#61: Post-3Q23 Earnings + Portfolio Update

Reading Time: 6 minutes

The greatest value investor of all time, Charles Munger, died on Tuesday. Would Munger (or Buffett) ever invest in any pure-play programmatic adtech company? Never say never, but it’s doubtful. None of the 18 public adtech companies we track would pass Munger’s litmus test.

If a business earns 18% on capital over 20 or 30 years, even if you pay an expensive looking price, you’ll end up with a fine result. Adtech companies barely return their cost of capital, getting to an 18% ROIC steady-state in the future is unlikely for many, so cardinal rule #1 is broken from the get-go.

We have three baskets for investing: yes, no, and too tough to understand. Our best guess is that adtech companies would fall into bucket #2 because of Rule #1). If you’ve ever had the pleasure of listening to an adtech sales pitch then you know there is no way Munger (or anyone) would understand these businesses.

Every time you hear EBITDA, just substitute it with bullshit. Even worse is “adjusted EBITDA.” Figure out your best estimate of true free cash flow or economic profit (same thing in the end) and you’ll know what you need to know.

Where do they stand?

Q3 earnings across Adtech Land are done and dusted. Everyone is now deep into Q4 trying to scrape up or process as much gross ad spend as possible and trying to hang on to take rates (or juice them as much as possible) as the revenue engine across adtech continues to slow down.

Across our AdTech18 portfolio, TTD still leads the way by a big margin. Investors were not happy with TTD’s Q4 guidance sending the stock down 18% post-earnings. It’s recovered a bit but is still down 10% since November 9 and down 32% since the end of July.

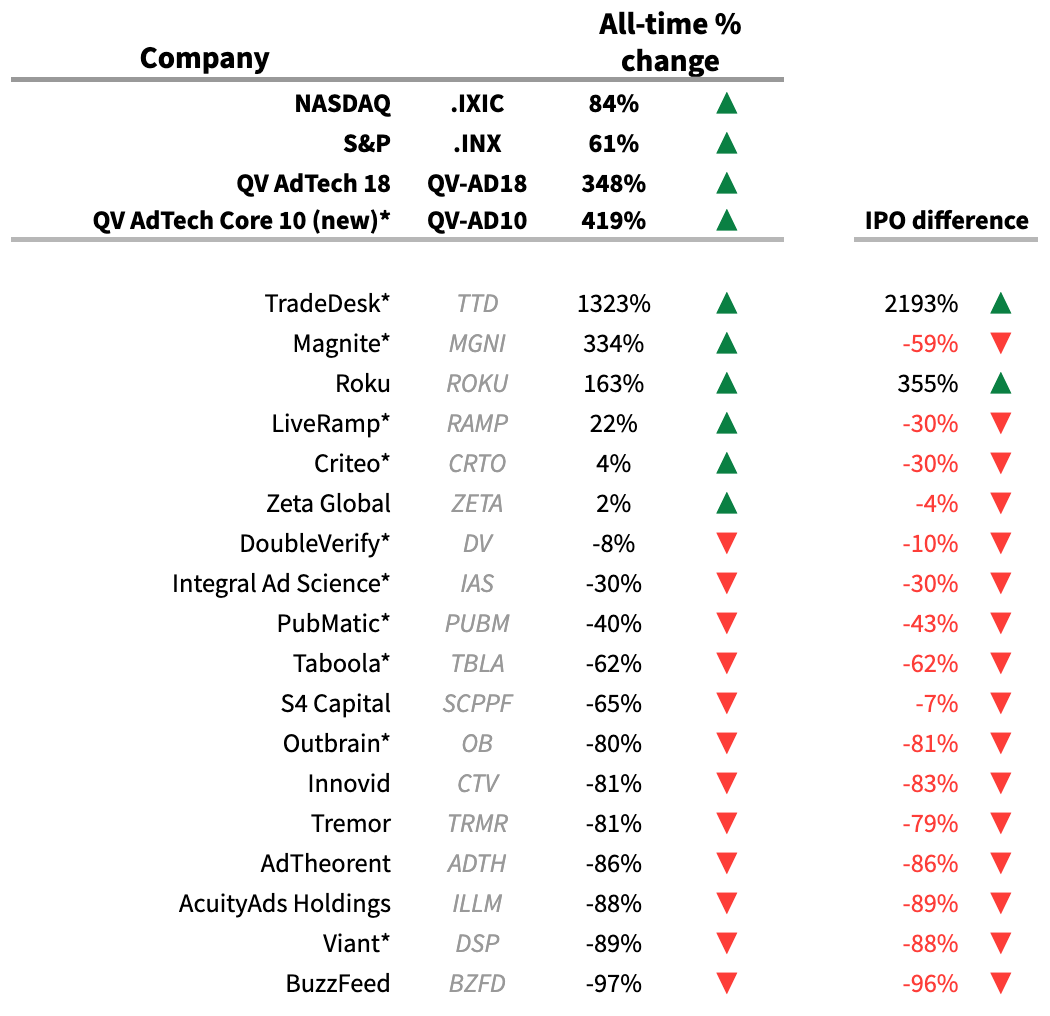

Had you bet $100 in January 2018 when our AdTech18 portfolio started, you’d be up $448 today after accounting for your $100 initial investment. The AdTech18 was up 48% in the first half of 2023 beating the NASDAQ which was up by 32%. However, things have reversed course in H2 with AdTech18 down –26% and the NASDAQ down just –9%.

Winners: There are six players above water, but Criteo and Zeta barely make it into the winner’s circle. Zeta is still trading at 12x book value. That makes no sense on a fundamental valuation basis, it can only make sense on a speculative basis but nothing needs to make sense when speculation is in play.

Notably, Magnite has generated 334% in gains since 2018 but is also trading –59% below its IPO price.

Losers: The other twelve are all losers for investors. The majority are really big losers with the group trading at –63% below IPO prices on average.

A sliver of silver lining: Looking at just the AdTechCore10 players, 3Q23 was good for seven out of ten in terms of share price action before and after announcing earnings/guidance.

QV AdTechCore10, AdTech18 and MarTech18

Judging by where our Quo Various portfolios stood before the pandemic and looking at where things have settled with investors getting a better sense of the future, the adtech world is more or less trending toward where it would have been had the pandemic not occurred.

Twelve out of the AdTech18 went public during the pandemic and all of these “children” of the pandemic are performing poorly relative to their IPO prices. They went public in a low-interest rate environment benefiting from a misguided investor mindset that created unreachable expectations. Valuations have since declined with every passing quarter as downward expectations are coming in line with the economic realities of these firms.

AdTechCore10 and AdTech18: That said, our core ten portfolio is up 419% since January 2018 with the full portfolio of 18 players lagging behind but still up 348%.

MarTech18: We’ll delve deeper into the 18 MarTech players we’re tracking starting in 2024. These players as a group are up 159% since January 18 but trending down toward NASDAQ returns. Shopify, HubSpot, and Sprout Social generate nearly all the gains.

Interestingly, there is a notion amongst venture capital and public investors in general that MarTech is better than AdTech because MarTech is built on SaaS revenues. AdTech business models are generally built on a percentage of revenue even though some try to spin themselves as SaaS models.

Investors usually believe SaaS is superior because it is supposedly built on long-term contractual commitments. However, just like economics points out that all costs are variable in the long run, so too is customer commitment to a SaaS model. In other words, any “commitment” to a SaaS contract can be broken at any time just like expected media spending can disappear or not materialize as planned.

Rule of Thumb: In either case, a better way to compare and contrast AdTech vs. MarTech is with metrics like net revenue retention and customer lifetime (assuming the data is made available).

Revenue Trend Across AdTechCore10

Revenue growth across our AdTech10 group in 3Q23 was 14.9% on a YoY basis. While that metric is somewhat informative, a better view into revenue growth is looking at the trailing 12-month (TTM) trend which was 10.6% in 3Q23.

In either case, the natural trend curve into the future points to deceleration anyway you cut it. By the end of 2024, the TTM growth rate will be around 5% which is less than the predicted growth rate of the overall digital ad and display ad markets.

The good news: Our core ten portfolio is sitting on $3.6 billion in excess cash. With declining revenue growth in mind and plenty of extra cash on hand, we’d expect to see much more M&A activity in 2024 and 2025 than we saw in 2023.

As far as purchasing power goes, if we assume 50% of M&A deals are done with cash and 50% in stock, the core ten alone would have $7.2 billion in dry powder. With $45 billion in combined market capitalization, it’s not hard to imagine 8% going toward M&A deals to sweeten the pot.

Something has to change. Time will tell.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.