We have two new episodes for you from Advertising Economic Forum Podcast Season 2. Check out Episode 3 interview with Mattia Fosci, CEO/co-founder of Anonymised. The “open web” is losing ground to walled gardens, and identification is a big part of the problem as advertisers increasingly allocate media money to those target-accurate audiences. Mattia shared his view on tapping the full potential of open web and CTV audiences with ID-less data. And in Episode 4, we had a candid and fun chat with Scott Ensign, Chief Strategy Officer of independent agency, Butler/Till. You’ll hear about the benefits of their employee-owned structure and reasons why independent agencies are winning.

Tune in to the new episodes on Spotify or Apple.

Behavioral Economics and the Last Media Dollar Game

Imagine this: You’re a brand advertiser. You have exactly one dollar left to spend on media. You have to spend it on Linear TV or Meta. You have to pick one. It’s do or die. Which one would you pick?

Let’s flip the script. You’re a direct response advertiser faced with the same choice. Which one would you pick now? Linear TV or Meta?

From the perspective of a brand advertiser’s mindset, Linear TV probably wins that match, but maybe not. For direct response marketers, Meta probably wins in most cases, but maybe not. Situations and past choices matter. Constraints and trade-offs matter.

Now imagine there are 22 distinct media channels (see descriptions below) involved in a game of behavioral economics where you get to play them off each other in one-on-one matches.

That’s why we created a simple game called Last Media Dollar. When you play Last Media Dollar, you get to make a series of choices in random match-ups just like that.

The game takes just a few minutes to play. You end up getting what consulting firms like McKinsey would charge a fortune for and take months to deliver. When you play the Last Media Dollar, you get a neat dashboard with charts and other relevant information about how you played the game. It goes by fast, and the payoff is worth it.

The game objective is not about winning. You "win" when you walk away with a smarter, data-driven understanding of where your last media dollar belongs in a world of limited media budgets, many choices, many bosses, and competing incentives.

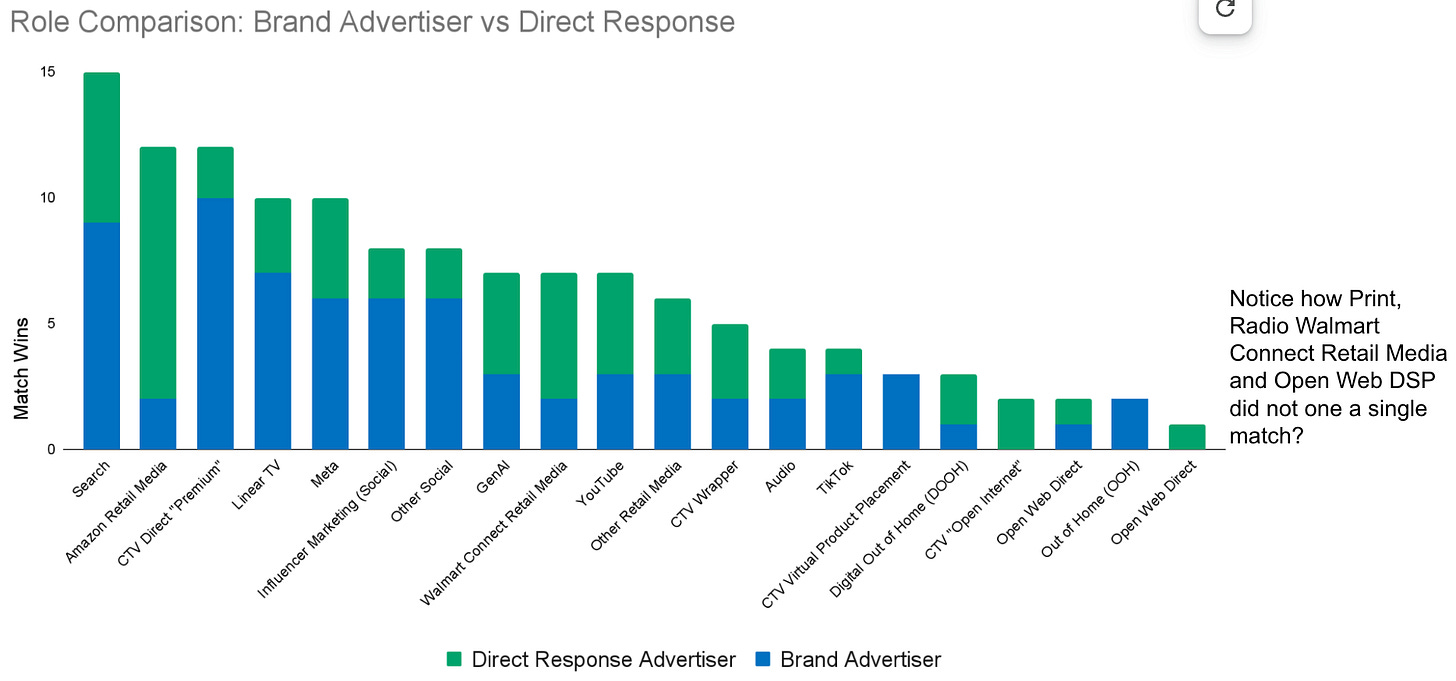

The more you play, the more your behavioral economic levers deep inside your mind rethink the trade-offs at stake. You get a reporting dashboard that shows various visualizations about how you dealt with the trade-offs. Here’s what it might look like after you play twice — once as a brand advertiser mindset and a second time in direct response mode.

The dashboard also shows you:

Your Traditional vs. Digital breakdown

A neat waffle chart and a “media flow” stacked chart

Commentary on your top three toughest choices.

There is also a pie chart that shows how much of your media spending goes to the Big 3 (Google, Meta, and Amazon) relative to all the other channels combined.

22 Media Channels

The Last Media Dollar game presents 22 mutually exclusive channels. That means the same $1.00 can’t be spent in two different places at the same time. You have to make choices, just like in the real world. A specific media channel is classified as “Traditional” or “Digital.”

Traditional Media

1. Linear TV, Ads that run on linear TV channels

2. Out of Home (OOH), Ad spend on static billboards

3. Print, Ad spend on newspapers and magazines

4. Radio, Ad spend on terrestrial radio stations

Digital Media

5. Meta, Ad spend on Facebook, Instagram, or WhatsApp

6. Search, Ad spend in Google search, Bing, and Yahoo search

7. Amazon Retail Media, Ad spend on Amazon Retail Media Ads such as Sponsored Products, Sponsored Brands, Sponsored Display/Video, and offsite ads via Amazon DSP

8. YouTube, Ad spend on YouTube video

9. TikTok, Ad spend on TikTok

10. CTV Direct “Premium,” CTV ads (sometimes shoppable) on premium CTV streaming services such as Netflix, Hulu, Amazon Video, Disney+, Peacock, Paramount+, etc., typically bought on a direct basis.

11. CTV “Open Internet,” Ad Inventory bought via DSP that is tagged as CTV content (sometimes shoppable)

12. CTV Virtual Product Placement, Ad spend on in-scene virtual product placement in CTV streaming content.

13. CTV Wrapper, Ad spend on display-like units that wrap around CTV content while in play.

14. Walmart Connect Retail Media, Ad spend on Walmart Connect, such as Sponsored Search Ads, Product Carousel, Brand Amplifier, Native In-grid Display, offsite ads via Walmart DSP, and in-store ads.

15. Other Retail Media, Ad spend on other retail media platforms such as Criteo, Citrus ads, etc.

16. GenAI, Ad spend on ads that run in GenAI results.

17. Influencer Marketing, Ad spend on influencer marketing platforms that connect brands with social media creators and their social audiences.

18. Audio, Ad spend on digital audio such as Spotify, Apple, iHeart, YouTube AudioDigital Out of Home (DOOH) (Digital), Ad spend on digital billboards.

19. Other Social, Ad spend on other social media such as Snap, X, Pinterest, LinkedIn, etc.

20. Digital Out of Home (DOOH), Ad spend on digital billboards.

21. Open Web Direct, Ad spend on website display inventory such as banner ads and in-stream or out-stream video bought directly on a guaranteed reserve basis or programmatic guaranteed via a DSP.

22. Open Web DSP, Ad spend on website display ad inventory such as banner ads and in-stream or out-stream video ads bought via a DSP, SSP, or Ad Network.

Enjoy!

We’d love your feedback. Please let us know if you have ideas to make the game even better. Send your thoughts to quovadis@lemonadeprojects.com.

Disclaimer: This post, and any other post from Quo Vadis, should not be considered investment advice. This content is for informational purposes only. You should not construe this information, or any other material from Quo Vadis, as investment, financial, or any other form of advice.