its Q1 2021 earnings.

Walmart is building infrastructure to support its fast-growing retail media business. After more than a year of testing, it settled on a custom-built version of the Trade Desk DSP (AdExchanger).

Target’s Roundel wants to build a media business to rival Amazon (Digiday).

Instacart is starting a self-serve ad platform to connect brands with shoppers (Marketing Dive).

80/20 Rule In Play: All the Other DSPs Get $9.4 Billion

So, we started with a $53 billion market for DSPs and carved it up between the main players taking 82% — that leaves $9.4 billion in marketer ad budgets for all the other smaller DSPs to fight over.

How many are there of meaningful size? We estimate about 50 or so and break them out into two groups:

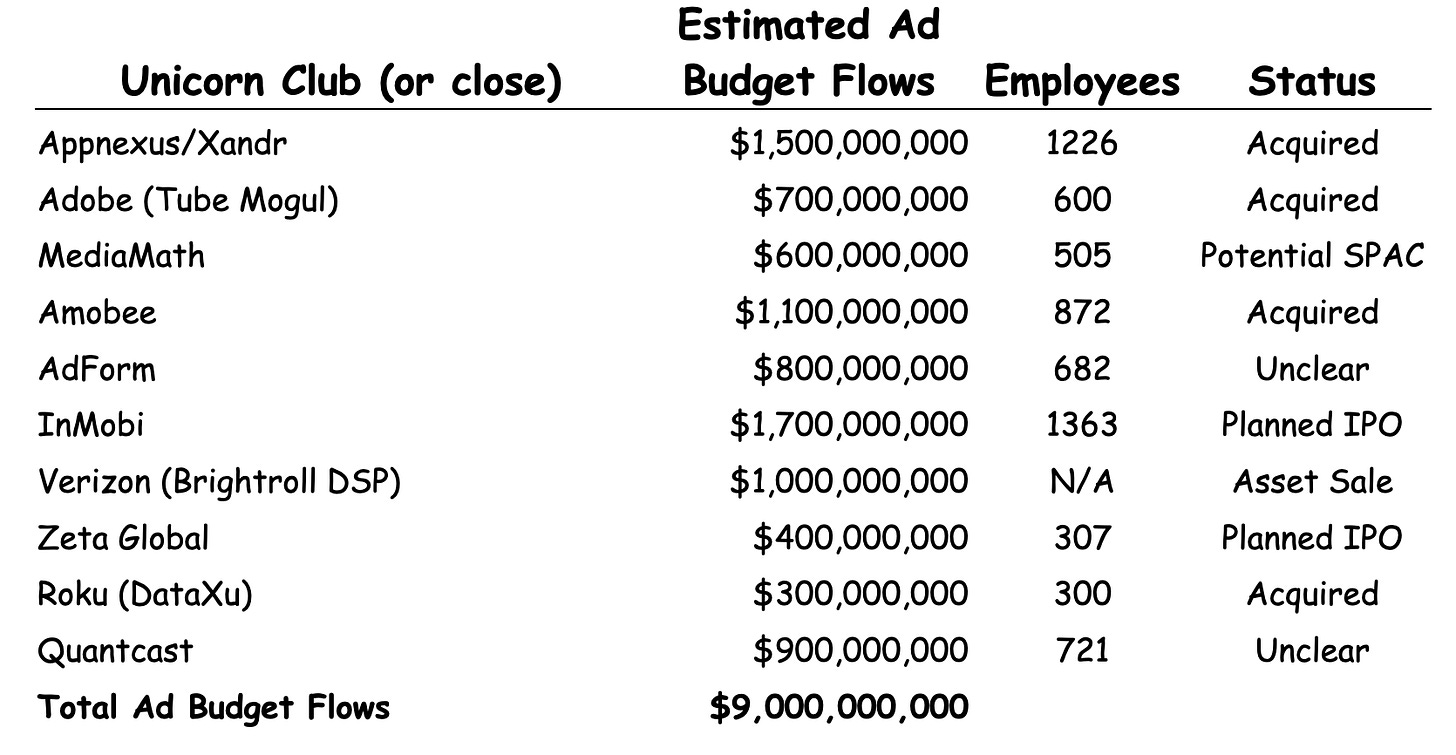

Unicorn DSPs — these players attract $1 billion in ad budgets, give or take a few hundred million. We’ve identified 10 bigger-name DSPs that fit the Unicorn profile and account for a combined $9 billion in ad spend.

Small of the Small DSPs — these small players will likely have fewer than 100 employees and share the remaining $400 million.

Unicorns

None of our 10 Unicorn DSPs are public companies, and there is little reliable information available on how much ad budget they take. So, the best we can do is use LinkedIn employee counts and apply those to what we know about TradeDesk (big player), Criteo (medium player), and Viant (small player) to approximate ad budget flows.

Given this small sample size, we think the sample statistic for ad budget flow per employee is around $1.3 million. Yes, we know we shouldn’t run a regression with just three inputs, but we’re doing it anyway.

Small of the Small Club

As far as we can tell, the remaining 40 DSPs take in ~$400 million or ~$10 million each on average. If we apply the 80/20 rule to this group, the top eight average $42 million, while the bottom 32 average just $2 million. If you’re a VC investor in the space, you know our numbers feel about right!

If you’re in the small DSP club, here’s some encouragement from AC/DC — “it’s a long way to the top if you want to rock' ‘n’ roll!”

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

eMarketer: Worldwide Total Media Ad Spending is $557 billion, May 4, 2021

Your market share estimates for the Google and TradeDesk DSPs are very close to an estimate published by the Wall Street Journal on 3/4/21 (in an article titled "Google Crushed Many Digital Ad Rivals. But a Challenger Is Rising."). You estimated 42% and 8% respectively, and they estimated 40% and 8%. So this helps to support that your estimates are in the right ballpark.