April 2, 11 AM ET: Use Case Webinar with Adelaide Metrics | Pricing MFA Out Of Your Ad Buys

Special Guest: Marc Guldimann, CEO and co-founder of Adelaide Metrics

Are you in? The AdTech Economic Forum is 29 days away. Many of our readers already know that attention metrics are the new currency of pricing media. That’s a fundamental shift changing how media money flows and gets measured. Marc Guldimann is one of the world’s top experts on the “attention economy” and his academic background in Social Decision Sciences from Carnegie Mellon will be on full display at The AdTech Economic Forum when he moderates a session called “Publisher Economics Are In Flux” with Paul Bannister (Chief Strategy Office of Raptive) and Sheila Spence (VP of Corporate Development at Spotify).

AdTech Economic Forum is invite-only. If you want to be there and improve your fluency in the language adtech economics then get on the invite list today.

Pricing MFA Out Of Your Ad Buys

“What you have to do and the way you have to do it is incredibly simple. Whether you are willing to do it is another matter.” — Peter F. Drucker

Situation

MFA sites masquerade as high-quality content but generate low attention units or none at all. That’s a fact.

MFA sites exploit an arbitrage opportunity by buying cheap clicks and filling pages with ads to earn more than the cost per click (CPC), misleading advertisers with high viewability and brand-safety scores despite their low value. Quo Vadis illustrated how MFA site owners think about financial math in December 2023 — it’s so easy.

Complication

Using blocklists to avoid MFA sites is ineffective. That’s also a fact.

MFA operators can easily create new domains whenever one is blocked and continue their arbitrage practices. They always seem to be one step ahead of the buy-side making it difficult for advertisers to identify and avoid these low-quality placements resulting in wasted ad spend. Of course, it helps a lot when advertisers explicitly demand cheap reach inventory not realizing (or ignoring) the fact that a $2 CPM actually costs $40 if just 5% of the impressions turn into ads that matter.

Solution

By integrating attention metrics with your DSP bidder you enable attention-based bid pricing. That’s a thesis and it’s a good one. It’s probably a fact too but you can’t turn a thesis into fact unless you test and learn.

By comparing placement quality based on actual attention metrics rather than superficial measures like VCR and viewability, advertisers can bid appropriately, paying more for high-attention units and less for low-quality placements.

Impact

Implementing attention-based metrics to correctly value media prices disrupts the MFA profitability model by bidding the true value of the media on offer in auctions (or on a direct-buy basis) which in turn eliminates the MFA arbitrage opportunity. It’s a matter of fighting MFA arbitrage with your own arbitrage strategy. Beat them at their own game.

By ensuring that bid prices reflect the true value of media placements, the arbitrage opportunity that MFA sites rely on is eliminated. This approach reduces the incentive for MFA activities, leading to a healthier advertising ecosystem where ad spending gets allocated towards genuinely engaging and valuable content, benefiting advertisers, consumers, and publishers.

Rule of Thumb: The price an any good or service — from MFA sites to apples, cars, plane tickets, toothpaste, etc. — is nothing more than the information you have before you buy it.

Bid Price Mechanics 101

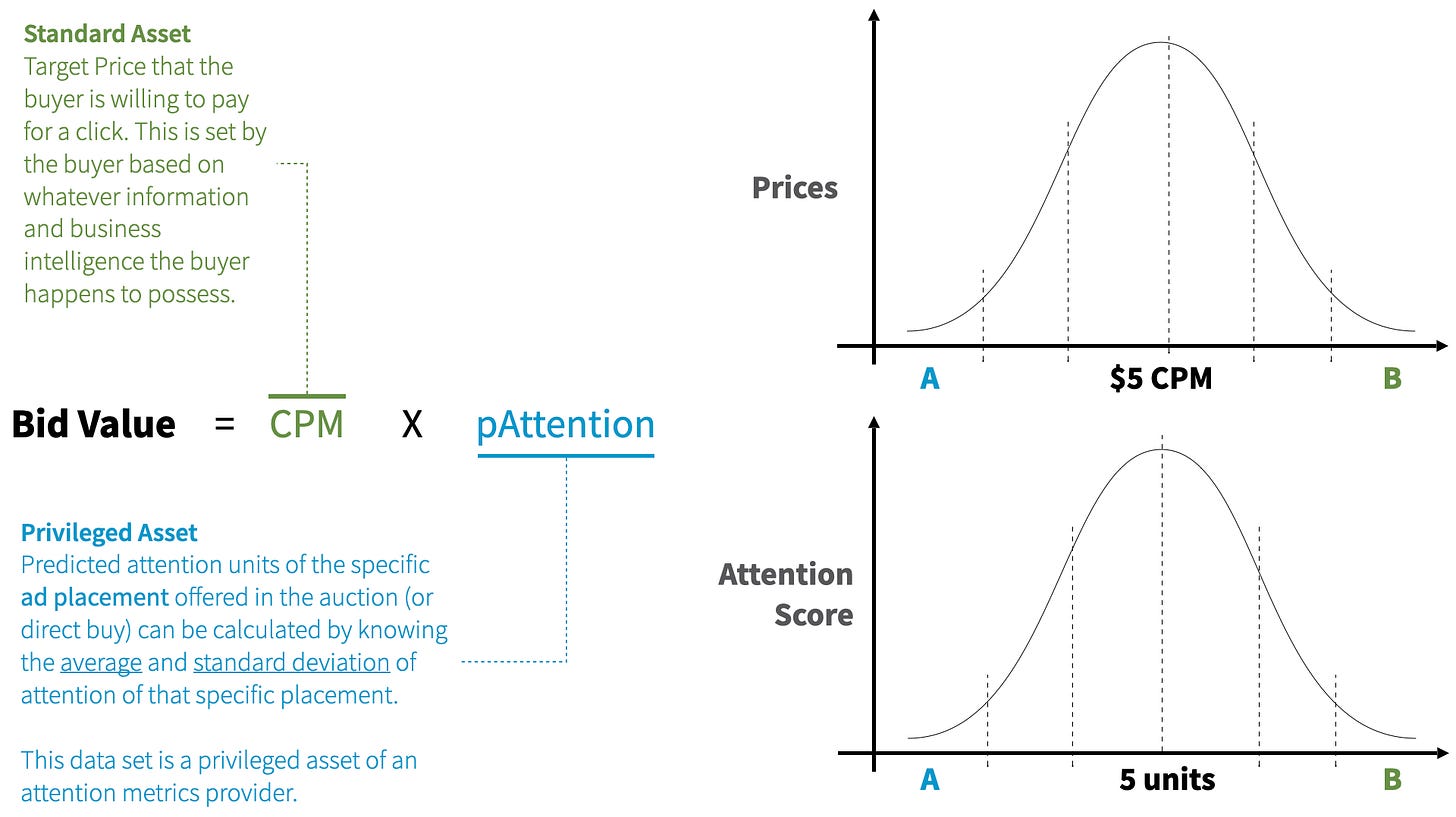

Let’s dig into bid price mechanics from the perspective of a retargeter to illustrate the concept of privileged data assets, capabilities, and power. With that laid out, we can apply attention data to the same concept which is one of the topics we’ll cover in our webinar on April 2 (Register Here).

That’s the basics of retargeting bid pricing in a nutshell. For example, if an advertiser is willing to pay $1.00 for the “ideal” click and the DSP bidder predicts the user ID in question has a 1% chance of clicking, then the eCPM Bid Value is $10.00.

The data set required to accurately predict that 1% click probability is a privileged asset held by DSPs with massive scale. This mathematical factor explains why so much money is moving to retail/commerce media as the 3rd party cookie goes away and why DSPs with scale (e.g. Trade Desk, Yahoo, etc.) are striking deals as off-site tech partners.

But that’s not all. Knowing the user’s historical conversation rate across all activities is another major privileged asset while the conversion rate of the campaign is a “standard asset” and readily available to any advertiser. An individual advertiser knows the conversion rate of its own users, but it does not know the universal conversation rate across all that user’s activity. That’s a privileged asset and market power.

Turning back to our example, let’s take our $10 eCPM bid value and assume the user ID has an average historical conversion rate of 2% and the ad campaign in question is converting at 1%. That’s great to know because it doubles the bid value to $20. Conversely, if the historical conversation rate of the user in question is 1% while the campaign is crushing it with a 2% conversion rate, the eCPM bid value falls to $5 because the user has less propensity to buy.

Apply the same concept to attention metrics

The retargeting example is the domain of direct response advertisers. Upper-funnel brand advertisers don’t care about clicks (nor should they ), they care about attention and salience.

Advertising — and pretty much everything else — always comes down to an expected value probability. If buyers can predict with decent accuracy the attention units generated by an ad (before bidding), then they can use this privileged asset to properly price media buys.

For instance, imagine a CPG buyer is willing to a pay $5 CPM for good cookieless audience targeting data (perhaps sold by the publisher and/or an identity provider). The rest of the advertiser’s budget buys the actual media.

Let’s say the CPG is also willing to pay $5 for the “idea” ad placement which gets an average attention score of 5 units. By calculating the average and standard deviation of the price paid and attention units, the rest is straightforward.

If you pay price point A (low price) you should expect to get attention unit A (low attention). That’s a fair price.

If you pay price point B (high price) you should expect to get attention unit B (high attention). That’s also a fair price. You get what you pay for.

If you pay price point A (low price) and get attention unit B (high attention), then you got an amazing deal and should keep buying it as long the price-quality spread stays in your favor. The opportunity to buy Porsches for Kia prices won’t last forever, so “get it while you can” as Janis Joplin said.

If you pay price point B (high price) but only get attention unit A (low attention or zero attention), which is the MFA case, then you’re in a lemon market situation resulting in a really bad deal.

Programmatic Lemon Market Game: The math is spelled out in this paper on Pages 16 and 17. This working thesis paper uses viewility data as a proxy for ad quality. Swap in attention metrics and the math works even better.

Privileged Asset: The ingredients for pricing based on attention data require having market-level (or near-universal) attention data across many sites and apps. Only scaled attention metrics providers can calculate the market average and market standard deviation.

Individual advertisers can only know their own statistics but they can “rent” what they need from attention data providers and feed it to their DSP and/or custom algo partners.

You heard it here first. Give it a go. What do you have to lose?

We’ll cover this topic and more with Marc Guldimann on April 2 at 11AM ET.

Ask Us Anything (About AdTech)

If you are confused about something adtechie, then a bunch of other folks are probably confused about the exact same thing. Send your question over and we’ll get you an answer.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.