#2: Who Says Ads Don’t Work? Wasn’t Me!

How wrong could we be and how much might we change our answer?

Welcome to Quo Vadis, your periodic source for fresh programmatic news and off-the-beaten-path perspective. If someone was kind enough to share this with you, then you’re in luck! Just click here to join the conversation.

Today is National Get Over It Day! Programmatic people everywhere are self-reflecting and moving on from all their identity issues.

Cheetos Are Oh So Good

A Case Study in Media Math

It’s been one month since the big Super Bowl extravaganza, giving us ample time to marinate once again on the big question: “Is it worth it?”

So, when we see branding gurus make claims like, “You’d be foolish not to advertise on the Super Bowl” — because it ONLY costs $5.5 million for your 30-second shot at advertising glory — we’ll take the bait and test that giant assumption.

Who doesn’t like those crunchy, cheesy delights known as Cheetos? I certainly do! I'm munching away right now… for inspiration's sake, of course.

I’m not alone. In the 30 days since the Super Bowl — where Tom Brady and his Buccaneers’ defense crushed the “unbeatable” KC Chiefs — 77 million Americans have enjoyed 2 bags of Cheetos.

The few times a year when I indulge, I can’t get enough of those finger-licking-good, perfectly crunchy morsels. I know they’re engineered for addiction, but I go for it anyway. So make that 77 million + one.

Like so many others, I’m already branded. But will I munch on more Cheetos, or perhaps try Frito-Lay’s new Cheetos Crunch Pop Mix, just because of a star-studded ad during Super Bowl LV? Not gonna happen.

Will $20M+ for a Cheetos Super Bowl Ad Ever Pay Off?

This year, Cheetos’ 83-second Super Bowl ad featured two A-list actors, one Grammy winner, and an A-list director. Quo Vadis estimates that the all-in cost was around $20M. If Frito-Lay is looking for positive ROI, they’ll have to sell mountains of Cheetos to get there.

More specifically, if such a big-budget splurge ends up selling more comfort junk food than Frito-Lay would have sold without running the ad, then great. But is it likely?

What does the math say?

If the ad was actually worth it, then Frito-Lay needs to sell an extra 20 million bags of Cheetos. Is that in the realm of probabilities? Nobody really knows, but one thing we can do is break down the math to see what the odds say.

Media Cost

A 30-second spot for Super Bowl LV costs $5.5 million. Cheetos bought 83 seconds, which comes to just over $15M (assuming no discount).

A-list Actors and a Grammy Winner

With two big-time actors — Mila Kunis and Ashton Kutcher — plus another big-time musical artist — Shaggy, the one and only — the ad bill rises another $3 million (more or less, let’s not split hairs quite yet).

Music License

What about the music licensing for Shaggy’s famous tune “It Wasn’t Me?” Let’s be cheap and throw in another $100K. It’s probably double or triple, but who’s counting.

A-list Director

Friends of Quo Vadis in the creative production biz tell us a glitzy super bowl ad could easily cost a million or more, particularly when an A-list director like director Bryan Buckley is attached. The price tag for a two-time Oscar-nominated director who was dubbed the "King of the Super Bowl" by the New York Times could not have been cheap. So, let’s say Buckley cost a smooth million.

Grand Tally

Air time = $15M

Stars + Music = $3.1M

A-List Production = $1.5M

All in, the total cost is a whopping $20 million! Probably more.

Was It Worth It?

Cheetos’ global sales are $4 billion, and we know from Pepsi Co’s 10-K/21 that Frito-Lay does around 60% of revenue in North America (2021 10K). So, even though the Super Bowl is a global phenomenon, let’s assume the ad for Cheetos Crunch Pop Mix was targeted to US consumers aiming to increase Cheetos $2.5 billion in annual US revenue (60% x $4B).

TIME OUT

"How wrong could we be and how much might it change our answer?"

The Frito-Lay division of PepsiCo cranks out tantalizing 30% operating margins. So, after spending $20M in shareholder cash on a glitzy Super Bowl ad, that decision would need to generate $65M in incremental sales just to break even on the expense ($20M ➗ 30%).

Walmart, Amazon, grocery stores, and gas stations sell Cheetos for $3.00 a bag. If the $20M was money well spent, then an army of consumers will be totally mesmerized by the ad and consume an extra 22 million bags at some point in the future ($65M in incremental sales ➗ $3.00 per bag).

Since the ad was for a new product launch, it feels safe to assume that the goal is to get people munching away sooner rather than later. As the thinking goes, Cheetos Crunch Pop Mix is tasty enough, then people will hopefully talk about it, post selfies on Instagram, and invent fun Cheetos dances on TikiTok to promote their brand love. If all that turns into more than enough incremental sales, then great!

The Hard Reality of Probabilities

Even though the good folks at Frito-Lay claim advertising success with PR headlines — “Cheetos Crunch Pop Mix Steals the Spotlight with Super Bowl Ad Featuring Ashton Kutcher, Mila Kunis, and Shaggy” — the big question remains. As good or bad as this single starstruck ad was, will it increase sales by 2.6% ($65M ➗$2.5B)?

Since Frito-Lay’s YoY sales growth is around 3%. Given our math, it seems that the expectation for a single Super Bowl ad is to generate nearly an entire year’s worth of growth? Does that sound probable?

TIME OUT

"How wrong could we be and how much might it change our answer?"

I can hear the brand pundits now. “Branding is a long-term investment! It takes years for the investment to pay off!” We’re sticklers for numbers and assumptions, so let’s test that assumption too.

Sure, it makes sense that brands are nurtured over time, and good branding can create lingering sales effects. So, what if we compound Cheetos’ 3% annual sales growth on $2.5 billion in sales over the next five years to account for the brand effect?

After five years, North American Cheetos sales will have increased by $390 million. That means if a single Super Bowl ad contributed $65 million to the pot (just to break even), it would account for nearly 17% of total growth over the five-year period.

If you think this big advertising bet still makes sense, we should definitely head to Vegas and hit roulette tables with you!

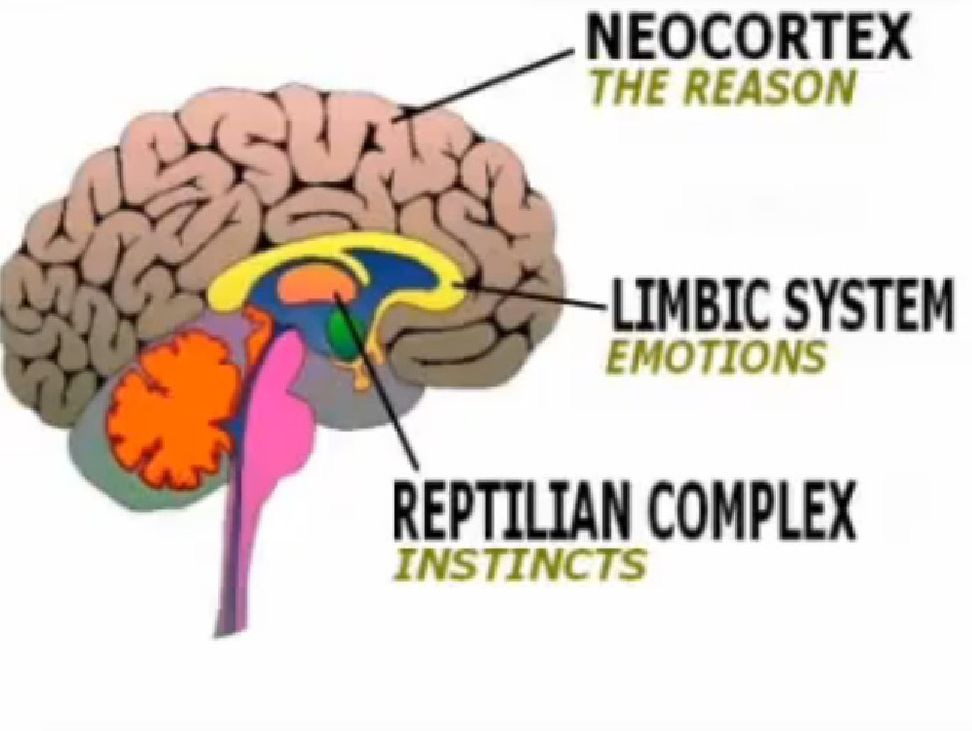

Your Reptilian Brain Is Getting Twisted by Advertising MadMath

Deep down inside, your reptilian or primal brain is saying, “Wait a second, there is no way those odds will ever pay off. Run for cover!”

But once the rational thinking brain kicks in with its executive functions, your answer can change dramatically. Executive functions are basically a collection of cognitive skills, including the capacity to plan, organize, initiate, self-monitor, and control one's responses in order to achieve a goal.

For example, what if the wrong incentives nudge marketers to outspend the competition in a quixotic quest for market share gains that ebb and flow independent of ad spend? What if escalating ad spend gets you invited to the really good parties at Cannes Lions? And maybe that Cheetos ad might even win a coveted Lions trophy! (those parties are really good, BTW!)

Maybe our line of thinking helps explain why advertising is always such a struggle. One part of the brain tries to do the obvious — like not dump $20 million on a bet with almost no upside — but then the other part takes over, desperately wanting to make everything in advertising seem totally believable.

Once the latter trumps the former (which it almost always does), all advertising decisions — including giant cognitive leaps of faith with programmatic ads — are great decisions, even when they’re not.

Nobel Prize-winning economist, Richard Thaler, explains it better than us! He also plays a cameo role in The Big Short. If Thaler’s explanation doesn’t explain the rationale for Super Bowl ads with such poor payoff odds, what does?

What About Programmatic Ads?

One thing is for sure with Super Bowl ads. Even though you might be in a Cheetos-and-Bud Light coma and not be able to tell one Super Bowl ad from another, at least these perfectly produced ads are totally viewable and the media context could not be better.

Now, let’s contrast that with Cheetos’ programmatic display ads. How about 50% viewability (on a good day), along with really good odds that many ads will be served to tons of bots on sites you would not want your mother to know about? Even if every single ad makes it through what we call “the ad quality minefield,” the pixels still have to render on a page or in an app after being “ad served.”

Just like Winston Churchill called democracy “the worst form of government, except for all the others,” it looks like Super Bowl ads might still be the worst form of advertising.

Programmatic advertising is the opposite — it’s probably the best form of advertising, except for the other alternatives. And that’s not because the tools or data are bad; it’s because the tools are used for purposes other than advertising.

It’s Just Basic Arithmetic

Research says Cheetos’ annual revenues are $4B globally. If Cheetos are like other CPGs and allocate 10% of revenues to advertising, then their total annual ad budget is around $400M, give or take.

Of course, not all of this is media spend. Around one-third is probably allocated to buying ads, with the other two-thirds going to creative production and trade marketing.

So, if media spend for Cheetos is $133M, and around 15% runs through a DSP to buy display ads (like at other CPGs), then Cheetos probably dumped around $20M into programmatic in 2020.

Have You Ever Seen a Cheetos Display Ad?

You’ve probably never seen a Cheetos display ad during all those countless hours you spend consuming ad-supported content. Don’t worry, you’re not alone.

It turns out that a simple search on Moat’s free banner ad tool (a verification company owned by Oracle) tells us that Cheetos runs all kinds of display ads.

But if you — and probably most other people you know — have never seen one, then where is the $20M in programmatic spend going? If programmatic ads are truly about advertising and connecting a product with an audience (and not a masquerade to spend big bucks and take fees), then why haven’t you ever seen a Cheetos display ad?

Sure, programmatic ads bought via DSPs and sold by SSPs have unresolved viewability challenges and other chronic ad quality issues, but that hasn’t stopped the market from growing from $0.00 in 2007 to $40B worldwide. What gives?

Perhaps the closest parable is how Moody’s, S&P, and Fitch gave junk mortgage bonds A+ ratings when the underlying mortgages were worthless. And look what happened to that market. Is programmatic too big to fail?

No, the answer cannot be negative odds.

Just think — if Super Bowl ads are one of the best ways to get consumer attention with a totally viewable experience and a deeply captivated audience, and the ROI odds make for a risky bet, then what are the odds that $20M in programmatic ads will actually pay off?

No, the answer cannot be negative odds. That’s not possible. Ok, maybe it is, but programmatic advertising has enough low-hanging fruit to deal with before delving into Quantum Mechanics.

Quo Vadis Sponsored Use Case

Get A Winning Hand With AdSlot Premium Automation

You’re a brand marketer, but you’re worried.

How can you buy the best ad inventory in a post-cookie world? How do you get the most viewable display ads? If you could get more guarantees, you’d sleep better at night.

You’re ok with programmatic auctions because you think the price is right. You love the promise of automated audience targeting. But you’re not sure what you get — there are no guarantees

Wanna Know a Trick?

Whether you’re running brand campaigns or trying to reinvent retargeting without cookies, there’s a trick you should know.

Stop listening to advice that puts programmatic auctions first. All those fees will clean you out, particularly the ones you don’t know about. They tell you, “don’t worry, we’re doing awesome Private Marketplace Deals.”

Sure, if you like bets with no upside, then stick with that advice. But publishers sell all the good stuff first. All the rest goes into auctions, even pre-bid.

But Old-Fashioned Insertion Orders Are a Big Pain!

You’re right. Buying premium guaranteed inventory with old-fashioned insertion orders is a pain. Endless email threads, last-minute dramatic phone calls, lost PDF attachments, and messy spreadsheets are all prone to mistake. It’s expensive, annoying, and unnecessary.

AdSlot Gets The Buying Job Done

Forget about all the manual work! AdSlot automates publisher-direct media buying through a direct ad server connection with all the top publishers. Streamline your buying across all the top media brand sites where 95% of audiences go every day. It’s a no-brainer.

Want to Learn More?

Invest 30 minutes of your time to make your ad buying better, faster, cheaper.

Join our Quo Vadis Education Session on March 31st when your truth-seeking host, Tom Triscari (CEO, Lemonade Projects) will interview Cary Dunst from AdSlot.

We’ll Put Some Aces In Your Pocket

Brand Marketing Masters — we’ll show you how to blend attention metrics with premium buying.

Direct Response ROAS Freaks — we’ll show you how to turn premium inventory into ever-fresh retargeting pools with 1st party data.

Ask Us Anything (About Programmatic)

If you are confused about something, a bunch of other folks are probably confused about the same exact thing. So here’s a no-judgment way to learn more about the programmatic ad world. Ask us anything about the wide world of programmatic, and we’ll select a few questions to answer in our next newsletter.

Join Our Growing Quo Vadis Community

Was this email forwarded to you? Sign up for our monthly newsletter here.

Get Quo Vadis+

When you join our paid subscription, you get at least one new tool every month that will help you make better decisions about programmatic ad strategy.

Off-the-beaten-path models and analysis of publicly traded programmatic companies.

Frameworks to disentangle supply chain cost into radical transparency.

Practical campaign use cases for rapid testing and learning.