#88: 2Q24 Portfolio Update

Healthy revenue growth, Improving EBIT margin, Break through resistance.

AdTech Economic Forum 2025: The Davos of AdTech is returning to The New York Times Center on March 19, 2025. We curating an experience like no other in adtech. Secure your spot today at the intersection of adtech, economics, and finance!

Where do they stand?

Earnings season for 2Q24 was good for adtech. As our readers know, Quo Vadis sits back a few weeks as the dust settles on adtech earnings season and watches how investors react to new data. Here’s what they saw in Q2:

Revenue growth looks healthy

EBIT margins are improving across the sector

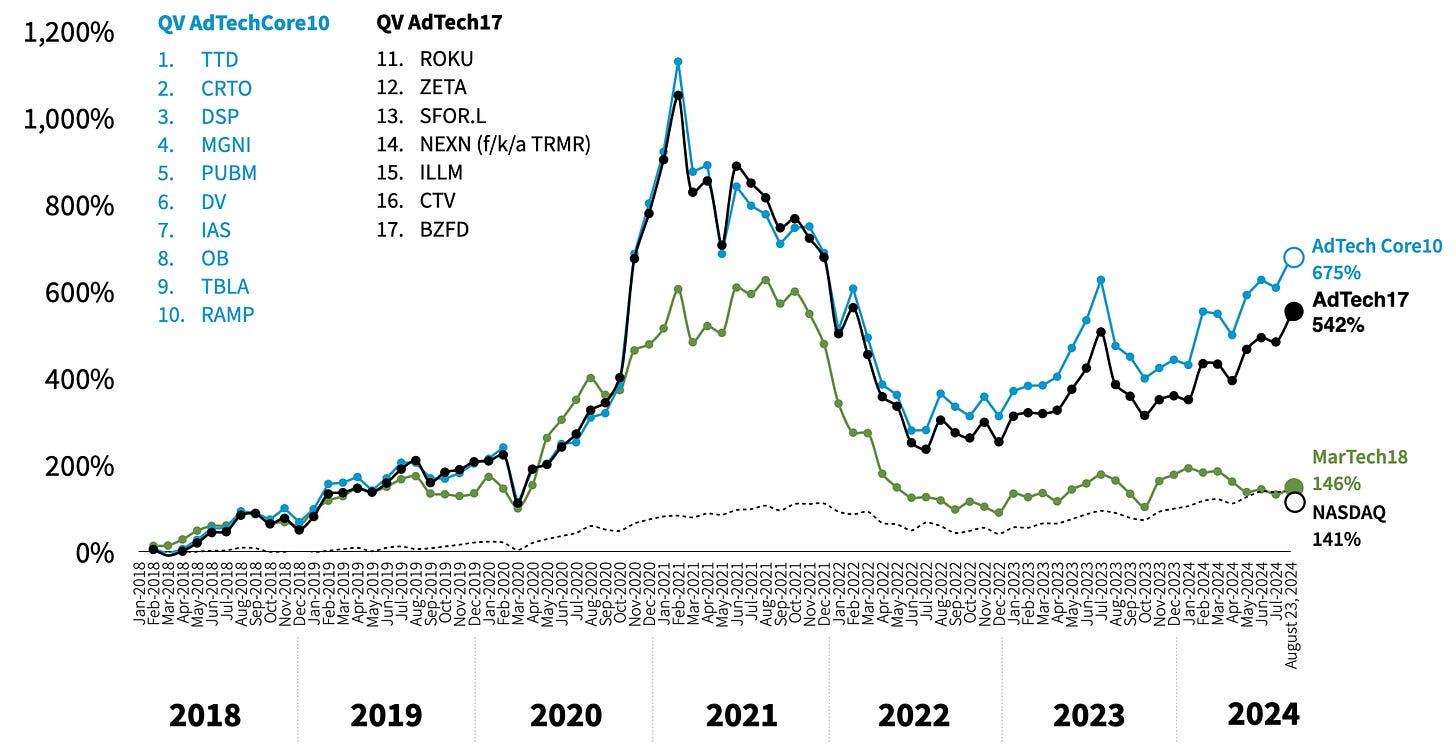

Adtech stocks have bounced within the same high-low boundaries since October 2023. Our AdTech Core10 portfolio broke through the upper boundary resistance in August.

Had you bet $100 in January 2018 when our AdTech17 portfolio started, you’d be up $542 today after accounting for your $100 initial investment. The AdTech17 was up ↑29% in the first half of 2024 and gaining steam on a year-to-date basis delivering ↑40% gains. Compared to the broader market, the NASDAQ was up ↑15% in the first half and up ↑18% year-to-date so adtech continues to outperform the broader tech market.

Good News: Magnite is making up ground on getting level with its IPO price in April 2014.

Most Interesting News: Investors seem to love Zeta. It’s trading at 25x book value (the highest in the AdTech17) yet TTM return on invested capital (ROIC) is –7% and the company has never made an operating profit. Go figure.

Quo Vadis Quarterly Update is brought to you by Adelaide. Procurement plays a critical role in selecting media partners, yet traditional metrics often fall short. Discover why attention metrics should be at the forefront of your digital procurement strategy for better efficiency, ROI, and brand impact. Learn more at Adelaide!

Portfolio Performance

Our AdTechCore10 consists of three DSPs (TTD, CRTO, DSP), two SSPs (MGNI, PUBM), two verification providers (DV, IAS), two evolving ad networks (TBLA, OB) and one identity provider (RAMP). The combined group is up 675% since January 2018 and trending upward in August.

We also track 18 MarTech stocks in an equal-dollar portfolio starting in January 2018. In Q2 the MarTech18 regressed to NASDAQ returns.

We find it interesting that Adtech companies usually make money on a CPM or percentage of media spend basis while MarTech companies usually charge SaaS fees. Conventional thinking says SaaS business models are supposed to be superior to business models linked to ad spend. If that’s the case, why does adtech deliver better returns?

As long as overall media spending keeps growing, one would assume adtech performance will likely follow.

Martech companies are different. What if CFOs and procurement folks start poking around cost efficiencies across the marketing stack. What if the consumer pulls back spending, with particular regard to SMB e-commerce products? If those two forces gain steam, we might see the MarTech18 dip below NASDAQ returns over the coming two quarters.

As they say in Econ 101, all costs are variable in the long run. That means a 3-year SaaS contract with a 30-day termination period is only worth the next 30 days of revenue.

Revenue Growth and EBIT Improvement

What a difference a year makes! One of the things we like to track is the “Rule of 20” which is revenue growth + EBIT margin. Sure, earnings reports across the adtech sector are full of non-GAAP “adjusted EBITDA” results which you should mostly ignore. If you instead want a more pure view of financial performance and valuation creation, then you’ll be better off focusing on EBIT (operating profits).

“Every time you hear 'EBITDA' substitute it with 'bull**** earnings'.” — Charles Munger

In any case, Q2 was good to adtech on a Rule of 20 basis. At the same time last year, combined net revenue growth ex-TAC and EBIT margins were mostly dismal with lackluster growth and terrible operating profit performance. Flashforward to 2Q24 and the AdTechCore10 is looking much better.

Weighted average YoY revenue growth across the AdTech Core 10 in 2Q24 was up 17% and weighted average EBIT margins across the group were close to 9%.

Looking back at 2Q23 compared to 2Q22, revenue growth was 11% but EBIT margins were –5.3%. At that time, only four out of ten generated positive operating profits.

Full-year growth in 2023 finished at 13% on 11% Q2 growth. Assuming ad spend levels remain stable for the rest of 2024, it would not be surprising to see revenue growth across the AdTechCore10 finish the year up ~18%.

Rule of 20 by Category

Our three DSP players deliver the best performance with TTD leading the way. We’d speculate that one of the reasons is that DSPs are closest to demand-side money flows and they control downstream payables.

Hats off to Viant for getting over the 20% hurdle rate in Q2. EBIT margins are close to breakeven so we expect to see DSP remain above 20% going forward.

Magnite squeezed out a profitable quarter with a 6.5% operating profit margin and 9% revenue growth inching it closer to our 20% hurdle rate at 15%.

Verification providers are a tail of two players. Historically, DV has performed well against the Rule of 20 while IAS has lagged. IAS flipped the script in 2Q24 edging out DV with similar revenue growth but better EBIT margins at 11.2%.

As far as our two ad networks go, Taboola put in 21% revenue growth compared to –14% in the same period last year. They also improved EBIT margins from –20% in 2Q23 to –5% in 2Q24. Taboola’s Yahoo deal is ramping up and driving these much-needed gains, “Ex-TAC Gross Profit, a non-GAAP measure, increased by $26.4 million, or 21.4%, primarily due to new digital property partners, a majority of which is related to Yahoo supply.” We assume continued growth going forward and a boost from TBLA’s new deal with Apple. We expect to see TBLA beat the Rule of 20 over the following two quarters.

Outbrain closed a massive M&A deal buying Teads for $1 billion and change using a private equity structure (debt financing). OB broke into positive revenue growth territory in Q2 and improved EBIT margins. Once Teads starts to kick in, we’d expect operating profit margins to jump past 20%.

Busting Through Resistance

With revenue growth and EBIT trending upward in Q2, our AdTechCore10 finally broke through upper boundary resistance. The portfolio flighted with the upper boundary in June, dropped in July, and busted through in August.

With rate cuts coming against a backdrop of a cautious consumer and slowing retail sales, we would not be surprised to see the AdTechCore10 bounce around the upper boundary for the rest of 2024.

Choice Comments from 2Q Earnings Transcripts

Viant — look at the scoreboard more closely

We are experiencing a new paradigm with the accelerating rise of streaming and the growing dissatisfaction with the walled gardens, with the larger players trying to set the rules for ad tech.

As it turns out, Meta had another blowout quarter with 22% revenue growth and a rosy outlook. TikTok is growing like a weed and so is Amazon’s ads business growing 20% in the period. Snap’s revenue was up 16% in Q2. Google’s ads business was up 11% with YouTube was up 13%. So, if advertisers are so dissatisfied with walled gardens, why do they continue to increasingly allocate ad budgets to them? One reason might be that walled gardens are the least-worst alternative. And a related reason might be because that’s where they can target audiences with the most precision and effectiveness.

Criteo — the one-stop retail media enters escape velocity

Our vision is quickly coming to life as we continue to transform our company into a Commerce Media powerhouse. We have a leading market footprint, including 65% of the top 30 retailers in the Americas and 50% of the top 30 in EMEA, and we believe we've become the hub of Retail Media to complement Amazon.

Speaking of scoreboards. Check out Mimbi’s Retail Media Network Index. Everything Megan Clarken says checks out. The other thing not enough folks realize about Criteo is the size and value of its conversion data. It’s massive and getting bigger.

TTD — on cheap reach, stones, and glass houses

First, much of the mass scale is predicated on cheap, owned and operated content, which is often just user-generated videos or social content that is essentially free to produce and ultimately, mostly lower quality and higher risk for large advertisers. The big tech owners of this content have an inherent incentive to direct demand toward it because the margins on it are so significant. But it's often not where the marketers target customers spend most of their time nor where they're the most leaned in. Second, after several years of uncertainty, the business flaws of cheap reach are more apparent than ever.

If a CMO has been going to the CEO or CFO and saying, look, I was able to drive down costs, and the scorecard says it's working. But then a couple of years later down the road, business results are not consistent with those marketing metrics. And as a result, there's a disconnect. This is arguably one of the main reasons that CMOs have the shortest tenure on the C-suite.

Everything is relative. Any economic good, including an ad impression, is cheap relative to an average and standard deviation. For example, let’s say the average CPM across all the various channels like linear TV, streaming CTV, outdoor, radio, streaming audio, search, display ads on social, banner and video ads on publisher and commerce media sites, etc. is $20. Let’s also say the standard deviation is $5. Let’s further say the average clearing price on TTD’s platform is $5 even though it could be close to $3. That’s three standard deviations from the mean. If relativity matters, then that means TTD sells cheap reach inventory if the average price is in fact around $5. That said, the more TTD succeeds going upstream to secure verifiably high-quality CTV inventory, the less it will be dealing in cheap reach.

Another interesting analysis on this point would be to price inventory by something fungible like attention units. For instance, buying $5 inventory that scores low on attention (like banner ads) is not the same as buying $5 inventory that generates a high attention score. The former could be worth $1 in real dollar terms while the latter could be worth $20.

Regarding the comments about CMO tenure, Brian Wieser from Madison & Wall already set us straight in his August 8th post:

Incidentally, the latest report from Spencer Stuart on CMO tenures shows an average tenure of 4.2 years vs. 4.5 years for other C-level functional leaders, a difference which is hardly likely to be a consequence of “data predicted on cheap reach that doesn’t match up with the business outcomes over time.” Moreover, if larger brands’ marketing choices are successful, they should impact brands over much more than 4.2 years, illustrating further why this assertion is unlikely.

Ask Us Anything (About AdTech)

If you are confused about something adtechie, then a bunch of other folks are probably confused about the exact same thing. Send your question over and we’ll get you an answer.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.