#40: TTD Earnings Release + Thoughts

Earnings call commentary; ROIC downward trend continues; Fundamental growth decline; Updated valuation statements for paid subscribers

Reading Time: 11 marvelous minutes

Housekeeping

March 1st Webinar: You won’t want to miss this one! Register today for our deep-dive webinar on TTD’s valuation. It’s on March 1 at 10:00 a.m. ET.

Adjusted Financial Statements: Quo Vadis paid subscribers have received a link to check out our valuation statements and reconciliations updated through Q4-FY22, including our calculations on ROIC, Fundamental Growth, and other relevant analysis. Paid subscribers also received a link to join our TTD Q&A webinar on March 2nd. Check your inbox.

Earnings call

Last week we posted our thoughts along with a fundamental valuation framework to get under the hood of The Trade Desk (TTD).

Now that management reported FY22-Q4 earnings last Wednesday, we’ve made a few minor adjustments to our model but the story stays the same:

Bottom Line: TTD is clearly not a value investment. It’s a speculative momentum play at best. That does not mean investors can’t make money because they can — as long as they are really good at timing their buy/sell decisions.

TTD’s earnings slash “narrative” call was interesting as usual. Dialing into TTD’s matrix can feel like entering a fictional land full of comforting stories where Tooth Ferries, Easter Bunnies, and Oompa Loompas come out from the edges handing out all the Wonka Chocolate Bars investors and analysts can eat.

And they do eat it up. The stock closed at $49.92 the day before earnings and finished at $66.30 after earnings. That’s a giant 35% gain in one day. The stock has come back down -10% as of the closing bell on Friday, but it’s still significantly up — for now.

The rub: Caveat emptor is always a good rule of thumb in Adtech Land. It’s not actually important what is said (or not said) on these earnings/narrative calls. What matters is how much you believe it to be true.

If you’re looking for a sound summary of the call, we recommend checking out Brian Wieser’s new newsletter Madison & Wall. Wieser highlighted some of the best gems heard on the call. We’ll cover a few others here today.

As Brian likes to quote Machiavelli,

“A prince [investor] who is not himself wise cannot be wisely advised… Good advice depends on the shrewdness of the prince who seeks it, and not the shrewdness of the prince on good advice.”

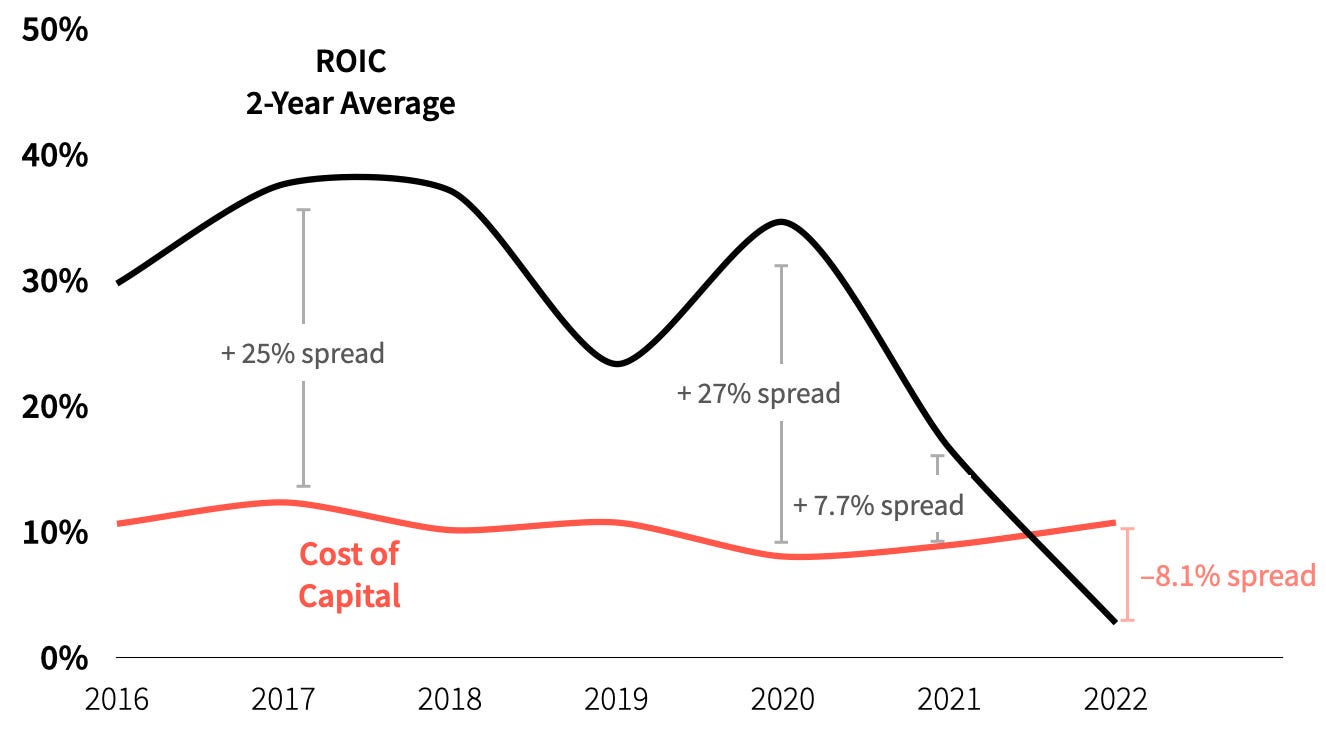

ROIC < WACC = not a good trend line

We’ve updated our historical analysis on TTD to include FY22 actuals vs. the estimates used on our pre-earnings post.

While TTD’s management likes to focus on “adjusted EBITDA” to juke investors away from looking at stock-based compensation (SBC) as a real expense (we’ll cover that topic in a minute), we don’t fall into such financial nonsense that easily.

Quo Vadis is interested in value investing, not voodoo accounting tricks. At the end of the day, all we care about is TTD’s spread between return on invested capital (ROIC) and its cost of capital. We also care a lot about fundamental growth — we’ll get to that in a minute too.

ROIC is trending down since 2020. Why? Because even though TTD has a relatively low invested capital base, it is not producing enough net operating profits after cash tax adjustments (aka NOPAT) to generate a return above a slightly rising cost of capital.

As of right now, TTD generates a negative economic spread. That means the company is destroying value not creating value. If you don’t believe us, go ask Warren Buffett and Aswath Damodaran.

Of course, the current state does not mean TTD won’t someday, in the distant future, turn into a value-generating company. That could still happen. It all depends on the quality and accuracy of your assumptions about the company’s future.

If you’re looking to find hope in TTD’s future, check out Patrick O’Shaughnessy podcast with CEO Jeff Green (Apple or Spotify). We were turned onto it by a friend of Quo Vadis. It’s a fascinating interview, one of the best we’ve come across.

Register for our TTD Valuation Webinar: We’ll go deep into TTD’s historical numbers and illustrate our key forecasting assumptions on our March 1 Webinar.

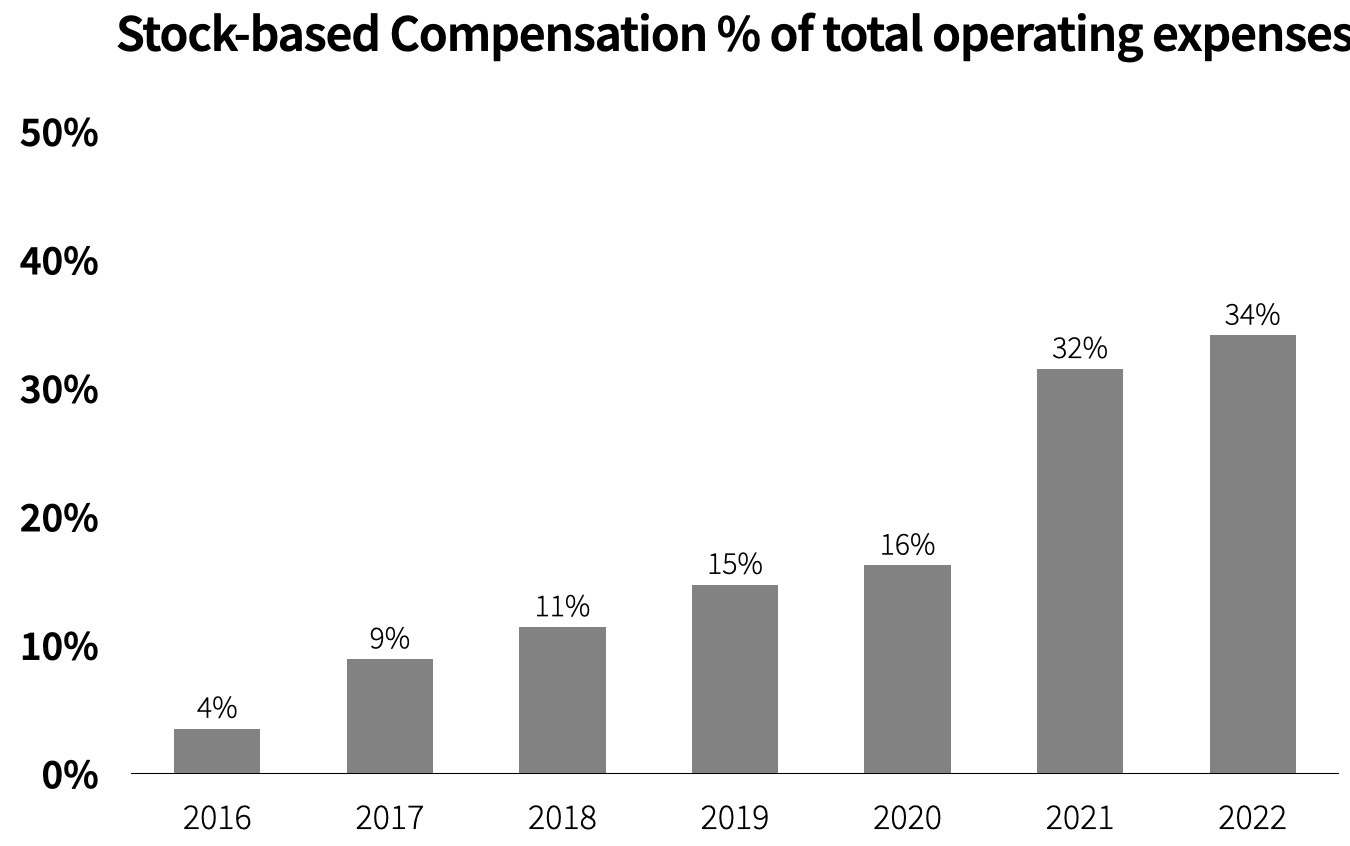

“Adjusted” EBITDA & Stock-based compensation (SBC)

Instead of management getting real and focusing on how TTD will generate an ROIC spread that justifies its current share price (now trading insanely high at 14x book value), they instead focus on non-GAAP metrics like “adjusted” EBITDA.

Why do they do this? Because “adjusted EBITDA” removes stock-based compensation. When a very real expense item like SBC represents 34% of your total expenses, that seems material to us and anyone else interested in value investing.

Here’s what Warren Buffett said about stock-based compensation in Berkshire Hathaway’s 1992 annual report:

“If options aren’t a form of compensation, what are they? If compensation isn’t an expense, what is it? And, if expenses shouldn’t go into the calculation of earnings, where in the world should they go?”

According to TTD’s management thinking, all you have to do is “adjust” EBITDA by adding back SBC to make it go away. Presto! Now SBC is not an important thing anymore… nothing to look at here.

Here’s what NYUs finance guru and valuation specialist Aswath Damodaran said about SBC with respect to his valuation of Twitter in 2014:

“…but that cannot be the rationale for adding it back to get to net profit, since net profit is an accounting earnings number, not a cash flow. One possible explanation that can be offered (and it is a real stretch) is that Twitter [TTD] views stock-based compensation as an extraordinary expense that will not recur in future years and that the adjusted net income should therefore be viewed as a measure of continuing income. I will believe this explanation if I see Twitter [TTD] stop using stock-based compensation, but I don't see how they can afford to. They have a lot of employees, some of whom are highly paid, and they cannot afford to pay them cash.”

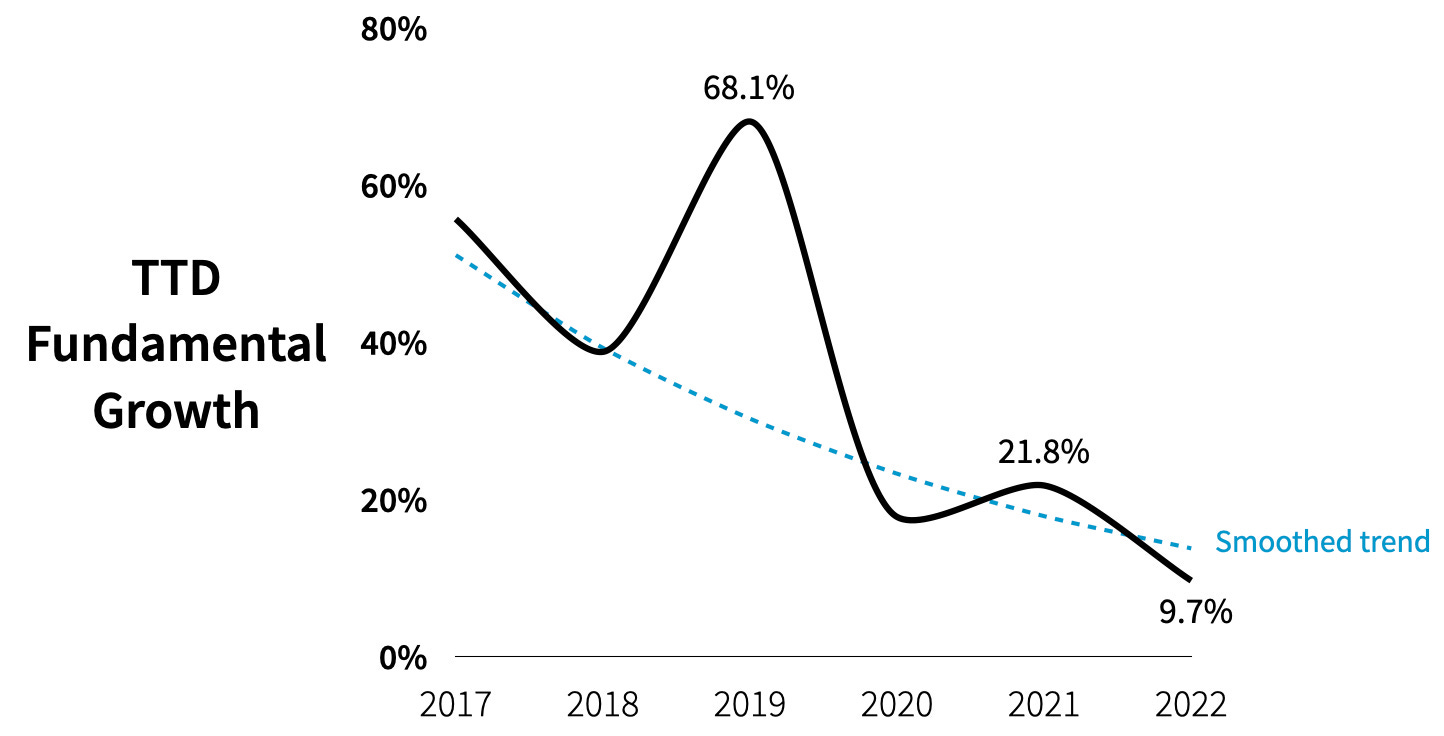

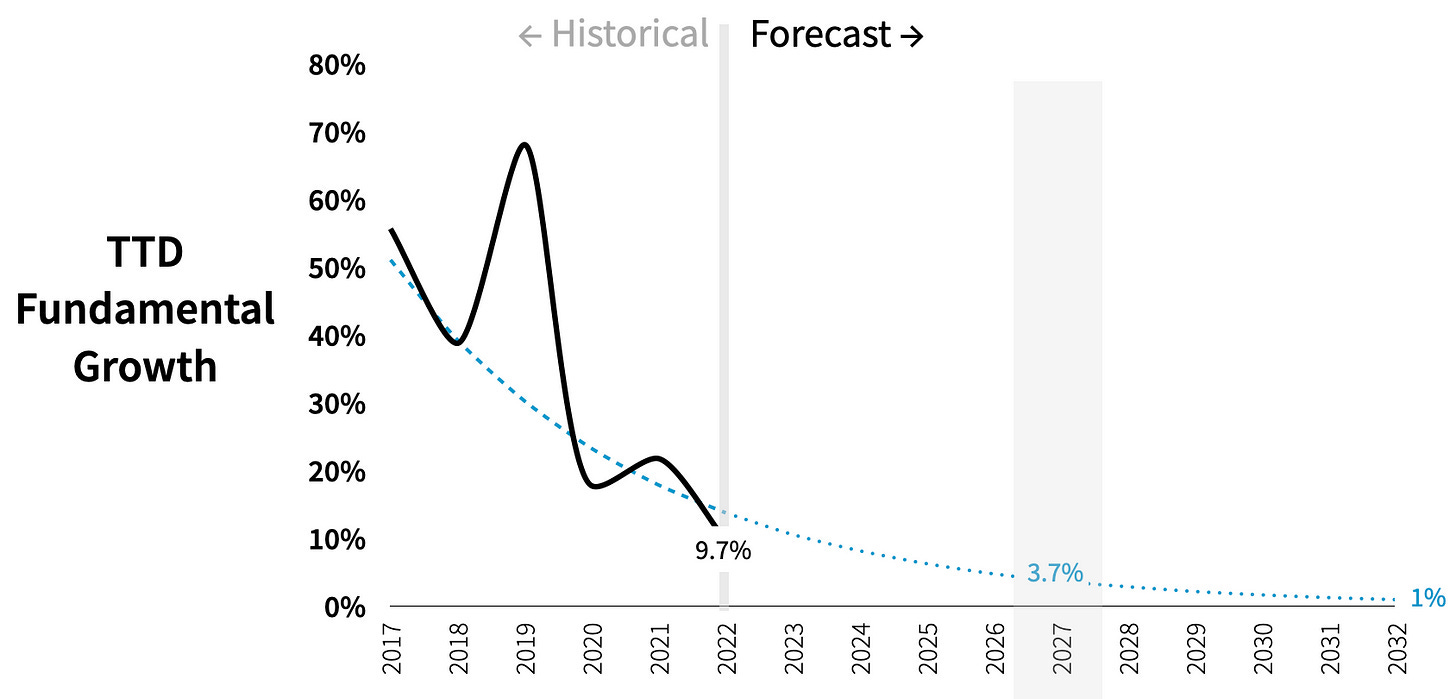

Fundamental growth just got worse

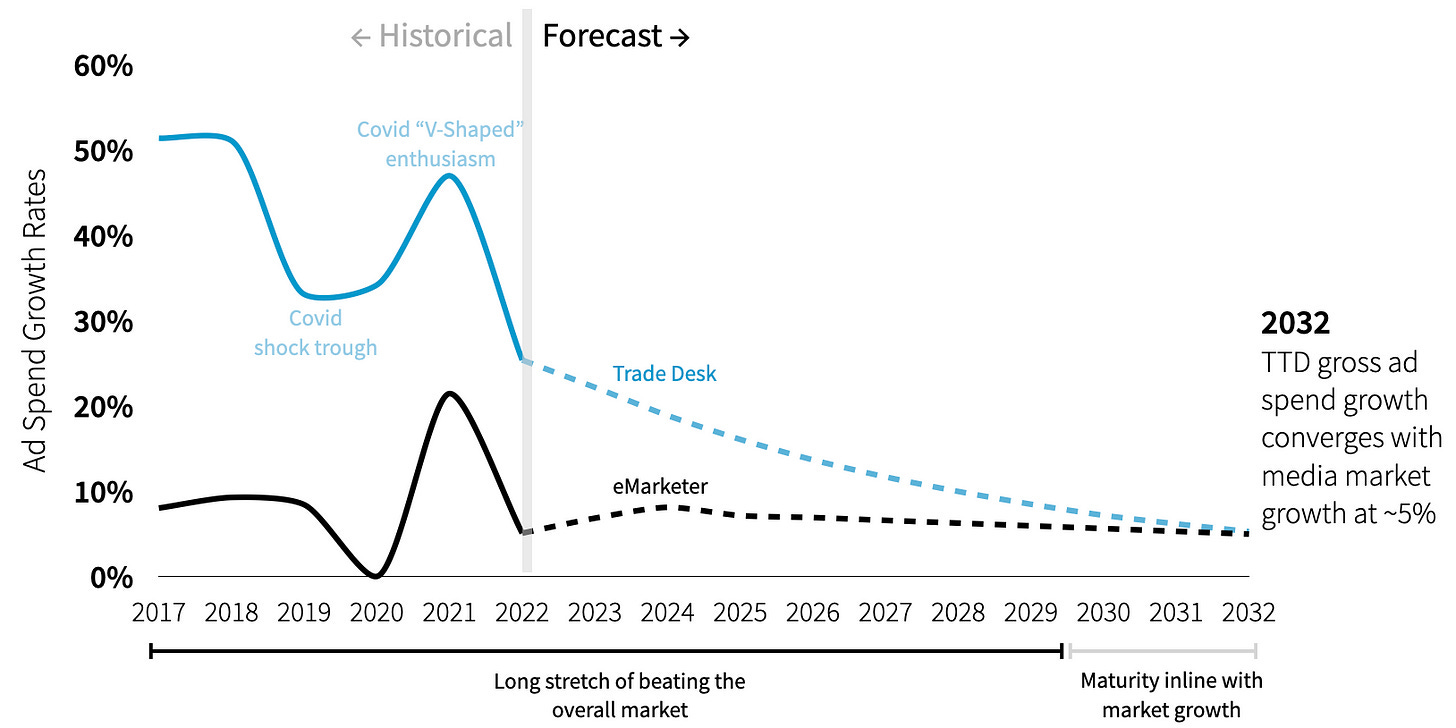

As we pointed out in our pre-earnings post, fundamental growth rates for every company eventually approach GDP growth rates at some point in the company’s maturity curve.

The key to creating more value is to keep the growth ball in the air for as long as possible. But for TTD, its fundamental growth story ends around 2027 when it finds parity with global GDP growth. That’s how we TTD’s historicals playing out into the future.

For instance, the IMF projects global GDP growth to fall from 3.4% in 2022 to 2.9% in 2023, and then rise to 3.1% in 2024. So, when we project TTD’s fundamental growth trend into the future, we get a GDP parity around 2027.

Let’s juxtapose this terrible trend line with management’s comments when asked about Google’s anti-trust case on the earnings call:

So let me just give the sort of punchline first, which is that I believe we will win regardless of the outcome. So no matter what happens, I think we’re going to win. (Jeff Green, CEO)

From our perspective, that’s an odd way to think about “winning.” If the company was really winning, its fundamental growth would look a lot more like Google’s did when Google was just 14 years old like TTD is today. But it doesn’t. And that’s a real fact.

Gross ad spend updated for FY22

The day before earnings we said gross ad spend would come in between ~$7.94 billion and $8.30 billion. Given past performance, we would not have been surprised if TTD beat the upper end of our range. But they didn’t even come close with just $7.74 billion in reported gross ad spend for FY22.

In fact, TTD’s CEO Jeff Green kicked off the call by saying:

“Let me start by highlighting the numbers. Spend on our platform in 2022 was nearly $7.8 billion, a record for us.”

Let’s dismiss the fact that management took some liberties on how to round up vs. rounding down. What’s more important is shining a light on gross ad spend growth and what it means for the future.

Gross ad spend growth curves, like all long-term growth curves, tend to trend down, not up, over time. So TTD’s whiff on FY22 gross ad spend has become more material in our forecast assumptions.

When we play out TTD’s gross ad spend growth rates in the future, they beat market growth rates (eMarketer) until ~2030 when it converges with overall market growth. That’s a really short growth half-life as far as we can tell.

And guess what? Whatever that growth consists of in terms of inventory sourcing, it includes everything that TTD throws around with its CTV narrative + retail media + UID2.0, etc, etc, etc.

Speaking of CTV

TTD’s earnings calls can be nicely summarized with a Venn diagram. The entire narrative and message map are always about CTV and UID2.0. The middle ground is where the growth narrative is supposed to play out in the investor’s psyche.

All in all, “CTV” has taken the cake in three of the last four earning calls as the #1 word. “UID” has been a top 10 contender over the same four quarters except for Q3 earnings when it ranked a lowly 22nd place. These two words are far an away the most popular in TTD’s earnings call lexicon. Interestingly, “Netflix” was a top-ranking word in Q1 and Q2, but disappeared in Q3 onward.

It’s really difficult for Quo Vadis to buy the CTV story as it currently stands. We just don’t see things shaking out in TTD’s favor despite having $7.7 billion in demand to swing around.

And looking at our gross spend analysis, we can’t get to a place where TTD attracts enough good CTV inventory to boost the growth trend.

Keep in mind that “video” is now defined in three buckets.

“In late January, inside a sunny conference room at the JW Marriott in Marco Island, Fla., a working group of advertising technology executives gathered to discuss a contentious new update to a pair of terms—in-stream and out-stream advertising—whose precise definition would determine the fate of billions of dollars in digital video advertising.” (AdWeek)

Primary in-stream — requires the viewer to initiate the video and play it with the sound on, will represent between 5% and 10% of total video inventory, and garner CPMs equivalent to those of connected TV. These are like the ads you get on YouTube or Tubi.

Accompanying in-stream — accounts for roughly 40% of total video inventory, starts automatically and plays without sound, but the ads must accompany editorial video.

Out-stream — the most performance-oriented option of the bunch, will refer to the remaining 50% of video inventory. Absent any editorial video content, these ads offer marketers the most affordable vehicle for exposure (but are also the most likely to be lemons disguised as peaches). Out-stream ads are basically banners with video. Go to any recipe site and you’ll see what we mean. Be prepared for total annoyance. Here’s a good recipe example for Best Muffins Ever.

Thought Bubble Question: How much inventory is bought via TTD (or any DSP) from SSPs that is declared in the bid stream as "in-steam" to fetch high CPMs but it's really "out-stream" and worth much less?" If you're an investor in the space, we recommend asking the IAB how many publishers have adopted the new standard.

Spoiler alert: Not many. That's why we still view programmatic as a lemon market.

What about UID, that sounds like a growth driver, right?

Speaking of IAB, last March IAB Tech Lab declined to play the admin role for UID2.0 fearing liability for violations of the General Data Protection Regulation (GDPR).

On the plus side, Disney integrated with UID2 in pursuit of better addressability. Before getting the green light, Disney’s army of lawyers would have made sure it was “Disney Safe.” So, if UID2.0 does not break CCPA and other state laws, it could gain adoption. Maybe.

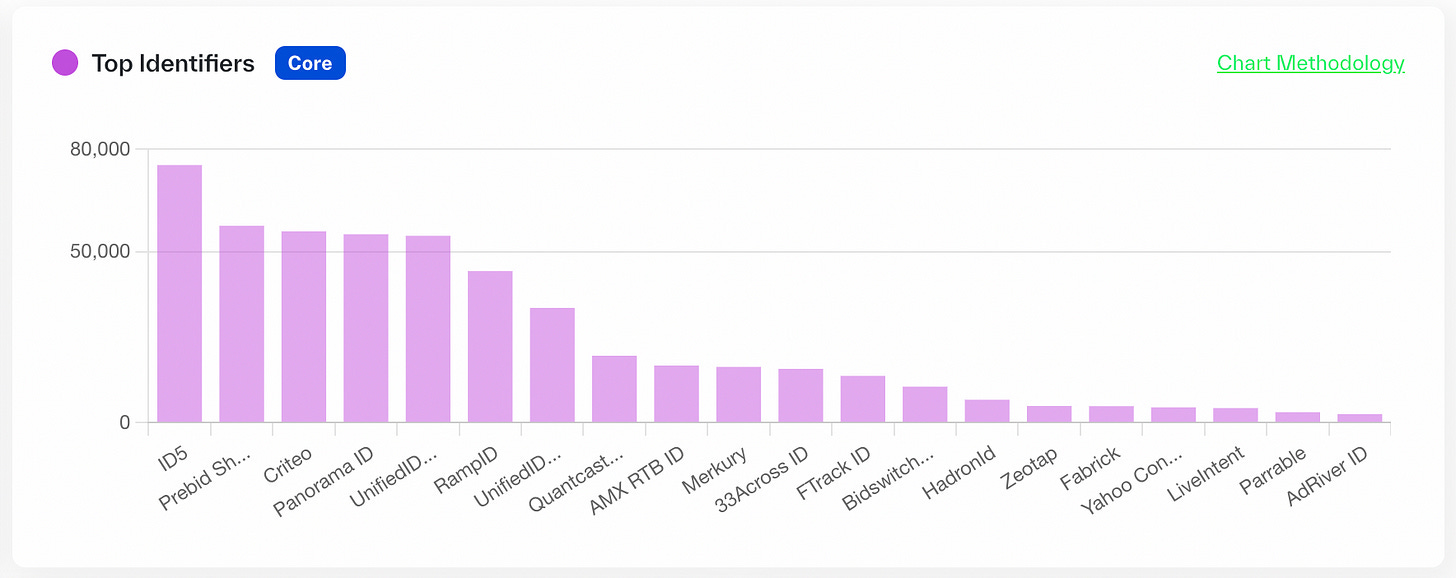

But UID2.0 is not the only game in town. According to Sincera’s data across 200K popular sites, ID5 is the clear leader.

In any case, no matter how we look at the data identifier race, the competition is ongoing. And no one on the planet knows how it will pan out while the risk that it all goes to shit tomorrow is equally real.

Take rates

We pointed out before how gross ad spend is an unaudited number. We also think it makes for a very convenient mechanism to smooth out the thing that TTD wants investors to focus on the most (besides “adjusted” EBITDA) — consistent take rate management.

And now we know this razzle dazzle to be more true than ever before. Green closed the call by making sure to highlight:

“I just want to underline a couple of really important points here. First, our take rate has gone up 3 years of the last 6 years, and it’s gone down 3 years last 6 years, stayed pretty much the same the entire time for a publicly traded company.”

Again, not a single person on the planet, outside of TTD management, knows exactly how much gross ad spend runs through TTD’s platform. Therefore, only management knows what their true take rates may or may not be.

Recommendation: We recommend thinking about take rate calculation in terms of output value:

Take Rates (output value) = Net Revenue / Gross ad spend

Net Revenue (output value) = Gross ad spend (sales success) x Take rates (value add success)

There is a world of difference between those two equations. The first one is razzmatazz using unaudited gross ad spend like a take rate dial. And in both cases, gross ad spend is still an unaudited number, but at least the second approach is more real.

Whatever the case may be, the trick is to extract as much “take rate” as you can without being too greedy. The more you take, the more you have to defend so advertisers keep grooving on your story and keep ad flows heading your way.

You don’t have to be totally take-rate legit in adtech land. You just have to appear to be too legit so they don’t quit!

Don’t forget to register for our TTD Valuation Webinar: Join our March 1 Webinar and you’ll see how we model out future take rates and other key operational drivers.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.