#52: Yahoo! stacks up better than most

Tech IPOs are back; Yahoo's valuation puzzle; Opportunities abound

Reading Time: 9 “Do you Yahoo?” Minutes

It looks like tech IPOs are coming back. That’s a good thing for the next wave of adtech, martech, and the venture capitalists that back them. Instacart went public last week with a decent debut raising $660 million. The stock price popped to $40 but has since trickled downward –25% to ~$30/share.

Next up to enter the public arena was Klaviyo opening at $36.75 and closing at $32.76 raising $345 million. Both Instacart and Klaviyo have an ~$8.5 billion market cap.

That brings us to Yahoo! An amazingly resilient company any way you cut it. Despite the rollercoaster ride over the last ~15 years, Yahoo is like a Timex watch, “it takes a licking and keeps on ticking.”

Yahoo had about 150 million daily active users in May 2021 and has 900 million monthly active users today. Yahoo is not only #1 or #2 in key categories like Finance, Sports, and News but also has the 4th biggest email service with a 3% market share.

The company is currently owned by Apollo, one of the most successful private equity firms. They know what they like when they see it. When private equity sees the potential to own a recurring cash flow machine like Yahoo, they go all-in, implement their playbook, and create value.

PE Playbook in 3 Steps:

Invest in companies that are struggling or in the wrong home but have high potential.

Put the best managers in place to improve profitability.

Exit for a higher price by selling or IPO.

So, with IPOs apparently back after a nearly two-year hiatus, and Yahoo getting in tiptop shape, that got us thinking:

Bottom Line: Yahoo is worth $20B or more

When we do this type of analysis, we start by asking:

How wrong could we be and by how much might we change out answer? This entire post could be wrong, but Yahoo was worth a minium of ~$8 billion when Apollo bought it and today it is more likey worth closer to $20 billion on a discounted cash flow basis.

For instance, in November 2022 Axios reported that Yahoo’s 2021 revenues were $8 billion. Our model estimates $7.9 billion in total revenue in 2021 — we'll get into it in a minute.

According to eMarketer, the global digital ad market — search, display, and other (e.g. affiliate listings and classifieds) — grew by a CAGR of 22.2% from 2016 to 2021. Assuming Yahoo underperformed at Verizon delivering an 11% average annual revenue growth, the quick comps (Google, IAC, and Yellow Pages) get us close to an $8 billion valuation.

That’s our floor value. We believe Yahoo is worth much more.

Yahoo Puzzle Pieces

Getting a decent answer means looking for puzzle pieces, finding the corners, and plugging holes with reasonable assumptions.

The first thing to do is find puzzle pieces by dividing Yahoo’s journey into three epics:

Last few years as a public company (10K filings)

Apollo ownership (press releases, CEO interviews, and trade press reports)

The future with a few reasonable assumptions on revenue growth, cost controls, and investments in invested capital

Last few years as a public company

A natural starting point is to look back at Yahoo’s last few 10K filings from 2014 to 2016. This forms our foundation. We examine revenue and costs of the core business lines. We make adjustments to cash taxes resulting in net operating profits. Then we get a view on invested capital and depreciation to arrive at free cash flow.

Our goal is to get the cleanest possible view of Yahoo’s main operating assets (e.g. search and display advertising) and strip out anything we consider non-operating.

For example, Yahoo’s 2016 balance sheet had $33 billion in “Investments in Alibaba Group” and another $3 billion in “Investments in Equity Interests” that were massive but non-operating nonetheless. These huge investment gains in Alibaba require an adjustment to deferred taxes ($13.6 billion in 2016) and also affect our estimate of cash taxes on the operating business.

So, after stripping out everything not related to core operations and making adjustments for various goodwill impairments, we end up with a clean enough view of Yahoo’s underlying operating business.

Verizon Years

Verizon acquired Yahoo in 2016 (and AOL too) and rebranded it as “Oath” which later became Verizon Media. Unfortunately, when media/technology companies like Yahoo end up under TelCo ownership they tend to stagnate. The track record is not pretty:

AOL + Time Warner was a disaster

Appnexus + AT&T didn’t pan out

Singtel + Turn never got traction

Verizon + AOL + Yahoo is the same story

After these odd couple marriages are consummated, they typically don’t get enough attention or they get the wrong type of attention along with a tangled web of big company politics and some culture clash mixed in. In any case, things didn’t work out as planned at Verizon which was repeatedly stated in various earnings reports from 2017 to 2021:

Our media business also achieved lower than expected benefits from the integration of the Yahoo Inc. and AOL Inc. (AOL) businesses.

Enter Apollo in 2021

Apollo bought most of Verizon Media in 2021 for $4.5 billion and rebranded as Yahoo. Verizon maintained a 10% stake in the company which will very likely prove to be a really smart move for Verizon shareholders.

Despite the stagnation under Verizon, Yahoo’s main properties — Homepage, News, Sports, and Finance — are still #1 or #2 in their respective categories while search revenue continues to deliver easy money through Yahoo’s partnership with Microsoft Bing.

We think the future is very bright under new management that continues to execute in all the right areas. Buying Yahoo might be the deal of the century. Anytime you can buy a company worth at least $8 billion today for $4.5 billion you should do it. In fact, the deal has returned Apollo’s cash faster than any deal in the private equity firm’s history.

When Apollo did the deal, they secured roughly $2 billion in debt to finance the deal and that’s already paid back. They sold the right to license Yahoo’s name to Yahoo Japan (a completely separate company owned by Masayoshi Son’s Softbank) for $1.6 billion and also sold EdgeCast to Limelight for $300 million.

Bridging between 2021 to Present

The years between 2016 and 2021 leave a five-year gap in our puzzle. That’s okay. All we need is an anchorage to 2021 to make a bridge.

In November 2022, Axios reported that:

“Yahoo generates around $8 billion in GAAP revenues annually. The company reported $7.1 billion in full-year revenues in 2020, the last year it was owned by Verizon.”

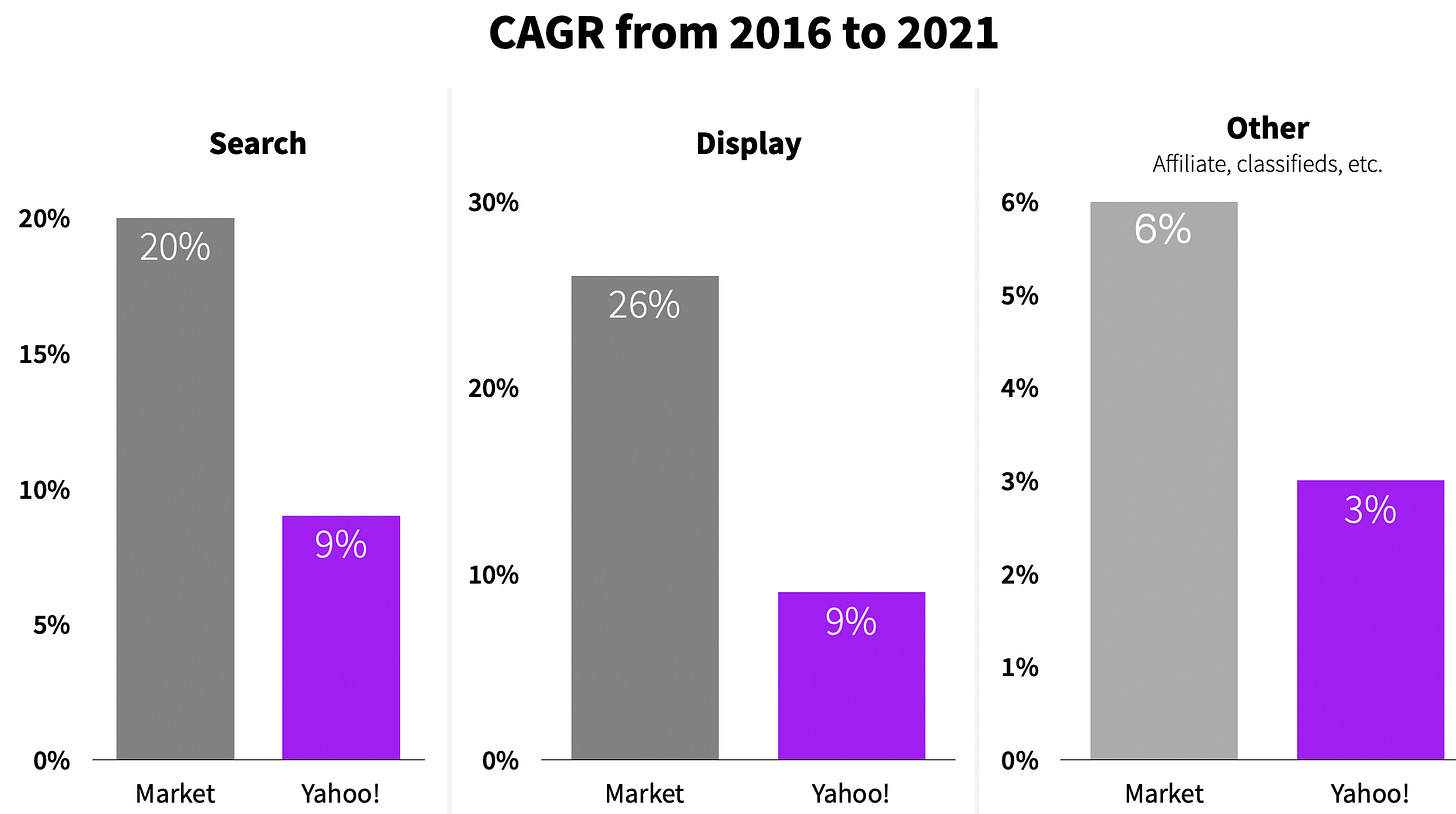

From there, we back into an estimate of Yahoo’s revenue CAGR from 2016 to 2021 and benchmark it against eMarketers market size calculations across search, display, and other (affiliate, classifieds, etc.)

Given Verizon’s regular comments that “the media business achieved lower than expected benefits”, we assume all three revenue segments grew at half the overall market rate over the five-year period.

By 2022, we estimate that Yahoo’s new management team gathered steam and started to gain ground on overall market growth.

Heading into 2023, we think Yahoo caught up with market growth in Search and Other while display revenue beat market growth. Earlier this year, not only did Yahoo make a shrewd move by shuttering its sell-side SSP stack and cutting 1600 heads to position itself as a buy-side advocate similar to The Trade Desk’s, but it also leveraged its incredible direct publisher relationships with Backstage. Direct-to-publisher is the way to go and Yahoo is in prime position.

Take all of that, plus $180 million in AOL subscriber revenue — yes, that goldmine is paying off — and then add the confidence of CEO Jim Lanzone heard in various interviews over the last two years and the cash flow puzzle starts to fall into place.

The Future

Looking ahead over the next five years, it seems inevitable that Yahoo will beat market growth with search revenues as traffic to its properties grows. Any fine-tuning to the product and investment in AI will go a long way.

Today, Yahoo’s share of search revenue is sub 2%. Growing it to a 2.5% or 3% share over the next five years in what will be a $350 billion market in 2028 is huge for free cash flow.

Looking at the display world — Yahoo’s bread and butter — we envision a similar picture where management consistently beats market growth.

Our model estimates total revenue in 2028 at $15.8 billion. Given headcount reductions early this year, and keeping traffic acquisition constant at 32% of revenue along with fixed cost productivity improving over time from 31% of revenue in 2021 to 28% in 2028 (fixed costs were 50% of revenue in 2016), Yahoo is already in play to produce a 20%+ operating profit margin. That’s a standout in the adtech world. Not a single player in our AdTech18 sniffs 20% operating profit margins.

Getting to a $22.6 billion valuation

Overall revenue grows at 10% per annum through 2028. We might be lowballing it a bit.

We grow YoY investments in invested capital from the current range of 3% to 10% over the next five years

Net Operating Profit after Tax (NOPAT) is a function of revenue growth and cost controls. Our model churns out ~10% YoY growth which seems more than reasonable.

ROIC stays steady at a healthy 30%. Anything above 25% is excellent for value investors.

By 2028, we get an investment rate (net investment as a portion of NOPAT by reinvesting profits back into the business) of 29% which translates into a fundamental growth rate of 9%. That’s well above a ~3% predicted GDP growth rate so things are looking really good for Yahoo’s investors.

In the end, we get to a $22.6 billion valuation with a 12% cost of capital, 25% return on new invested capital, and a 3% terminal growth rate. Considering Apollo’s $4.5 billion investment, that’s a really nice payoff.

Here’s the thing. We think our 10% CAGR assumption on revenue growth is quite reasonable. It does not include two areas of additional growth areas where we think Yahoo can play ball — 1) Taboola and 2) Retail Media.

Taboola and Yahoo signed a 30-year deal. The deal makes Taboola the exclusive native advertising partner for all of Yahoo’s digital properties. Moreover, both companies expect to generate $1 billion in annual revenue from this newly formed partnership, if integrations go well. Yahoo has ~180 million daily active users (DAU) and Taboola reports having 500 million DAUs. Taboola laid out $831 million in traffic acquisition funds to publishers last year. Assuming Yahoo gets Taboola widgets on 25% of its traffic in 2024 and works up to a steady state of 75% by 2026, that revenue boost adds a few hundred million to Yahoo’s valuation.

Retail Media is ripe for big players like Yahoo with so many assets and people in play. Criteo pegs the retail media market opportunity at $42 billion ex-Amazon and ex-China. There is no reason why Yahoo cannot capture $1 billion or more. Assuming $1 billion in retail media revenue is the same as giving Yahoo a 2.3% chance of achieving it. We’ll take those odds. If so, that would add another $1.2 billion in valuation.

Yahoo’s Valuation Compared to the AdTech 18

The Trade Desk is by far the biggest company by market cap in our AdTech18 portfolio. If our ~$23 billion Yahoo valuation is close, then it would be ranked #2 behind TTD’s $36 billion market cap. Yahoo would also be 2x more valuable than ROKO in the #3 spot. Everyone else is much smaller.

As we’ve pointed out in previous posts, investors have big expectations for TTD. Even if management somehow grows to $50 billion in gross spend by 2028 from $7.8 billion in FY22 AND keeps take rates at 20% AND gets their cost-basis way lower than it is today, they’d only produce enough cash flow to be worth around $30/share or $15 billion in market cap.

Perspective is important. Think about it. DSPs and SSPs are basically reseller ad networks because they buy inventory and sell it for a margin. Sure, they might add some value with audience targeting and other bells and whistles, but an ad network is still an adwork. For instance, every time a DSP gets a bid request from an SSP, it “holds” inventory for a few seconds, adds some value, and sells it.

Companies like Yahoo are different. Yahoo owns the inventory it sells and uses its massive scale to attract other publishers to join its universe. That’s a huge advantage. That’s why Yahoo’s massive sales force and incredible reputation of trust make it a formidable competitor, particularly when it comes to media agency decision-making.

As far as advertisers go, Yahoo knows that world better than anyone. Advertisers tend to allocate ad budget toward the choice of least regret. Yahoo is in poll position or darn close and everyone knows it.

Yahoo!’s Opportunity Matrix

Another reason to be optimistic about Yahoo’s future is a combination of a great management team, a known brand that buyers and sellers trust, and a matrix of opportunity against real assets.

Look at Yahoo’s main assets: Content, DSP, Backstage, Search, Studio, and eMail.

Now think about the big things going on in advertising: AI, CTV, Retail Media, and Identity.

Yahoo is in a prime position across the chess board.

AI creates value everywhere for those who can harness it.

CTV mixed with Yahoo’s DSP and direct publisher assets is a runway with less friction than others will run up against.

It’s still early days for Retail Media, everyone will eventually gravitate toward trusted partners with big audiences and first-party identity graphs.

With all that in play, it all comes down to management, incentives, and relentless execution. Yahoo has it in spades.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.