Happy New Year, Quo Vadis Community! Thanks again for making our 2022 subscriber growth so amazing!

We’re kicking off 2023 with Three Top Tips for our marketer subscribers.

Tip #1 is on retail media attribution — a tricky problem, but solvable by experimenting with Shapley Values.

Tip #2 coming later this week is on Custom Algos.

At that point, your excitement for Tip #3 on working media cost waterfalls will be overwhelming! Yes, go chasing waterfalls in 2023!

Reading Time: 8 wonderful minutes

What is retail media?

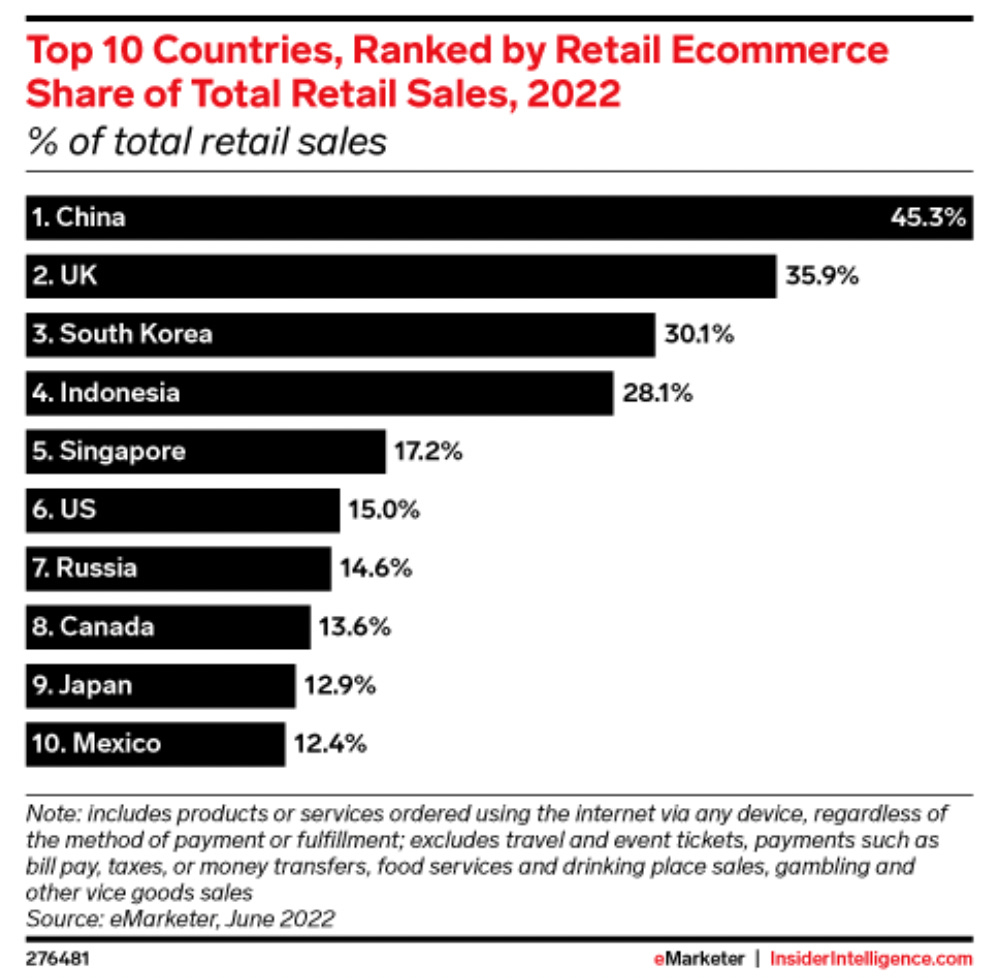

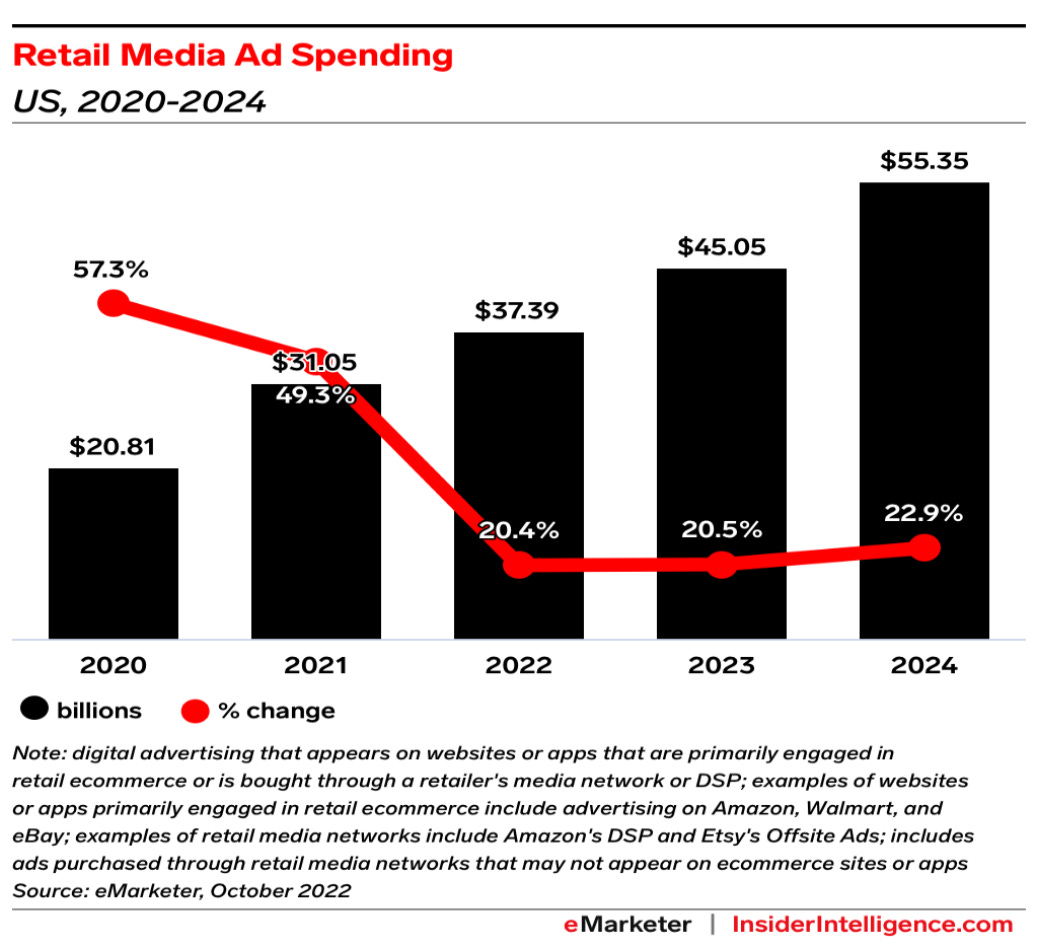

Retail media is the new popular kid in town. E-commerce sites of all types with decent traffic — from Walmart to Instacart and Marriott to Shopify — are either doing it or getting into it.

As the saying goes: “On a long enough timeline, everyone sells ads.”

Let’s cut to the chase and ask our friendly ChatGPT oracle, “Can you tell me what retail media is with an example of banner ads for shampoo at Walmart?”

Brilliant Answer

Certainly! Here is an example of how Walmart might use banner ads to promote a new line of shampoo:

Walmart creates banner ads featuring images of the new shampoo and its packaging. The ads might include a tagline highlighting the shampoo's key benefits, such as "Say goodbye to frizz with our new sulfate-free shampoo" or "Experience the power of nourishing ingredients with our new moisturizing shampoo."

Walmart places banner ads on its website, targeting users who have shown an interest in hair care products. The ads might appear at the top or bottom of the page, or as a sidebar ad.

When users click on the banner ad, they are directed to a landing page on Walmart's website with more information about the shampoo. The landing page might include customer reviews, a list of ingredients, and details on how to purchase the product.

Walmart might also run banner ads on other websites, targeting users who have visited hair care-related pages or who fit a specific demographic profile. The ads might appear at the top or bottom of the page, or as a pop-up ad.

Through these banner ads, the new shampoo is promoted to a targeted audience. The goal of the campaign is to increase sales of the product and raise awareness of it among potential customers.

In other words

E-commerce players like Walmart, Target, and CVS run e-commerce sites for people to buy all kinds of stuff made by all kinds of CPG companies, such as P&G, Unilever, Nestlé, L’Oreal, etc.

So, with tons of shopper traffic, they repurpose these daily shopping experiences into an advertising experience just like a publisher.

Think of retail media as a 2 x 2 game

Not retail media

When Walmart runs a house ad to promote a sale on walmart.com, that’s just using its own audience data to run in-house self-promotions. If you click, Walmart knows more about you.

When Walmart runs a programmatic campaign buying ads on a news site like Hollywood Reporter to promote its grocery service, that’s just regular ol’ display advertising.

Retail media

When General Mills shifts its trade marketing budget from physical stores to the online world and buys audiences and ad placements for Nature Valley Crunch on Walmart’s home page, that’s retail media!

When a consumer clicks on that Nature Valley ad, then shoots over to Hollywood Reporter to catch up on gossip and gets retargeted with a Nature Valley ad (landing page at Walmart.com), that’s also retail media.

For example, when Walmart Connect Launched Its New Demand-Side Platform, Walmart DSP To Expand Its Off-Site Media Offerings at Scale with The Trade Desk, that retail media retargeting.

Walled Garden Measurement Problem

Advertising and measurement is a funny thing. On one hand, every marketer claims to want better measurement. On the other, there is always a jittery bit of marketer FOFO when it comes to the confirmation bias of always wanting to look good vs the probabilistic reality of advertising actual outcomes.

Technologically, precise advertising measurement is quite doable in a variety of ways. The trouble is that you can end up finding out pretty quickly (and painfully) how your success bias makes past decisions look bad today. No bueno!

But for those no-fear marketers interested in both the art and science of doing advertising measurement right, it comes down to perhaps the very best Peter Druckerism of all time…

“What you have to do and the way you have to do it is incredibly simple. Whether you are willing to do it is another matter.”

With retail media, marketers are presented with a classic but solvable measurement challenge. When players like Walmart, Target, and CVS light up retail media networks, they position themselves as audience data walled gardens making cross-measurement seemingly impossible.

Not only do these new walled gardens own privileged audience data assets, but they also know what people buy, how much, when, and to some degree, why.

For the P&Gs and all other CPGs in the world, that rich and accurate audience data makes them salivate! So they push all their chips on the table and go big.

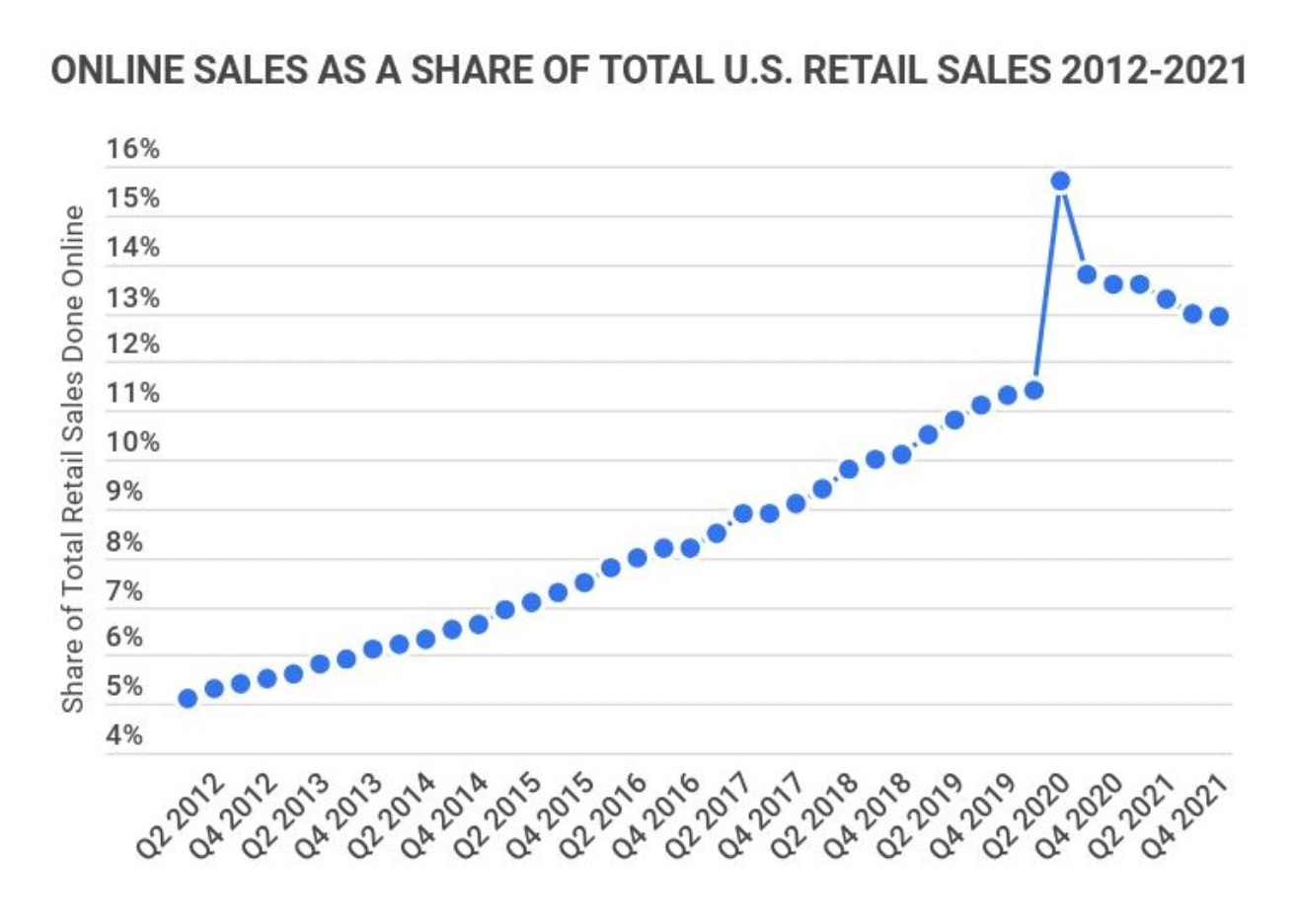

And as more consumers shift to online shopping and home delivery, the more trade advertising budgets are shifting from offline to online.

This consumer shift presents a measurement challenge (and opportunity) when, for example, a P&G brand like Tide laundry detergent spends ad dollars across various retail media players like Walmart, Target, and CVS.

Enter Shapley Values

But how can marketers know which ones contribute the highest returns in terms of actual sales?

That’s where Shapley Values come in handy. This incredibly useful concept comes from a genius UCLA game theorist named Lloyd Shapley. He won the Nobel Prize in 2012 for making contributions to all kinds of things all around us every day.

Disclaimer

Many moons ago, yours truly took Lloyd Shapley’s “Intro to Game Theory” class as an elective in undergrad at UCLA. I liked games, and I liked theoretical stuff, so I figured what the heck!

And now… here we are using Shapley Values to solve for retail media measurement.

Simply put, Shapley Values are a fair way to distribute both gains and costs across several actors working in a coalition toward a common goal.

For example, when P&G’s brand manager at Tide spends retail media ad budget on Walmart, Target, and CVS, she’ll want to know how each contributes to overall sales.

In this instance, Tide, Walmart, Target, and CVS are a coalition of “players” that cooperate to obtain a certain overall gain (more Tide sales) from their cooperation. Since some players might contribute more sales to the coalition than others, the brand manager needs a way to distribute outcomes of the game (more Tide sales).

In other words, she wants to know how important each player is to the overall cooperation and what payoff (attribution) each one can reasonably expect.

Here’s how it works

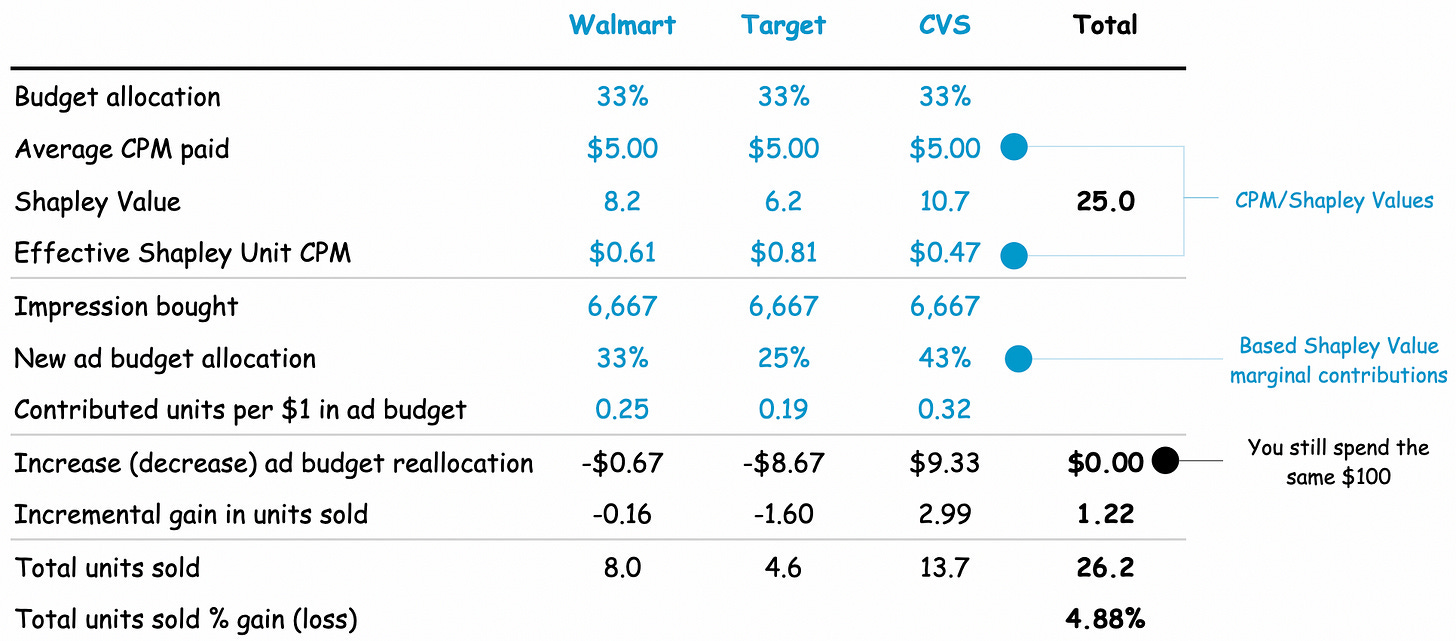

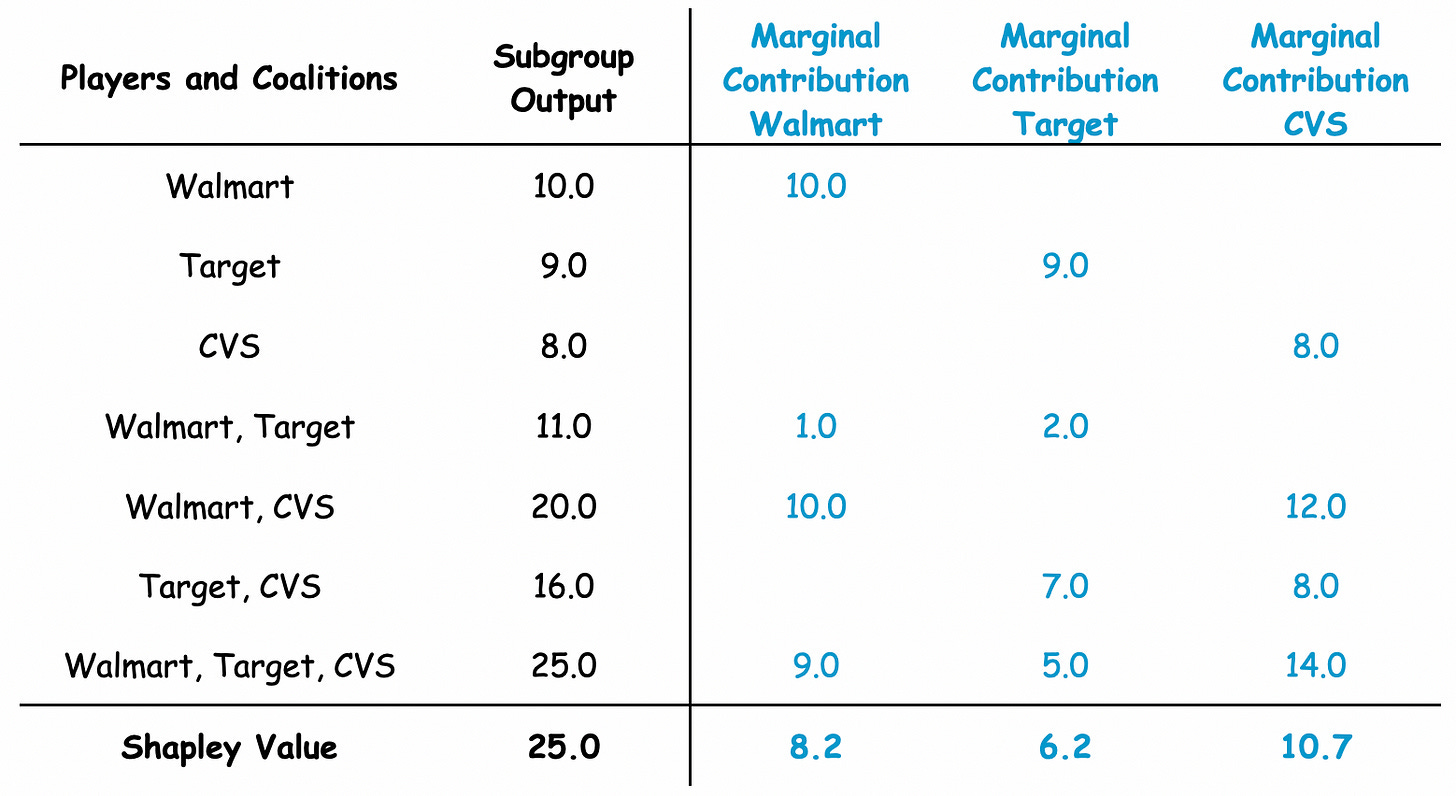

Start with three retail media players on the plan: Walmart, Target, and CVS, and imagine we have $100 in ad budget split evenly across each player.

Tip 1: To pull off this experiment, you’ll need to start and stop spending with each player and each coalition one at a time. If you can’t manage to make this tiny change, then at least you’ll always be really good at jumping over six inch huddles 🤣🤣🤣

To get cooking in her programmatic lab, our brand manager starts by spending ad budget on Walmart first, gets 10 Tide sales, and pauses that campaign.

Then she runs the same start/stop on Target and CVS to see what each provides on its own. Let’s say these players drive 9 and 8 sales, respectively.

Next up, she runs ad budget on Walmart and Target at the same time and gets 11 sales. Not bad — that combo created an incremental gain.

She does the same for the other two pairings: Walmart/CVS and Target/CVS.

With her remaining ad budget, she runs all three players at the same time and gets 25 total sales.

Results

To her surprise, it turns out that CVS contributes the most to the coalition, with a Shapley attribution score of 10.7 unit sales. Why does CVS works so incrementally well when paired with Walmart and Target? She certainly want to dig into it!

Optimization Impact

Let’s assume our three players all charge a $5 CPM as a blended price for inventory and audience segmentation data.

CVS has the lowest effective “Shapley” price at $0.47 per unit of marginal contribution. Think of this like a qCPM (e.g. getting more quality on each ad dollar spent).

Given the relative contribution of each player, P&G re-allocates the next $100 in ad spend by downgrading Walmart and Target spend and upgrading CVS.

With this reallocation, P&G will get fewer sales on Walmart and Target but will make it up (and then some) on CVS.

In the end, Tide sells 5% more units. That’s a really big deal in 2023 for high-volume, low-margin businesses that have no more room to pass price increases (inflation) onto consumers. It’s all about volume sales in 2023 baby!

Tip 2: Marketers can handle the counting of sales outcomes in an obtuse way by simply counting the conversions of each player, e.g. as if advertising treatment had its hand in every single sale.

Or, if you really want to get at the heart of experimenting with Shapley Values, then you’ll need to estimate incremental conversions by running test and control groups.

Since retail media players are walled gardens, they probably won’t let you run a program to gather incremental statistics. But what you can try is turning campaigns on and off in each player round in 24-hour cycles. On = Test, Off = Control.

Project management help is on the way

If you’re a curious marketer working at a big brand and dreamoing to have some fun with Shapley experiments in 2023, give us a shout at quovadis@lemonadeprojects.com.

We'll run the project along your side the whole way. Good times! A simple Shapley value model

For our Quo Vadis paid subscribers, we built a simple plug-and-play Shapley model in Google Sheets for you to mess around with. You’ll see how easy Lloyd Shapley made his calculations.

Tip #2 on Custom Algos and Tip #3 on Cost Waterfalls also come with nifty models.