#41: TradeDesk Valuation Build Out

When curiosity turns into a model; What is TTD worth?; How do we get there?

Reading Time: 11 instructive minutes

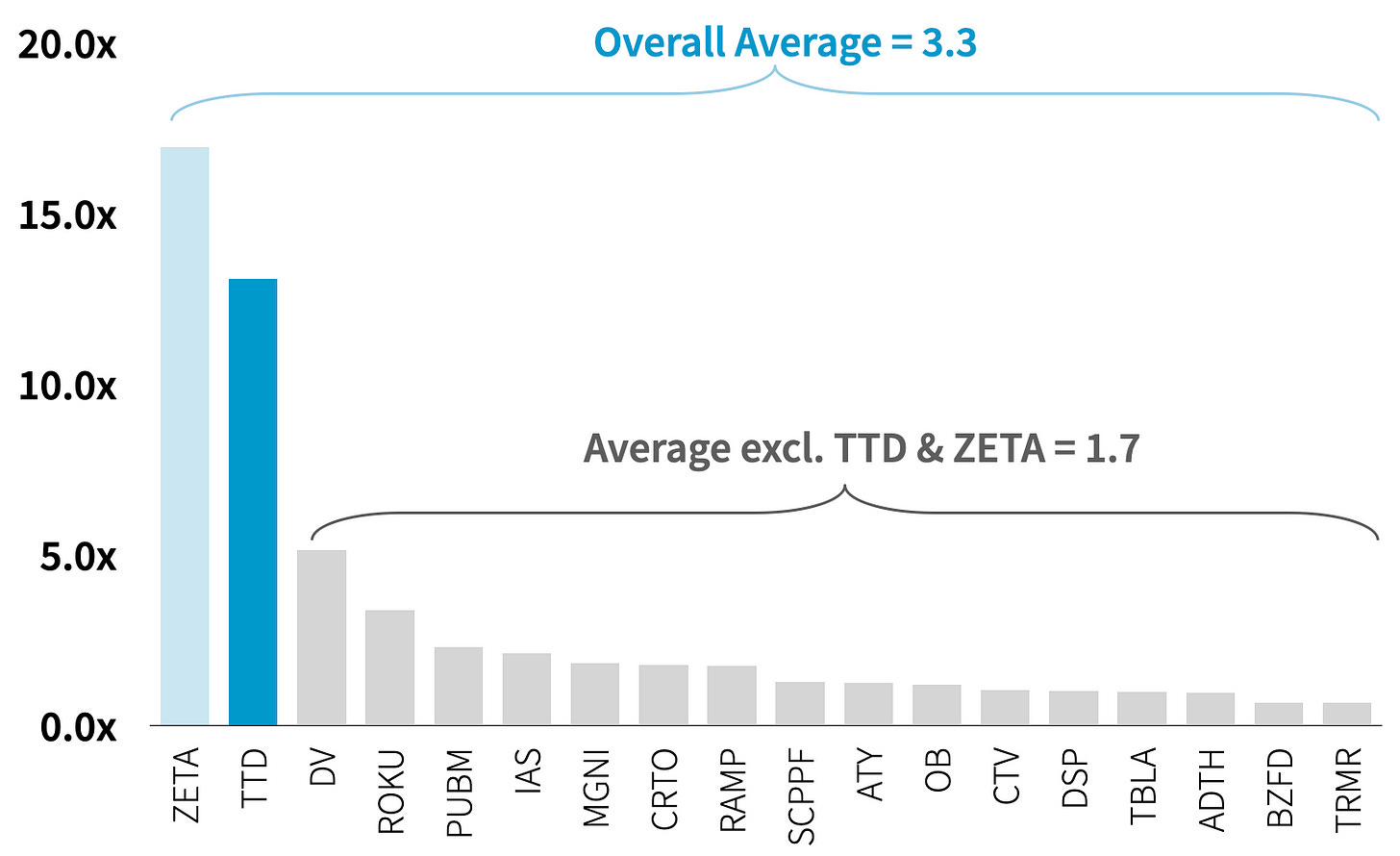

The Trade Desk (TTD) is trading at multiples far beyond the rest of the sector. Such a giant spread makes Quo Vadis, and others, quite curious about how investors are thinking (or not) about valuing TTD.

So, we did what our incredible Quo Vadis community would want us to do. We built a by-the-book discounted cash flow model to find out what the heck is going on in reality.

Bottom Line: Our model says TTD is worth $18.50/share on a fair value basis. It’s trading at $58 today. That’s a big gap between our “intrinsic” valuation for TTD and the current share price. $18.50 is a soft ceiling as our model includes some favorable forecasting assumptions as you’re about to see.

A highly priced compliment?

TTD is trading at ~13x book value. TTD’s book value suggests investors value the company at a big premium (relative to alternative investments) with a strong belief that management will nail future growth prospects like an Olympian pole vaulter going for a world record.

That’s a really nice compliment and a big belief in management’s ability to create tons of value in the future.

Disconnect or drinking too much Kool-Aid

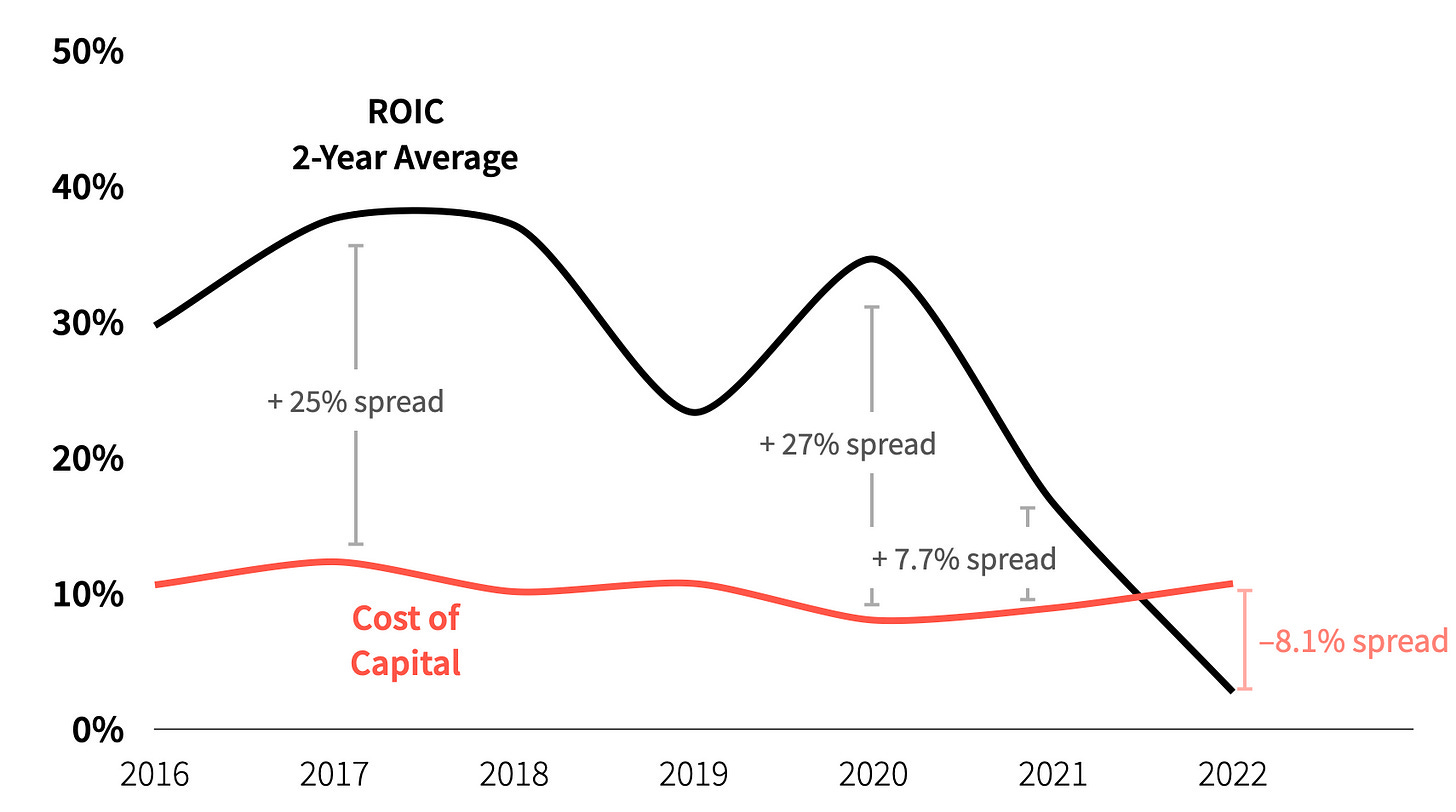

TTD’s historical performance tells a different story. The company’s ability to create value by generating returns on invested capital (ROIC) greater than its cost of capital has clearly slipped over the past two years. When any company’s ROIC is less than the cost of capital, it is destroying value not creating value for shareholders. That’s a fact.

And then there is “fundamental growth”

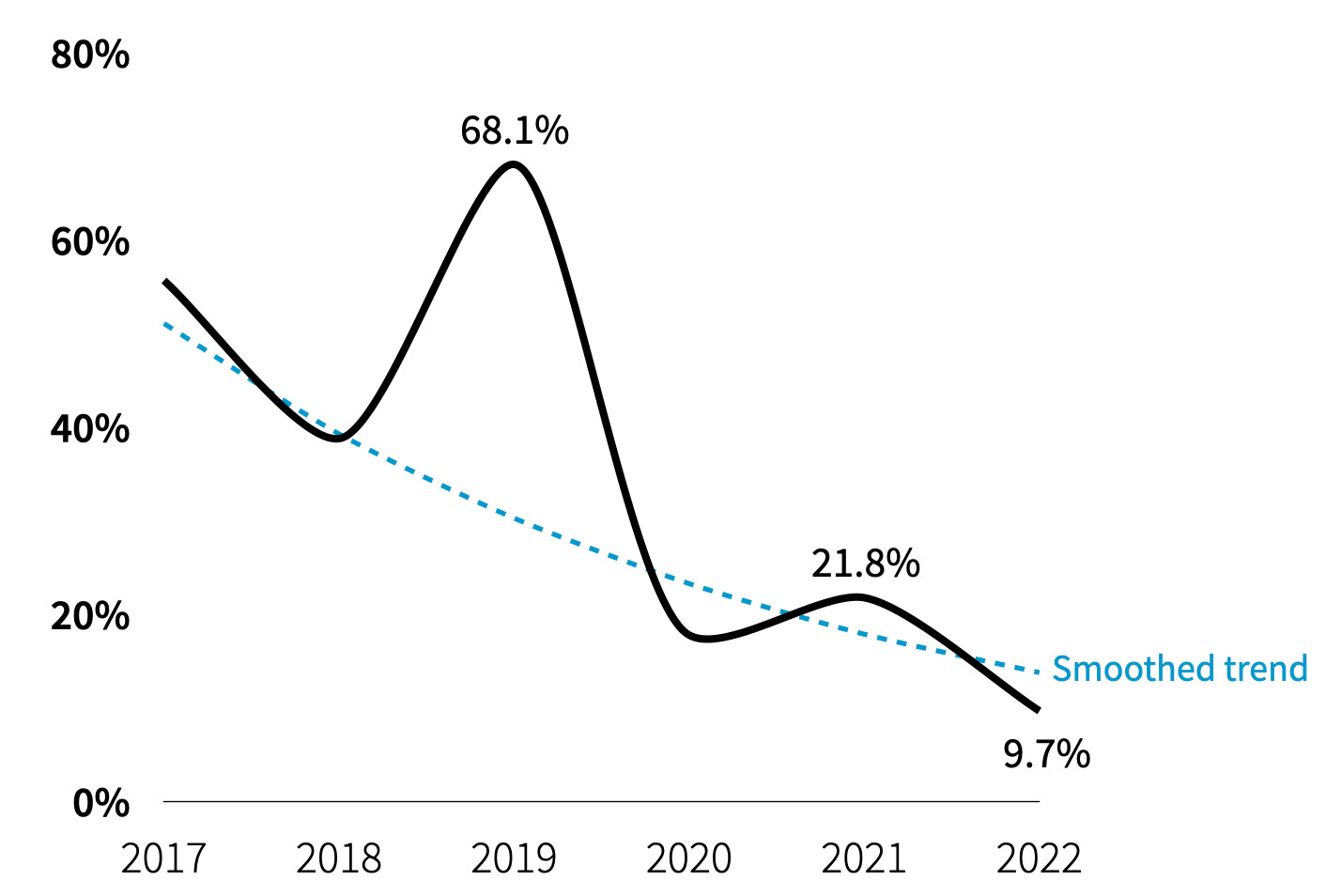

Fundamental growth is, well, fundamental to valuation. Fundamental growth happens when a company's investment rate (the portion of operating profits that it invests back into the business) is multiplied by returns on those investments in physical assets and working capital.

In other words, if TTD’s management is good at investing shareholder cash back into the business, then those investments will generate more returns than alternative investments which means the company is creating value.

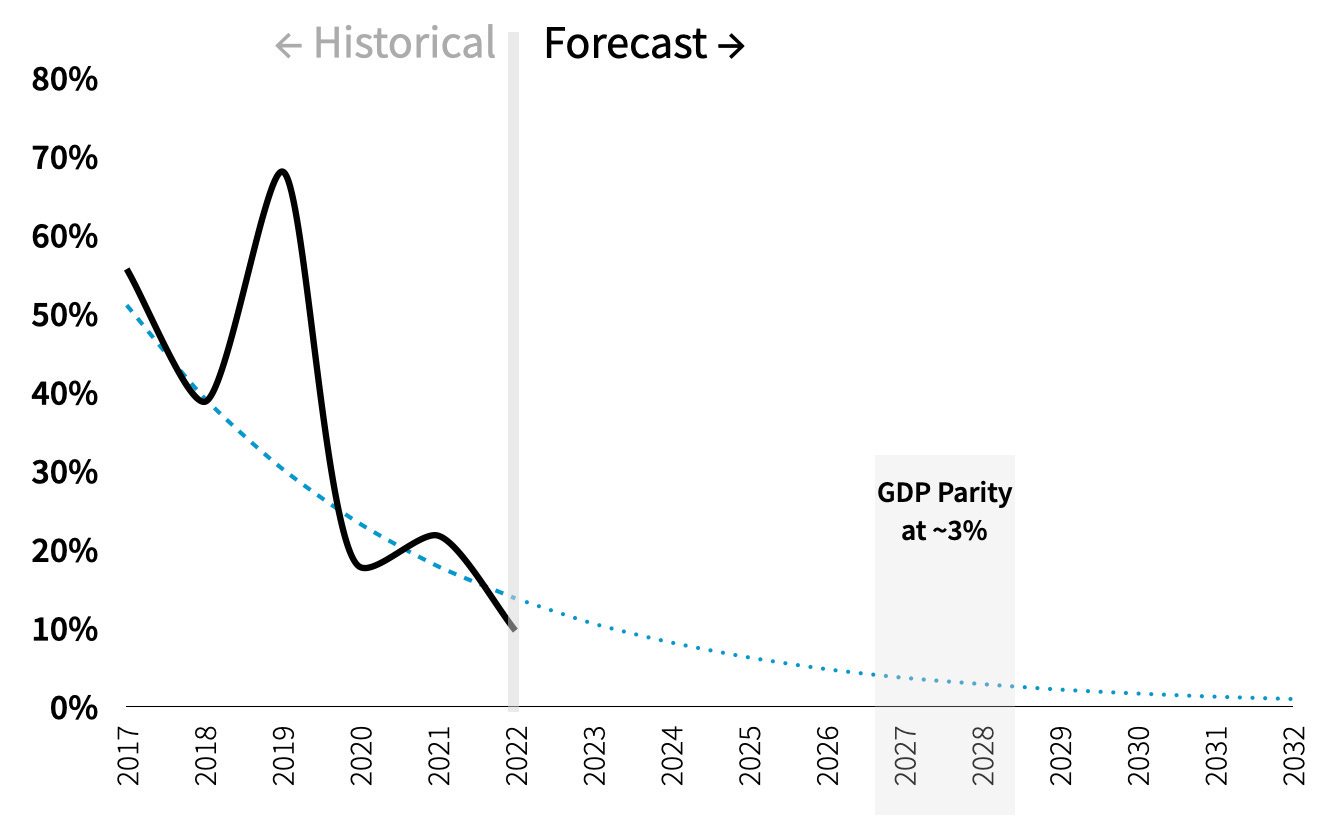

Eventually, as a company matures, fundamental growth rates converge with GDP growth at ~3% per year. That’s also is a fact of life.

How do we know it’s true? Because if a single company grew more than GDP forever it would eventually become the world’s economy.

When we project TTD’s fundamental growth trend into the future, we see that it’s heading toward GDP parity around 2027 or 2028. That’s a pretty short maturity trend and not a great sign. More importantly, while asset prices tend to lie, fundamental growth curves tend not to lie. The key to our modeling technique is to see if TTD can beat its own fundamental growth trajectory (more on that below).

Quote of the Century: Don’t ever take anything at face value. Because face value is the biggest lie of any market. Nothing is ever priced at its true worth. “Ugly American,” Ben Mezrich.

While the market seems to care about beating “adjusted EBITDA” and EPS, we care more about beats on fundamental growth.

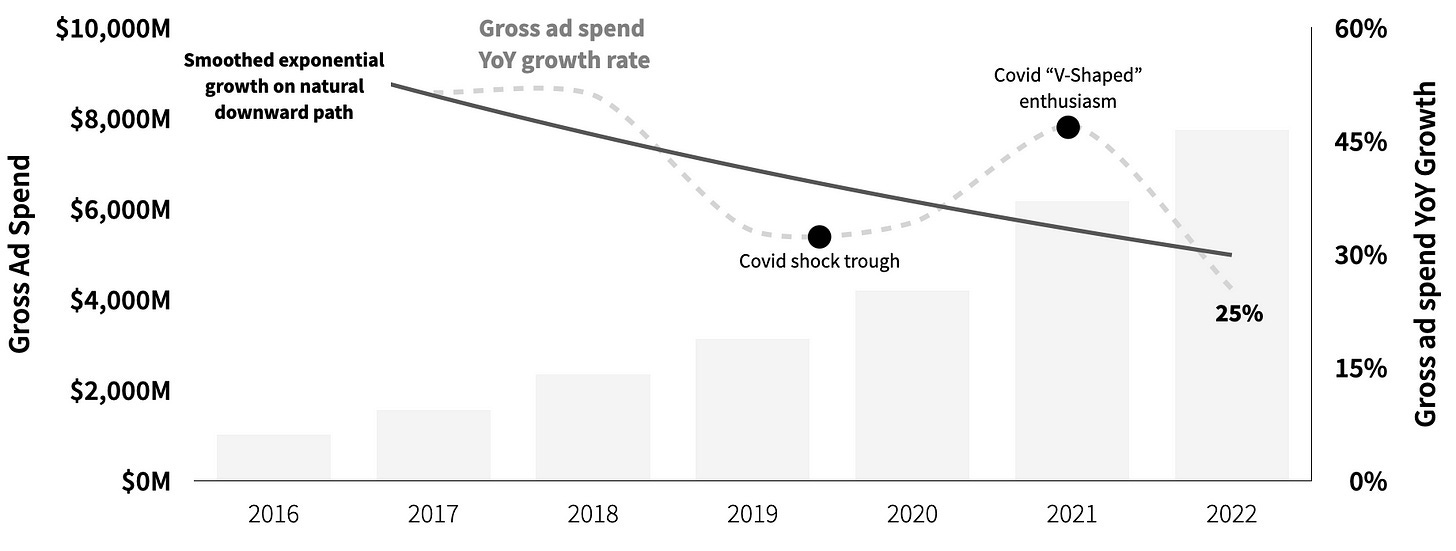

Gross ad spend growth in the past

TTD’s gross ad spend grew 25% year-over-year in 2022 to $7.74 billion. Prior to management’s Q4 earnings release, we expected at least $8 billion, but TTD fell short.

Besides Google, The Trade Desk is far and away the best at attracting ad budgets into its worldview. TTD’s compounded annual growth rate is 33% since 2016 when TTD busted through the $1B mark giving TTD a ~1% global media share today. Not too shabby!

Overall global media spending, digital ad spending, and display ad spending grew at 7%, 17%, and 19%, respectively, over the same seven-year period (eMarketer). TTD crushed the overall market.

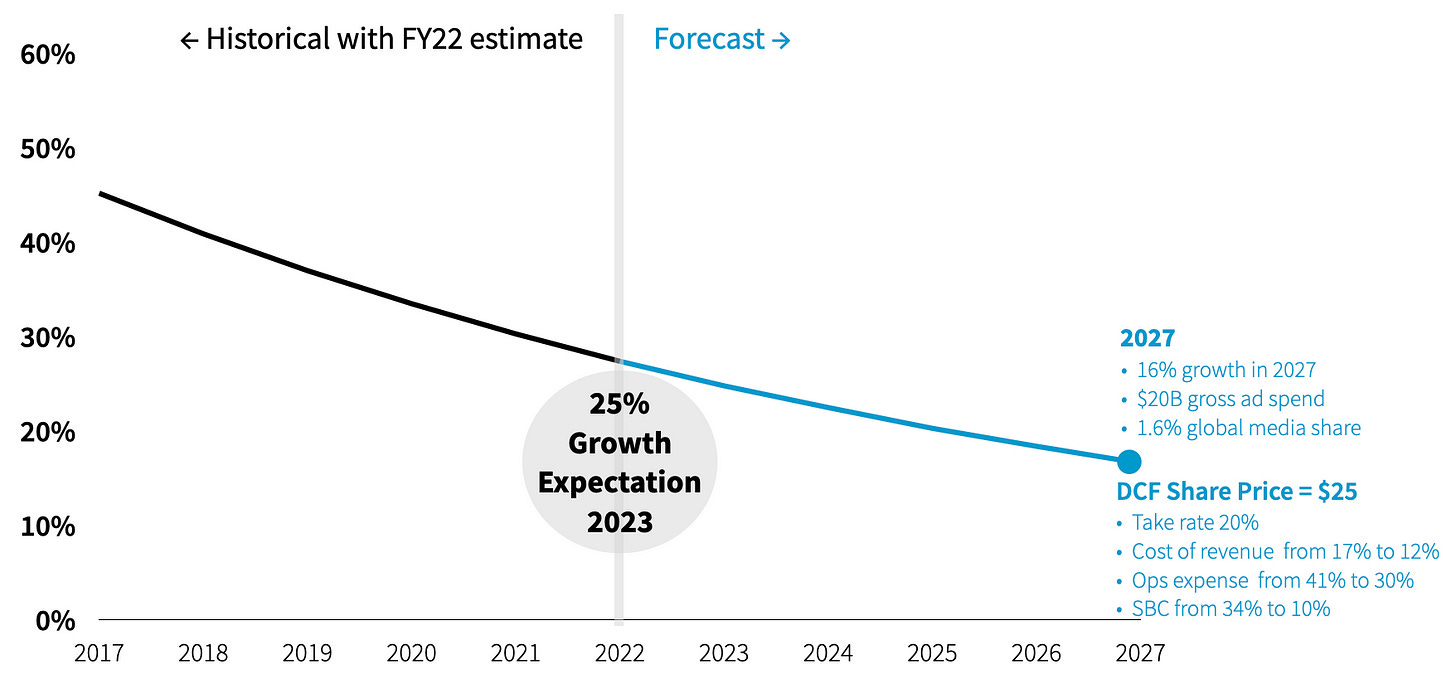

Gross ad spend growth in the future

But… if we play out TTD’s ability to capture gross ad spend over the next five years, we only get to $20 billion in 2027. Just follow the trend line into the future and do the math.

eMarketer says global media spending will be growing at a 7% CAGR through 2027. By staying on its current trend line, TTD will still beat market growth rates by a nice margin in 2027 with a 16% CAGR and control a 1.6% share of global media spend. Well done, that’s one helluva achievement!

Assuming take rates stay constant at 20% (unlikely) — and management reduces costs across the board (not easy, we’ll show you why in a second) — The Trade Desk’s fair value price would be $25/share. Our model says $25/share is TTD’s price ceiling — and that’s if everything goes really well.

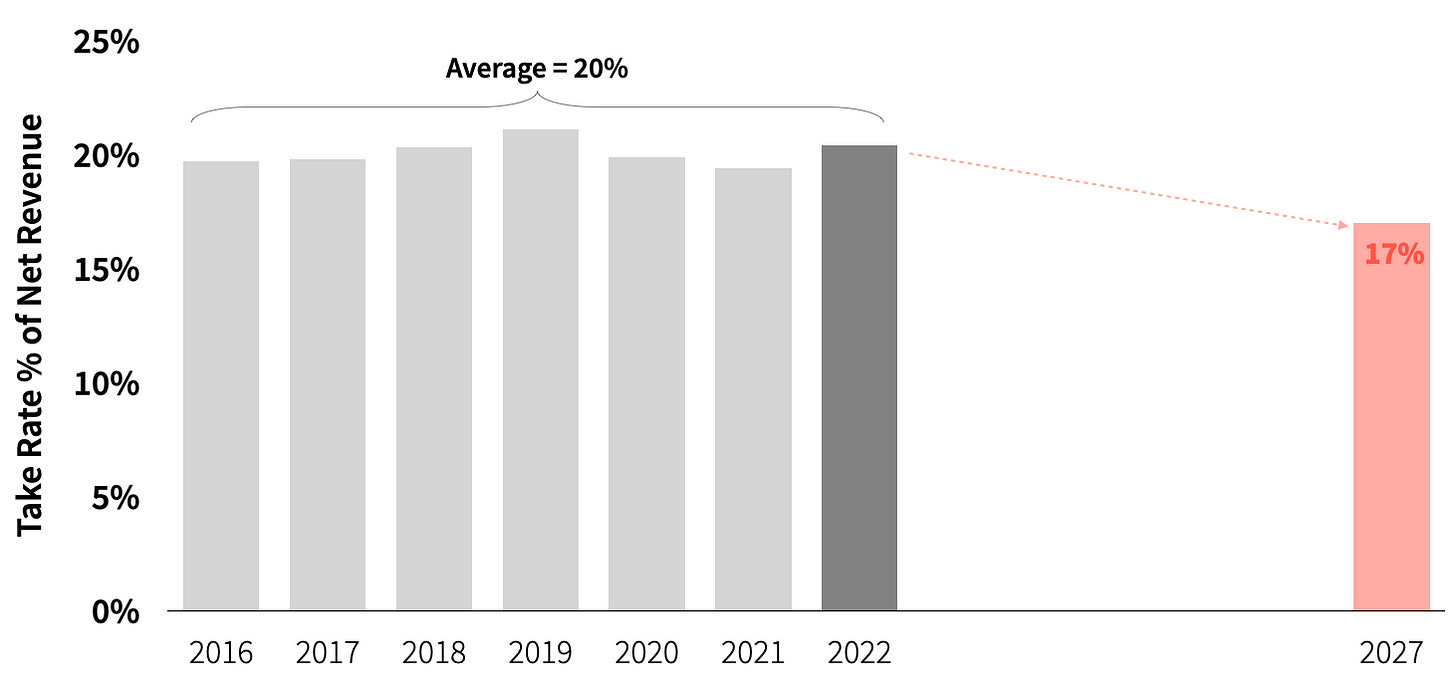

Keeping take rates high is pivotal for TTD

Speaking of take rates, TTD has managed take rate optics at a steady ~20% average (unaudited number) since 2016. While that’s a nice accomplishment, it is really difficult for us to reconcile 20% future take rates with management’s CTV narrative.

The way we see it, more CTV means more downward pressure on take rates because premium content makers have all the bargaining power. Perhaps more concerning is the fickleness of media agency partners who are always looking for new tech partner options while advertisers and procurement are always seeking supply transparency and reduced fees.

If that is not enough, you also have to consider regular ol’ competition which has a habit of coming out from the edges. TTD and all the other current adtech players will likely have more competition of various types in the future, not less. So, we think it’s fair to assume TTD take rates move down to 17% by 2027.

Reminder: Value creation in AdTech Land is about attracting gross spend and then extracting take rates to make net revenue happen. After that, management must find scalable profits whereby variable and fixed costs don’t grow as fast as net revenue.

Cost of revenue reduces with scale

TTD calls cost of revenue “platform operations.”

“Platform operations” expense includes “internet traffic” associated with the viewing of available impressions or queries per second (“QPS”), hosting costs, platform management personnel costs, and amortization of acquired technology and capitalized software costs for the development of platform” (FY23 10K).

As gross ad spend grows, we can buy into a reasonable narrative that variable costs will slide down to maybe 12% of net revenue by 2027. We think TTD and other adtech players will increasingly figure out better supply path optimization and other ways to reduce CPU cycles needed for continuous number-crunching.

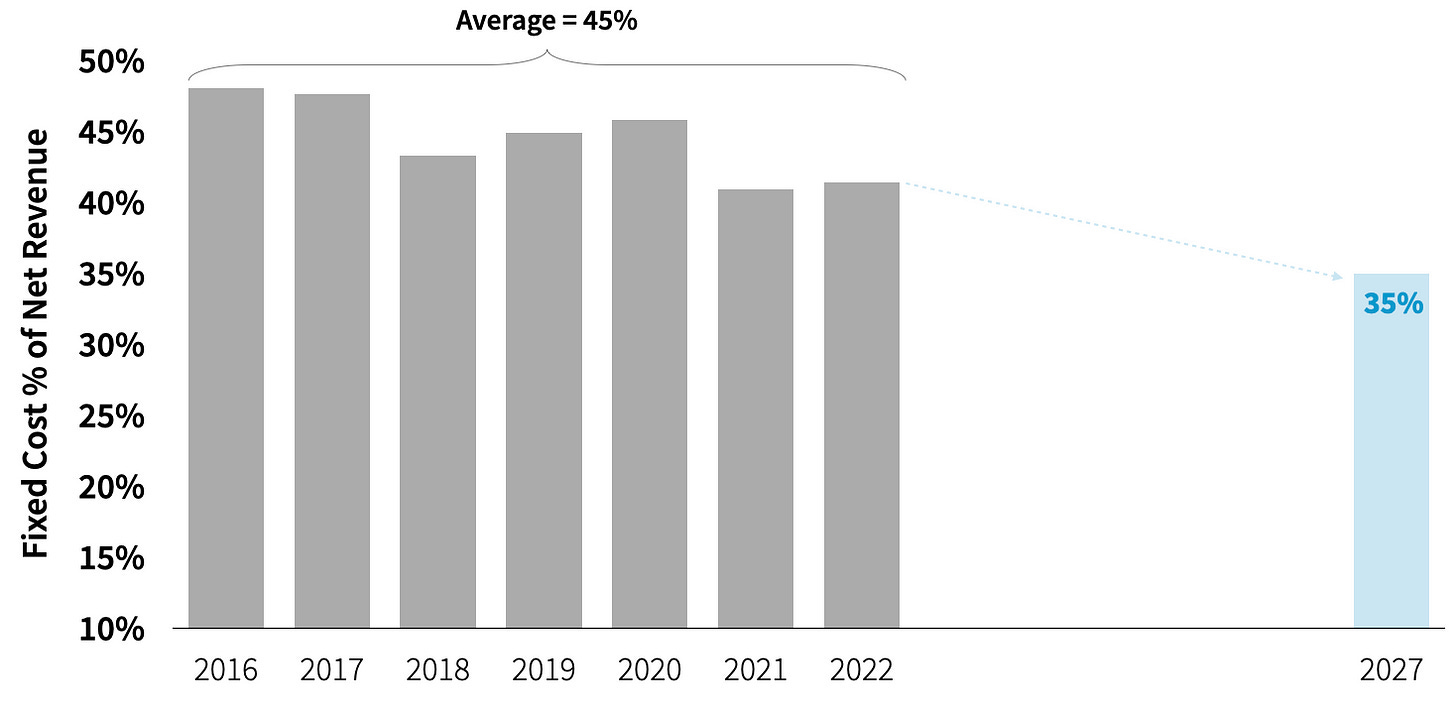

Fixed people costs are coming down… maybe

TTD’s fixed operating costs (SG&A + R&D) as a percentage of net revenue in 2022 was 41%. While we see a downward trend line heading to maybe 35% by 2027, fixed people costs present a potential problem for management to overcome.

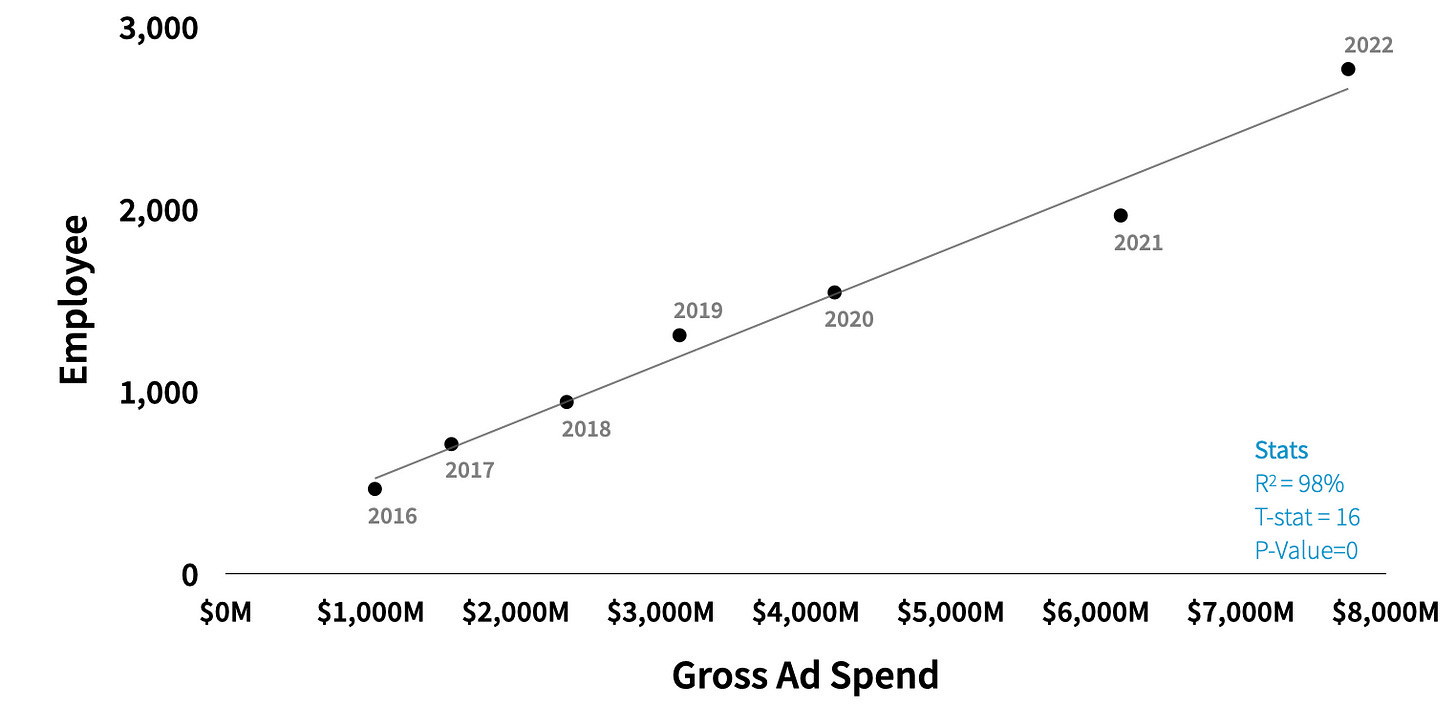

Every time gross ad spend grows, so too does hiring talent. More people means more costs as TTD successfully attracts more ad spend. We’d like to see a lot more separation between gross ad spend and fixed costs dependence (aka scale) but the jury is out for now.

That said, building or adopting AI tools, outsourcing human cost centers to lower-cost locations, and reducing the managed serviced burden of running campaigns on behalf of clients or agency partners are all areas to bring fixed costs down over time.

The big whammy, stock-based compensation

TTD’s share of stock-based compensation (SBC) compared to net revenue is gigantic compared to its closest adtech peers at 31% in FY22. For instance, Criteo and Magnite clocked in together with an average SBC of just 8.5% of net revenue. Google, the adtech gold standard, has averaged SBC at 11% of net revenue since 2012 ranging from 9% to 13%.

Although we really can’t see it happening, our model assumes TTD will somehow get SBC down to 15% of net revenue by 2027. We struggle to see this cultural change occurring because TTD’s management will somehow need to incentivize current and new talent to attract all that gross ad spend and keep the flywheel spinning (see more here).

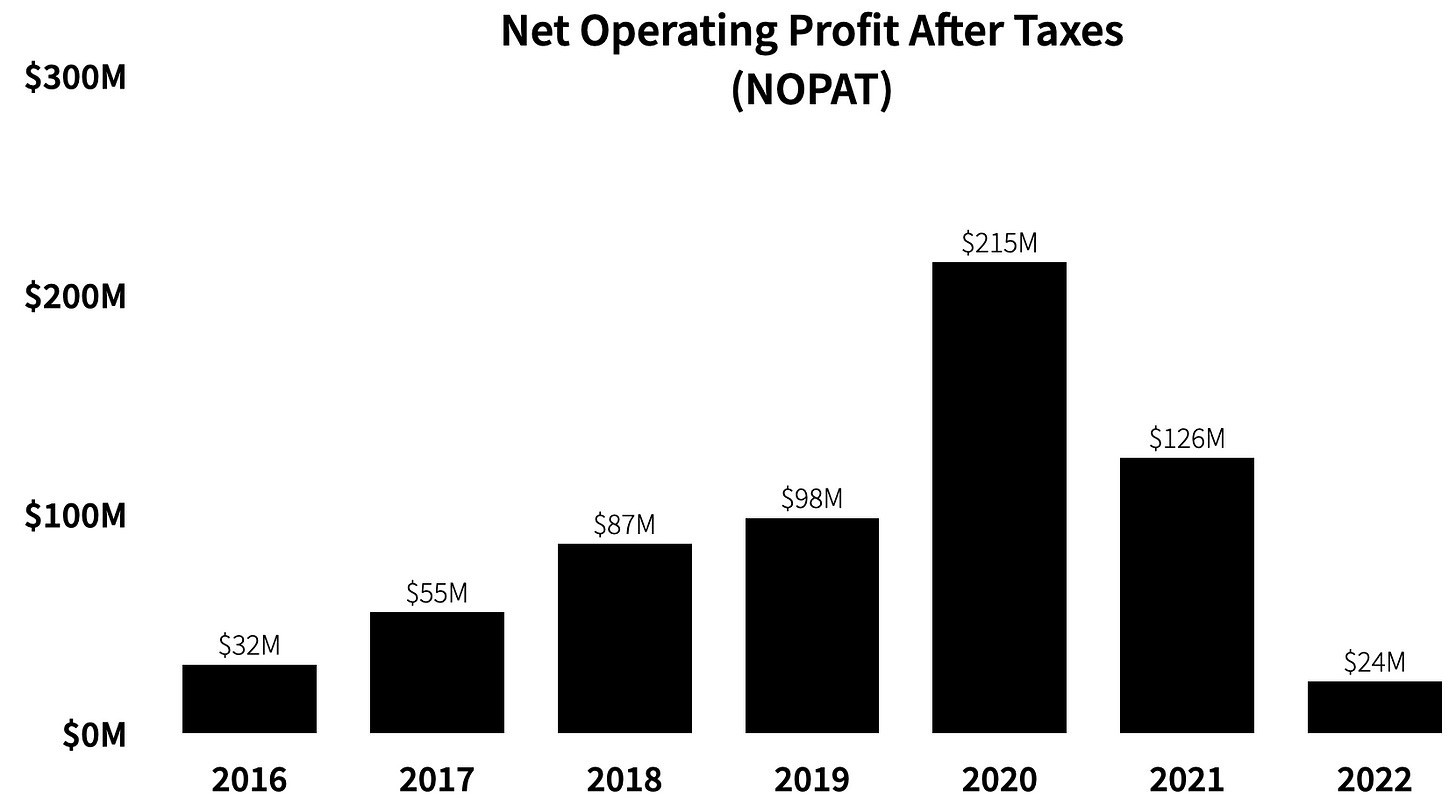

Net Operating Profits after (Cash) Taxes

After we adjust operating profits for cash taxes vs. reported taxes (see adjustments here), it becomes clear that TTD is on the wrong trend line when it comes to producing operating profits. As gross ad spend has moved upward, so too have operating costs so operating profits have gotten harder for management to squeeze out of the business model.

“Every time you hear 'EBITDA' substitute it with 'bull**** earnings''

That’s not Quo Vadis saying it. It’s Charlie Munger. We especially appreciate what Munger’s partner Warren Buffett thinks about EBITDA:

“It amazes me how widespread the use of EBITDA has become. People try to dress up financial statements with it. “We won’t buy into companies where someone’s talking about EBITDA. If you look at all companies, and split them into companies that use EBITDA as a metric and those that don’t, I suspect you’ll find a lot more fraud in the former group. Look at companies like Wal-Mart, GE and Microsoft — they’ll never use EBITDA in their annual report.”

Importantly, the A-list companies Buffett mentions are amazing cash-flow machines that generate returns well above their cost of capital.

TTD runs on an investor relations narrative that is laser-focused on “adjusted EBITDA”, which is a gazillion times worse than plain ol’ EBITDA-based valuation that disgusts Buffett and Munger. Adjusted EBITDA causally adds back all that heavy SBC cost as if it does not matter.

The thing about SBC from a valuation perspective is that it does matter. A lot. Particularly if you’re an investor interested in free cash flow creation.

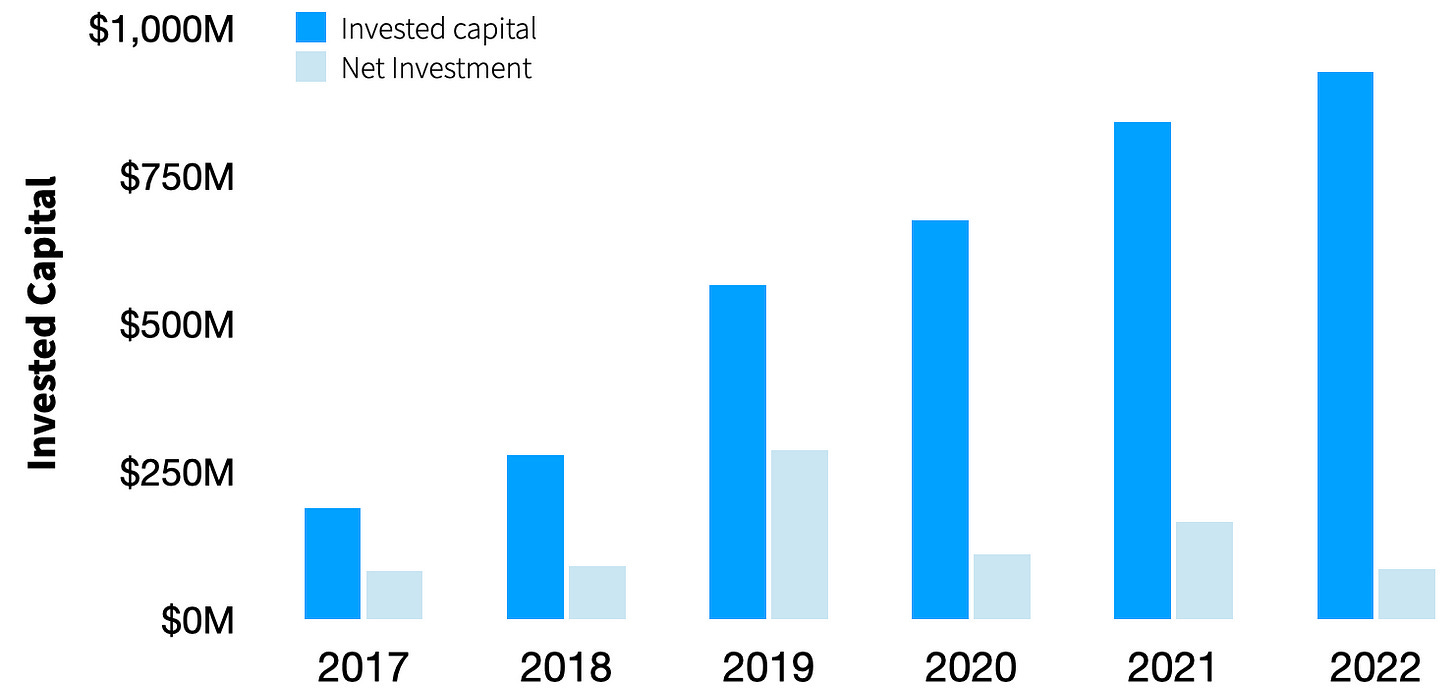

Invested capital in past

Now that we have a good view into historical operating profits, let’s take a look at TTD’s invested capital over the last seven years.

When value investors invest in a company, they are basically looking for management to be better stewards of their capital than other alternatives. That means they are looking for management to be awesome at investing capital into core operations that in turn make money. Simple to say, hard to do.

For TTD, invested capital is split evenly between operating working capital and physical assets used to make the business hum. With that in mind, what becomes incredibly important for future value creation is the historically tight relationship between gross ad spend and invested capital outlays.

Every time gross ad spend grows, so too does TTD’s invested capital base. The difference between invested capital from one year to the next gives us a view into net investment, which nicely captures changes in operating working capital and capex all in one number.

So, after we subtract net investment from NOPAT we get a clear view of real free cash flow. The very thing investors want more than anything else… and TTD’s real free cash flow story ain’t very good.

TTD’s Free cash flow in the past

As you can see, when we break clean from management’s “adjusted EBITDA” narrative we get a clear view of reality: The Trade Desk has not been a free cash flow machine. Quite the opposite.

That does not mean TTD will not generate cash in the future because it very likely will. However, there is no realistic scenario that we can find where TTD generates enough future cash to justify its current share price.

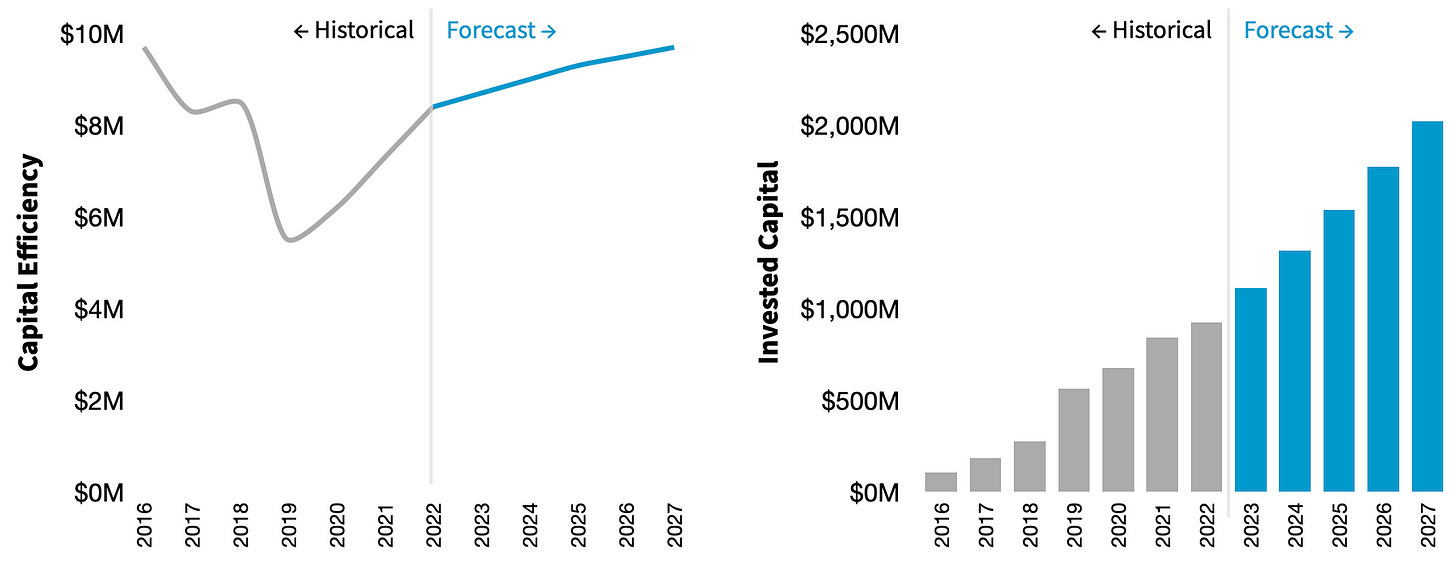

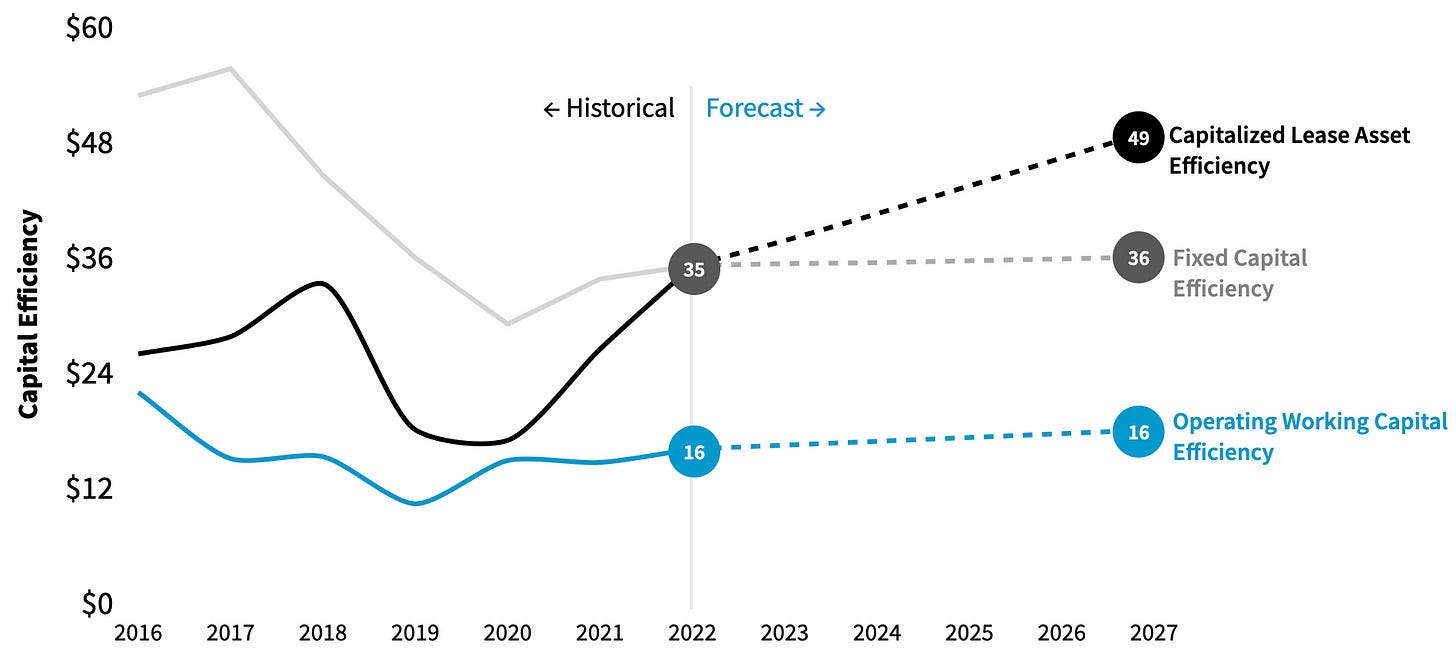

Invested capital and capital efficiency in the future

One of the more important ratios in our model is capital efficiency. Capital efficiency for TTD is the amount of gross ad spend produced for every dollar of investment capital.

Looking at the past, TTD’s capital efficiency has been a rollercoaster ride but we give some benefit of doubt and assume it will get better and flatten out around 2027 at ~$10.

To be sure, we break down invested capital outlays into three components:

Operating working capital: assume stays relatively constant going forward.

Fixed capital: also assume stays relatively constant into the future.

Operating leases: assume TTD will figure out hybrid remote work mixed with team events leaving and other non-cancelable commitments remain relatively flat so TTD gets more bang per buck.

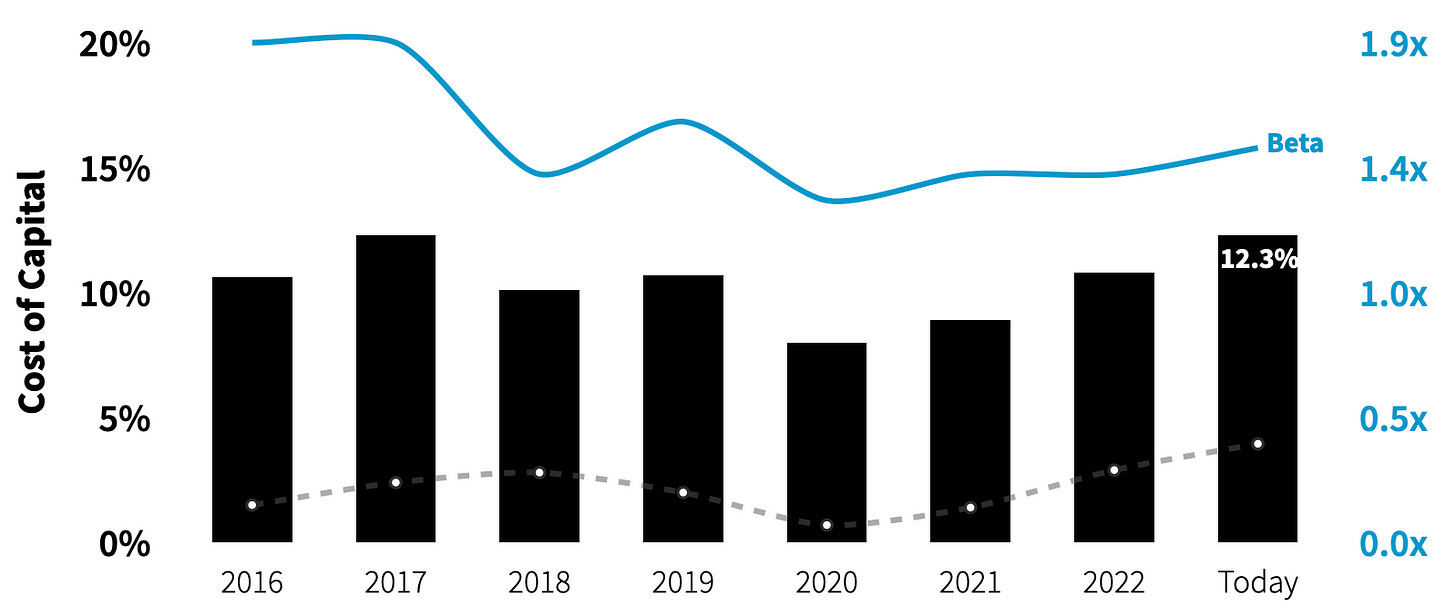

Cost of capital

TTD’s current cost of capital is 12.3% (nearly all equity). Although the risk-free rate is rising for everyone, TTD’s forward beta is falling which keeps the overall cost of capital in a reasonable zone given the relatively risky (high beta/large terminal value) and poorly understood nature of the adtech sector.

Free cash flow in the future with fair growth and cost assumptions

Fair Value Assumption Summary

TTD stays on its current gross ad spend trend.

Take rates decrease from 20% today to 17% in 2027.

Cost of revenue decreases from 20% of net revenue to 12%.

Fixed operating costs (SG&A + R&D) decrease from 41% of net revenue to 35%.

Stock-based compensation somehow moves from 31% of net revenue to 15%.

TTD’s cash tax rate is assumed to be constant at 26% of EBIT.

We assume future returns on capital at a constant 30%, terminal NOPAT growth at 10%, and fundamental growth at 4%.

Fair Value

$18.49/share

Current share price = $58.00

Back to Fundamental Growth

If our reasonable and somewhat favorable assumptions come true, TTD will beat its fundamental growth trajectory by a 10% spread. Not bad!

What can change? Big Bets?

The Trade Desk has $1.4 billion in cash + equivalents. Let’s assume they lever up 80% and go shopping with $7.5 billion in hand. Since CTV inventory is supposedly key to growth, and the best inventory could be hard to come by, is it totally unimaginable to see TTD use cash + debt + shares to acquire Paramount?

Paramount’s market cap today is ~$14 billion and TTD's is $28 billion. Paramount has lots of awesome content and streaming assets including Pluto TV.

While we are at it, let’s throw in Criteo at a 25% premium to its current price, and voilà… that could be an interesting growth combo worth a lot more than where TTD is heading today on its own.

TTD Financials, Adjustments, and Reconciliations

If you’re interested in checking out our NOPAT, Invested Capital and Free Cash Flow work you can access it here. If you find any material issues with our methodology or calculations, please let us know. Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.