#85: Teads $2.2 Billion Fair Market Value

Mark your calendars! The Davos of AdTech is returning to The New York Times Center on March 19, 2025. We set a high bar at our inaugural event last April. We intend on smashing it with another highly curated experience at the intersection of adtech, economics, and finance. We have limited seating and tickets will go fast. If you want to lock in your seat before we sell out, get it done today!

Teads is in play

Adtech M&A is certainly heating up. Last week Digiday reported that Teads is exploring various sale options:

In September 2023, “Teads owner Altice Europe appointed Morgan Stanley to advise on the divestiture of the ad tech asset it acquired for $307 million in 2017 with sources telling Digiday that both private equity and strategic players have explored a deal.”

The reported valuation at the time was in the rarified territory of €2.5 billion to €3.0 billion. (USD ~$2.75 to $3.25 billion). Digiday’s coverage last week also said, “Separate parties familiar with the financials told Digiday it is widely understood that Altice’s initial target price was north of $1 billion.” The last time adtech saw an M&A deal north of $1 billion was when AT&T bought Appnexus six years ago in 2018.

This kind of news piques our Quo Vadis curiosity so we did our best to puzzle together a fundamental valuation model. As imperfect as it may be, our model tells us that $2.2 billion is close to the magic number.

If you want access to our model and the valuation narrative discussed in this post, feel free to reach out to tom@lemonadeprojects.com. Teads Fair Market Value

Let’s start by translating available public information into a valuation narrative. We have more than enough primary puzzle pieces to get a good directional idea:

July 2021 F1 SEC filing for IPO (note that F1 filings are the same as an S1 filing. The main difference is that an F1 is for foreign companies that are planning to list their securities on U.S. exchanges or offer their securities to U.S. investors. An S1 is for US companies looking to do the same.

Teads most recent self-reported fiscal 2021 financial results.

LinkedIn current employee count (aka “associated members”).

Teads Business Model

At its core, Teads is a well-done ad network with a proprietary ad unit embedded in publisher sites. On the supply side, Teads claims direct integrations with more than 2,800 publishers who run its proprietary ad unit. On the demand side, Teads offers a self-serve buyer interface as well as a managed service and earns a healthy fee (aka “take rate”, “gross margin”) by connecting the two sides. It’s a classic ad network that creates asymmetric information vis-a-vis data collection and enrichment which in turn generates the circumstances for margin creation.

Teads Revenue Puzzle

Let’s start with what we know from Teads’ SEC filings and self-reported financials in 2021.

Teads reports on a gross revenue basis (aka “gross ad spend” in TradeDesk parlance). As our readers know, everything in adtech starts with how much media spend a company can attract and its ability to extract a fee. Teads does well on both counts.

As of FY21, Teads was operating a relatively large business compared to say public companies like Viant with just $223 million in gross revenue or AdTheorent with just $170 million in FY23. Teads processed $678 million in gross ad spend in 2021. We estimate $852 million in FY23.

Teads ‘ F1 filing does not break out Cost of Revenue between traffic acquisition costs and the variable costs to process data.

F1 filing pages 28/29: “Traffic acquisition costs consist primarily of fees paid to third-party publishers or media owners and strategic partners that are directly related to a revenue-generating event. It allows [Teads] to have a direct and exclusive access to the inventory. Other cost of revenue includes expenses to third-party hosting fees, data purchased from third parties, insights cost and platform operation.”

We looked at Taboola and Outbrain as rough “ad network” comparables. TBLA and OB break out ex-TAC from other costs of revenue. TBLA’s processing costs are 8% of gross ad spend and OB is 4%. We use the average of 6% as an assumption for Teads to arrive at net revenue ex-TAC for FY19 and FY20.

Next, we turn to headcount growth as a proxy to estimate gross ad spend. Teads reported $678 million in gross ad spend in FY21 but did not provide much more information at that time other than claiming 1,035 employees

What we do know is that gross ad spend grew 25.5% between FY20 and FY21 and headcount grew at a near identical rate.

LinkedIn tells us that Teads currently has 1,326 employees (aks “associated members”) at the end of 1H24. We ran a straight-line calculation to fill in FY22 and FY23 with 1,175 and 1,300 employees, respectively. This translates to a 13.5% proxy of revenue growth in FY22 and 10% in FY23. Our puzzle is starting to get filled in.

We apply these employee growth rates to reported gross ad spend in FY21 and arrive at roughly $850 million in gross ad spend for FY23.

Pre-covid gross margins were 51% in FY19 and ballooned to nearly 60% in FY20. Based on post-covid normalization observed across public adtech players, we assume 50% gross margins in FY21 to FY23 which gets us to around $425 million net ex-TAC revenue for FY23.

Cost of revenue, Traffic Acquisition, Operating Expenses, and EBITDA Margin

Based on what we can gather from available data, Teads is an EBITDA machine making it the ideal target for private equity.

Notably, PE firms are increasingly shifting their deal structures to include more equity and less debt in response to higher interest rates compared to the Zero Interest Rate Policy (ZIRP) era. During the ZIRP era, deals often featured high leverage ratios, sometimes exceeding 6x EBITDA. Current market conditions are seeing lower leverage, in the range of 4-5x EBITDA. With $157 million in estimated FY23 EBITDA and 37% EBITDA margins on net revenue ex-TAC, a private equity deal could lever up toward ~$800 million in debt with the rest in cash.

Example: Let’s say PE did the deal using a senior debt insttument at 7% interest on a 7 year term. The interest payment in the first year would be around $56 million (declining thereafter) which is looks to be easily servicable for Teads.

Here’s how we break down Teads estimated EBITDA for FY23.

As discussed above, we estimate gross revenue at $852 million. That gets Teads close to entering the one billion “unicorn” club. Very few adtech companies process more than one billion in gross ad spend.

We already plugged in a 50% gross margin (after TAC) generating $426 million in net revenue.

Data processing and compute costs (aka “cost of revenue”) were 12% and 10% of net revenue in FY19 and FY20, respectively. We assume 10% to fill in our puzzle for FY21 through FY23.

R&D expenses were 5.8% and 5.0% of net revenue in FY19 and FY20, respectively. We assume a pre-covid rate of 6% for FY21 through FY23.

Sales and marketing expenses were 40% and 24% of net revenue in FY19 and FY20, respectively. Again, we assume a pre-covid rate of 40% for FY21 through FY23.

General and Administrative were 11% and 8% of net revenue in FY19 and FY20, respectively. Similarly, we assume a pre-covid rate of 10% for FY21 through FY23.

Next, we capitalize R&D on a five-year schedule from FY19 through FY23. Given only two years of full historical data (FY19 and FY20), we built a synthetic amortization schedule to get a decent estimate resulting in a $5.6 million upward adjustment to EBIT (e.g. the difference between the actual R&D expense and amortized expense in FY23 is $5.6 million).

Depreciation and amortization were 1.3% and 1.4% of net revenue in FY19 and FY20, respectively. We assume a pre-covid rate of 1.5% for FY21 through FY23.

Add it all up and you get to $157 million in estimated EBITDA in FY23 translating to a 37% margin on net revenue. That’s outstanding financial performance in the adtech space.

Value Drivers

Now that we have a reasonable historical view of operating profits, we can fill in a few more puzzle pieces to see what value creation is like for Teads.

We remove depreciation and amortization from EBITDA to get EBIT and then make a standard assumption about Teads’ cash tax rate setting it at 27% (marginal tax rate considering federal, state, and local taxes).

Given Teads Dutch setup, 27% might be a little high. In any case, $110 million in estimated FY23 NOPAT is a fantastic performance.

Next, we turn to invested capital.

Note how invested capital ballooned during the pandemic when sales at adtech companies went ballistic. A large portion of this increase was an increase in receivables which normalized post-pandemic.

Assuming Teads’ capital efficiency ratio (net revenue generated for every $1.00 of invested capital) has remained steady at around 1.0, we estimate invested capital sits at $420 million in FY23.

With $110 million NOPAT and $420 million in invested capital, Teads generates very healthy returns on invested capital (ROIC) of around 26%. That beats every public adtech company we track in the Quo Vadis AdTech18. The Trade Desk, for example, generated just 14.5% ROIC in FY23 according to our model.

Although it’s not shown in the table above, our model estimates FY22 invested capital at $402 million, therefore net investment in FY23 was around $18 million.

With $110 million NOPAT and $18 million in net investment (the YoY change in operating working capital plus capex), free cash flow in FY23 was around $92 million. If our model is close to being on track, that’s outstanding performance relative to other adtech peers.

Valuation Stack to $2.2 Billion Valuations + Scenarios

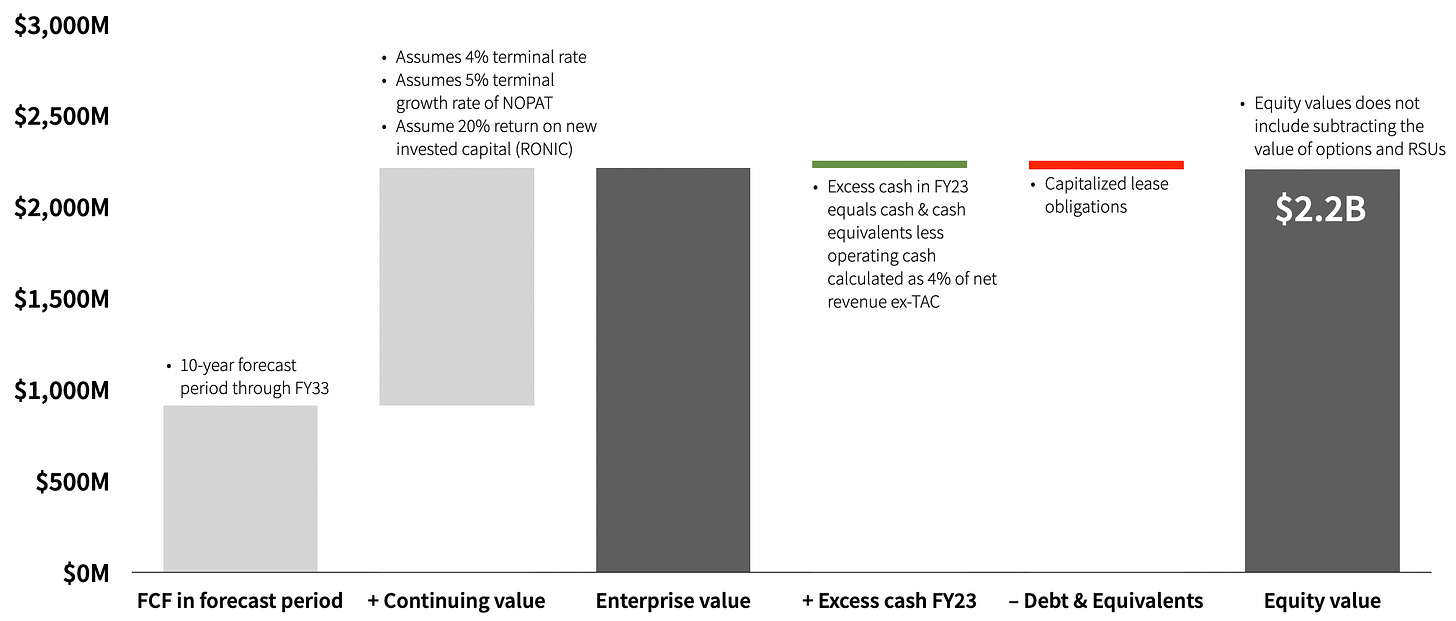

With our puzzle pieces in a reasonably good place, we can now illustrate an equity valuation narrative getting us $2.2 billion.

Revenue Growth Going Forward

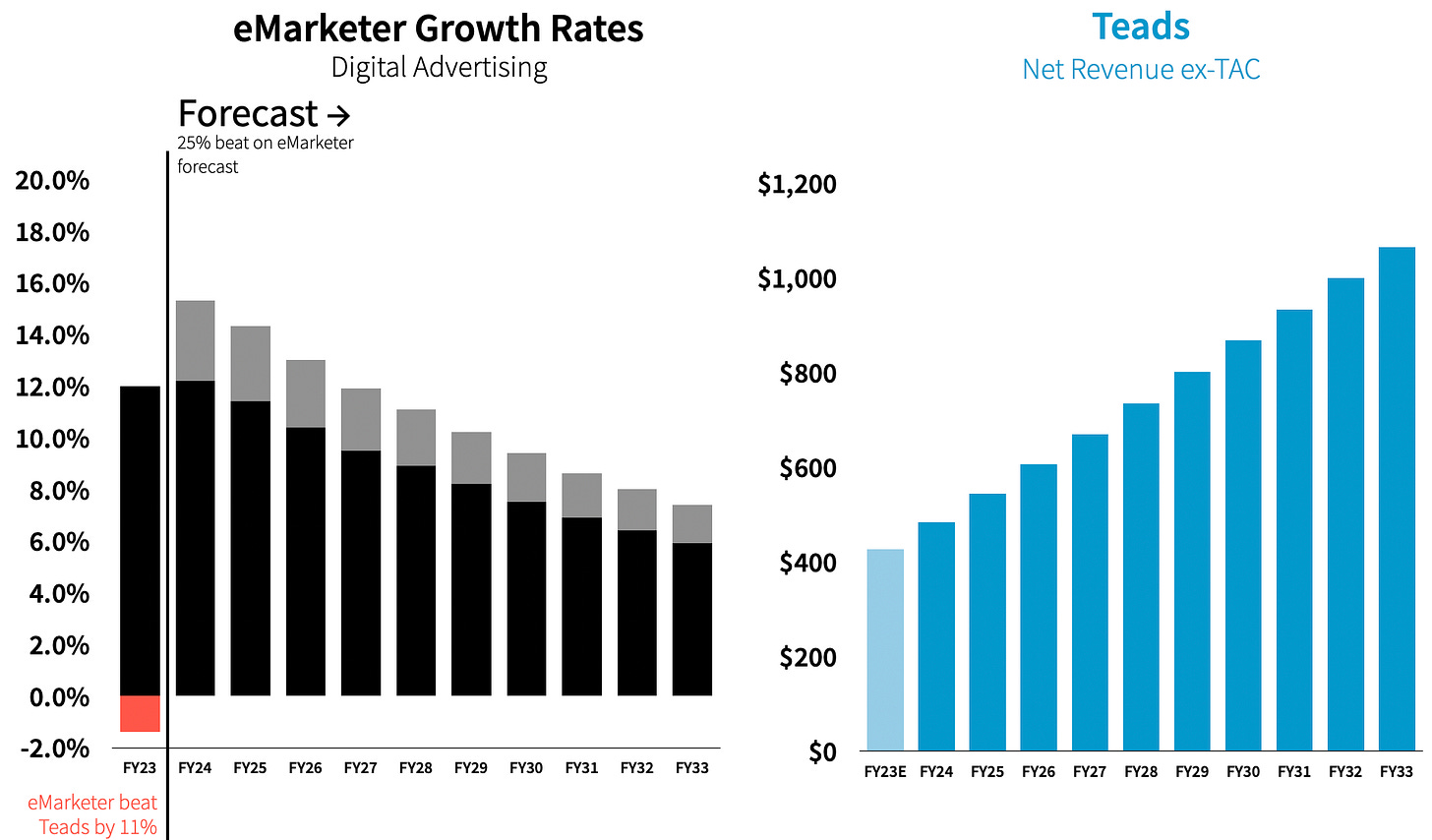

To model out future net revenue ex-TAC, we use eMarketer’s digital ad forecast as a baseline and assume Teads will beat it by 10% each year over the next 10 years.

For instance, eMarketer estimates that FY24 growth will be 12.2%, so our expectation for Teads is to grow revenue by 13.4%.

Earlier we estimated 10.6% revenue growth from FY22 to FY23 using headcount growth as a proxy. Over the same one-year period, eMarketer says the digital ad market grew by 12%. That means overall market growth beat Teads growth by 11% — something to keep in mind to tune your thinking about the future.

In any case, if Teads manages to beat the overall market by 10% going forward over a 10-year forecast period, and maintains 50% take rates, it will reach the coveted “unicorn club” in FY25 (e.g. attracting more than $1B in gross ad spend).

Valuation Stack

Our $2.2 billion fair market valuation estimate assumes the following:

EBIT margins remain constant at 35% over the 10-year forecast period.

10% annual growth in invested capital.

20% return on new invested capital (RONIC). Note that given our plug values, ROIC in FY33 will be 32% compared to 26% in FY23.

11.3% cost of capital. We use a weighted average across our AdTech Core10 — TTD, CRTO, DSP, MGNI, PUBM, RAMP, IAS, DV, TBLA, OB)

4% terminal growth rate is used in our continuing value calculation.

27% cash tax rate.

Result: $2.2 billion equity value on $156 million in estimated FY23 EBITDA translates to a pricing multiple of 14.7x. Our AdTech Core10 is trading at 41x EBITDA ex-TradeDesk. TTD is trading insanely high at 151x EBITDA.Other Scenarios

Given Teads’ Dutch tax status, one might reduce cash tax rate from 27% to 20% leading to a $2.4 billion equity value.

Alternatively, we can play it conservatively and keep the cash taxes at 27% but reduce Teads’ cost of capital. The weighted average beta across our AdTech Core10 is 1.43. Although it might be a stretch, the percentage of debt compared to equity does correlate reasonably well with betas across our limited data set. More debt correlates to a higher beta. Teads debt weighting is only 3%, which would bring its cost of capital down to 10.1% thus booting equity value to $2.5 billion.

Assuming the available historical data is accurate and the company has trended with the market over the past few years, even the worst-case scenario yet still rational gets us to a $1.7 billion equity value on the low end.

Altice Whopping Returns and Potential Acquirers

If our valuation puzzle is within a reasonable range, Altice stands to get a fantastic return. They acquired Teads in 2017 for €307 million (USD $330 million at the time). A deal value of $2.2 billion would generate a whopping 565% internal rate of return. Impressive to say the least.

The big question remains — who will buy Teads? While private equity buyers with plenty of dry powder ready to go will certainly have their eye on owning such a nice free cash flow machine, there is one high-profile adtech buyer that comes to mind — The TradeDesk. Here’s why it could make sense:

Last May we posted a note titled “Valuing The TradeDesk Is Two Sides of Coin.” We estimated 23% EBIT margins on $1.95 billion in net revenue. Owning Teads’ 35% EBIT margins on an additional $426 million in net revenue increases TTD’s EBIT performance by 10% on a weighted basis and increases net revenue by 22%.

In 2021, Teads had direct integrations with more than 2,800 publishers across the globe. That kind of connectivity could be quite valuable when it comes to TTD’s efforts to succeed with Open Path, UID2.0, and its SP500+ initiative.

TTD’s FY23 10K states a need to “expand our international presence” and “development of international markets.” However, TTD’s international exposure compared to US revenue is just 13%. Teads offers a reduced-risk gateway to find more success much faster in these non-US markets with local language talent and existing relationships on the ground.

Even at a $2.2 billion price tag, TTD can easily afford a cash + equity deal. With $1.4 billion in cash & equivalents along with a robust stock price and almost no debt outside of capitalized lease obligations, TTD could get a deal done.

Lastly, TTD does not have a history of buying other companies. When it comes to building, buying, or partnering, they tend to build and sometimes partner.

Time will tell. We look forward to seeing Teads consummate a deal and finding out if our puzzle model is close.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.