#39: Quo Vadis TTD Earnings & Valuation

The Trade Desk reports earnings on Wednesday; All eyes on gross ad spend; Register for our Webinar on TTD DCF Valuation

Reading Time: 9 intimate minutes between you and Quo Vadis… so special!

Today is Valentine's Day. We love you, Quo Vadis subscribers! ❤️💓❤️

Today also kicks off Random Acts of Kindness Week. So what is Quo Vadis doing for you? We’re glad you asked. Keep reading and find out!

All eyes on gross ad spend

Like many others in the adtech world, we think The Trade Desk’s (TTD) performance is one of the best bellwethers in the space. TTD’s management is scheduled to report Q4 earnings on Wednesday, February 15 — we can’t wait!

TTD has attracted $6.2 billion in gross ad spend to its platform in FY21. We expect to see at least $8.0 billion on Wednesday, maybe a bit more. $8+ billion means TTD runs almost 1% of global media spending, according to eMarketer’s numbers, making TTD far and away the biggest demand owner across our QV AdTech 18 portfolio.

We’ll come back to gross ad spend and what that could mean (or not) in a hot minute.

TTD Valuation with a Quo Vadis Webinar

It turns out that quite a few other adtechies and investors are also eyes wide open in anticipation of Wednesday’s earnings call. The stock is covered by 26 analysts, 16 have it as a buy, nine say to hold, and just one ranks TTD as a strong sell.

As our readers know, we are Goldilocks-level curious at Quo Vadis, which makes us ponder questions like:

TTD is trading at 12x book value, which is relatively high and at the same time an investor compliment to what they think TTD will achieve in the future. Since TTD 0.00%↑ is trading at $49 per share with a market cap of close to $24 billion, is that price just right, too high, or even too low?

So we built a neat discounted cash flow (DCF) valuation model to find out for ourselves. It’s a Lewis and Clark expedition into the adtech frontier to understand more about TTD’s business model today and pull on various assumption levers to get a decent idea of what the future could hold.

Join our March 1 Webinar at 10 a.m. ET

As a random act of kindness to our subscribers, we are going to give you our programmatic experience together with some finance and valuation skills — not to mention a dose of economic fundamentals and game theory thinking — to hopefully find some new knowledge and share a fresh perspective.

Register today for our deep-dive webinar on March 1 at 10:00 a.m. ET.

By that time, most of the adtech sector will have Q4 earnings done and dusted, leaving just a few stragglers.

Stragglers: AdTheorent, DoubleVerify Integral Ad Science, Acuity, Viant, S4 Capital, and BuzzFeed deliver earnings from March 2 all the way to March 21.

Yes. That’s the answer if you’re wondering whether we’ll update our TTD model on a quarterly basis and share what we find.

And yes again. That’s the answer if you’re wondering whether Quo Vadis is modeling out other adtech players in the space.

***Quo Vadis Paid Subscribers: You got a special note today to join a Q&A webinar session on March 2 at 10:00 a.m. ET. We also gave you access to our Trade Desk NOPAT and Invested Capital statements and reconciliations. Why run valuation on TTD?

For starters, TTD is trading at 12x book value. That basically means investors are shouting, “We have a high level of confidence that The Trade Desk will eventually grow into this mighty valuation.”

Besides Zeta, which is trading at 16x book value (nobody really knows why), the rest of our QV AdTech 18 portfolio trades at an average book value of 1.7x.

Looking at the entire NASDAQ, the broader market is trading at 4.9x book value, which obviously says a ton about investor confidence in TTD’s ability to meet high bar expectations.

A bigger concern: It’s one thing to study a company that is potentially overvalued relative to its peers and has lots of work to do to grow into the current valuation. But the more important thing is to figure out if a company is a value investment or something more akin to a momentum play, or even a speculative investment where getting lucky means timing the market is everything. If you think you can time the market, you’d have better chances betting on the Jets to win Superbowl 58 next year.

Anyhow, we are mostly interested in understanding if TTD is a value investment or not. That’s precisely where valuation gets fun. And when we look at TTD in the context of a value investment, it concerns us in two ways.

The first is TTD’s historical economic spread over its cost of capital. It’s not a great story — at least not recently. The second is about historical fundamental growth and where that trend line is heading. If investors play out this key valuation driver, they’ll probably have a hard time reconciling with their 12x book value thesis.

Economic Spread: Value investors look for one thing above all else.

Their guiding principle of valuation creation in any business — including adtech businesses, which oftentimes feel like they are suspended from economic fundamentals and known market mechanisms — is a refreshingly simple construct.

Companies that grow and earn a return on capital that exceeds their cost of capital create value. When managers, boards of directors, and investors have forgotten it, the consequences have been disastrous (Koller, Goedhart, and Wessels).

***Adjusted Financial Statements:

Quo Vadis Paid Subscribers... you have received a link to view our adjustments and reconciliations to TTD’s financial statements including our calculations on ROIC, Fundamental Growth, and other relevant analysis. With three quarters in 2022 behind us and the fourth coming tomorrow, we estimated where we think NOPAT and Invested Capital will land for FY22.

Bottom Line: The spread between The Trade Desk’s Invested Capital (ROIC) over its cost of capital used to be good, but with heavy stock-based compensation and relatively high variable expenses (cost of revenue) in more recent years, the spread appears to be declining. From where we sit today before Q4 earnings release, we see a –5.2% spread.

Depending on how Q4-FY22 turns out, TTD’s economic spread could remain negative or flatten out. We’ll know more tomorrow.

In any case, negative economic spreads are the opposite of value creation. That’s called value destruction. If this trend continues, value investors will likely look for better alternatives — and there are many that produce really fat ROIC. Here are ten alternatives, including Moderna, Advanced Micro, and Apple, among others.

Fundamental Growth: Besides creating the biggest possible economic spread, the other thing we look at is fundamental growth. Out analysis looks to see where it’s been, where it is today, and where it might be heading in the future.

Long story short, if a business is generating real profits (vs. accounting profits) and investing a portion back into the business and getting a good return on those investments, it grows. Period. Full stop. End of story.

Eventually, fundamental growth rates for every company approach GDP growth rates at some point in the maturity curve. That’s fundamental growth in a nutshell.

How do we know this is true? Because in a magical world where it is believed a company can grow at rates higher than GDP forever, that company would eventually become the world’s economy.

Yes, some companies like Google, Apple, and very few others continue to grow at rates well above GDP, but the rate still declines over time. And some companies with low growth at maturity can have eureka moments of reinvention or perhaps they are in the right place at the right time and experience a “sigmoid” growth moment. These moments are an exception, not the rule.

Fundamental Growth Example

Your company makes $100 in profits this year, and you reinvest $50 back into operations. Your investment rate = 50%.

If your ROIC is currently 20%, your fundamental growth rate is 10% (50% x 20%).

We estimate TTD’s growth rate for 2022 will be around 22% off a high of 68% in pre-COVID 2019. But we are mostly interested in the exponential trendline going forward.

Future Growth: Here’s the problem. Google is the most successful advertising company to date. Meta is probably in second place, with Amazon chasing. Apple and Netflix are contenders, but really only Apple (or maybe Amazon) could become “Google Big” at some point in the future of advertising.

The main thing about all of these alternatives is that they all have elevated fundamental growth rates compared to TTD and they also have longer lifespans to date.

From our point of view, The Trade Desk’s growth story is looking like David Bowie’s character in the movie The Hunger with Catherine Deneuve and Susan Sarandon where Bowie ages rapidly in a few days instead of over the course of a regular lifespan.

Register for our TTD Valuation Webinar: We’ll get deeper into TTD’s fundamental growth in our March 1 Webinar.

Back to gross ad spend

First things first. Every year TTD reports gross ad spend. That’s the ad budget monies running through its platform.

From these funds, TTD “takes” around 19% to make net revenue. After taking out variable (“Platform Operations”) and fixed costs (SG&A and R&D), and non-cash expenses (like depreciation, amortization, and stock-based compensation), the company is left with operating profits. At least that’s the goal.

The intriguing feature of gross ad spend as reported by TTD is that it’s pretty much an unaudited number.

How is it tabulated?

Is the tabulation consistent from year to year?

Is it binary with total certainty (e.g. a dollar is either spent on the platform or not) or is judgment used?

If any judgment is used, is it the same judgment criteria from year to year?

We ask these questions because if the counting of gross ad spend is subjective with room for flexibility from one period to the next, then that would make for a convenient way to “smooth out” take rates with the optical illusion to show YoY consistency.

Note: We are not saying this happens. We're are simply being Rene DesCartes existentialistic because if you can "conceive or imagine something without confusion or contradiction, then that thing is possible."For example, when a company reports how much cash it has on its balance sheet, an auditor or the SEC or FINRA can go check by looking that the bank account. When it comes to unaudited things such as gross ad spend, the “bank” is a basically server containing a database full of impression logs. And similar to a Swiss bank, the disclosure of any information regarding these logs (and sometimes even their existence) is private.

Just think for a moment. If the entire valuation of a business is totally dependent on an ability to attract ever bigger amounts of advertiser dollars, and if this number is unaudited and unverifiable, then how can investors truly value the business with any hope of accuracy whatsoever?

And that’s why TTD looks more like a momentum play at best and speculative play at worst.

Predicting FY22 gross ad spend

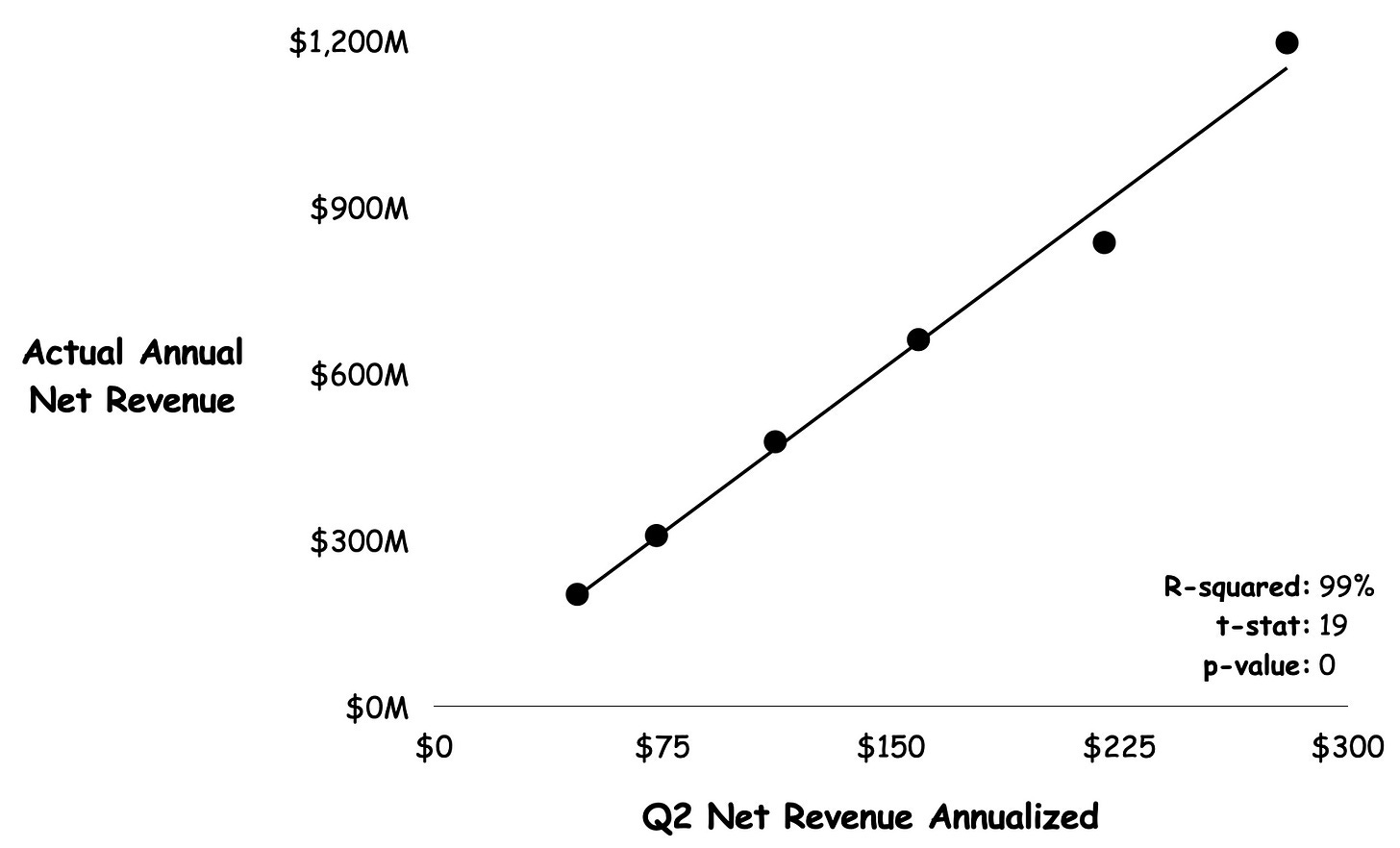

Last August, we ran a back-of-the-envelop model showing how TTD’s Q2 net revenue has been a really tight predictor of full-year net revenue since 2016.

So, with $377 million in Q2 FY21 net revenue, our half-baked regression model predicts FY22 net revenue will come in at $1.51 billion when TTD reports on Wednesday. That feels a little light.

Assuming TTD’s take rates remain the same as last year at 19%, gross ad spend in FY22 will be ~$7.94 billion. If take rates come in at 18.85% or lower, then TTD’s gross ad spend will bust through the $8 billion mark.

If our prediction model comes true, TTD will report $420M in net revenue tomorrow and $1.58 million in full-year net revenue. At 19% take rates, full-year gross would be $8.30 billion. That’s a big number.

Market consensus thinks Q4 net revenue will be 24% better than last year. That would put Q4 FY22 at $490 million. So let’s take the $456 million midpoint between our $420 million prediction and consensus $490 million and call it a day. That translates to $1.54 million in FY net revenue and $8.12 billion in gross ad spend for the year.

Register for our TTD Valuation Webinar: Join our March 1 Webinar and you’ll see how we model out future take rates and other key operational drivers.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.