#27: Q1 2022 Portfolio Rundown

Q1 bloodbath for adtech; 52-week lows going lower?; Margin compression is coming; Are they on a "flight to ad quality?"

Reading Time: 11 minutes

Quick Highlights

Quo Vadis tracks 18 adtech stocks that are dependent on programmatic spending growth.

Only 1 out of these 18 companies had positive stock price performance from March to April (S4 Capital, aka Media.Monks).

From April through May 20, 5 out of 18 companies experienced positive price movements (MGNI, ROKU, DV, ADTH, and CRTO).

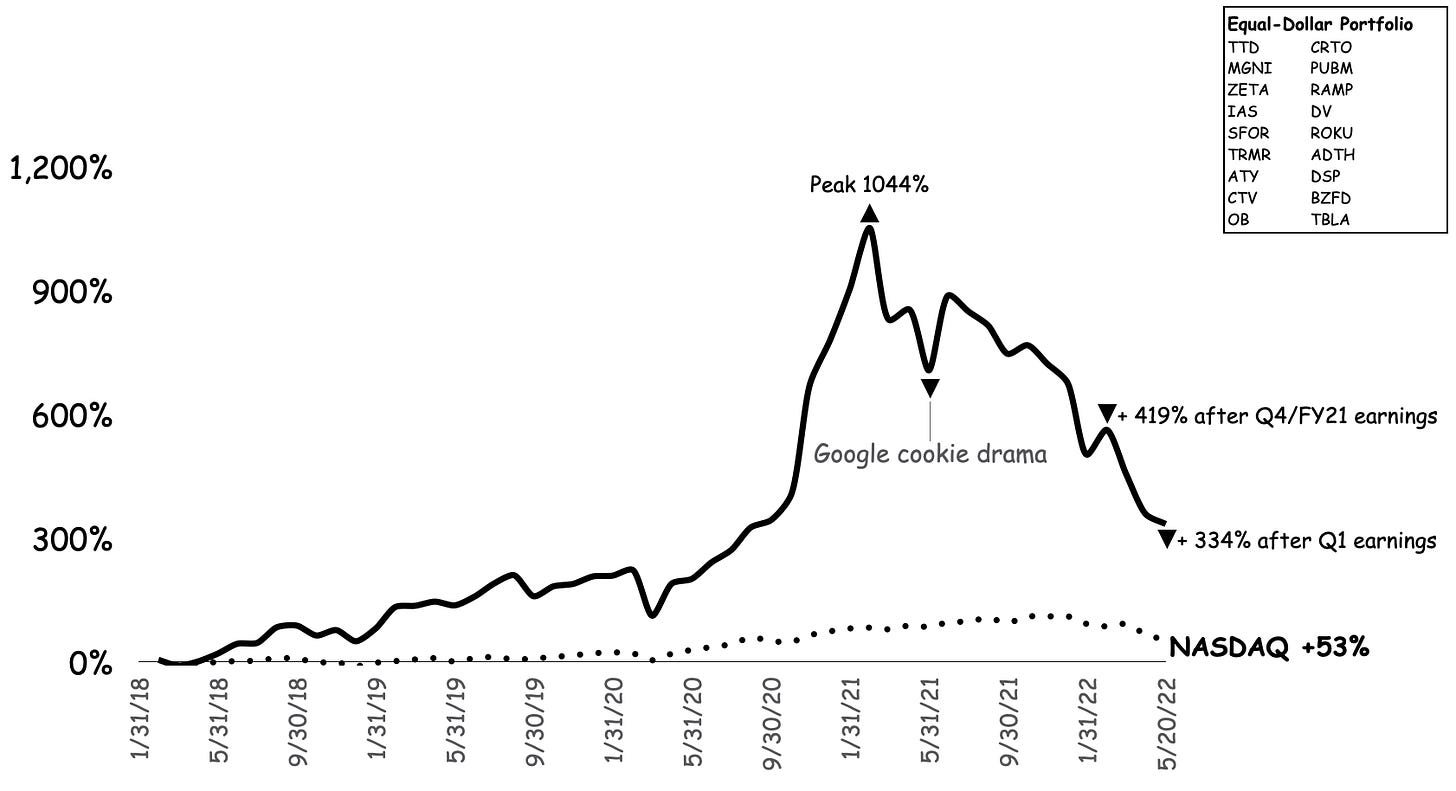

Other than that, our portfolio is off –62% since its peak in February 2021, while the NASDAQ is off ~30% since peaking in Q4 2022.

Only 5 out of our 18 adtech companies are up since January 2018 or since entering our equal-dollar portfolio: TTD, CRTO, MGNI, ROKU, and SFOR. All of them beat the NASDAQ over that time period except for CRTO, which saw 12% gains vs. 53% for the NASDAQ.

Bottom Line: Adtech success in Programmaticland is all about being really good at two things:

Attracting ad budget to your platform (hopefully on a legitimate basis without buying bot traffic or pushing inventory that David Ogilvy would never call “advertising”)

Extracting fees one way or another such that your clients and other stakeholders will bear it

That’s why Quo Vadis is betting on a massive ad quality correction and take-rate compression as the ad economy is pulled by the gravity of whatever happens in the macroeconomy.

It’s the last call to get on the “flight to ad quality.” The plane is leaving. Who is going to be allowed on it? Who forgets their passport and will be turned away at the gate?

Those who get clean now (and can actually prove it with real data) and those who have strong balance sheets will survive the macro trough and likely be very big winners. Ad budgets will flow to these survivors known for trading in ad quality, but their take-rates will likely go lower. That’s okay as long as volume-to-price elasticity works in your favor. Only the very best management teams will be able to pull that off.

Where do they stand?

Yes, the NASDAQ and other indices are taking a beating in the current correction. As of May 20, the NASDAQ is off –27% since January but still up 53% since January 2018 when we started our Quo Vadis equal-dollar portfolio.

In contrast, Bitcoin is off –24% since January 2022 but up 185% since January 2018.

And while our programmatic portfolio is off –44% since January, it’s still up 334% since January 2018, beating the broad market and Bitcoin by miles.

Portfolio Gains Down to 334%, beats Bitcoin

Apple Ad Sets the Tone for Programmatic

The Rundown

The Trade Desk (TTD)

As of Q1 reporting, revenue was up 43% from one year earlier.

TTD’s stock price was down -3% the day after its Q1 earnings release but up 17% as of May 20 and trading 34% above its 52-week low. Not bad, all things considered!

Based on Q1 2021 revenue of $315M, TTD's forward annualized revenue expectation (see call-out below) for 2022 is $1.7B, which is 43% higher than its 2021 total revenue.

Biggest News: During the quarter, The Trade Desk announced its collaboration with LiveRamp to create European Unified ID, a new privacy-first, interoperable solution for the European advertising market.

The formula for Forward Annualized Revenue Expectation is a betting lens into what is expected vs. macroeconomic expectations. For example, TTD did $1.2 billion in 2021 revenue and just posted $315 million in Q1 2022 revenue. If you take TTD’s Q1 2021 revenue of $220 million and solve for the annualized proportion, you get $1.7 billion in expected revenue for FY22n— that’s 43% growth.

LiveRamp (RAMP)

Speaking of LiveRamp, Q1 revenue was up 26% from a year earlier, while stock performance since RAMP’s Q1 earnings announcement on February 9 is down -43% and trading dangerously close to a 52-week low.

Based on Q1 2021 revenue of $150M, RAMP's forward revenue expectation for 2022 is $638M, 26% higher than 2021 total revenue.

Best News: Given the UUID deal with TTD, and comparing the combined effort to other top players, UUID 2.0 was in need of a boost.

ID5 is a venture-backed identification provider with a suite of identification services that appear to be the little engine that could. With $7.2 million in total funding according to Crunchbase, and assuming ID5 is breaking even or better on a cash flow basis (which indicates top management skill), we wonder how long it will be before they take in some top-up money when nobody else can and/or get acquired by a suitor looking past the coming trough toward where usable/targetable IDs are heading.

Criteo (CRTO)

QoQ revenue change was up 3% at their Q1 earnings call on May 4.

CRTO’s stock price was up 10% from the day before earnings and up 7% since then but is trading just 14% above its 52-week low.

Based on Q1 2021 revenue of $184M, CRTO's forward revenue expectation for 2022 is $804M, which is 3% higher than 2021 total revenue. Quo Vadis smells a beat on that number!

Most Important News: Retail Media Contribution ex-TAC grew 48% year-over-year (at constant currency), increasing 51% year-over-year. In light of Marriott deciding to join the club known as “on a long enough timeline, everyone sells ads,” along with CRTO’s identity position (+ great cash position and little debt) and proven ability to generate free cash flows (unlike most other companies we track), we think CRTO is in good shape to weather the coming storm. Not to mention Criteo’s owned-and-operated identity solution is in a Peloton position — not the company PTON, the bicycle race in France where Criteo’s heart is based. :)

S4 Capital (Media.Monks)

After delaying 2021 results a few times due to purported accounting hiccups, year-over-year revenue for Sir Martin Sorrell’s all-digital play was up 101%.

Gross profit was up 90% YoY, but gross profit margins fell from 86% to 82%, with EBIT coming in at –£42 million. No big deal — plenty of time with plenty of whoppers out there to turn revenue growth into profits and free cash flow.

S4’s stock price was down –7% after reporting Q1 earnings and down –14% as of May 20, trading just 6% above its 52-week low.

Good News: The elephant in the room is gone, with investors taking note that SFOR’s stock price is up 105% since going public, beating the NASDAQ by 2x. We would not be surprised to see gross profit hit unicorn status in 2022. Why? Because the business model is in the right place at the right time. Who else out there has weathered more macro storms and come out ahead?

Pubmatic (PUBM)

Q1 revenue was up a healthy 25%, but that did not move the stock price when PUBM reported on May 9.

The good news is that stock performance is up 18% since reporting, but Pubmatic is trading just 22% above its 52-week low.

Based on Q1 2021 revenue of $55M, PUBM's forward revenue expectation for 2022 is $238M, which is 25% higher than its 2021 total revenue. Given that PUBM owns its tech and management seems focused on growing organically vs. acquiring revenue, Quo Vadis thinks this is the best long-term play for SSPs looking to get on (and stay on) the “flight to quality.”

Cool News: Rajeev Goel, cofounder and CEO of PubMatic, was named an Entrepreneur Of The Year® 2022 courtesy of Ernst & Young. Entrepreneur Of The Year is one of the preeminent competitive business awards for entrepreneurs and leaders of high-growth companies who think big to succeed. Congrats, Rajeev! From what we can tell, Pubmatic is very well-managed — this is key in good times and even more so in bad times.

Magnite (MGNI)

Q1 revenue was up 93% from a year ago and trading 24% above its 52-week low. MGNI’s stock price was up 5% on earnings day and is still up 5% since reporting.

Based on Q1 2021 revenue of $118M, MGNI's forward revenue expectation for 2022 is $906M, which is 93% higher than 2021 total revenue. Yes, we hear you. That number sounds out of whack. MGNI would need to acquire more growth revenue (or have a whopper second half) to keep up that pace, but those acquisition opportunities seem to be weakening as adtech faces a full-court press.

Biggest News: MGNI’s ex-TAC revenue attributable to CTV was $42.3 million for Q1 2022, up 253% year over year. As our readers know, this CTV topic is a recurring theme for Quo Vadis because nobody really knows what this inventory is or from where it is sourced. Can anyone out there in Programmaticland provide a forensic data trial with screenshots of the ads and where they ran?

Roku (ROKU)

While ROKU is not 100% dependent on programmatic media success, it does have a material impact on the business. Overall Q1 revenue was up 28% from one year earlier and trading 25% above its 52-week low.

ROKU’s stock price was up 8% when management reported earnings on April 28 and up 11% since reporting.

Based on Q1 2021 revenue of $734M, ROKU's forward revenue expectation for 2022 is $3.5 billion, which is 28% higher than their 2021 total revenue.

More CTV News: Management’s Q1 letter to shareholders said, “The gap between ad dollars and viewership is starting to close, and eventually all TV advertising will be streamed.” While that prognostication might eventually come true, it’s hard to believe that current take-rates will persist in the TV world dominated by supply-side bargaining power and even harder to believe that the best inventory will be traded on biddable pipes. Time will tell.

Integral Ad Science (IAS)

IAS’s Q1 revenue was up 33% from one year earlier.

Stock performance since their earnings announcement is up 11%.

Integral Ad Science is trading 18% above its 52-week low.

Based on Q1 2021 revenue of $89M, IAS's forward revenue expectation for 2022 is $430M, which is 33% higher than 2021 total revenue and 3% higher than the consensus at $417M.

Important News: A data scientist by the name of Sam J posted his view on LinkedIn: “The industry does NOT want you to think about this topic. But bots don’t consume products and services. They do consume marketing budgets.” And adtech companies get paid on a percentage of volume basis. Show us the incentive and we’ll predict the behavior.

Augustine Fou expressed a similar sentiment on LinkedIn: “The flywheel of ad fraud. Perps that already made money can easily pay for fraud verification to check their bots are working. They also pay for MRC accreditation so they can operate in broad daylight. Some even set up fraud detection firms so they make money coming and going.”

DoubleVerify (DV)

Looking at IAS’s brethren, DoubleVerify, Q1 revenue was up 43% from one year ago and trading 30% above its 52-week low.

Although DV’s performance failed to impress investors on earnings day, taking the price -5%, investors have woken up on the happier side of the bed since then, taking the stock up 17%.

Based on Q1 2021 revenue of $97M, DV's forward revenue expectation for 2022 is $466M, which is 43% higher than its 2021 total revenue. That seems like a stretch.

Funniest News: The great Bob Hoffman went wild in his weekend newsletter, deciding to make a bold but believable prediction: “I hate making predictions. I'd much rather make fun of the fools who think they can predict the future. But today I'm going to go against all my best instincts and become a prediction idiot myself. I think in the next 12 months, the foundation of the adtech industry is going to fall apart.”

If Bob is right, and a real “flight to ad quality” prevails such that marketers tighten their belts and get back to advertising discipline vs. spending money in a game of ad brinkmanship, then our forward revenue expectation formula will likely fall apart.

Taboola (TBLA)

Q1 net revenue (ex-TAC) was up 24%, but the stock is down –7% since reporting on May 13 and trading dangerously close to a 52-week low.

Based on Q1 2021 revenue of $112M, TBLA's forward revenue expectation for 2022 is $549M, which is 24% higher than their 2021 total revenue.

No News, But A Question Instead: Does Taboola buy traffic?

Outbrain (OB)

For Outbrain, Q1 net revenue (ex-TAC) was up 2% from one year earlier, sending the stock down –25% since reporting on May 12. Outbrain is trading just 6% above its 52-week low.

Based on Q1 2021 revenue of $54M, OB's forward revenue expectation for 2022 is $245M, which is 2% higher than their 2021 total revenue.

No News, But The Same Question Instead: Does Outbrain buy traffic?

Zeta Global (ZETA)

Q1 revenue was up 24% from one year earlier. That might sound okay, but the investors sold off, pushing the stock down –5% since reporting on May 11.

Compared to other adtech players, at least Zeta Global is trading 47% above its 52-week low, which is much better than most of the sector.

Based on Q1 2021 revenue of $126M, ZETA's forward revenue expectation for 2022 is $566M, which is 24% higher than their 2021 total revenue.

Worst News: The last thing you want is to end up in Edwin Dorsey's Bear Cave newsletter (your weekly source of short-seller news). Zeta Global made it in, getting described as "a roll-up of low-quality marketing and data gathering companies.” Not good.

Tremor (TRMR)

Q1 revenue was up 13% from one year ago and the stock is up 9% since reporting, but it’s still trading only 18% above its 52-week low.

Based on Q1 2021 revenue of $71M, TRMR's forward revenue expectation for 2022 is $384M, which is 13% higher than their 2021 total revenue. Will they make it in such a tough market?

When In Doubt News: Tremor has 40 mentions of the word CTV in their earnings transcript. That’s stunning, but not surprising. You’ll hear this word more and more as things go from bad to worse for adtech. In the fraternity party of adtech, the best advice is “When in doubt, whip it [CTV] out.”

Acuity (ATY)

For ATY, Q1 revenue was down -13%, but that was better than what the market expected, sending the stock up 33% since reporting on May 13.

Based on Q1 2021 revenue of $19M, ATY's forward revenue expectation for 2022 is $106M, which is -13% lower than their 2021 total revenue. This is what can happen to advertising businesses caught up in macro econ troughs, particularly small ones that need to attract more and more ad budget. Accomplishing this limbo dance will get increasingly difficult in a “flight to quality” environment.

News: Nothing in particular.

Viant (DSP)

Q1 revenue was up just 8% from one year ago, sending the stock price down -8% since reporting on May 4. As of May 20, Viant is trading just 19% above its 52-week low. How low can you go?

Based on Q1 2021 revenue of $43M, DSP's forward revenue expectation for 2022 is $241M, which is just 8% higher than their 2021 total revenue. It’s going to get tough out there for these smaller players.

News: Nothing in particular.

AdTheorent (ADTH)

Q1 revenue was up 10% from one year earlier.

ADTH’s stock price was up 9% the day after announcing Q1 earnings, holding up at +11% since reporting on May 12.

Based on Q1 2021 revenue of $34M, ADTH's forward revenue expectation for 2022 is $181M, just 10% higher than their 2021 total revenue.

Biggest News: AdTheorent is the only stock out of the 18 we track that is currently above its mid-point 52-week high/low range, currently trading 110% above its 52-week low—a standout in the sector.

Why is that? Maybe it’s because AdTheorent’s CTV revenue grew 42% in Q1 2022 compared to Q1 2021. Management believes that its “data-driven and performance-focused approach to CTV is a competitive advantage that will sustainably drive above-industry revenue growth.”

That’s great except for one little problem: When the forensic folks get into the data, what are the odds they can’t find the source of all that CTV inventory everyone in the sector is hyping up and betting on? Where is it? What is it? How can it be so?

Innovid (CTV)

Speaking of CTV, Q1 revenue for Innovid was up 44% from one year earlier. Stock performance is up 4% since reporting earnings, and CTV is trading well above its 52-week low.

Based on Q1 2021 revenue of $26M, CTV's forward revenue expectation for 2022 is $130M, which is 44% higher than 2021 total revenue.

Biggest News: Innovid put out a new study claiming “Global CTV Impressions Outpace Mobile, Accounting for Nearly Half of Video Impressions.” We’ll buy you a drink at Programmatic IO in Vegas next week if you can show us where all this CTV inventory is coming from!

Buzzfeed (BZFD)

Q1 revenue was up 26%, and so is the stock by 18%.

Based on Q1 2021 revenue of $92M, BZFD's forward revenue expectation for 2022 is $502M, which is 26% higher than their 2021 total revenue. That’s a tall mountain to climb if the “flight to ad quality” takes off.

News: Nothing in particular.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.